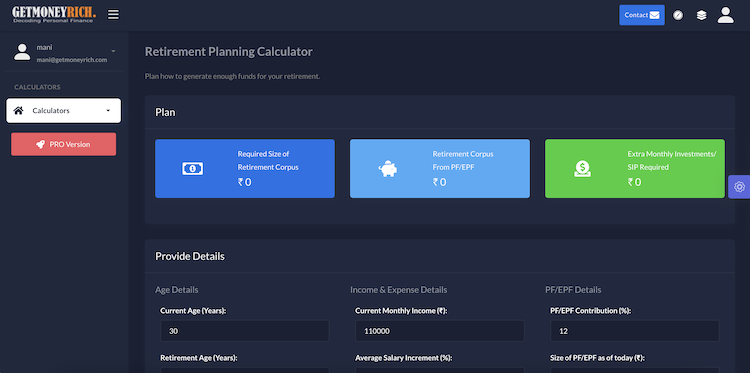

Unlock the secrets of retirement planning in India with this comprehensive calculator. Discover how age, income, and investments shape our financial future. I’ll suggest you, explore all the variables of the calculator. There are 14 number variables that shape the final result. Change a few tiny bits in each of the variables and observe how it affects the final outcome.

The Calculator

There is one aspect that remains constant for all humans is the importance of securing a financially stable future. Retirement planning, often overlooked by many of us, stands as a cornerstone for a peaceful and prosperous life in old age. A good retirement planning calculator can be our powerful ally in this endeavor. It can offer us the ability to plan post-retirement life.

Indians are seeing an improving life expectancy rate coupled with soaring aspirations. These two make retirement planning an uncompromisable need. The algorithm of our retirement planning calculator has been tailor-made to the Indian context. Whether you are somebody who lives in the fast life of a Metro or in a fast-evolving Tier-3 city, this calculator is suitable for all. This tool is designed to help you chart a course toward a dignified retirement.

In this article, I’ll talk more about this retirement planning calculator. If you would like to know about the basic concepts that shape the outlines of retirement planning, please check this article. This retirement planning calculator aims to give its users this specific deliverable, “what I should do now for successful retirement planning.”

But to answer this holistic question, the calculator needs to comprehend a few critical aspects of the user like age, income, expenses, etc.

Let’s explore more about these aspects that are the roots of my retirement planning calculator.

About Retirement Planning

Retirement planning is the process of setting up a specific goal of building a suitable-sized retirement corpus. The corpus building is intended to ensure a comfortable and financially secure life post-retirement. One of the most critical aspects of retirement planning is an accurate estimation of the needs of a retired life.

Our financial needs do not cease to exist after we stop working. Hence, when we are young, we must try to foresee our retirement needs and plan for them. It starts with visualizing our retirement lifestyle and estimating expenses. Once we know these, we can develop a savings and investment strategy to meet our goals.

Retirement planning is important because it can help us to:

- Maintain our standard of living post-retirement

- Achieve financial independence before retirement.

- Avoid running out of money in retirement

- Leave a legacy for our loved ones

The best time to start retirement planning is as early as possible. This gives us more time to grow our money through compound interest. However, it is never too late to start planning for retirement. Even if one is close to retirement, there are still steps that can be taken to improve the financial situation.

Let’s explore more about how our calculator does the retirement planning.

The Age Factor

Age is a pivotal factor in retirement planning. Our online calculator includes the age factor as a primary input in the planning process:

- Current Age: The initial age at which an individual starts planning for retirement is a key determinant. The earlier one begins, the more time they have to accumulate savings and investments. It gives them the leverage of the power of compounding. Delaying retirement planning can result in a significant increase in the loan to build the required corpus. The calculator uses the current age as a baseline to do the computations.

- Retirement Age: This age sets the target for when an individual wishes to retire. It sets a time target before which all activities related to savings and investing must be accomplished. It provides insights into how long an individual has to prepare for financial independence.

- Life Expectancy: With increasing life span in India, planning for a longer retirement is crucial. The calculator considers life expectancy as a parameter, helping users ensure their financial resources last throughout their retired lifetime. Underestimating life expectancy can lead to outliving one’s savings. It is a common concern among retirees, hence it is one of the critical parameters while planning for retirement.

Age is a central element in retirement planning. It influences our savings, investment choices, and income needs. The calculator incorporates three age elements to ensure a comprehensive approach to retirement planning.

The Income and Expense Factor

Income and expenses play a pivotal role in retirement planning, shaping an individual’s financial landscape. Our calculator takes two variations each from the income and expense elements to do the necessary calculations:

Income:

- Current Monthly Income: An individual’s current earning estimates are taken to factor in the corpus building through the PF/EPF route. Here I’ve assumed that most of the people using the calculator are of salaried class, hence the PF/EPF element. Nevertheless, non-salaried income earners can also use this calculator without concern of impending fallacies creeping into the calculations. At the concept stage, we just recall that the higher the current income, the more potential there is to save and invest for the future.

- Average Salary Increment Till Retirement: The calculator recognizes that salary increments over time can significantly benefit the retirement plan. One needs just to put a rough estimate of the expected annual income growth. For a typical Indian, this value can range from 5% onwards. It is crucial to know how much extra effort one must put into building an accurately sized retirement corpus. The higher the income growth forecast, the less the extra effort required.

Expense Factors:

- Current Monthly Expenses: Every person has their own typical expense requirements. The current expense levels of the user help the calculator set the baseline for an individual’s lifestyle and financial commitments. By accounting for this, it can also do the math for what level of expenses are expected during the retired lifetime.

- Retirement Expense as a Percentage of Current Monthly Expenses: This parameter adds another layer of accuracy to the final estimates. A study proves that post-retirement, generally, people tend to spend more conservatively as compared to when they are working. But High HNI people can spend more upon retirement than they do in their busy work lives. To get a more accurate estimate, the calculator accepts this input from its users.

The calculator keeps a synergy between income and expense numbers. Balancing and optimizing these two elements is essential to ensure that the retirement calculator is moving in the right direction to do the cost estimations.

The Factor of Outstanding Loan(s)

Factoring in the element of outstanding loan balances is a crucial factor in retirement planning. Our retirement calculator prompts users to account for this factor as well. It is one of the most important factors in dealing with post-retirement needs.

The loan balance acts almost like a roadblock to one’s financial independence. Hence, the calculator assumes that, unless the outstanding loan balance is within an acceptable range, it can pose a serious threat to the retirement goals.

Any liability can have a substantial impact on the retirement corpus. High loan balances at retirement can significantly reduce an individual’s available funds for retirement. If there are substantial loans outstanding at the point of retirement, there are only two alternatives left. Either one will have to compromise the quality of life post-retirement or will have to start saving and investing more from today.

The consideration of loan outstanding within the retirement planning calculator provides a holistic view of an individual’s financial health. It demonstrates a practical approach by urging users to account for existing debts as part of their retirement plan. It thereby ensures that their financial well-being in retirement is not hampered by the burden of unpaid loans.

Contributions to Retirement Fund (PF & EPF)

At this step, the retirement planning calculator enters its key zones. The government and private sector employees mandatorily contribute toward building a retirement corpus. The employer also contributes to the fund making it doubly beneficial. For a majority, the PF/EPF forms a major component of their accumulated retirement fund.

The parameters in this section encompass the contribution to Provident Fund (PF) and Employee Provident Fund (EPF) savings. For Indians, these two avenues are prominent retirement investment instruments in India.

- Percentage of Basic Income Going to PF/EPF: A fixed percentage of the basic component of one’s CTC (Cost To Company) goes into PF/EPF. It plays a vital role in retirement planning because it determines the size of monthly contributions that go into PF/EPF. These small but regular payments to the retirement fund accumulate and become a substantial corpus over the years.

- Size of PF/EPF As of Today: Depending on the age group of the user using the calculator, the size of the current PF/EPF corpus, which has already been accumulated, must be noted here. For the calculator, this value serves as the starting point for a more detailed calculation of the size of the retirement corpus.

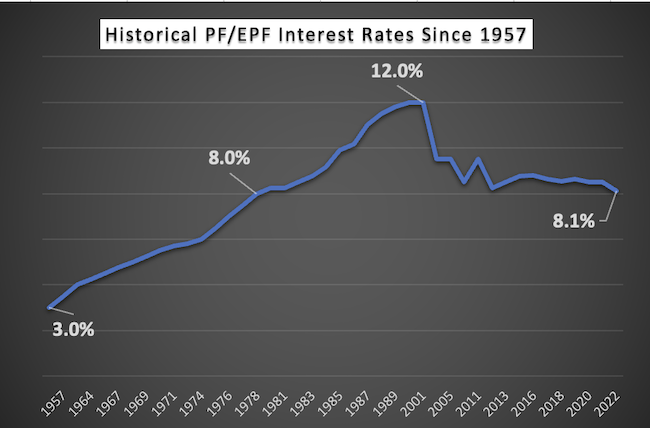

- Interest Earned By PF/EPF Deposits: All the contributions made towards the PF/EPF earn an interest. The rate of interest is decided by the government. But over the last 45 years, the rates have remained over the 7.5% per annum mark. The rate of return earned on PF/EPF deposits makes a significant impact on the finally built corpus.

By keeping the PF/EPF details variable, users can use this calculator to try a flurry of permutations and combinations of their choice. Even small changes here can alter the output end result by a lot.

The Need For Additional Investments

There are two key investment-related parameters that play a critical role in retirement planning, inflation and return on investment (ROI).

- Average Inflation Till Lifetime: Inflation makes things more expensive over time. It is a crucial factor to consider in retirement planning. This is especially true for people in India as our average inflation rates are much higher than what prevails in Europe and North America. A higher rate of inflation means that the future cost of living will be significantly higher in INR terms. Including the factor of inflation is necessary to adjust the retirement corpus that keep pace with the rising prices.

- Expected ROI From Mutual Funds: The calculator includes the variable of the expected return on investments in mutual funds. It acknowledges that investments play a pivotal role in bridging the deficit between the required retirement corpus accumulated using PF/EPF. The parameter underscores the importance of choosing suitable investment vehicles and achieving reasonable returns to meet retirement goals.

These parameters are integral to retirement planning. They highlight the need to safeguard against inflation and aim for reasonable returns (ROI) to ensure that the retirement corpus remains adequate.

Handling of Retirement Corpus After Retirement

In this article, I’ll not go into details about how to invest the retirement corpus in India, but allow me to explain the concept in brief. As important as it is to build the corpus, it is equally critical to re-invest the built fund.

But the main issue with the retirement fund is, that one cannot take too many risks with this money. Conversely, it is also true that one cannot keep this money as idle cash. There are tailor-made investment alternatives available to handle post-retirement corpus. Ideally, one must keep their funds parked only in these specific options.

The clarity about how we will handle the built retirement corpus post-retirement, we must have it today.

Our calculator mainly gives four options to the users. These four options encapsulate the various alternatives individuals have for handling their retirement funds. It starts with keeping the funds in a savings account in a bank fixed deposit. People with slightly more appetite for risk can keep the money in debt or hybrid mutual funds.

The calculator recognizes the significance of this choice because it directly impacts the potential returns, risk exposure, and liquidity of the retirement corpus.

The calculator aims to sensitize the implications of these choices on the size of the final retirement corpus. The higher the number here, the lighter the effort required (as of today) to build the final amount.

The Final Results: Path to Financial Independence

A retirement planning calculator is more than just a digital tool. It’s our guiding star toward achieving financial independence in retired life. As one diligently enters the details required by the calculator, the calculator works tirelessly behind the scenes to provide a set of final results.

- Size of Retirement Corpus Required: This figure represents the amount one needs to secure a comfortable retirement. It’s not just a number; it’s the user’s financial destination. The calculator gives a clear target in terms of a definite number. After considering key factors like inflation, life expectancy, desired standard of living, etc, this number gets populated.

- Retirement Corpus Built From PF/EPF Contributions: The calculator also highlights the financial power of our PF/EPF contributions. It estimates how much one will have in the PF/EPF account after considering the regular contributions, interest rates, and time horizon. For a majority of salaried class people, out of the total retirement corpus that needs to be built, a majority portion gets built here itself.

- Extra Monthly Investments (SIP) Required: The calculator also tells the users the additional monthly investments that are needed to bridge the deficit (if any) between the requirement and the PF/EPF corpus. More often than not, our PF/EPF funds will remain slightly short of what we require to maintain a decent standard of living post-retirement. Hence small extra contributions to mutual fund acts as our fall-back plan.

These final results are not mere numbers; they are the milestones on our road to financial security. They encapsulate the power of informed planning, strategic investment choices, and financial wisdom. With these results, one can take concrete steps to build a retirement fund.

Have a happy investing.

Thanks for designing the retirement calculator and the detailed explanation on using the same. The calculator unfortunately does not take into consideration the existing investments and hence the additional investment amount calculation is not correct. Can a filed be added to indicate current investment across all investment classes?