Welcome to a journey of financial wisdom drawn from one of the most popular personal finance books, ‘Rich Dad Poor Dad‘. This groundbreaking book, penned by Robert Kiyosaki, has transformed the way millions across the globe perceive money and wealth creation. At its core, ‘Rich Dad Poor Dad’ lays bare two contrasting financial philosophies. The ‘poor dad’, a believer in traditional schooling and employment, and the ‘rich dad’, a proponent of financial education and entrepreneurial ventures.

These divergent perspectives provide a fascinating exploration of our financial conditioning and how it shapes our lives. The book’s overarching message is one of financial independence, achieved not merely through earning, but by learning.

It advocates for financial literacy and an entrepreneurial spirit, fostering an understanding that money can work for you, rather than you working for it.

Ready to unlock the key lessons from ‘Rich Dad Poor Dad’? Let’s dive in.

Video Summary

Importance of Financial Education

The first crucial lesson from ‘Rich Dad Poor Dad’ is the importance of financial education.

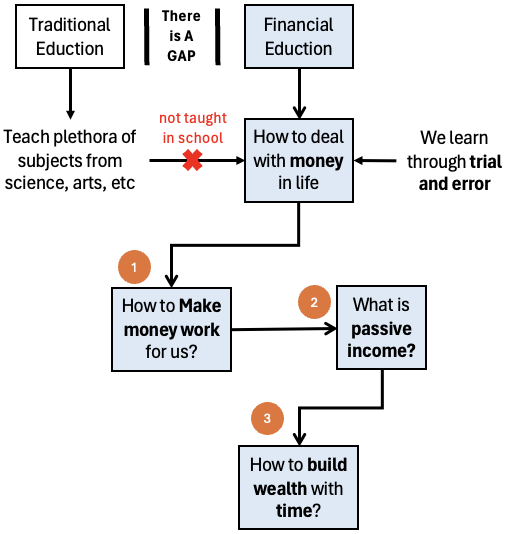

This lesson delves into a significant gap in our traditional education system – the lack of emphasis on financial literacy. From elementary school to university, we’re taught a plethora of subjects, from the sciences to the arts. Yet, the vital subject of managing money, understanding investments, and building wealth is often conspicuously absent.

This lack of financial education leaves many of us ill-prepared to navigate the financial challenges of adulthood. We end up learning through trial and error, often making costly mistakes along the way. But it doesn’t have to be this way. ‘Rich Dad Poor Dad’ underscores the importance of equipping ourselves with financial knowledge, not just to avoid pitfalls, but to seize opportunities and make our money work for us.

Financial education is more than just understanding the difference between a debit and a credit card, or learning how to balance a checkbook. It’s about understanding the principles of investing, knowing how to generate passive income, and learning how to leverage debt to create wealth.

It’s about understanding the power of compound interest and realizing that the greatest asset we have is our time.

With financial education, we can make informed decisions about our money. We can evaluate investment opportunities and understand the risks involved.

We can plan for our future, ensuring that we have a financial safety net for ourselves and our families. But perhaps most importantly, financial education gives us the power to control our financial destiny. It allows us to break free from the paycheck-to-paycheck cycle, build wealth, and achieve financial freedom. It empowers us to make choices that align with our dreams and aspirations, rather than being constrained by our financial limitations.

So, let’s start valuing financial education as much as we value our academic education. Let’s start learning, not just to earn, but to grow, invest, and create a secure financial future.

“Financial education isn’t just about money, it’s about freedom, control, and empowerment.”

Understanding The Difference Between Assets & Liabilities

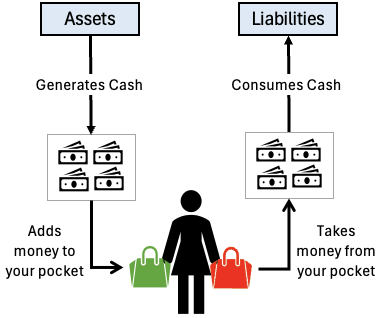

The second lesson from the book is understanding the difference between assets and liabilities. In the realm of finance, these two terms are core building blocks. Let’s start with assets.

- Assets are essentially everything that puts money into your pocket. They can be anything from a rental property, a business you own, stocks, bonds, or even royalties from intellectual properties. These are all examples of assets because they generate income or appreciate in value over time, or often, both.

- On the flip side, we have liabilities. Liabilities take money out of your pocket. They are your financial obligations. That new sports car you just bought? That’s a liability. Your credit card debt? Also a liability. Even your home can be a liability if it’s not putting money back into your pocket.

You see, the rich dad understood that the key to wealth is not about having a high income. It’s about amassing assets while minimizing liabilities. Because it’s your assets, not your income, that will keep money flowing even when you decide to stop working one day.

But here’s where it gets interesting. What many people often consider as assets, the rich dad sees as liabilities. That house you own, the car you drive, even the high-end furniture you’ve just bought, these are all liabilities if they’re not generating income. They’re taking money out of your pocket through mortgages, maintenance, and depreciation.

This is why understanding the difference between assets and liabilities is so crucial. It changes the way you see your financial world. It shifts your focus from chasing income to building and acquiring assets.

So, the next time you’re about to make a purchase, ask yourself:

- Is this an asset or a liability?

- Is it going to put money into my pocket or take money out of it?

This simple shift in perspective can be the difference between an endless cycle of earning and spending, and the path to true financial freedom.

“Remember, true wealth lies in acquiring assets, not liabilities.

Power of Mindset

The third important lesson in this book is about the power of mindset.

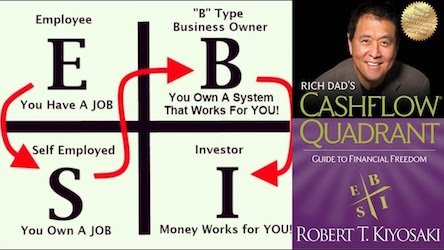

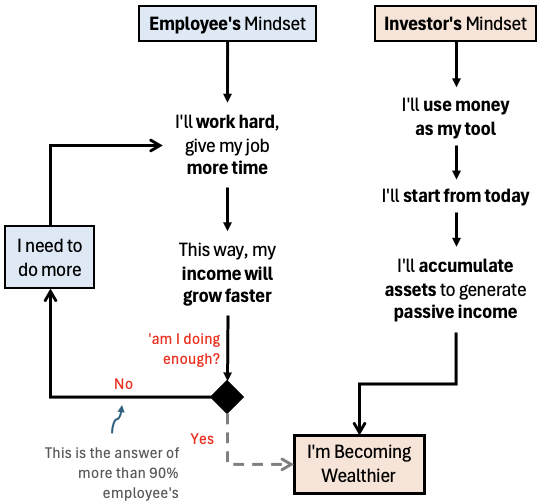

Now, imagine for a moment that you’re an employee. You work nine to five, you receive a paycheck, and you use that paycheck to cover your expenses. This is a cycle that repeats itself month after month, year after year. It’s a familiar pattern for many, and it’s not inherently bad. However, it’s a pattern that can limit your financial growth.

Now, let’s shift that image. Imagine you’re an entrepreneur or an investor. Instead of trading time for money, you’re using money as a tool. You’re investing it, you’re growing it, and you’re generating income from it. You’re not just earning money, you’re making your money work for you.

This is a different mindset, one that opens up a world of financial possibilities.

But how do you make this mindset shift? It starts by overcoming limiting beliefs about money and wealth. We all have them. These are beliefs that hold us back, that tells us we can’t achieve financial success, or that wealth is out of our reach. They’re beliefs that tell us money is hard to come by, or that it’s something to be feared.

The truth is, that wealth is not a zero-sum game. There’s not a finite amount of wealth in the world that’s being fought over. Wealth can be created, and it can be created by anyone. It’s not about being lucky or being born into the right family. It’s about having the right mindset, the right knowledge, and the right strategies.

So, start questioning your beliefs about money. Start challenging the thoughts that hold you back. Recognize that money is a tool, and like any tool, it can be mastered. Start seeing yourself not just as an employee, but as an entrepreneur, as an investor.

Mindset is powerful. It shapes our actions, it shapes our decisions, and ultimately, it shapes our lives. So if you want to shape your financial future, start by shaping your mindset.

“Your mindset, more than anything, can shape your financial future. Start thinking about assets and passive income.

Making Money Work For You

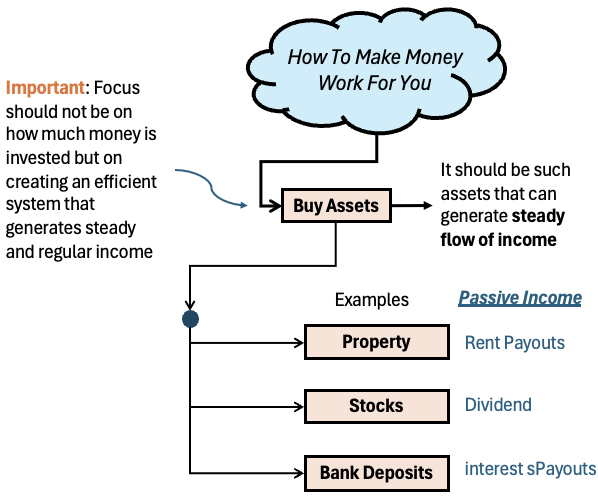

The next lesson in the book is about making money work for you.

Have you ever found yourself wondering how the wealthy seem to keep increasing their wealth, while you’re stuck running on the financial treadmill? The secret lies in a concept known as passive income.

Passive income is money that you earn without actively working for it. Instead of trading time for money, you’re leveraging your investments to generate revenue. It’s like having a dedicated team of workers who never sleep, continually adding to your bank account. This is where financial freedom truly lies.

When your passive income exceeds your expenses, you no longer need to work to live. You’ve effectively turned the tables and now. By making money work for you you have overcome the liability to managing your expenses by having to do a job.

So, how do you create passive income? There are numerous ways, but they all revolve around the idea of investing in assets that generate income.

- One of the most common methods is through real estate investments. By owning rental properties, you can earn a steady stream of income from rent payments. Over time, the property may also appreciate in value, providing you with a potential windfall if you choose to sell.

- Alternatively, you could invest in stocks. While the stock market can be volatile, it has historically proven to be a profitable investment over the long term. By carefully selecting a diverse range of stocks, you can earn dividends and potentially profit from increases in share prices.

- You could also consider entrepreneurship. Starting a business can be risky, but it can also be incredibly rewarding. Once your business is established and profitable, it can provide a steady stream of income with minimal input from you.

Remember, the goal isn’t to amass a mountain of cash. It’s about creating systems that generate income, so you can focus on what matters most to you. Whether that’s spending time with family, traveling the world, or pursuing a passion project. Financial freedom gives you the flexibility to live life on your terms.

“Don’t work for money, make money work for you.”

Risk & Failure

This lesson of the book is about embracing risk and failure.

In the world of financial success, risk isn’t just a concept; it’s an integral part of the equation.

- Failure: And what about failure? It’s not a deterrent; instead, it’s a valuable teacher. The road to financial success is fraught with uncertainty and unpredictability. But here’s the thing: the richest and most successful people are those who aren’t afraid to take calculated risks. Imagine standing on the edge of a cliff, looking down at a sea of opportunities. Jumping off might feel terrifying, but staying put guarantees stagnation. The same applies to your financial journey. Sure, investing your hard-earned money is a risk. Starting a business is a risk. But without taking these risks, the potential for growth remains untapped.

- Now, let’s talk more about failure. Nobody likes to fail. It’s uncomfortable, it’s embarrassing, and it can be downright disheartening. But consider this: every setback is an opportunity for refinement. Every failure is a lesson in disguise, teaching you what not to do, and guiding you towards a better approach.

Remember Thomas Edison? He didn’t invent the light bulb on his first try. Or his second. Or his third. It took him more than a thousand attempts to get it right. But he didn’t view those attempts as failures. Instead, he famously said, “I have not failed. I’ve just found ten thousand ways that won’t work.”

The same mindset applies to your financial journey. When an investment doesn’t pan out as expected, or a business venture goes under, don’t view it as a failure. View it as a lesson. Learn from it. Grow from it. And then, take that newfound knowledge and apply it to your next venture. Embrace risk. Embrace failure. They are not your enemies. They are your teachers, your guides, leading you on the path to financial success.

Remember, the greatest risk in life is not taking one. And as for failure? It’s not the end of the road. It’s just a stepping stone on the journey to success.

“On the road to financial success, failure isn’t the opposite of success, it’s part of it.”

Power of Networks & Mentors

The final lesson is about the power of networks and mentors.

Picture this – you’re navigating a vast ocean on a small boat. Wouldn’t it be easier if you had a seasoned captain guiding you, showing you the best routes, and helping you weather the storms? That’s the role of mentors in our financial journey. They’ve been there, done that, and they can help you avoid costly mistakes while accelerating your progress.

But mentors alone aren’t enough. You also need a supportive network. Imagine a fleet of boats, all heading in the same direction, sharing information, resources, and encouragement. That’s what a network does. It provides a supportive environment where you can learn, grow, and thrive. It’s a place where you can share your victories, learn from your defeats, and gain insights that can propel you towards your financial goals.

Remember, you’re the average of the five people you spend the most time with.

Conclusion

So there you have it, the key lessons from Rich Dad Poor Dad.

We’ve delved into the depths of financial education, dissected the difference between assets and liabilities, explored the importance of mindset, looked at how money can work for you, embraced risk and failure, and highlighted the power of networks and mentors. These are the pillars that form the foundation of a robust financial future.

But what does it mean for you?

Well, it’s not just about understanding these lessons, it’s about putting them into action. It’s about taking these insights, these nuggets of wisdom, and using them as tools to sculpt your own financial landscape. It’s about taking control of your financial destiny.

Our takeaways

Let’s talk about financial education. It’s not just about knowing how to count your pennies or understanding the difference between a debit and a credit. It’s about comprehending the financial world that we live in and how it affects you.

It is about understanding the power of investments, the importance of saving, and the potential of compounding. It’s about being able to make informed decisions that can positively impact your financial future.

Then we have assets and liabilities. It’s not just about knowing the difference between the two, it’s about understanding how they work and how they can work for you. It’s about making informed decisions to acquire assets that generate income and appreciate in value, while minimizing liabilities.

The importance of mindset cannot be overstated. Shifting from an employee mentality to thinking like an entrepreneur or an investor can be a game changer. It’s not just about earning a paycheck, it’s about creating multiple streams of income.

Making money work for you is another key lesson. It’s not just about earning money, it’s about making your money work for you. It is about understanding the power of passive income and utilizing it to achieve financial freedom.

Embracing risk and failure is a part of the journey to financial success. It’s not about avoiding risks or fearing failure, it’s about understanding that these are stepping stones to success. It’s about learning to view setbacks as opportunities for growth and refinement.

Lastly, the power of networks and mentors. It’s not just about surrounding yourself with people who support your financial goals, it’s about seeking guidance from mentors who have walked the path that you aspire to tread.

So, what’s next?

Well, the ball is in your court.

It’s time to take these lessons and apply them in your life. Start with financial education, understand the difference between assets and liabilities, shift your mindset, make your money work for you, embrace risk and failure, and tap into the power of networks and mentors.

Remember, this is not a one-size-fits-all approach. Each individual’s financial journey is unique, and it’s up to you to carve out your own path. But with these tools at your disposal, you’re well equipped to navigate the financial terrain and create a future of financial freedom.

So, go forth and conquer.

Arm yourself with knowledge, equip yourself with the right tools, surround yourself with the right people, and create a future that you can be proud of. A future where you are in control, a future where you are not just surviving, but thriving. A future where financial freedom is not just a dream, but a reality.

Now, it’s your turn to take these lessons and create your own path to financial freedom.

Have a happy investing.

Suggested Reading: