Have you noticed how expensive eggs have become lately? If you’ve been to the grocery store, you’ve probably felt the pinch. But something interesting is happening, people aren’t just complaining about egg prices; they’re doing something about it. They’re raising their own chickens. This trend isn’t just about cutting grocery costs. It’s creating a ripple effect, benefiting companies that sell farm supplies, like Tractor Supply Company (TSCO).

And that’s where things get interesting for investors. I thought why blog about this interesting development. It also highlights how people adapt to crisis situation.

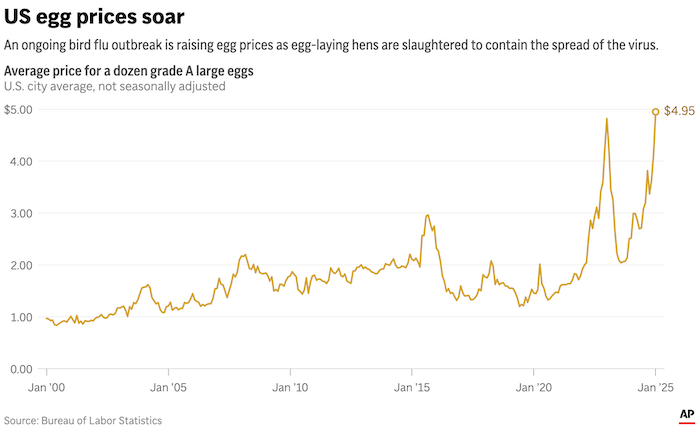

Egg Prices Are Surging—Here’s Why

Over the last few months, egg prices in the United States have skyrocketed.

By January 2025, the average price for a dozen Grade A large eggs hit a record high of $4.95, according to the U.S. Bureau of Labor Statistics. This was a 19.5% jump from $4.15 in December 2024 and nearly 50% higher than February 2024’s $3.50 price. In some areas like California, eggs have been selling for $9 or more per dozen due to local supply issues.

The main reason? A widespread avian influenza (bird flu) outbreak that has been affecting poultry farms since 2022 but worsened in late 2024. Just in December 2024, over 18 million egg-laying hens were culled to stop the virus from spreading.

With fewer hens producing eggs, supply has shrunk while demand remains strong, especially during holiday seasons.

On top of that, rising costs of feed, fuel, and transportation have further pushed prices up.

And it’s not over yet, the USDA predicts egg prices could climb another 20% in 2025 if supply doesn’t recover.

That means relief might not come anytime soon, forcing consumers to look for alternatives.

The Silent Store That Speaks Volumes

A recent visit to a Tractor Supply store in spring revealed an unusual sight, silence. Normally, during this season, you’d hear baby chicks chirping away in metal brooders. But not this time. Why?

Because they were all sold out.

This tells us that a growing number of people are taking poultry farming seriously. And while baby chicks are cheap (around $5 per chick), first-time buyers don’t stop there. Raising chickens requires a lot of additional supplies, heat lamps, feeders, water dispensers, pine shavings, brooder setups, and specialized feed.

TSCO sells all of these under one roof.

Even better? Once people start raising chickens, they’ll keep coming back for chicken feed and other supplies for years. This isn’t a one-time purchase, it’s a long-term customer acquisition strategy that TSCO benefits from.

Recession-Proof or Just a Temporary Trend?

Some investors worry that retail stocks suffer during a recession. But here’s an interesting thought: could farm supply stores actually thrive in an economic downturn?

History offers some clues. During World War II, people started Victory Gardens, small backyard farms, to combat food shortages. In tough times, people look for ways to save money and become more self-sufficient.

The same logic applies today.

If inflation keeps pushing food prices up, more households may invest in growing their own food, not just chickens but also vegetables, fruits, and even small-scale farming.

That means increased demand for seeds, fertilizer, tools, and animal feed, all things TSCO sells.

Is TSCO a Good Investment?

TSCO isn’t just benefiting from the chicken boom.

The company has a well-established customer base of hobby farmers, homesteaders, and rural communities. Their business model revolves around selling essential supplies that people need, recession or not.

Plus, TSCO isn’t just a store, it’s a one-stop shop for rural living. Their product lineup includes livestock feed, farm equipment, gardening tools, pet care items, and even clothing.

This diversified revenue stream helps them stay resilient, even in economic downturns.

Look at the revenue, profit, and EPS trend of TSCO for the last four years:

| Breakdown | 12/31/2021 | 12/31/2021 | 12/31/2023 | 12/31/2024 | Growth (%) p.a. |

|---|---|---|---|---|---|

| Total Revenue | 1,27,31,105 | 1,27,31,105 | 1,45,55,741 | 1,48,83,231 | 3.98% |

| Net Profit | 9,97,114 | 9,97,114 | 11,07,226 | 11,01,240 | 2.51% |

| EPS | 1.72 | 1.72 | 2.02 | 2.04 | 4.36% |

Final Thoughts

Investing isn’t just about looking at stock charts, it’s about observing real-world trends.

When baby chicks sell out at a farm supply store, it’s a strong indicator that consumer behavior is shifting. And when that shift aligns with a company’s long-term business model, it can create a decent investment opportunity (for we small retail investors). It’s just an observation I though to share in this blog post.

With egg prices soaring and no immediate relief in sight, more people may turn to backyard poultry farming. That could make Tractor Supply Company (TSCO) a stock worth watching.

What do you think, are farm supply stores on their way to becoming recession-proof?

Have a happy investing.