If you’ve ever peeked at a company’s balance sheet and wondered, “What on earth are retained earnings, and why should I care?”, you’re in the right place. I’ve been down that rabbit hole myself, and trust me, once you get the hang of it, retained earnings start to feel like the unsung hero of a company’s financial story. Today, we’re diving deep into what retained earnings are on a balance sheet, where they show up, and why they matter to folks like you and me. Whether you’re an investor, a small business owner, or just someone curious about how businesses tick, it is a must-know concept for all.

Let’s declutter the topic of retained earnings together, step by step, with a cup of coffee in hand (or tea, if that’s your vibe).

So, What Are Retained Earnings on a Balance Sheet?

Consider this, You run a little bakery. After paying for flour, sugar, and that fancy espresso machine (because who doesn’t love a good latte with their croissant?), you’ve got some profit left over. Now, you could take all that cash and treat yourself to a well-deserved vacation, or you could keep some of it in the business to buy a bigger oven or open a second shop down the road.

That money you decide to keep? That’s retained earnings in a nutshell.

On a balance sheet, retained earnings are the portion of a company’s profits that aren’t paid out to shareholders as dividends. Instead, the company holds onto them, stashing them away like a financial rainy-day fund.

These earnings pile up over time and become a key part of the company’s equity. Basically, it belongs to the owners (or shareholders, in a public company). Think of it as the business saying, “Hey, we made some money, and we’re keeping it to make even more money later.”

I have an interesting question. Are retained earnings just cash sitting in a vault?

No, they’re often reinvested into the business, paying off debts, funding new projects, or keeping things running smoothly.

So, when you see “retained earnings” on a balance sheet, you’re looking at a snapshot of the company’s accumulated profits over its lifetime (minus whatever it’s handed out to shareholders as dividends).

Where Does Retained Earnings Go on a Balance Sheet?

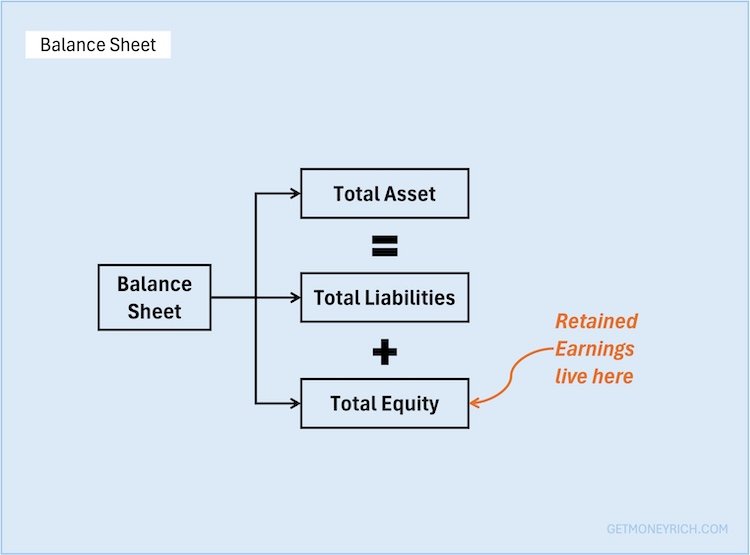

Alright, let’s get practical. If you’ve ever opened a balance sheet (or pretended to know what’s going on while nodding at your accountant), you’ll notice it’s split into three big sections: assets, liabilities, and equity. Retained earnings live in the equity section, right alongside things like common stock or additional paid-in capital.

It’s like the equity section is the “who owns what” part of the balance sheet, and retained earnings are a big piece of that puzzle.

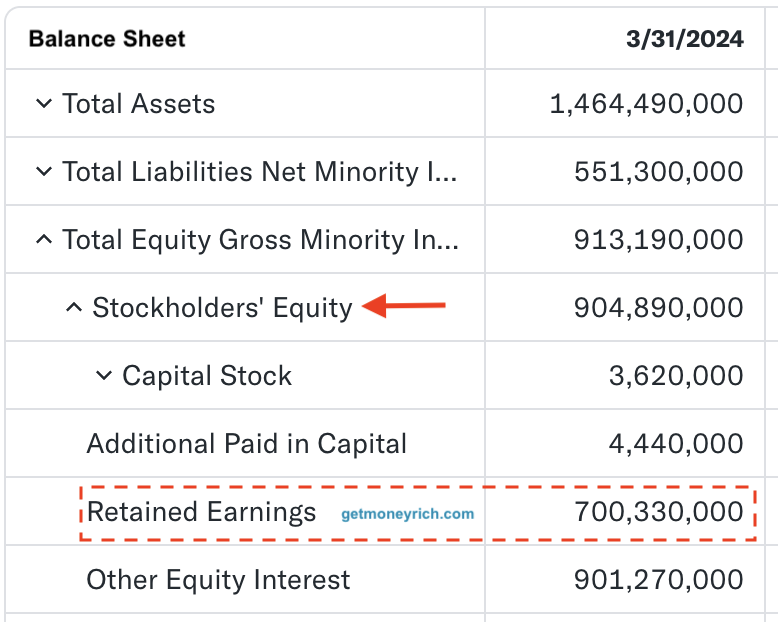

More specifically, you’ll usually find retained earnings listed as a line item under “Shareholders’ Equity” or “Owner’s Equity,” depending on whether it’s a corporation or a smaller business. It might look something like this:

- Shareholders’ Equity

- Common Stock: $50,000

- Additional Paid-In Capital: $20,000

- Retained Earnings: $75,000

- Total Equity: $145,000

In this example, the $75,000 in retained earnings is money the company has socked away from its profits over the years.

It’s not a pile of cash you can touch, t’s more like a tally of what’s been reinvested or kept for future use.

Sometimes, it’s even labeled as “Reserves & Surplus” in certain financial statements, just to keep things interesting (or confusing, depending on your mood) 🙂

So, to answer “Where does retained earnings go on a balance sheet?” It’s nestled cozy in the equity section, showing you how much profit the company has decided to hang onto rather than give away.

Why Should You Care About Retained Earnings?

Now, you might be thinking, “Okay, cool, it’s on the balance sheet. But why does this matter to me?”

Fair question. Retained earnings are like a window into a company’s soul, or at least its financial health.

Here’s are a few carefully picked reasons why I think they’re worth your attention:

- Growth Potential: If a company’s piling up retained earnings, it’s likely planning something big, maybe a new product line, a shiny factory, or a push into a new market. For example, tech giants like Apple or Amazon have historically kept hefty retained earnings to fuel their next big innovation. As an investor, that’s a signal they’re not just coasting, they’re aiming to grow.

- Financial Stability: Retained earnings are a safety net. Imagine your bakery hits a rough patch, maybe flour prices skyrocket (thanks, inflation). Having some earnings stashed away means (as current assets like cash) you can keep the lights on without begging for a loan. Companies with solid retained earnings tend to weather storms better.

- Shareholder Value: Even if a company isn’t paying dividends right now, retained earnings can still boost your wallet later. When those earnings get reinvested (wisely), they can drive up profits, earnings per share (EPS), and eventually the stock price. It’s like planting a seed today for a bigger harvest tomorrow.

- Debt Management: Ever notice how some companies seem to shrug off debt like it’s no big deal? Retained earnings can be used to pay down loans. It is a way of cutting interest costs and making the balance sheet look prettier. Less debt = more flexibility.

I’ll let you in on a little secret.

When I first started investing, I ignored retained earnings and obsessed over revenue, net profits or stock price. Big mistake. It’s like judging a book by its cover. Retained earnings tell you what’s really going on under the hood.

How Are Retained Earnings Calculated?

Let’s get hands-on for a sec. Calculating retained earnings isn’t rocket science, but it does require a few numbers from the financial statements. Here’s the formula I use:

Retained Earnings = Beginning Retained Earnings + Net Profit – Dividends Paid

- Beginning Retained Earnings: Whatever was in the pot at the start of the period (say, last year’s balance).

- Net Profit: The money the company made this year, after all expenses and taxes.

- Dividends Paid: Cash handed out to shareholders during the period.

Let’s try a quick example. Say your bakery had $50,000 in retained earnings last year. This year, you made a net profit of $30,000, and you paid out $5,000 in dividends to your cousin who owns half the shop.

Here’s how it shakes out:

- $50,000 (beginning) + $30,000 (net profit) – $5,000 (dividends) = $75,000 (Retained Earnings)

Boom! Your new retained earnings balance is $75,000, and that’s what’ll show up on this year’s balance sheet.

Easy, right? This number keeps rolling forward each year, growing (or shrinking) based on profits and payouts.

What Can Mess With Retained Earnings?

Retained earnings don’t just sit there looking pretty, they’re affected by a bunch of real-world factors.

Here’s what I’ve learned to watch out for:

- Net Profit (or Loss): If the company’s raking it in, retained earnings grow. But a loss? That’ll eat into the stash, sometimes even turning it negative (yikes!). Read this blog about this company called McKesson Corp, its main issue was negative equity.

- Dividends: The more a company pays out, the less it keeps. Some companies, like mature ones with steady cash flow, love big dividends. On the other hand, growth-focused ones hoard earnings instead. Some companies pay dividends so high that their retained earnings (equity) corpus begins to reduce.

- Share Buybacks: When a company buys back its own stock, it dips into retained earnings. It’s a trade-off. How Fewer shares outstanding can boost EPS, but it shrinks the equity pool.

- Accounting Adjustments: Things like asset write-downs or changes in rules (say, depreciation schedules) can tweak net profit, rippling through to retained earnings.

I once got tripped up by depreciation, thought it’d boost retained earnings since it’s a non-cash expense. Nope. It reduces net profit, so it actually drags retained earnings down. Lesson learned: Cash flow and earnings are two different beasts.

Real-Life Examples: Retained Earnings in Action

Let’s make this relatable with a couple of companies I’ve poked around in:

- Company A: The Dividend Lover

Imagine a utility company that’s been around forever. It retains 40% of its profits and pays out 60% as dividends. Over five years, its retained earnings grow slowly, but its stock price stays stable. Why? Because shareholders get a nice quarterly check (dividends) and they do not think about selling (going elsewhere). The balance sheet shows only modest retained earnings, but that’s okay, it’s all about steady income here. - Company B: The Growth Junkie

Now imagine a tech startup retaining 100% of its profits, no dividends at all. Its retained earnings soar as it pours cash into R&D. The balance sheet’s equity section is fat with retained earnings, and while the stock price lags at first, it explodes later when those investments pay off. Risky, but rewarding if you’re patient.

Which one’s better? Depends on what you’re after, cash now or growth later.

The quantum of earnings (net profit) that are getting retained on the balance sheet tell you which path the company’s on.

How to Spot a Good Use of Retained Earnings

Here’s my rule of thumb: Check how retained earnings translate into results. Look at metrics like:

- Return on Equity (ROE): Are they earning a decent return on that equity pile?

- Earnings Per Share (EPS): Is it growing, showing those earnings are working?

- Stock Price Growth: Over time, does the market reward the retention?

If a company’s retaining profits but its fundamentals (like ROE or EPS) are tanking, that’s a red flag.

It’s like lending your friend money for a “sure thing” that never pans out. On the flip side, steady growth in these metrics means they’re putting retained earnings to work like a champ.

Conclusion

So, there you have it, what retained earnings are on a balance sheet, where they go, and why they’re a big deal.

They’re not just some boring number; they’re a story of what a company’s done with its profits and where it’s headed. Whether you’re eyeballing a stock, running your own analysis, or just trying to sound smart at dinner, understanding retained earnings gives you an edge.

Next time you’re staring at a balance sheet, hunt down that retained earnings line in the equity section. Ask yourself, is this company saving up for something big, or just coasting? You’ll be surprised how much it reveals.

Got thoughts? Drop a comment below. I’d love to hear what you think. Plus, it’ll help this post climb the Google ranks (wink, wink).

Happy investing, friends.

Great post

I really appreciate you for publishing this blog here; it’s really a helpful and very useful for us. This is really appreciated that you have presented this data on retained earnings, I love all the information shared. Great article!!

pls when did you write this article?

i nee to reference you

In calculating retain earning for FY19 BY mistake u put negative sign instead of positive sign(in balance seat fig)

Great post thanks for this amazing article with us all. It’s nice to see that you’re sharing such valuable information with us all. Good work it’ll definitely add a lot of value to your readers.