Power Grid Corporation of India, is a publicly traded “Maharatna” company. The company comes under India’s Ministry of Power. It is a company that transmits nearly half the nation’s electricity. It was incorporated in 1989, it owns and maintains India’s interstate transmission system. Power Grid also offers consultancy services in power transmission as well. Power Grid is listed on both NSE and BSE. It is one of the major players in India’s power infrastructure sector.

In the last few months when PSU stocks have been a rage, my stock engine is pointing towards one such PSU (Power Grid). It is arguably one of India’s most critical infrastructure companies. It is the backbone of the nation’s electricity grid. Power Grid transmits nearly half the power used across the country. This ensures vital electricity reaches homes and industries, underpinning economic activity and daily life.

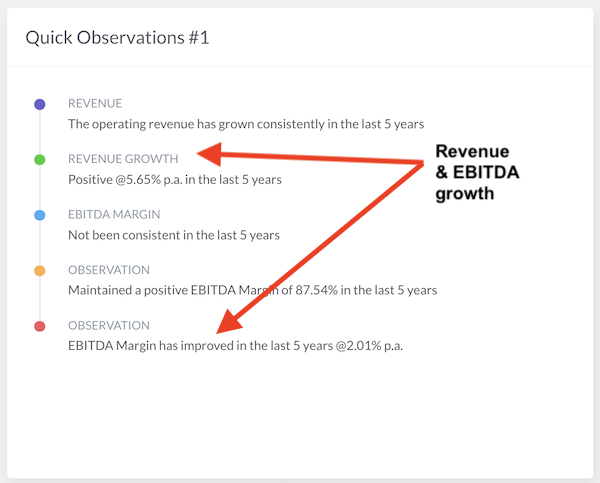

I generally, avoid investing in PSUs. But a few government-run companies have very well-managed businesses. I feel Power Grid is one such company. In the last five years, Power Grid has seen revenue growth, profit growth, and even margin expansion.

Overall Fundamentals

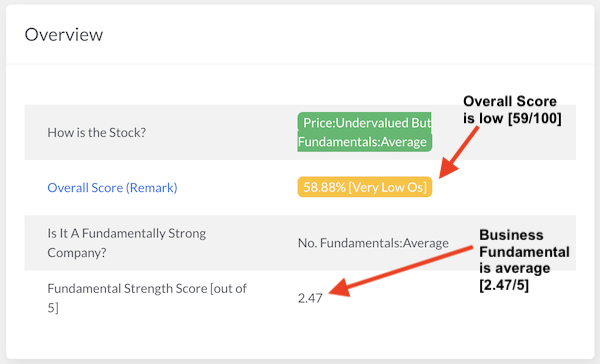

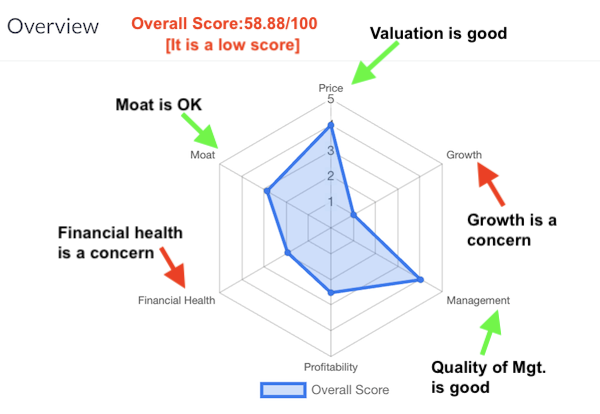

With this initial impression of the company, I thought to check the fundamentals of Power Grid in more depth. There are two things that I check first in my stocks: the overall score matrix (spider diagram) and the intrinsic value vs price balance.

So you can see, in my Stock Engine, the Power Grid was showing mixed signals. On one side, the price valuation score was high, by the financial health and growth prospects looked like a concern.

How The Fundamentals Are Showing Mixed Signals

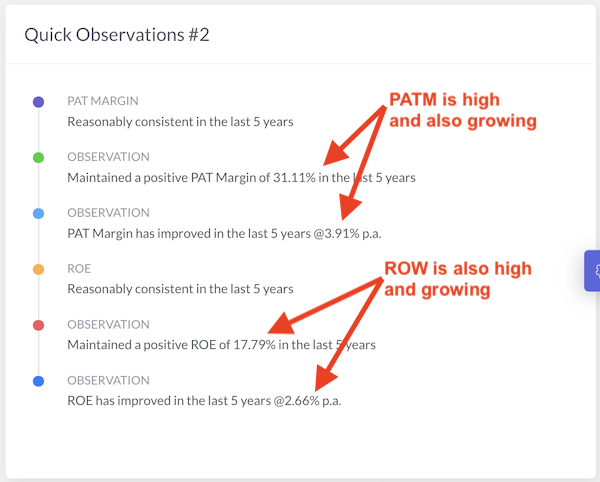

PAT Margin and ROE

The Good part: See the PAT Margina and ROE of Power Grid. These two profitability metrics have been consistently high. Furthermore, the company has also seen PATM and ROE expansion in the last five years. In the last 5 years, Power Grid has maintained a healthy PATM of 31% and ROE of 17.8%. Moreover, these metrics have also improved at a rate of about 3% per annum in the past years.

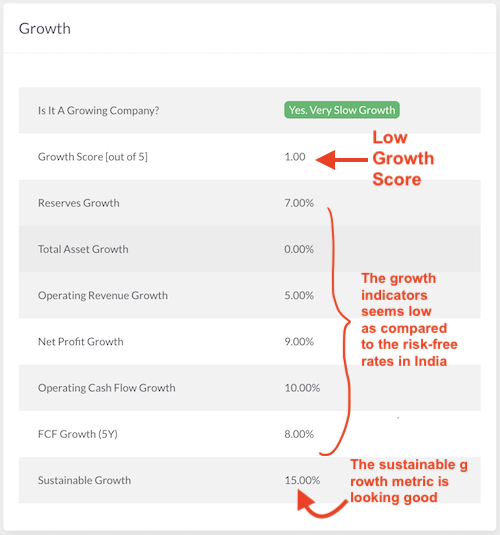

Growth Metrics

The Stock Engine has given it a growth score of only 1 out of 5. It is a low score. The company’s reserves, assets, and operating revenue are growing slowly (below the risk-free rate). However, net profit, cash flow, and FCF are growing at a decent rate. The Stock Engine’s algorithm for the sustainable growth rate is also showing good numbers at 15% per annum.

However, if the revenue and asset base are not growing at a similar pace as profits and free cash flows, such growth is less sustainable.

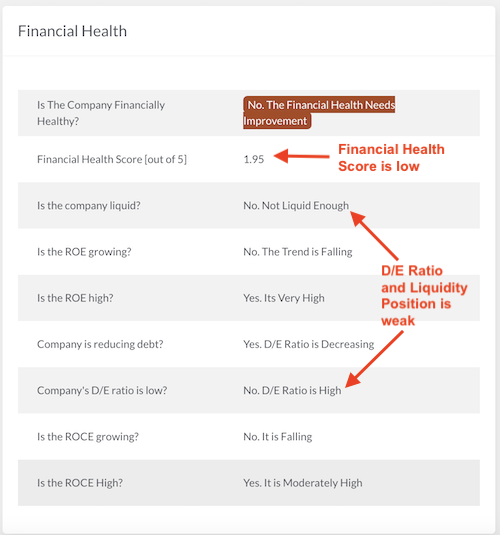

Financial Health

The Financial Health Score of Power Grid is low. The reason is attributable to low Liquidity and high Debt-to-Equity ratio (D/E).

In the last five years, the current and quick ratio of Power Grid has mostly remained below one (1). This is not a good liquidity metric. Moreover, the cash ratio has been even lower. Only about 10% of the total current liabilities could be managed from the current cash balance of the company. This puts the company in a risky zone. But this is also true that the cash flow position of the company grid is good. This is the reason why even lower liquidity metrics are not adversely harming the company’s stocks.

On one hand, the D/E ratio of the company remains high at about two (2). But in the last five years, it has reduced its debt burden considerably. Moreover, the Interest Coverage Ratio has come close to three (3) in the last five years (from 2 levels). So, we can say that the company’s solvency is not great but not so bad either as its scores are pointing.

Final Words

The Stock Engine is estimating the Power Grid stock as undervalued. But there are two concerns with this stock, financial health and growth. Having said that, it is also true that Power Grid is a quality Maharatna company.

Here are a few additional understandings about Power Grid that are worth noting that go beyond the number crunching.

Key Points:

- Stability in a Volatile Market: Power Grid is a defensive play in one’s stock portfolio. In a volatile market environment, particularly with upcoming elections, such stocks can be a passifier.

- Improved Operating Performance: Power Grid has demonstrated strong execution and revenue growth in its core transmission business. This trend is likely to continue in the coming years as the country’s power demand is only rising rapidly.

- Strategic Positioning: Being India’s largest power transmission company, Power Grid is strategically positioned to benefit from the growing domestic transmission and distribution (T&D) expenditure.

- Aggressive Growth Strategy: The company is aggressively deploying growth capital, especially in light of the revival in the domestic T&D capex cycle. This can be seen as a positive move for investors seeking growth.

- High Revenue Visibility and Capex Plans: Power Grid has a substantial capital expenditure plan. They have made revisions to its capex targets for the coming fiscals. This gives it good revenue and growth visibility.

- Valuation and Dividends: We have seen that Power Grid is attractively priced. The current dividend yield of the company is about 4.5%, making it an appealing option for investors.

For me, this type of stable and potentially lucrative company is a good bet as I’m always ready to buy and hold stocks for a very long term (8-10 years).

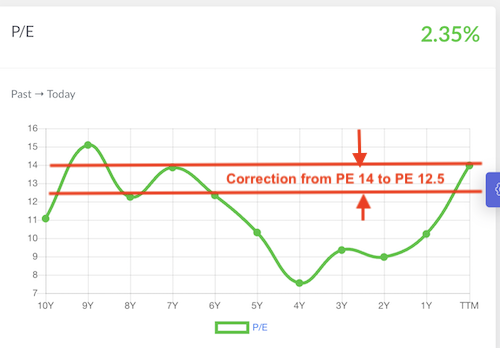

But as it is a PSU, my apprehensions are always high. Hence, I will not buy this stock at current PE levels. I’d like to build a more comfortable margin of safety before venturing in. I’ll wait for its PE to correct from PE14 to PE12.5 levels.

Have a happy investing.

Suggested Reading:

![Solvency Ratio - 5 Yrs [Debt to equity]](http://ourwealthinsights.com/wp-content/uploads/2024/03/Solvency-Ratio-5-Yrs.png)