Price discovery is the natural mechanism through which the price of a stock is determined. Prices reflect the interaction between buyers and sellers. It is the result of what one is willing to pay and what the other is willing to accept. This dynamic ensures that stocks are valued as fairly as possible in real-time.

But why is this important? For investors, price discovery offers clarity. It shows the current worth of a stock based on demand and supply. It helps the investor to decide whether he will buy, not buy, or sell.

Factors like company performance, market sentiment, global events, and economic trends all influence this process. For example, if a company reports higher profits than expected, its stock price may rise as more buyers will prefer buying the stock.

I believe, understanding price discovery can help investors appreciate how the stock markets work.

Topics:

1. Key Participants in the Price Discovery Process

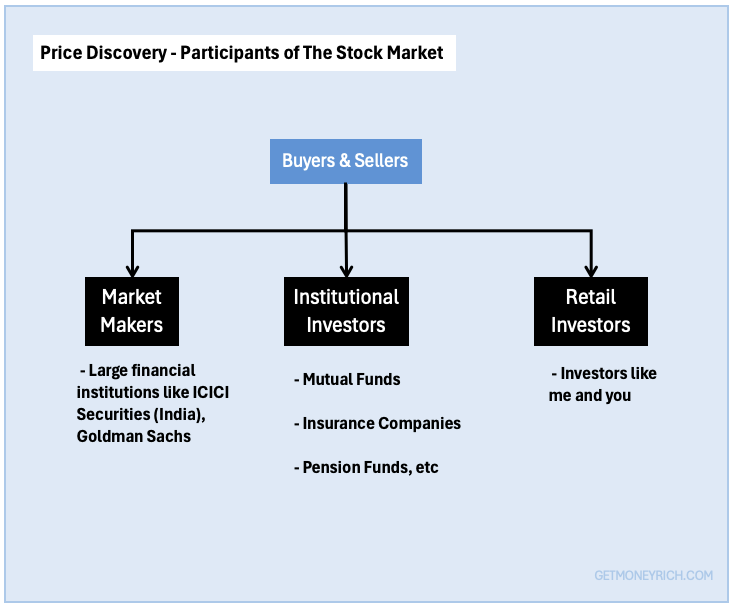

The process of price discovery relies on the active participation of various players in the stock market.

At its core, buyers and sellers are the main participants. Buyers express their willingness to purchase a stock at a certain price, while sellers indicate the price at which they are ready to sell. The interaction between these two groups creates a balance. This demand-supply balance determining the stock’s price at any given moment.

Market makers also play a crucial role. These are entities, often large financial institutions, that ensure there is enough liquidity in the market. Liquidity means making sure that buyers can find sellers and vice versa. Market makers do this by continuously quoting buy and sell prices, bridging gaps when the market is slow. Without their presence, trades could take longer to execute, disrupting the natural flow of price discovery.

In India, large financial institutions like say ICICI Securities act as market makers for some stocks. Globally, firms like Goldman Sachs perform this role. For example, Goldman Sachs is a prominent market maker on the NYSE. They facilitate trades for numerous securities daily.

Not all stocks have market makers. Market makers are typically more active in large-cap stocks and highly traded mid-cap stocks,

Another important factor is the type of investors involved.

- Institutional investors, like mutual funds, insurance companies, and pension funds, bring significant money in the market. Their large-scale trades can heavily influence stock prices. Prices sometimes moving up or down based on their buying or selling decisions.

- Retail investors, on. the other hand, are individuals like you and me. This type of investors also impact the process, though on a smaller scale. For example, during the pandemic, retail investors worldwide heavily traded certain stocks, creating price surges.

From my perspective, understanding these participants helps us realize why stock prices fluctuate. It’s not random; it’s the result of real-time actions by diverse players, each with their own goals and strategies.

2. Mechanism of Price Discovery

The mechanism of price discovery in stocks revolves around the basic principle of demand and supply.

When demand for a stock exceeds its supply, prices tend to rise. Conversely, when there’s more supply than demand, prices fall.

Imagine a popular new smartphone launch. If thousands of people want it but only a few units are available, its price shoots up in secondary markets. Similarly, in stocks, demand and supply reflect investor sentiment and actions, directly influencing prices.

Stock exchanges and trading platforms act as the marketplace for this process.

Exchanges like the BSE and NSE provide a transparent platform where buyers and sellers meet. They ensure trades are executed efficiently and prices are updated in real-time based on the latest transactions.

Trading platforms, whether apps or websites, make this process accessible to everyone. It allows investors to track price movements and execute trades seamlessly.

Bid, Ask, and Spread

An important aspect of price discovery is understanding the bid and ask prices.

The bid price is what a buyer is willing to pay, while the ask price is what a seller wants for the stock.

The difference between the two is called the spread.

For example, if you’re selling a bike, you might want to sell it at a price of Rs.10,000 (ask). But the buyer is offering only Rs.9,500 (bid). The spread between this transaction of Rs.500.

In order for the trade to happen, the spread must come down to zero. How it will happen? Either the ask price should come down or bid price should go up.

When both parties agree on a price, the trade happens, and this agreed price becomes part of the stock’s ongoing price discovery.

3. Factors Driving Demand and Supply

The demand and supply of a stock are influenced by a mix of factors.

- Out of all factors, the company-specific factors often take the lead. For instance, if a company like Britannia reports better-than-expected revenue and profits, it attracts more buyers. This increases the demand and pushing its stock price higher. Similarly, news about management changes, product launches, or legal troubles can sway investor sentiment. A high-profile example is when PayTM faced strict actions in the past from SEBI. In that scenario, its stock saw sharp movements as markets reacted to uncertainty.

- Macroeconomic indicators also significantly impact demand and supply. In India, factors like interest rates and inflation guide investor decisions. When the RBI cuts interest rates, borrowing becomes cheaper, boosting corporate profits and stock demand. Conversely, high inflation erodes purchasing power and impacts company costs, often leading to reduced investor interest in stocks. For instance, during periods of rising inflation, sectors like FMCG can see price adjustments due to reduced consumer spending.

- Global events also plays a critical role in this equation. Geopolitical tensions, such as border disputes or changes in international trade policies, create uncertainty. For example, the U.S.-China trade war disrupted global markets, influencing Indian stocks connected to exports. Similarly, the 2008-09 mortgage crisis was a stark reminder of how global crises can destabilize stock prices worldwide.

In my view, tracking these factors provides a clearer understanding of market behavior.

Knowing what drives demand and supply helps investors to stay ahead and take informed bets on quality stocks.

4. Role of Information & Analysis

Information is the lifeblood of the stock market. It plays a crucial role in price discovery.

Every piece of news, whether about a company, an industry, or the economy, can influence investor behavior.

- Information Spread: When a company like Reliance, for example, announces a major acquisition, this information spreads quickly. This spread of information prompts investors to reassess its future prospects. Based on their interpretation of the news, they adjust their buy or sell decisions. The faster and more accurate this information spreads, the more efficient the price discovery process becomes.

- Markets rely on transparency to function efficiently. Stock exchanges and regulatory bodies, such as SEBI, ensure that companies disclose relevant data. This data can be quarterly earnings, debt levels, or major events. This transparency helps to create a level the playing field. It allows all types of investors, big or small, to access the same information.

Efficient markets are those where prices reflect all available information at any given time.

In India, the rapid adoption of technology has improved market efficiency. With development of mobile and web apps for stock analysis and trading, even retail investors now receive updates instantly. The technology has bridged the gaps that once existed.

Having said that, insider trading, is still a challenge. When some individuals gain access to privileged information and takes buy/sell bet based on this information, it is not good. It actually undermines the transparency of the stock market. Insider trading makes it harder for ordinary investors to compete fairly.

For stock investors like us, following credible news sources that gives us updates about companies is the key. The more closely and minutely we can track this new, better will be our investment calls. On one side we must read news, and on the other side we must also have tools to do in-depth fundamental analysis of stocks. A combination of these two can help us invest like a pro.

5. Short-Term vs. Long-Term Influences

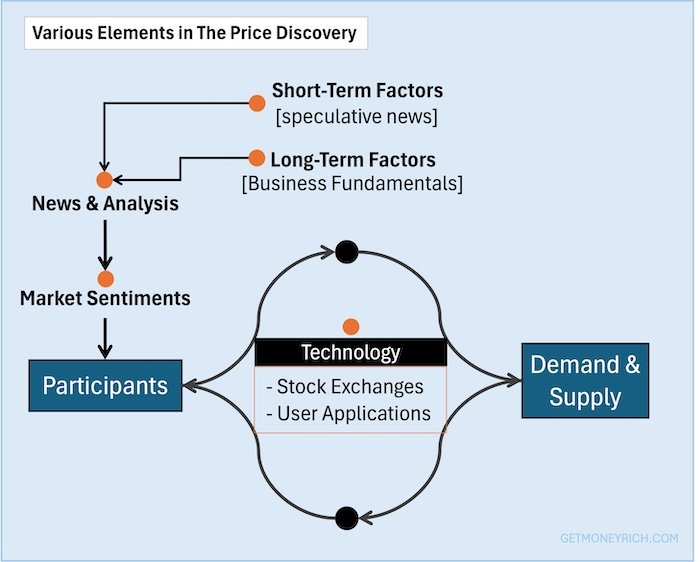

Price discovery operates differently over short-term and long-term horizons.

- Short-term movements are often driven by speculation, news events, and day trading activities. For instance, a rumor about a policy change or a sudden spike in oil prices can cause traders to buy or sell stocks aggressively, creating sharp price swings. Day traders aim to capitalize on these small, quick changes. They focus less on a company’s fundamentals and more on market sentiment. They can using technical charts to predict price patterns. This creates volatility, but these fluctuations usually don’t reflect the true value of a company.

- In the long term, fundamentals play a decisive role in price stability. A company’s earnings growth, debt levels, and competitive positioning determine its intrinsic value. For example, over decades, Nestle India has consistently delivered strong financial performance. It has anchored its stock price upward despite short-term ups and downs. Factors like revenue growth, innovation, and leadership quality ensure that long-term investors remain confident in such stocks, stabilizing their prices.

The key difference lies in the nature of these influences.

- Speculation may cause sudden price jumps or drops, but these are often temporary.

- Fundamentals, on the other hand, may cause slow price movements, but it ensures that prices gravitate toward their intrinsic value over time.

In my view, while short-term trading can offer opportunities, it is the long-term perspective that creates lasting wealth.

6. Impact of Market Sentiment

Market sentiment plays a powerful role in price discovery, often driving stock prices away from their fundamental values.

Behavioral finance explains how emotions like fear and greed influence investor decisions. For example, during a bull market, greed can lead investors to buy stocks at inflated prices, driven by the hope of higher returns. Conversely, during market crashes, fear can cause panic selling, pushing stock prices lower than their true value.

A key driver of market sentiment is herd mentality, where investors mimic the actions of others. This behavior is common in speculative bubbles. Take the dot-com bubble of the late 1990s. It was a time when investors rushed to buy internet-based company stocks without analyzing their fundamentals. People used to buy these stocks simply because others were doing the same (herd mentality). When the bubble burst, stock prices crashed, wiping out significant wealth.

Both herd mentality and fear & greed are trading pattern of investors driven by their psychological set-up. News and events and analysis from perceived experts can build this psychology. The news can be of speculative types or related to business fundamentals. They build a market sentiments that eventually drives the market towards its highs or lows.

Understanding market sentiment is crucial for investors. While emotions can provide short-term price signals, they often lead to irrational decisions.

Long-term investors must stay focused on fundamentals. The must always resist the temptation to follow the crowd. Recognizing when sentiment is driving prices can help investors avoid buying overvalued stocks and selling in a panic mode.

7. Role of Technology

- In the past, price discovery in stock markets was a manual process. Trades were conducted on physical trading floors, where brokers shouted bids and offers. This system was slow and lacked transparency, often leading to inefficiencies. Prices were influenced more by local factors and delayed communication, making it challenging for traders to act on real-time information.

- The advent of modern stock exchanges like NSE and BSE transformed trading by introducing electronic platforms. These enabled real-time transactions, making price discovery faster and more transparent. Traders could see live price movements, and the influence of human delays and errors reduced significantly. This brought a new level of efficiency to the process.

- Settlement cycles have also evolved. Earlier, settlements took several days, providing opportunities for manipulation. For example, Ketan Parekh exploited the delay in settlements to inflate prices artificially. Today, with T+1 settlement cycles, such manipulation is harder as trades are settled within a day. It has enhanced the market’s integrity and supporting a more natural price discovery.

- The development of mobile and web applications has democratized trading. Retail investors can now trade from their homes using apps. This increased participation enriches the price discovery process, as prices now reflect the views of a broader pool of investors.

- Finally, algorithmic and high-frequency trading (HFT) have revolutionized markets. These automated systems analyze data and execute trades in milliseconds, driving efficiency. However, their speed can also exaggerate short-term price movements, making the process highly dynamic but sometimes volatile.

8. Challenges in Price Discovery

- Lack of Accurate Information or Misinformation: Rumors or exaggerated news about a company can mislead investors. This disrupts natural price movements, causing undue panic selling or price inflation.

- Market Manipulation: Schemes like pump-and-dump artificially inflate stock prices through false information. Once manipulators exit, prices crash, leaving genuine investors at a loss.

- Illiquid Stocks: Stocks with low trading volumes face significant price swings from small trades. Limited buyers and sellers make price discovery inconsistent for these stocks.

- Need for Investor Vigilance: Investors must verify news, avoid speculative stocks, and focus on fundamentals. This helps navigate challenges and make better investment decisions.

Conclusion

The natural process of price discovery in stocks is a fascinating process. It is a balance between demand, supply of all listed stock in the stock market.

Ideally, it reflects the true value of a stock, driven by market efficiency.

However, history has shown how this process can be disrupted by individuals seeking quick gains.

Figures like Harshad Mehta and Ketan Parekh exemplify this. Mehta manipulated the system using bank receipts, inflating stock prices and creating artificial demand. Parekh, on the other hand, focused on specific stocks, using coordinated buying to inflate prices—later selling at a profit, leaving retail investors to bear losses. These manipulations not only distort price discovery but also erode investor trust in the markets.

In my view, while the stock market strives for transparency, vigilance is key. Learning from these episodes, investors should focus on fundamentals and avoid getting swayed by speculative trends.

A well-informed investor is the best defense against market manipulation.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.

![Understanding Block Deals: A Guide for Retail Investors [Also Fact Check]](https://ourwealthinsights.com/wp-content/uploads/2024/11/Block-Deals-Fact-Check-Thumbnail3.png)