Estimate Your Risk Profile

Answer the following 10 questions to determine your investment risk profile and get a personalized portfolio recommendation. Click “Next” to proceed to the next question.

Introduction

Before you dive into investing, there’s one key step you shouldn’t skip, understanding your risk profile.

Think of your risk profile as a guide that helps you pick the right investment strategy for you.

- If you’re someone who gets nervous about losing money (what we call “risk-averse“), you wouldn’t want to jump into high-risk investments like stocks that can be a rollercoaster.

- On the other hand, if you’re comfortable taking bigger risks, you might find safer options, like fixed deposits or debt plans, too boring and not rewarding enough.

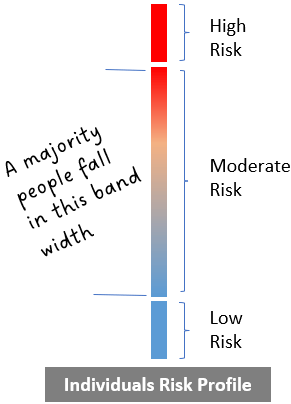

But we must also understand that our risk profile is not exactly black and white.

Most people aren’t at the extreme ends of being super cautious or super daring. Instead, the majority of us fall somewhere in the middle, in what’s called a “moderate risk profile.”

That’s where a lot of investors fit.

For those of us in this moderate zone, a balanced or “hybrid” portfolio, mixing safer investments with a bit of riskier ones, usually works best.

So, to sum it up, there are three main types of risk profiles:

- Low (cautious),

- Moderate (balanced), and

- High (adventurous).

And since most of us are in that moderate group, it’s a great starting point for building a smart investment plan that suits our comfort level.

Risk and Investing

Let’s face it, every time you invest your money, there’s a chance you might lose some of it.

That’s why people often say that risk and investing go hand in hand.

They are like two sides of the same coin. And this is something we all need to understand, especially now, when more and more people are jumping into the stock market.

Stocks can be exciting, but they’re also one of the riskiest places to put your money.

Here’s a fact that we must acknowledge. Before the COVID pandemic hit in 2020, about 40 lakh new Demat accounts (which you need to trade stocks) were opened each year. But after COVID, that number skyrocketed. In the financial year 2022, a whopping 1 crore new Demat accounts were opened, it’s an all-time record.

That means a lot more people are trying their hand at stock market investing.

This is great news for the market, it shows people are interested.

But there’s also a catch when many people try their luck in the stock market.

Many of these new investors are jumping in without really understanding what they’re getting into. They’re buying and selling stocks without knowing the balance between risk and reward.

- For example, some people’s risk profiles mean they should only have a small portion of their money in stocks. But instead, their portfolios are packed with stocks. What happens if the market crashes? They might panic, sell everything at a loss, and end up with much less than they started with.

So, how do we avoid this mess?

The key is to build an investment portfolio that matches your risk profile. That means figuring out how much risk you’re truly comfortable with and creating a mix of investments that fits you.

What is the lesson I’ve learned after being in the market for more than 15 years? It’s so important to stick to what works for your risk level, “don’t go overboard with risky investments if they’re not right for you.” Period.

Estimate The Risk Profile

What’s Your Risk Profile?

Have you ever wondered, “What kind of investor am I?”

To figure that out, you need to understand something called risk profiling. Don’t worry, it’s not as complicated as it sounds.

Risk profiling is just a way to measure how much risk you’re comfortable taking when you invest. It helps you find the right balance of risk that suits your personality and financial situation.

When professional investment managers work with clients, they create portfolios that are custom-made to match each person’s risk profile.

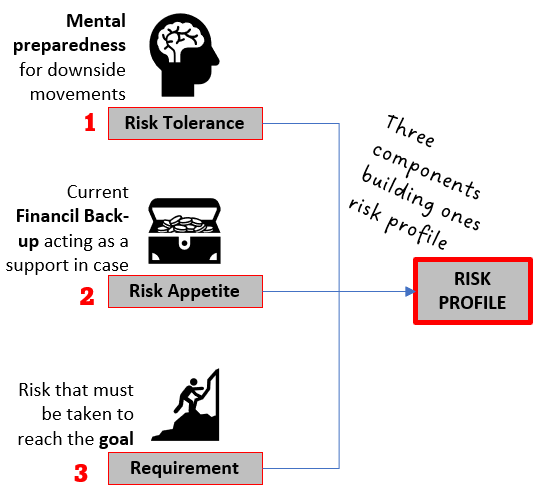

To do this, they look at three key things:

- how much risk you need to take to meet your goals,

- how mentally prepared you are to handle losses, and

- how strong your financial situation is right now.

The Three Pieces of Your Risk Profile

Experts often talk about two main factors that make up your risk profile: risk tolerance and risk appetite.

But I like to add a third one, risk requirement, because it’s just as important.

Let’s look at each of them:

- Risk Requirement: This is about whether your financial goals require you to take risks. For example, if you’re saving for a big goal like retirement in 20 years, you might need to take some risks to grow your money, even if you’re naturally cautious. On the flip side, if you’re already wealthy and just want to protect your money, you might not need to take any risks at all, even if you could handle them.

- Risk Tolerance: This is all about how well you can handle the ups and downs of investing, mentally and emotionally. Imagine your investment portfolio drops in value. If a small dip of 5–6% makes you really nervous, you probably have low risk tolerance. But if you can stay calm even if your portfolio drops 30% or more, that’s a sign of high risk tolerance.

- Risk Appetite: This depends on your current financial situation. If you’ve got a solid financial foundation, like a steady income and high savings, you might feel okay taking more risks. This will be true even if you’re not super comfortable with losses. But if you’re in your early 20s and still building your financial stability, you might not be ready to take big risks yet.

There are other factors that play a role in risk appetite too, and we’ll dive into those later in this post.

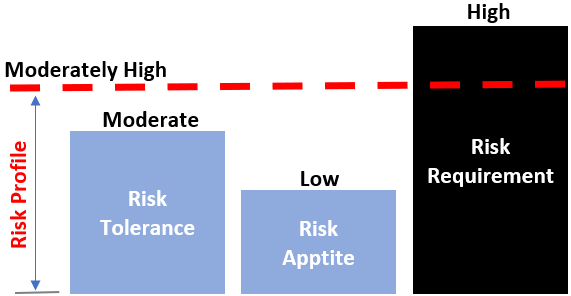

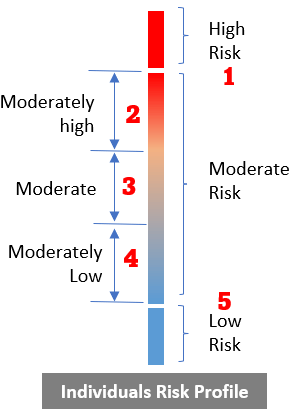

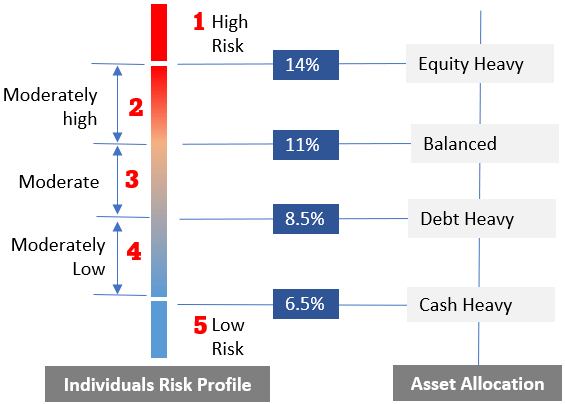

Based on these factors, risk tolerance and risk appetite, people generally fall into one of five types of risk profiles:

- High Risk

- Moderately High Risk

- Moderate Risk

- Moderately Low Risk

- Low Risk,

We’ll explore those categories in more detail now.

Understanding Risk Tolerance and Risk Appetite

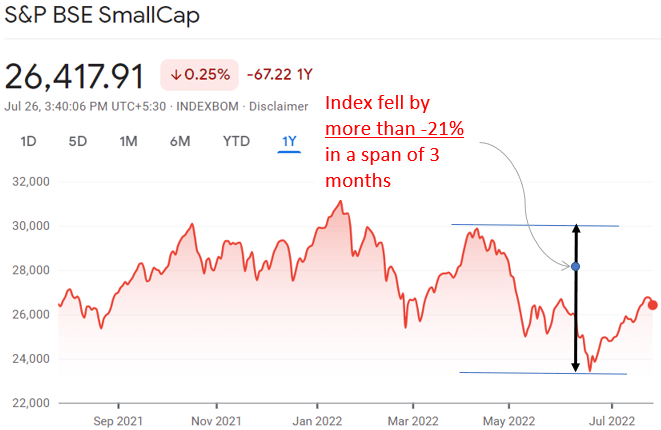

A. Risk Tolerance: How You Handle Losses Emotionally

Risk tolerance is all about how well you can emotionally deal with the idea of losing money, or actually seeing your investments drop in value.

When you invest in something risky, like stocks, the value of your portfolio can go up and down a lot in a short time. Sometimes, it might even drop by 30% or more.

How you react in those tough moments shows your risk tolerance.

If you stay calm and don’t stress out, that’s a sign of high risk tolerance. But if you panic and sell everything to avoid more losses, that means you have low risk tolerance.

So, what shapes your risk tolerance? Here are two big factors:

- Your Past Experiences: Your background and past with money can really influence how you feel about risk. For example, if you grew up in a time when prices didn’t rise much (low inflation), you might feel safe with simple investments like index funds. But if you were raised in a fast-growing economy, you might be more drawn to riskier options like buying stocks directly. If you or your family lost a lot of money in a big market crash, like the one in 2008, you might be extra cautious and avoid stocks during tough times, like the COVID crash in 2020. On the other hand, if you saw your parents only invest in super-safe things like insurance plans, you might think stocks or equity funds are too risky for you.

- Your Natural Personality (Maybe It’s in Your Genes): Some people just seem wired to handle investment risks better, it might even be in their DNA! These folks see a market crash as a chance to buy more at lower prices, rather than a reason to panic. They might feel excited to invest in stocks or equity funds during a downturn. Others might prefer a safer mix, like hybrid funds, while more cautious people, like our grandparents, might stick to bank deposits even when the market dips.

How you behave during a market slump says a lot about your risk tolerance.

B. Risk Appetite: How Much Risk You Can Afford to Take

Risk appetite is a bit different. It’s about how much risk you can actually afford to take, based on your financial situation.

Even if you’re not naturally comfortable with risk, you might still be able to take some chances if you have extra money to invest. I believe anyone can grow their risk appetite over time. For example, I’ve built mine by making sure I set aside money to invest right at the start of each month, before I spend on anything else. I call it “paying myself first.”

Here’s what influences your risk appetite:

- Your Current Financial Health: If you’re in a strong financial position, you’ll likely feel more comfortable taking risks. So, what makes you financially stable? Let’s discuss in more details:

- Steady and Extra Income: If you have a high, stable salary, you might be more willing to take risks compared to someone like a freelancer with an unpredictable income. Also, if you live frugally and have extra money left over each month, you’ll have a higher risk appetite. But if you tend to spend a lot, you might not have much spare cash, which can make you more cautious.

- Your Emergency Fund: An emergency fund is like a safety net, it includes things like cash savings and insurance. The bigger your emergency fund, the safer you’ll feel, which can make you more open to trying riskier investments.

- Your Current Investments: If you already have a solid investment portfolio that’s doing well, it can boost your confidence to take more risks. Not only does it give you experience, but it also makes you feel more financially secure.

- How Long You Plan to Invest (Your Time Horizon): The longer you can leave your money invested, the less you’ll worry about short-term ups and downs. For example, if you’re investing for a goal that’s just 3 years away, you’ll probably play it safe with moderate risks. But if your goal is 20–25 years away, like saving for retirement, you’ll likely feel more comfortable with riskier investments, knowing you have time to ride out any dips.

One last thing, knowledge matters.

The more you know about investing, like how stocks, mutual funds, or bonds work, the better you’ll handle the risks that come with them.

This is especially true for stocks. When you understand the basics of the stock market, you’re less likely to panic and more likely to make smart choices, even when things get shaky.

Matching Your Risk Profile to an Investment Strategy

Turning Your Risk Profile into a Plan

Figuring out your risk profile is a great first step, but it’s only half the job.

The real magic happens when you use that knowledge to create an investment strategy that fits you. Your risk profile can guide you toward the right mix of investments, and even give you an idea of the returns you might expect.

For example, let’s say you have a moderate risk profile (which, as we’ve mentioned, is where most people fall). You’d want a portfolio designed to aim for annual returns between 8.5% and 11%. That’s a sweet spot that balances growth with a level of safety you’re comfortable with.

Each risk profile, whether it’s High Risk, Moderately High Risk, Moderate Risk, Moderately Low Risk, or Low Risk, can be paired with a target return range like this (see the above infographic) to help you plan.

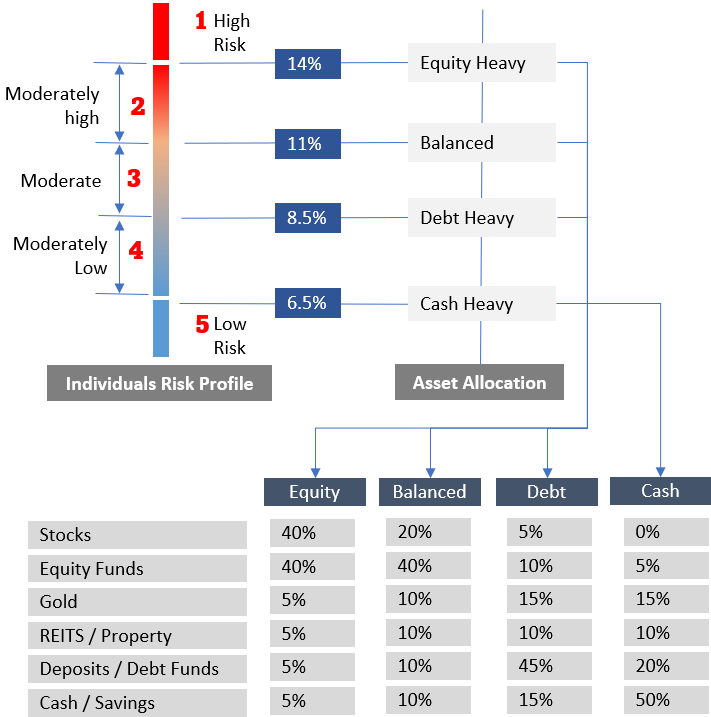

Building Your Portfolio: What Goes In?

Now that you know your risk profile and target returns, let’s talk about how to build your portfolio (use the above online tool to estimate your risk profile).

This is where asset allocation comes in. It’s just a fancy way of saying how you split your money between different types of investments, like stocks, bonds, gold, or real estate.

The goal is to create a mix that matches your risk profile and helps you hit those target returns.

Here’s a simple breakdown of how you might divide your money, depending on your risk profile:

- High Risk: Focus heavily on equity (e.g., >40% stocks, >40% equity funds, <5% gold, <5% Reits, <5% deposits/debt funds, and <5% cash) for higher returns, but expect more ups and downs.

- Moderately High Risk: Still lean toward stocks, but with a bit more balance (e.g., 40% stocks, 40% equity funds, 5% gold, 5% Reits, 5% deposits/debt funds, and 5% cash).

- Moderate Risk: Go for a balanced mix (e.g., 20% stocks, 40% equity funds, 10% gold, 10% Reits, 10% deposits/debt funds, and 10% cash) to aim for those 8.5%–11% returns we mentioned.

- Moderately Low Risk: Shift toward safer options (e.g., 5% stocks, 10% equity funds, 15% gold, 10% Reits, 45% deposits/debt funds, and 15% cash).

- Low Risk: Stick mostly to safe investments (e.g., 0% stocks, 5% equity funds, 15% gold, 10% Reits, 20% deposits/debt funds, and 50% cash) to keep your money secure.

I’ll be honest, this is a simplified version of asset allocation. In reality, it can get more complex.

But the above representation gives you a starting point to understand how your risk profile shapes your investment choices.

A Note for Beginners:

If you’re new to investing and don’t know much about different asset types (like stocks, gold, or real estate investment trusts – REITs), you’ll want to play it safer.

For beginners, it’s better to put more of your money into low-risk options, like bonds or fixed-income investments. This means your portfolio will be “debt-heavy,” and your returns might be lower than someone taking bigger risks.

But that’s okay, it’s all about starting at a level that feels right for you and building confidence as you learn more.

Conclusion

Why Your Risk Profile Matters

Before you start investing, taking the time to figure out your risk profile can set you on the right path. It’s like having a roadmap for your investment journey.

It will help you make smarter choices that fit your comfort level.

Whether you’re just starting out or you’re an experienced investor, here’s a tip, check your risk profile at least every 5 years. Why?

Because as you grow older, your priorities change. Maybe you’ll become more cautious as you near retirement, or you’ll feel braver after building some savings.

Either way, your risk profile will likely shift, and your investments should too.

For beginners, going through the process of figuring out your risk profile is a fantastic way to dip your toes into investing. It’s like a crash course in understanding yourself as an investor. You’ll get a clear picture of how much risk you’re okay with, what kind of returns you can expect, and how to split your money between different investments (like stocks, bonds, or gold).

Here’s a little trick I used when I was a beginner to test my risk tolerance before buying stocks, I’d imagine I had Rs.5,000 to invest. Then I’d ask myself, “How much of this could I lose without losing sleep?” Back then, my answer was usually Rs.500. So, I’d only put Rs.500 into stocks and invest the rest in safer options like mutual funds.

It was a simple way to ease into investing without taking on too much risk at once—you can try it too!

Have a happy investing.