After the recent event with the Paytm Payment Bank, my confidence in the top management of the company has seen a drastic shift. For me, till the next event, this is a no-go company.

The purpose of this article is to understand if Paytm stocks are a good buy. To answer this question, we will have to evaluate the macro and micro indicators of the company. As the company and its line of business are relatively new, we’ll also try to dig deeper into the Paytm business model.

Introduction

Paytm also known as ‘One97 Communications‘ was one of the favorite IPOs of India in 2021. It was listed in the NSE and BSE stock exchanges in Nov-2021. Since then its price has corrected by almost -64%. At its current price point of Rs.650 levels, should one care to invest in Paytm? Please read this article till the end to know my preference for Paytm as a stock.

In this article, we’ll discuss the future business prospects of Paytm. It will answer why this type of IPO (Fintech) makes so much buzz in the market. These types of companies are tailor-made to benefit from India’s growth story.

The Business Model of Paytm is also not so complicated. I know what I’m saying is contrary to what you must have heard about the company. Paytm may look like a complicated business because it is the first of its kind, especially in the listed space. So, we do not have any precedence to compare and judge its business model.

Video [Hindi]

Paytm’s Macro Indicators

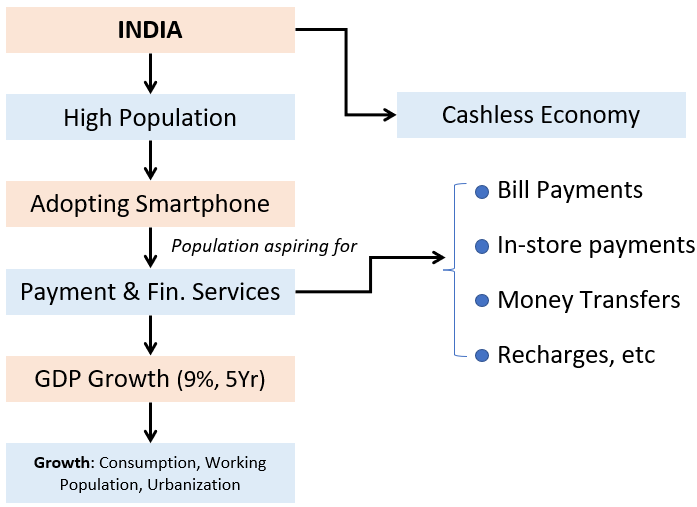

India has crossed the population benchmark of 140 crores. China is only fractionally ahead at 141.2 crores. Within this year (2023), India will become the most populated country in the world.

India’s growing population is keen to adopt smartphones. Almost all strata of people now have at least one smartphone in the household. India’s population is also reasonably smartphone-savvy. Hence, the majority of people do not hesitate to use mobile phones for bill payments, recharges, in-store payments, fund transfers, etc.

After the success of UPI-based technology, introduced by the GOI, Indians have become more receptive to using online services, like money transfers, etc. They aspire for better payment and financial services.

India’s GDP may grow at a rate close to 8-9% per annum in the next 5 years. It means, the economic consumption will further rise. A combination of the aspirations of the polulation and fast-growing consumption suits the revenue model of Paytm.

As the growth story of India is fuelled by consumption, a rising working population, and faster urbanization, it provides an ideal investment ground for companies like Paytm.

Furthermore, the trend of transforming India into a cashless society has also gained good momentum. People are using their mobile phone-based technology for online banking, bill payments, in-store payments, recharges, and other e-commerce activities.

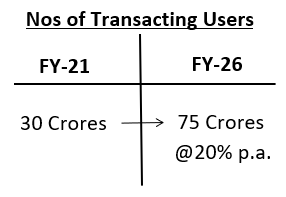

Between YR-20221 and 2026, the online transacting user base is expected to grow more than two folds at the rate of 20% per annum.

World Data

There is another set of data about online payments in India vs the world. It says that, in real-time transactions (like UPI), India has the biggest market. The number of transactions happening in India is about 48 billion, compares to China’s 18 billion, and other developed countries’ 7 billion.

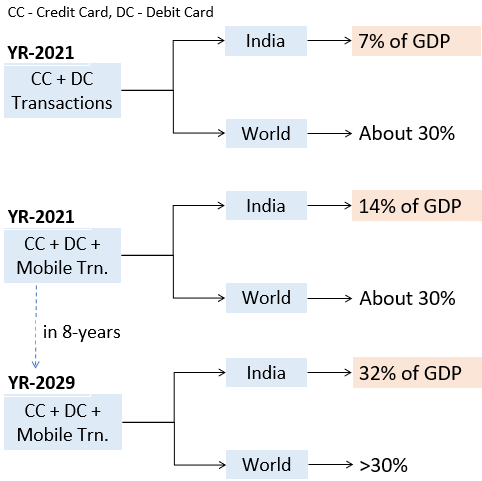

But if credit card (CC) and Debit Card (DC) transactions are added, India’s numbers are low.

In the year 2021, when India was doing online transactions of 14% of GDP, the world’s value was at 30% levels. In the next 8 years, by the year 2029, online transactions in India would increase to 32% of GDP levels. It will bring India to par with the world.

This data shows that online transactions are only going to rise in the coming decade. This kind of public behavior is certainly going to benefit companies like Paytm.

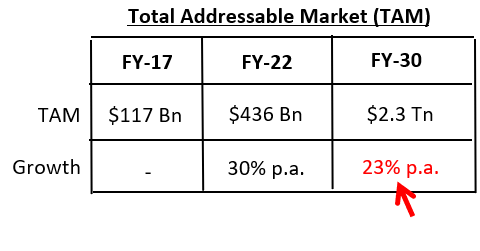

In terms of market size, the opportunity for Paytm in India looks very robust. The Total Addressable Market (TAM) for Paytm is expected to grow at 23% per annum in the next 8 years. In the last five years, the same market has grown at a rate of 30% per annum.

In the earlier days of Paytm, the year 2016 and before, Paytm had to offer incentives to people to start using the platform. But now, the trend has changed. More consumers and merchants are coming to Paytm on their own to use the platform.

There could be two main reasons for this changed behavior. First, the Paytm brand name is now more established. Second, the ever-growing user base of Paytm is making it a default choice of people (like Google Pay, PhonePe, etc). The result is that the consumer and merchant acquisition has gone into auto mode. Hence, the envisaged growth rate of TAM as shown above is more likely to become a reality.

Paytm Business Model

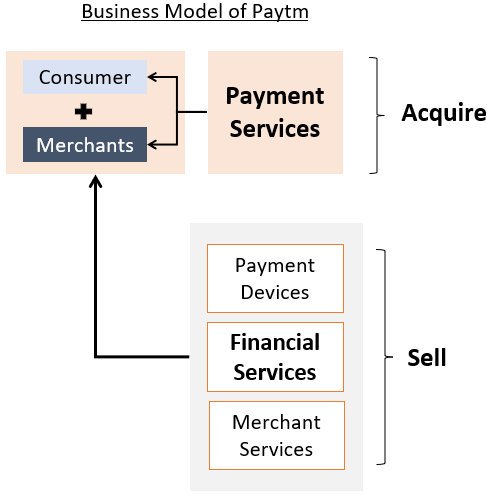

The Paytm Business model is basically a two-tier approach, acquire and sell. Paytm offers a range of payment services in India to acquire two kinds of customers, consumers, and merchants. The consumers are the ones who are spending, and merchants are the ones who are selling goods and services to the consumers.

The whole ecosystem of Paytm is mainly filled with these two types of people, consumers, and merchants. There is also a third entity called “partners”, which uses the Paytm platform to sell financial services and merchant services to Paytm’s customer base. The bigger will be Paytm’s user base, the more it will earn as commissions and fees from the partners.

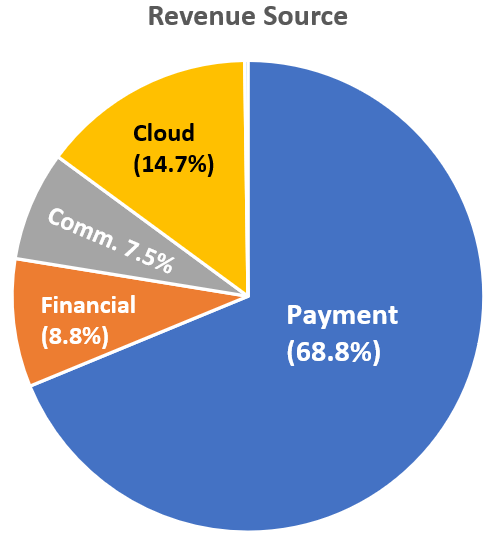

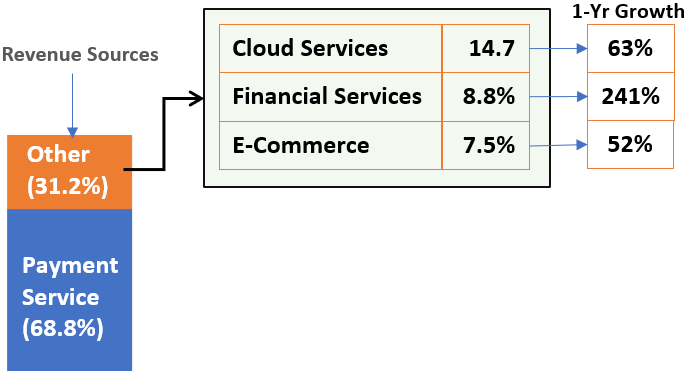

At present, the majority of its revenue is coming from Paytm’s payment services. It is a low-margin business model. But with time, when financial and merchant selling will gain pace, the profit and profitability of Paytm business will improve. For the moment, the revenue break-up of Paytm looks like this. The majority of revenue (68.8%) is coming from payment services.

Payment Services

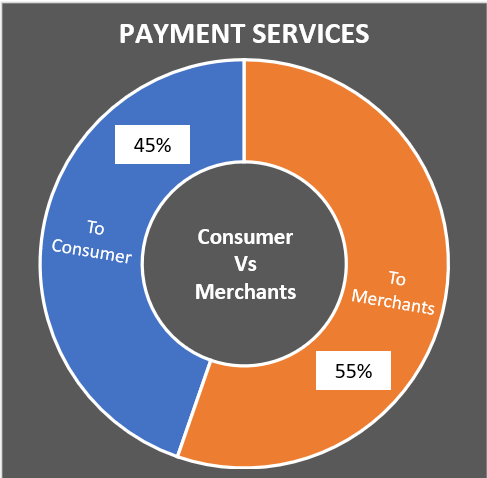

Out of all revenue sources, at present, payment services are bringing in the majority of numbers. The break-up of payment services offer to consumers and merchants, is shown below. Fifty-five percent (55%) of this revenue is from payment services provided to merchants. The balance, forth-five percent (45%), is from the consumer base.

Payment Services (Consumers)

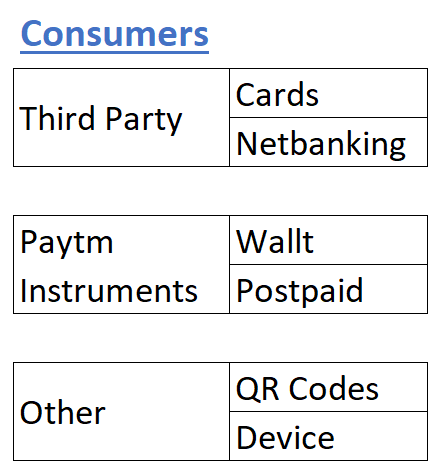

The payment services offered to consumers are of three types. The first is third-party services like card payments and net banking payments. Paytm also have its own payment solutions in the form of wallet and Postpaid services (BNPL Type). Other forms of payment solutions offered to consumers are QR codes and payment through devices.

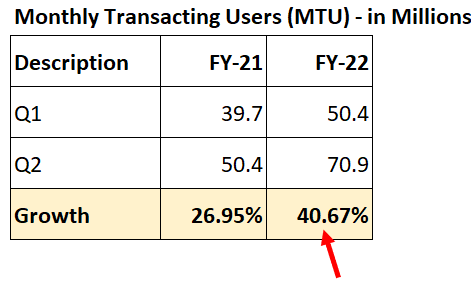

In the last four quarters (FY-22), the growth of consumers using Paytm’s payment services has been 41%. In FY21, the 4Q growth rate was a more modest 27%.

Payment Services (Merchants)

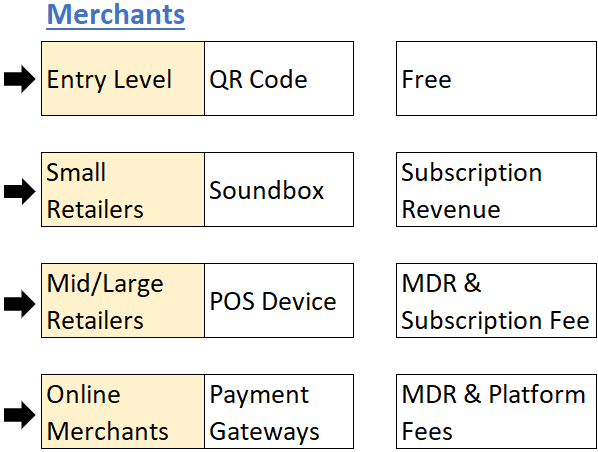

Payment services offered to the Merchants are slightly different from what’s offered to consumers.

To entry-level retailers, UPI-based Paytm QR codes are offered free of charge. To small retailers, Soundboxes are offered with a minimal monthly subscription fee. Middle and large-size retailers can also use Point of Sale (POS) devices, like card-swapping machines. These days, the POS devices offered by Paytm can also be used to make UPI payments. This has made Paytm’s POS device more acceptable among merchants. The POS device is offered by Paytm as a subscription plan. For retailers who accept online payment, Paytm offers them payment gateways.

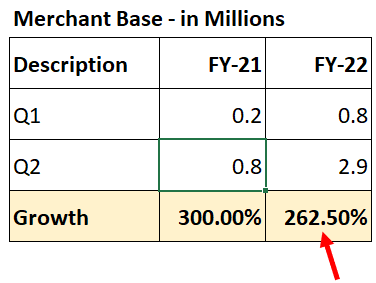

In the last four quarters (FY-22), the growth of merchants using Paytm’s payment services has been 262%. In FY21, the 4Q growth rate was 300%.

Financial & Other Services

At present, payment services generate 68.8% of Paytm’s revenue. The balance 31.2% comes from other valued added services like Cloud, Financial, and E-commerce services.

When one reads the annual report of Paytm, it will be clear that providing financial services to consumers and merchants is their priority. Within the financial service space, lending is what their main focus is. Why? Probably the business is more scaleable upon partnership with Banks and NBFCs. Paytm business model is to partners with Banks and NBFCs to offer lending services.

For Banks and NBFCs, partnership with platforms like Paytm gives access to potential borrowers that otherwise are too difficult to reach. Moreover, apps like Paytm also has insights into these people like their spending history, pattern, etc.

A combination of user database and user insights makes platforms like Paytm a goldmine for Banks and NBFCs to sell loan products. Paytm not only helps these institutions in terms of database and user analytics, but it also helps them in loan disbursal and collection. Hence, to get access to this kind of platform, banks and NBFCs offer commissions to Paytm. In the coming years, revenue through lending services is going to become a key vertical for Paytm.

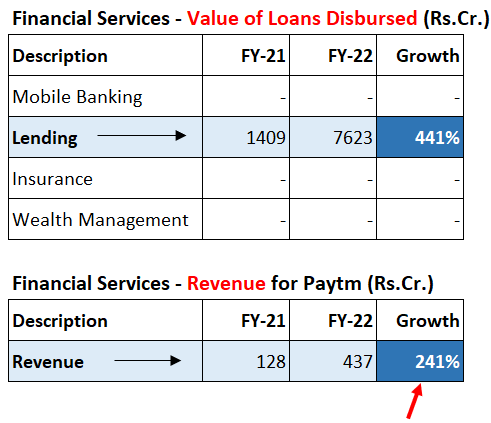

In the last year, between FY21 and FY22, through the Paytm app, Rs.7,623 crores worth of loans were disbursed to consumers and merchants. It was a growth of 441% in one year. This accounted for a revenue jump of 241% for Paytm from their financial services vertical.

Two other verticals of Paytm are Commerce services and Cloud services.

- Commerce Services: Users can use the Paytm app to book tickets for flights buses, trains, metros, movies, events, etc. Paytm also offers FASTag to pay tolls on highways. As the COVID-19 effect is now ending, people are spending more on these activities. Hence, in the last year, the revenue of Paytm from commerce services grew by 52% from Rs.245 crore to Rs.374 crore.

- Cloud Services: Paytm also offers cloud services to its merchant base by giving access to advertising services, software services, etc. in the last year, the revenue of Paytm from cloud services grew by 63% from Rs.448 crore to Rs.731 crore.

Is Paytm Shares a Good Buy

From the discussions we’ve had till now about the future business prospects of Paytm, it looks robust. The Paytm business model also is reliable and sustainable. So, if we are looking at this business with a time horizon of the next 10-15 years, the present valuation looks fairly priced.

But the main threat of Paytm as of today is its cash flows. Even after about 6+ years of operations, Paytm’s cash flow from operations is still negative. It is not a good sign.

Though the business is growing at a very healthy rate, cash is king for any company. At this expense rate, Paytm may run out of liquidity in few years. Then it may resort to debt, and that is where the never ending risk-loop will creep in. At present, Paytm is operating on a low-margin revenue stream. Till the revenue from financial, e-commerce, and cloud services grows, dipping into debt to manage working capital looks risky for Paytm.

Good Financial Indicators

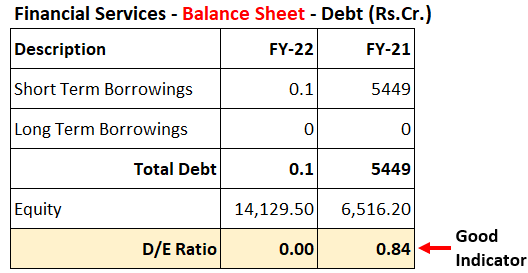

As of date, Paytm is almost a debt-free company.

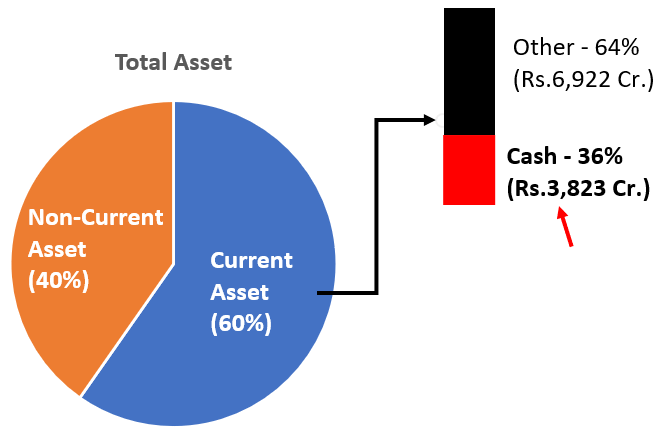

Paytm is sitting on a cash pile of Rs.3,823 crores. Out of the total current asset base of Rs.10,745 crore, the contribution of cash is almost 36%. Check the graphics.

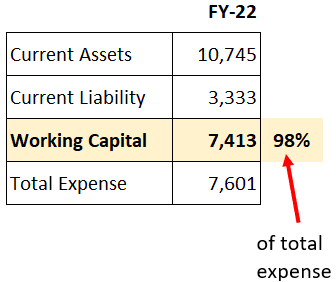

Paytm’s working capital is also very healthy. In the last FY, Paytm’s total expense load was Rs.7,601 Crore. In the same period, Paytm yielding a positive working capital of Rs.7,413 crore. This working capital suffices 98% of the total expense needs. We must also remember that out of the Rs.7,413 crore working capital, 36% is in cash. This makes the liquidity position of Paytm even healthier.

Worrisome Financial Indicators

A few worrisome financial indicators of Paytm are the following:

- EBITDA Negative: Even after so many years of operations, Paytm has still posted negative EBITDA numbers. As a result, the company’s PAT and EPS are negative.

- Operating Profit: The company’s operating profit is also negative. Total revenue from operations is Rs.4,974.2 Crore. Total operating expense including employee benefit cost is Rs.6,541 Crores. The challenge for Paytm is to convert its operations from a loss-making entity into a profitable one.

- Cash Flow From Operations: In FY-21, Paytm’s cash flow from operations was Rs. -2,269.6 Crores. In FY-22, the cash flow number has improved, but it is still negative (Rs. -1,088.4 Crore). The biggest challenge for Paytm is to transform its operations into cash flow positive.

Inference

The most concerning factors for Paytm are its prolonged negative cash flow and profitability. It also makes the intrinsic value of the company zero. So, if the question is, is Paytm share a good buy? It is not. I’ll not buy this share till it starts posting near-positive cash flow numbers.

As soon as the company becomes profitable, with its healthy future growth potential, it will yield a high intrinsic value. But till then, the stock will continue to be on my watch list only.

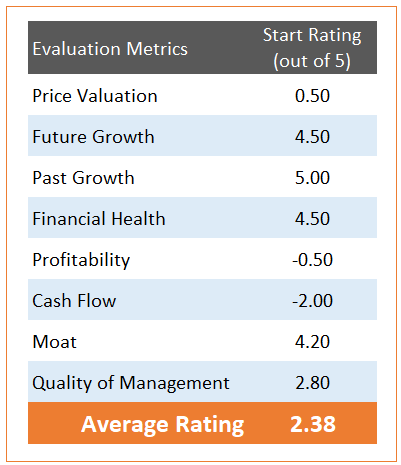

I’ve estimated a rating of 2.38 (out of 5) for Paytm. As soon as this rating crosses the four (4) mark, it should start attracting retail investors’ money.

Want more companies analysis

As a part of the business model series, it will come. Thanks