Stock market investing is not only about buying and selling stocks. After a stage, the investors begin to see the investments as a collection of stocks. Single stocks transform themselves into a shares portfolio.

A stage comes when the investor starts to pay less attention to individual stocks. For him/her, more important is the present value of the portfolio versus the cost of investment.

Suppose a person has built a portfolio consisting of about fifty (50) number stocks. Within this collection of stocks, the value of individual shares will go up and down each day. This volatility is unavoidable. But for the investor, short-term price movements matter less. More important is the cumulative worth of the total shares portfolio.

If you’ve reached a stage like this, your thought process has been pruned to build a bigger shares portfolio. But there will be new realizations, we will discuss them in this article.

Realizations about shares portfolio

We will mainly talk about five (5) major realizations related to a stock portfolio. I first realized it after the 2008-09 stock market crash. I formally started building an investment portfolio during that time. As I started investing during a market crash, the first few months were euphoric. Everything I touched became profitable, but soon I realized that upsides are not forever.

The same stocks that showed 40%+ gains in a few months, came close to being red. In those days, I first realized the benefits of diversification. To calm my nerves, I started looking at my basket of stocks as a portfolio. Inside the portfolio, volatility was rampant, but the present value of my portfolio remained green. It gave me a lot of confidence.

As I continued to watch my holdings, I realized a few important things which again helped me during the COVID-19 crash. Here are my findings:

#1. Lofty Gainers and Big Losers

No matter how carefully I was timing the purchase of my stocks, the accumulation of a few big losers seemed inevitable. Similarly, some stocks were also posting astronomical gains. So, I had mixed feelings about my shares portfolio.

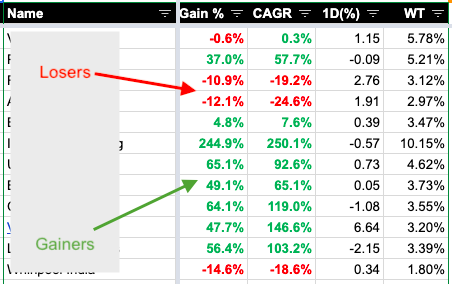

Here is a snapshot of my shares portfolio of a time when holding time was less than a year.

On one side I felt good about the gainers as it was proof that my stock analysis is correct. On the other side, the losers were becoming pain points. The temptation to sell the losers was high, but I did not do it.

I decided, instead of booking losses, it is better to re-check the fundamentals of their business. For most of my holdings, the fundamentals were reasonably strong. It gave me some confidence. In some cases, I bought more of the Red ones.

I remember, there was one penny stock that I bought just to satisfy my urge to trade. It was a stock I bought at Rs.0.65 per share. In 6-months it went up to Rs.3.5. It was my first multibagger (5-bagger). The underlying fundamentals of this stock were weak. Hence, when its price started to fall, I decided to sell it. At the time of selling, it was still a 3-bagger.

I could have hold-on to these stocks a bit longer, but I booked profits as I was not confident about it. I was not sure if its fundamentals would improve even in the coming years. It was operating in a sector with low profitability.

This was my first realization. We can continue to hold the losers if its fundamentals are strong. Booking profits, early, in stocks with a weak business is better.

#2. Maintaining Cash Balance (Liquidity)

It is one of the major realizations that I had when I first started maintaining my shares portfolio. After a lot of analysis, patience, and thought, I picked my stocks. So it will not be wrong to say that I liked my collection.

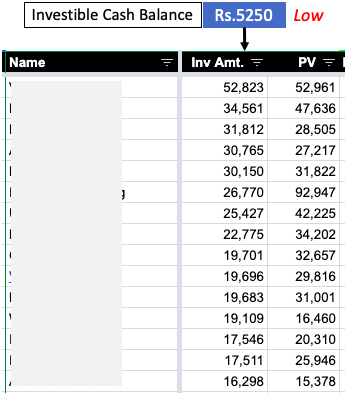

In this frame of mind, whenever I saw major corrections among my holdings, I wanted to buy more. Initially, It was not a big problem as I had an investible cash balance. But by the end of Yr-2009, most of my cash was already invested. I had little cash left for investing in stocks.

My share portfolio has about 50 number stocks. I used to read news and publications about them. In a few months, I was beginning to feel a level of competence. For sure, my know-how about these companies was better than other stocks of the market. My stock portfolio was actually becoming my stock watchlist.

So, in this list, if any stock was trading at 15-20% discount to my cost of purchase, I wanted to buy them. But the low investible cash balance was a limitation.

I realized that as important it is to do stock analysis, stock buying, and selling, it is equally essential to watch the cash. Maintaining a healthy investible cash balance is critical. Why? When it is time to buy more, enough liquid cash must be available.

#3. How Long To Hold?

There were few stocks in my portfolio that I was holding for almost 3-Years. The CAGR of these stocks was either low or negative. Similarly, there were few holdings that showed 25%+ CAGR returns after a holding period of 3+ years.

So again, there were two different shades of experience. One group was lagging and the other was sprinting in terms of returns. I was confused, how much longer I should hold them?

Back then I realized that it is essential to have a mindset regarding holding time. I buy such stocks that I can hold for the next twenty (20) years. This helps me see potential stocks from a long-term investor’s perspective. A company that may not continue to be a winner for the next 20-years, will not find a place in my portfolio.

So, any stock that might be rendering low returns now, but is likely to survive the next 20-Years, I will continue to hold them. Similarly, no matter how much the stock price has already appreciated, if the company is strong, there is no point selling it.

Though I would like to mention that, assumption about events so distant ahead in the future is mostly biased. But I make it anyways. If that decision is made based on the present position of the company, there is a good chance to get it right. Moreover, good company survive and perform much longer than 20-years.

#4. Adding New Stocks in Shares Portfolio

Experts say not to keep more than 15-20 number stocks in the portfolio. The idea is to keep the numbers low. Why? Because it helps in deeper tracking of individual companies. Too many companies will make the scene too crowded.

But when the holding period is as long as 20-years, the number of companies in the portfolio can easily cross the limit. I do not worry about it. Till I’m careful about the following things, the limit of 15-20 numbers does not bother me:

- Stock Selection Criteria: No stock is added to the portfolio without a thorough analysis. I have my own filters to seperate out bad companies. This selection criteria help me build a list of good companies. Within this list, if any company displays a large price correction, it becomes attractive. I use my tool to estimate its intrinsic value. If the company looks undervalued, I buy its stocks.

- Review The List: Atlease once every year I review my portfolio. In case I find any company weak, I make plans to book profits in times to come.

Over the years, I’ve realized that keeping the portfolio slender is not necessary. But it is important to add new stocks with extra care. If any bad company creeps inside, reviewing the list will highlight the mistake. I make sure to sell them even at a break-even price.

#5. One Visual Indicator, & Final Goal

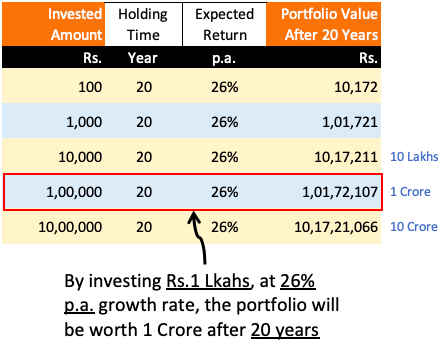

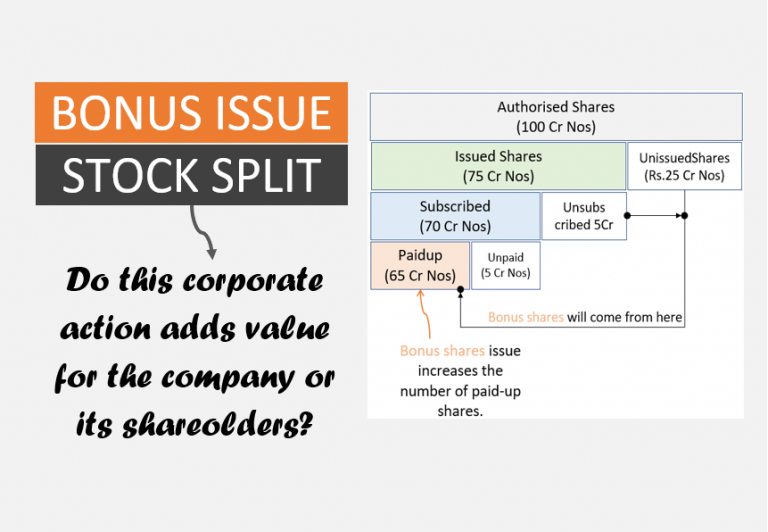

Over the years, I’ve realized that one visual indicator that’s worth tracking is CAGR (Compound annual growth rate). It can be the CAGR of the individual stocks and of the total portfolio. The ultimate goal is to keep the CAGR of my shares portfolio around 26% per annum.

I know, the expected return number is high, but it is within the practical limits. It is the reason why most of my stock picks are from the mid-cap and small-cap domains.

There is a significance of 26% per annum return. Let’s look at the below table. Rupee 100 invested for 20 years will become 10,000 at 26% per annum. Similarly, Rupees 1,00,000 will become Rs,1,00,00,000 in 20 years at 26% returns. The twenty-six percent number is acting like a 100 multiplier, in 20-Years, to the invested amount.

The above table also helped me to realize a simple but important investment lesson.

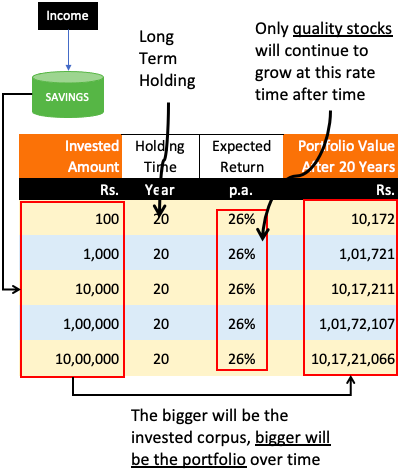

By investing continually in quality stocks will build wealth in long term.

How does the above table verify this quote? Allow me to explain it visually.

- Investing Continually: The heavier will be the invested corpus, the bigger the portfolio will grow over thime. It happens due to the power of compounding. How to do it? By investing continually. I do it by always keeping my investible savings reasonably funded.

- Quality Stocks: This realization is easy. Investing only in quality stocks will yield the expected returns of 26% per annum. So, the focus on fundamental analysis and price valuations cannot be avoided.

- Wealth Building: The present value of the shares portfolio represents wealth. Ultimately everythig is done here is for the purpose of wealth building. Investing continually in quality stocks will surely build wealth in long-term (20-Years).

Conclusion

Shares portfolio building is like an art. The total collection of stocks in the portfolio is like an individual asset. The characteristic of this asset is derived from its constituent stocks.

Imagine a stock portfolio worth Rupees 50 lakhs. It is almost like a real estate property, right? Its collective value will appreciate and it will also yield regular income as dividends.

After 5-10 years, the investor bothers less about individual stocks in the portfolio. The charm is more about the overall performance of the whole portfolio.

I hope you liked my thoughts and realizations about the stock portfolio.

Keep reading and have a happy investing.

Fantastic as usual. Thanks a lot. How to calculate the individual stock and overall portfolio CAGR. Please guide through this. Is it readily available or by any software.

Hi Mani,

I came across your website by chance a couple of years ago & its always been very interesting reading your thoughts & observations & investing using some of your stock screeners has mostly been positive until now.

Please keep up your excellent knowledge sharing.

Thanks !