In the next 20-years investment horizon, one sector that stands out from the rest is Pharmaceutical. Though, as a whole, this sector is not as profitable, there are pockets of value. Stocks of a few companies stand out. But if direct stocks are not for you, pharma ETFs will do.

The Exchange Traded Fund (ETF) is a hybrid financial asset that carries the benefits of both stocks and mutual funds. Just for understanding, we can remember them as stocks of an index.

In case you want to know more about ETFs in India, please read this article on the basics of ETF. I can assure you, it will be worth a read.

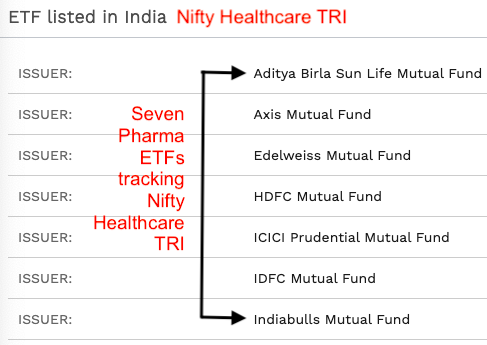

Only a couple of years back, before COVID, we had only three types of ETFs in India: index, banking, and gold. But in the last years, the market has seen seven pharma ETFs in India (some are still in the NFO stage). These ETFs track the Nifty Healthcare TRI or S&P BSE Healthcare index. You can read more about TRI (Total Return Index).

Prospects of Indian Pharmaceutical Industry

There are two main reasons why the Pharmaceutical industry is gaining traction in India. The first is because of the global demand for medicines made in India. The second is because of the future growth prospects.

Demand

India is the largest supplier of generic drugs to the world. What are generic drugs? When patents of original drugs expire, other manufacturers are allowed to duplicate its formula. These are referred to as generic drugs. The advantage of a generic drug is that it costs less. Why? Because to produce it, the company need not do any research, development, or clinical trials. Indian drug manufacturers produce quality and low-priced generic drugs. Hence the demand for their drugs is high across the globe.

To judge the quantum of demand of Indian manufactured drugs, here are a few data (source: IBEF):

- Vaccine: 50% of total vaccine demand of the world comes from India.

- USA: 40% of all USA’s generic drug demand is catered from India.

- UK: 25% of all UK’s medicine demand goes from India.

- Volume: India is the 3rd largest producer of pharma drugs by volume.

- Value: India is the 14th largest producer of pharma drugs by value.

Growth

The Indian Economic Survey 2021 has suggested that the Indian pharmaceutical industry will grow by three times (3x) in the next decade. This will account for a compound annual growth rate (CAGR) of 12% per annum in 10-Years. For any industry, a 10%+ long-term CAGR is lucrative.

After the COVID-19 pandemic, people have become more aware of their healthcare needs. It provides a fertile environment for the insurance sector. In this situation, if the insurance companies are able to sell more health insurance policies, expenses on medicine and healthcare will increase. It will further fuel the growth prospects of the pharma industry.

Pharma ETFs in India

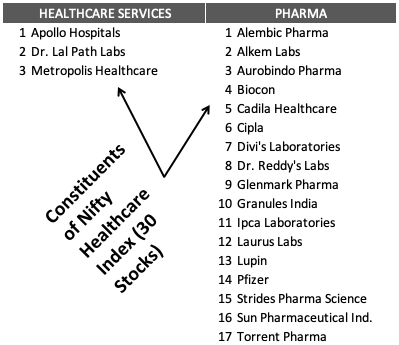

ETFs track the benchmark indices like Nifty Healthcare Index and S&P BSE Healthcare index. The nifty index is comprised of 20 stocks. Out of these stocks, 3 are from the healthcare industry and the balance is from the pharma industry.

The performance of the Nifty Healthcare Index since 2006 is shown in the below chart.

This is my assumption. As per the economic survey, the whole pharma industry will grow at 12% per annum for the next 10-Years. At this rate, this index can yield a 15-20% return per annum for a 10-15 year period.

The return of Individual stocks can be even better. But before buying stocks directly, its analysis is a must. I use my excel-based tool to analyze all my stocks. I call my tool, the stock analysis worksheet. But if one is not comfortable with individual stock investing, ETFs will be a fair bet.

Here we will see details of a few Pharma ETFs currently trading in the Indian stock market. Considering current demand and future growth prospects of the industry, these ETFs will perform.

List of Pharma ETFs in India

(Updated on 06-Feb-2022)

| SL | Fund name | Launch Date | Expense Ratio | Assets (Cr) | NAV |

| 1 | ICICI Pru Healthcare ETF | May-21 | 0.15% | 104 | 85.25 |

| 2 | Nippon India Nifty Pharma ETF | Jul-21 | 0.21% | 63 | 13.62 |

| 3 | ABSL Nifty Healthcare ETF | Oct-21 | – | 29 | 8.51 |

| 4 | Axis Healthcare ETF | May-21 | 0.22% | 20 | 85.3 |

Income Tax Applicable on ETFs

- Dividends: Dividends are taxable. They get added to the taxpayers annual income. The total income is then taxed as per the applicable tax slab. TDS of 10% will be deducted by the fund house if the annual payout is greater than Rs.5000.

- Capital Gain: Capital gains are not taxed upto Rupee one lakh. If the gains are above one lakh, it will be taxed. If the holding time is less than a year, applicable tax rate is 15%. For holding time above one year, tax rate of 10% is applicable.

Conclusion

Pharma ETFs are new for the Indian stock market. All four ETFs mentioned above have a launch date in the Year 2021. So how to make a guess about their potential future performance? There are three ways.

- First, we can look at the performance of the Nifty Healthcare Index. I’ve shown a chart plotted for years between 2006 and 2022. The chart gives a feel about how the healthcare and pharma industry as a whole has performed in the past.

- Second, we can check what the industry experts are saying about the sector. The prospects of Indian pharmaceutical industry is described here. Experts feel that the whole industry is likely to grow by 3x in next 10 years.

- Third, we can check the performance of sectoral funds operating in the pharma sector. The ETFs are new, but pharma funds have been in India since long time. There are two mutual funds operating in the healthcare space since last 20 years. One fund has a operating historay of 15 years. Let’s me give you their return numbers.

Returns generated a few pharma funds in the last 5,10,15, and 20 years,

| Fund Name | 5Y (%) | 10Y (%) | 15Y (%) | 20Y (%) |

| UTI Healthcare Fund | 12.71 | 14.86 | 13.92 | 16.37 |

| SBI Healthcare Opportunities Fund | 10.49 | 17.02 | 12.87 | 19.22 |

| Nippon India Pharma Fund | 16.60 | 18.01 | 19.27 | — |

| Nippon India Pharma Fund | 17.64 | — | — | — |

| SBI Healthcare Opportunities Fund | 11.73 | — | — | — |

| Tata India Pharma & Healthcare Fund | 15.86 | — | — | — |

| UTI Healthcare Fund | 13.84 | — | — | — |

These numbers prove that the Pharmaceutical industry’s stocks and mutual funds have given great returns in the past. Post pandemic, people will focus more on healthcare. Further, as the population of the world increase, India will consume and export more medicines.

The future prospects of good companies operating in the healthcare space are good.

I would personally like to invest in this sector via stocks, ETFs, or index funds.

Just for Information, the Indian pharma industry is the fourth largest in terms of total market capitalization.

I hope you liked the article. Keep reading and have a happy investing.

Just came across your blog !! You have mentioned sbi health care twice in your column which one is correct ?

Thanks MANI wonderful article on pharma ETFs. Thanks again for sharing.

The pleasure is all mine. Thanks