In the world of investing, few concepts capture the imagination, and the anxiety, of market participants quite like “recession proof stocks.” People also refer to them as evergreen stocks. The idea evokes images of unshakable companies that weather economic storms, delivering steady returns even as unemployment rises, consumer spending falters, and GDP contracts.

But what does recession proof really mean? Is it a realistic or overhyped notion? Let’s explore this concept in depth, examining its origins, the characteristics of companies often labeled as recession-resistant. We’ll also talk about the limitations of the idea, and how investors can think critically about building resilience in their portfolios.

Table of Contents

1. What Are Recession Proof Stocks?

At its core, the term recession proof stocks refers to shares of companies believed to perform well, or at least hold their ground, during economic downturns, such as recessions.

These are typically businesses whose products or services remain in demand regardless of the economic climate.

The logic is simple, when people tighten their belts, they may cut back on luxury goods or discretionary spending, but they’re unlikely to stop buying essentials like food, medicine, or utilities.

The appeal of recession proof stocks lies in their perceived stability. In a market where volatility can erase gains overnight, the promise of a safe harbour is very attractive.

However, the term is more aspirational than absolute. No stock or company is entirely immune to the ripple effects of a severe recession. But it is true that some businesses are better positioned to navigate turbulence than others.

2. Characteristics of Recession-Resistant Companies

So, what makes a company a candidate for being recession-resistant? While there’s no foolproof formula, several traits often stand out:

- Essential Products or Services: Companies that provide goods or services people need daily, fall into this category. Think food, healthcare, utilities, or basic household products. These are the type of items that tend to see more consistent demand. For example, people don’t stop eating, taking medications, or paying their electric bills just because the economy slows.

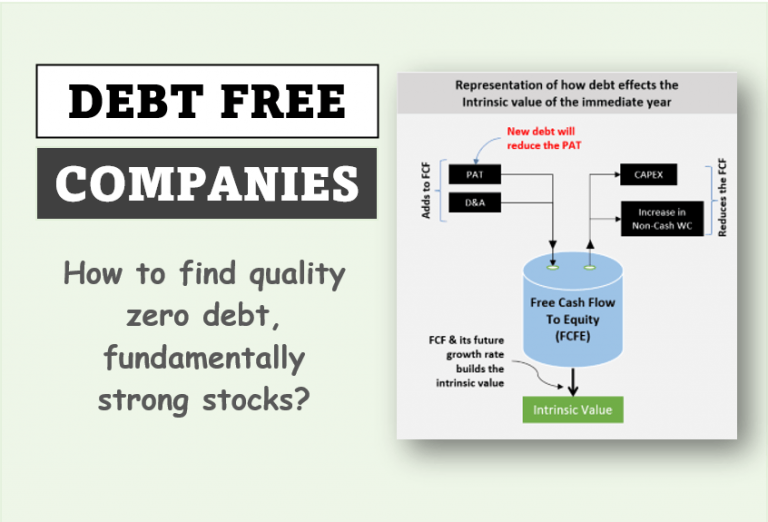

- Stable Cash Flows: Recession-resistant businesses often generate predictable revenue streams. This stability comes from long-term contracts, subscription-based models. It can also be due to a broad customer base that spans economic classes, reducing reliance on high-income discretionary spending.

- Low Debt Levels: Companies with manageable debt loads are better equipped to weather downturns. High leverage can become a liability when credit tightens or interest rates rise during a recession. Under such conditions, companies are potentially forced to opt for cost-cutting or dividend reductions.

- Strong Balance Sheets: Firms with robust financial health, including ample cash reserves and healthy profit margins, can sustain operations and even invest during downturns. Though even such stocks takes a beating during downturns, but they are better positioned for growth when the economy recovers.

- Defensive Sectors: Certain industries are inherently more recession-resistant. Consumer staples (e.g., food and beverage), utilities, healthcare, and sometimes telecommunications are often cited as defensive sectors. Why? Because they cater to basic needs that don’t fluctuate dramatically with economic cycles.

- Brand Loyalty and Pricing Power: Companies with strong brand recognition and the ability to maintain pricing power can often pass on inflationary pressures to consumers without losing market share, even in tough times.

These characteristics don’t guarantee immunity, but they can mitigate the impact of a downturn.

However, it’s worth noting that even companies in these sectors can face challenges if a recession is particularly severe or prolonged.

3. The Myth of True “Recession Proofness”

While the idea of recession proof stocks is compelling, it’s important to approach it with a healthy dose of skepticism.

No company is entirely recession proof.

Even the most stable businesses can be affected by broader market dynamics, such as declining consumer confidence, supply chain disruptions, or geopolitical instability. For instance, a healthcare company might see steady demand for its products, but if its supply chain is disrupted or raw material costs skyrocket, profitability could suffer.

Moreover, stock prices are influenced by investor sentiment as much as by fundamentals. During a recession, even companies with strong fundamentals can see their stock prices decline if panic selling grips the market. This means that while a company’s operations might remain stable, its stock price could still experience volatility, undermining the “proofness” investors seek.

Another limitation is that recession-resistant stocks often come with a trade-off: lower growth potential. Companies in defensive sectors like utilities or consumer staples tend to have steady but modest growth, as their products or services don’t typically experience explosive demand during boom times. This can make them less attractive to growth-oriented investors, especially in a bull market.

4. How Recessions Test Resilience

To understand recession proof stocks, it helps to look at how companies have performed during past downturns.

The 2008 financial crisis, for example, saw many consumer staples and utility companies hold up relatively well. Cyclical sectors like real estate, automotive, or luxury goods performed comparatively worse then defensive stocks. Companies like major food producers or pharmaceutical giants often maintained dividends and saw less dramatic declines in stock price. Eeven as broader indices like the S&P 500 plummeted, these stocks held well on comparative basis.

However, even these “safe” companies weren’t immune. Rising unemployment and reduced consumer spending sometimes pressured margins. Some saw their stock prices drop significantly due to market-wide fear. The COVID-19 pandemic in 2020 offered another case study. While some staples and healthcare companies thrived (e.g., due to increased demand for at-home products or vaccines), others struggled with supply chain issues or shifts in consumer behavior.

These examples highlight that while certain stocks may be more resilient, no company is entirely shielded from the broader economic fallout of a recession.

5. Building a Recession-Resilient Portfolio

| SL | Alternative #1 | Price ($) | Alternative #2 | Price ($) |

|---|---|---|---|---|

| 1 | Coca-Cola | 71.49 | PepsiCo | 156.42 |

| 2 | Berkshire Hathaway B | 499.82 | Markel Corporation | 1,887.76 |

| 3 | P&G | 172.65 | Unilever | 55.9 |

| 4 | Waste Management | 230.75 | Republic Services | 233.51 |

| 5 | J&J | 166.09 | Pfizer | 26.74 |

| 6 | Bank of America | 43.94 | JPMorgan Chase | 257.4 |

| 7 | Broadcom | 202.54 | Texas Instruments | 199.98 |

| 8 | Bristol-Myers Squibb | 58.21 | Merck & Co. | 91.43 |

| 9 | Kellanova | 82.69 | General Mills | 61.59 |

| 10 | Kroger | 65.47 | Albertsons Companies | 20.65 |

| 11 | McDonald’s | 310.72 | Yum! Brands | 154.15 |

| 12 | Caterpillar | 342.36 | Deere & Co. | 487.59 |

| 13 | AbbVie | 204.14 | Amgen | 315.63 |

| 14 | Home Depot | 393.29 | Lowe’s | 242.39 |

| 15 | Walmart | 97.69 | Costco | 1,055.66 |

| 16 | Mastercard | 564.03 | American Express | 293.34 |

| 17 | Visa A | 352.09 | PayPal | 74.07 |

| 18 | O’Reilly Automotive | 1,346.58 | AutoZone | 3,425.60 |

| 19 | ADP | 313.37 | Paychex | 151 |

| 20 | Aon | 397.57 | Marsh & McLennan | 234.2 |

| 21 | Canadian National Railway | 100.65 | Union Pacific | 245.89 |

| 22 | Philip Morris | 157.42 | Altria Group | 56 |

Rather than chasing an elusive “recession proof” stock, investors might be better served by focusing on building a recession-resilient portfolio. This approach involves diversification across sectors, including both defensive and growth-oriented investments, to balance risk and reward.

Here are a few strategies to consider:

- Diversify Across Sectors: While defensive sectors like consumer staples and utilities can provide stability, include some exposure to growth sectors (e.g., technology or renewable energy). These companies can capture upside potential during recoveries.

- Focus on Quality: Look for companies with strong fundamentals, solid balance sheets, consistent cash flows, and prudent management. Quality companies are better positioned to take itself out of downturns and emerge stronger.

- Consider Dividends: Dividend-paying stocks, particularly from stable industries, can provide a steady income stream during recessions, helping to offset potential capital losses.

- Stay Informed: Economic cycles are unpredictable, but staying informed about macroeconomic indicators, such as unemployment rates, interest rates, and consumer confidence, can help you anticipate potential downturns and adjust your strategy accordingly.

6. The Psychological Appeal of Recession Proof Stocks

Beyond the financial aspects, there’s a psychological draw to recession proof stocks.

In times of uncertainty, investors crave security, and the idea of a “safe” investment can provide peace of mind.

However, this desire can sometimes lead to overpaying for perceived safety. Valuations of defensive stocks can become stretched during periods of market fear, so as an investor we must always keep this in mind.

It’s also worth considering that what feels “recession proof” today might not hold up under unique or unprecedented conditions. The global nature of modern economies means that interconnected risks, such as pandemics, climate change, or geopolitical tensions. These factors can also can create challenges that defy historical patterns.

Conclusion

While certain companies and sectors can offer greater stability during economic downturns, no investment is entirely immune to risk.

Instead of seeking an unattainable ideal, investors should focus on building resilience through diversification, quality, and a clear understanding of their own financial goals and risk tolerance.

Recession-resistant stocks can play a valuable role in a well-rounded portfolio, providing a buffer against volatility and steady returns during tough times. But they’re not a silver bullet.

By combining defensive investments with strategic growth opportunities is a better idea. Maintain a long-term perspective and you can navigate recessions with greater confidence.

Learning about recession proof stocks is more about learning how economic ups and downs work that finding a perfect list. If we can learn how to prepare ourselves to handle tough times, we will emerge as a successful investor.

Have a happy investing.