Which Are The Best Ways To Invest Money? The Approach of a Beginner

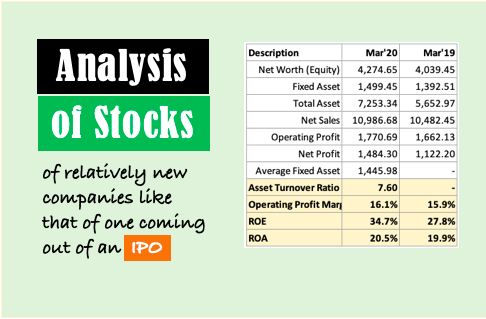

I was surprised to note how incomplete the information available around us is about the ways to invest money. Most write-ups point us only to investment options and say nothing more about them. People interested in knowing about the ways to invest money need more information. For example, stocks are an investment option. But how to invest in stocks? Readers would…