If you go by the definition of penny stocks, these are stocks of small companies that trade at a price below Rs.100. In the US, stocks trading below $5 per share are considered penny stocks. Generally, in the search for penny stocks, people often look for companies with solid growth and zero debt. But is this the right way to identify penny stocks? This is what we’ll answer in this article. [For a broader perspective, check out our guide on Top Stocks to Buy in India.]

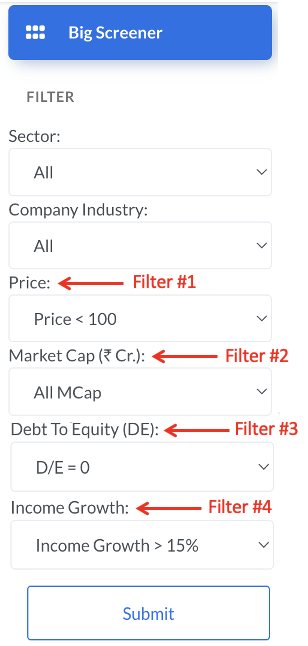

First, let’s identify those stocks that will comply with the conditions of our query – penny stocks with solid growth and zero debt. To find such stocks, I will go to the Big Screener of my Stock Engine. In the Big Screener, I’ll apply the following four filters to screen the stock.

Four Filters

- #1. Price Filter: I want to see a list of only penny stocks. What are penny stocks? Those stocks whose current market price is less than Rs.100 per share.

- #2. Market Cap Filter: Stocks of small companies trading below the Rs.100 mark are penny stocks. So, one can use the filters to see only those stocks whose market capitalization is less than Rs.500 crores. However, in this case, I have kept the market cap as “All MCap” as I wanted to see a bigger list of stocks.

- #3. Debt Equity Ratio Filter: Our query is asking us to show only those penny stocks whose debt is zero. Hence, one can use the filter to see only those stocks whose D/E is equal to zero.

- #4. Income Growth Filter: Our query has also asked us to show only those companies reporting solid growth. Hence, one can apply the income growth filter of more than 15% per annum.

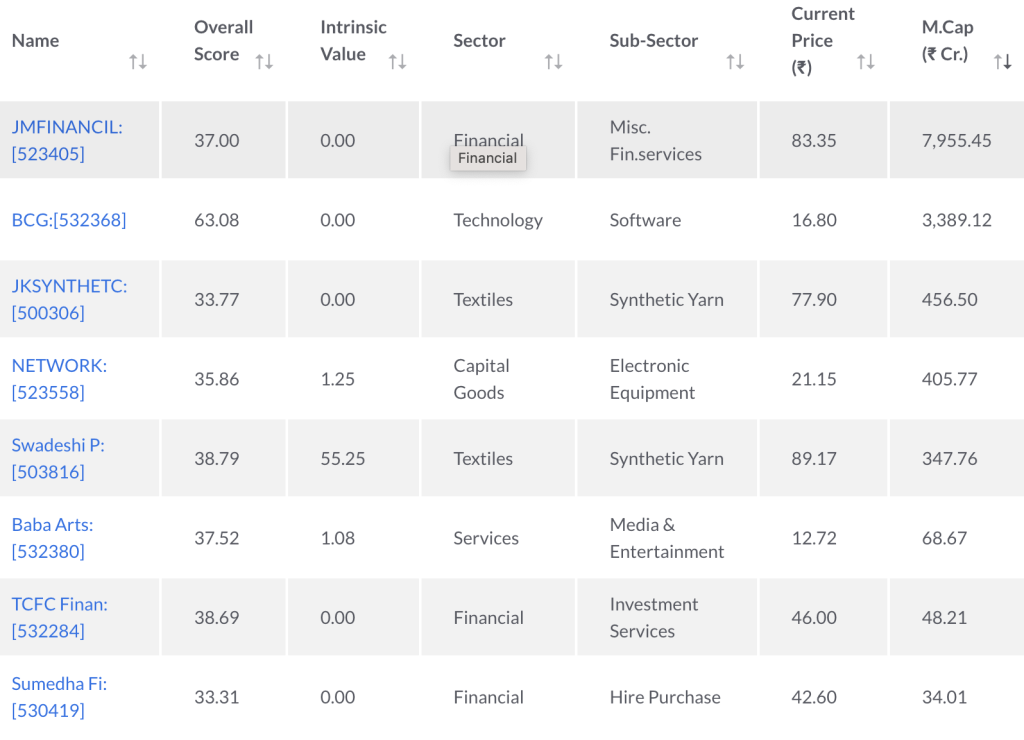

My Stock Engine has a list of about 1300 number hand-picked stocks included in its database. Only eight stocks passed the above four filters.

Now the question remains, are these stocks good for investing? Most of these stocks got an Overall Score in Stock Engine of below 40 (out of 100). Ideally, stocks that can yield a score of 75 are considered good. So, we can say that none of these filtered stocks (except for BCG:532368) are worth considering.

But there is a problem with BCG as well. The estimated intrinsic value of BCG is zero. It means that the company has issues with its free cash flows. Hence, the reliability of these stocks is also questionable.

How To Find Quality Penny Stocks?

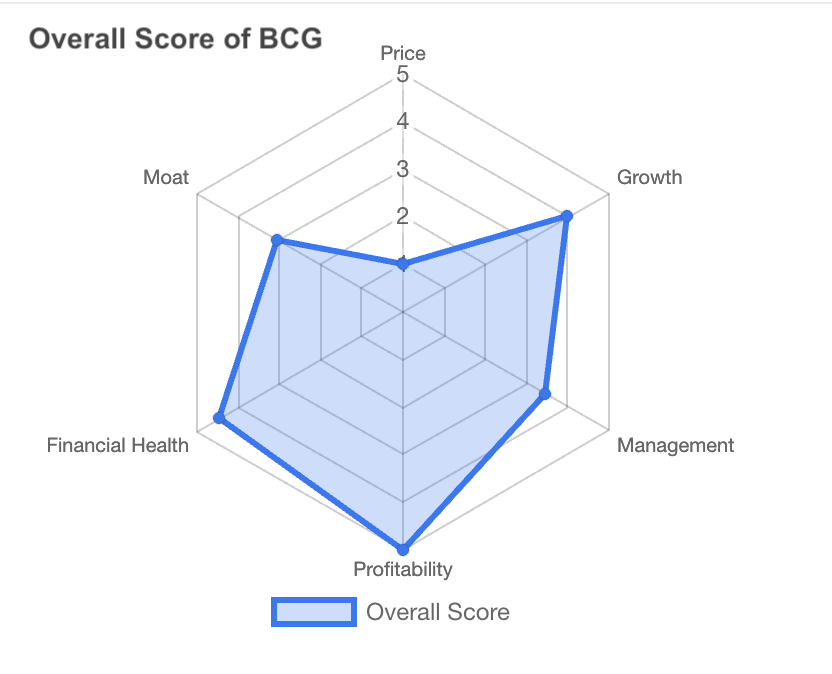

If the idea is to find quality penny stocks, depending only on growth and debt, is not enough. What is more important is the Overall Score. Why the Overall Score is important? Because it evaluates a company based on six parameters. All these six parameters can perform a 360-degree check of the business fundamentals of the company.

Out of these six parameters, three are the most basic elements of any business: Financial health, the profitability of business, and sustainable growth. The next two are those features that make a business special: quality of management, and economic moat. Finally, what matters most for all stock investors is the price valuation.

The algorithm of the Overall Score is so designed that it inherently gives high scores to big companies that are financially healthy and are growing fast. The main reason for the low scores of very small companies is the volatility of their income and profit numbers.

But volatility is a part and parcel of penny stocks. So, if we need to identify quality penny stocks, we must ignore the volatility factor. How to do it? To identify potential penny stocks using the Stock Engine, I use my pre-built screener theme specially designed for the penny stocks.

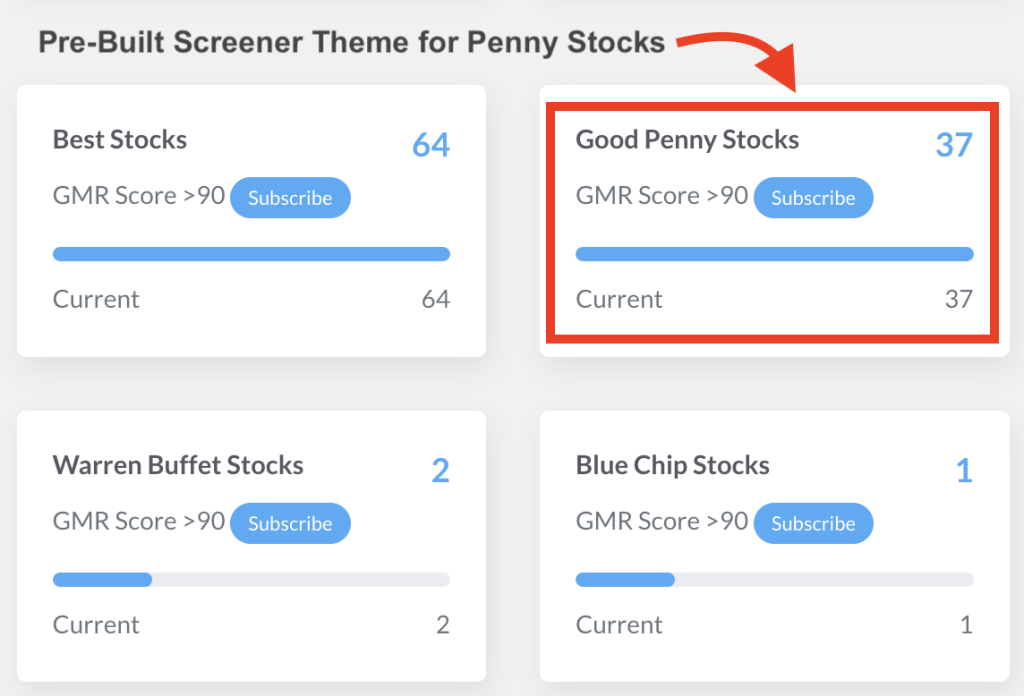

Pre-Built Penny Stock Screener Theme

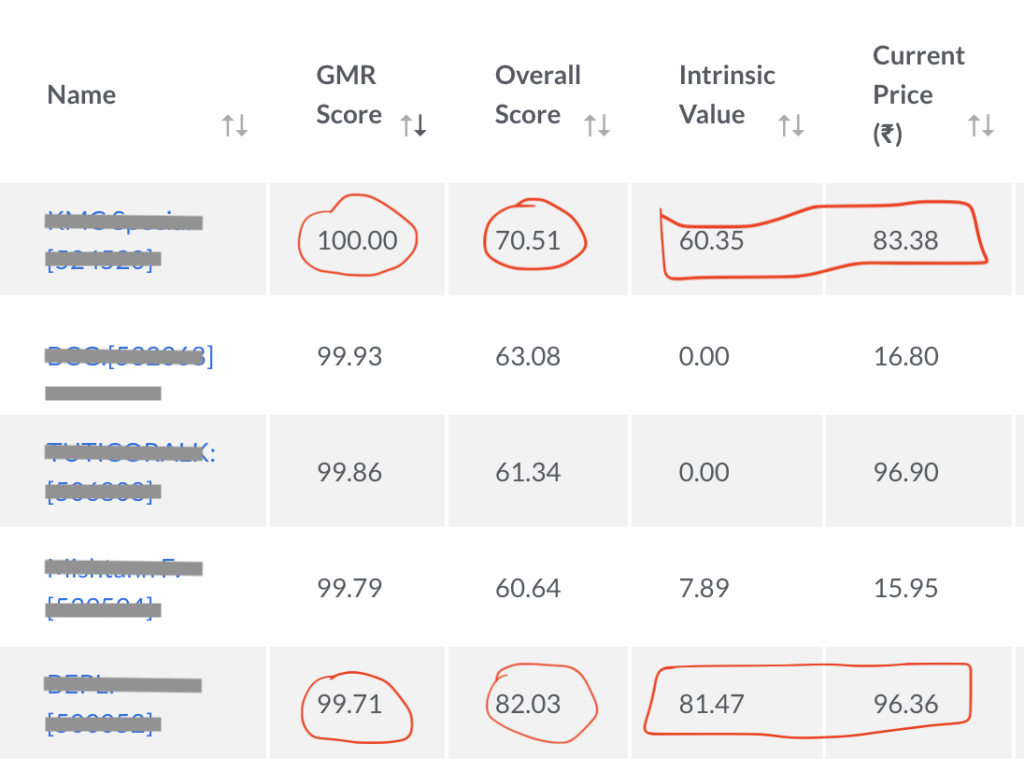

In this screener theme, there is an added scoring algorithm called GMR Score. For this theme, the GMR score scores all stocks considering a few specific parameters that make them a good penny stock.

[Just for clarification, the GMR Score in a Blue Chip Stocks pre-built screener theme, scores all stocks considering a few specific parameters that make them a good blue chip stock. So, the GMR score for a particular stock will change from theme to theme but their Overall Score will remain the same.]

A combination of a high GMR Score, a high Overall Score, and a small difference between the current price and the intrinsic value gives me my reliable penny stocks.

If I find some penny stock that has a high GMR and Overall Score but is currently looking very expensive (the current price is high compared to its intrinsic value), I wait for correction. Generally, for high-market penny stocks, a 10% correction can give a fair entry point. But I generally wait for a price correction of about 20% for low-market cap penny stocks.

Have a happy investing.

Suggested Reading:

![Compare Indian Banks: A Quick Fundamental Analysis [2023]](https://ourwealthinsights.com/wp-content/uploads/2021/05/Compare-Indian-Banks-Image4.png)