Summary Points:

- I explain the four quadrants: E, S, B, I.

- E and S mean trading time for money.

- B and I focus on systems and passive income.

- I share my journey from E to B and I.

- Small steps can help you move to financial freedom.

Introduction

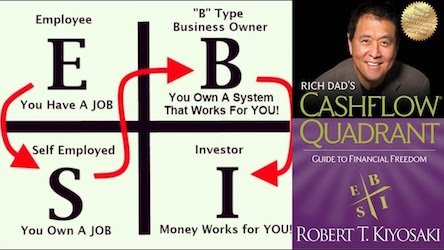

Today, I want to talk about something that completely changed how I think about money and financial independence. It’s a concept I first came across in Robert Kiyosaki’s book “Rich Dad’s Guide to Investing“, the Cash Flow Quadrant, or what he calls the ESBI Model.

I know many of us in India dream of financial freedom, but often we don’t know where to start. So, allow me to explain to you from what I’ve learnt from this book of Robert Kiyosaki.

When I started my investment journey in 2008 (check here my Journey), inspired by Kiyosaki’s Rich Dad Poor Dad, I was a mechanical engineer working a corporate job. Back then, I thought a good salary was the key to a secure life. But after reading Kiyosaki, I realised there’s a bigger picture. The Cashflow Quadrant helped me see how people earn money and why some become financially free while others stay stuck.

In this post, I’ll share with you how I’ve perceived the idea of Cashflow Quadrants (ESBI Model). I’ll fist show you how I visualize and remember the ESBI Model in my mind. Then, I’ll tell you how it is helping me to transform my life from mediocrity to financial independence. Yes, if we can understand the ESBI model, it has powers to transform our lives.

So, let’s dive into this idea and see what it can teach us.

What Is the Cash Flow Quadrant?

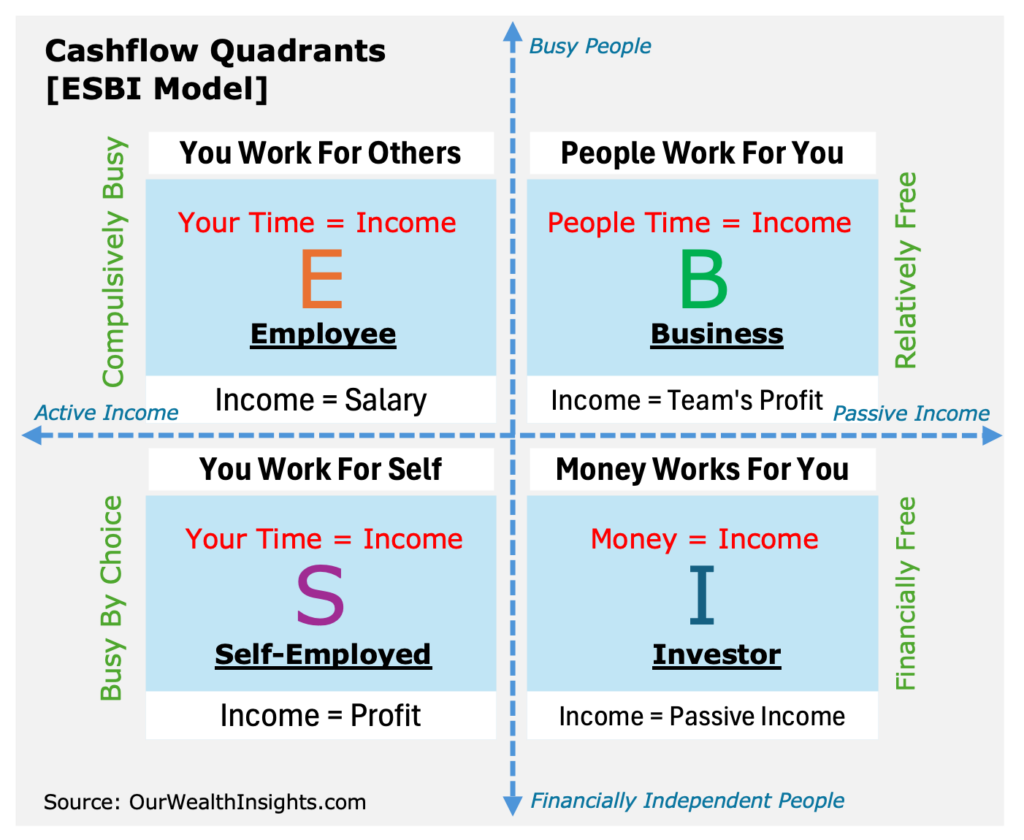

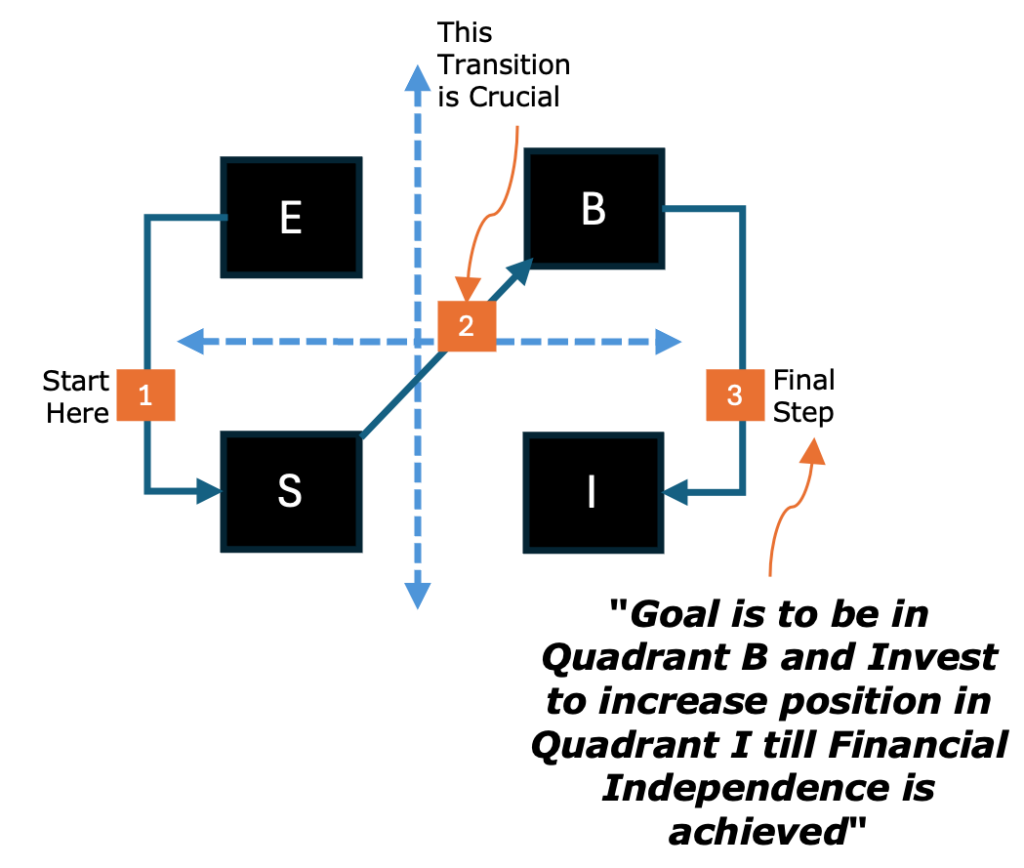

Imagine a square divided into four parts. This is the Cashflow Quadrant, and each box represents a different way people earn money. Kiyosaki calls these boxes E, S, B, and I.

Robert Kiyosaki would want you to visualize the four quadrants like below:

Let me explain what each one means.

- The “E” quadrant stands for Employee. This is where most of us start, like I did. If you work for a company, whether you’re a factory worker, a software engineer, or even a CEO, you’re in the E quadrant. Your income comes from a salary, and you trade your time for money. If you don’t work, you don’t get paid. Its simple, right. For people in this quadrant, “time is money.”

- Then the “S” quadrant, which stands for Self-Employed. These are people who work for themselves. Think of your local doctor, a lawyer, or even the grocery shop owner of your neighbourhood. They don’t have a boss, but they still trade their time for money. If they stop working, their income stops too. Kiyosaki also calls this the “solo and smart” quadrant because many professionals like accountants or consultants fall here. At present I’m here [solo but not smart 😊]

Now, let’s move to the other side of the quadrant, the B and I boxes.

- The “B” quadrant stands for Business Owner. These are people who own a system or a company where others work for them. Think of someone who owns a chain of restaurants or a big factory. They don’t have to work every day because their team keeps the business running, and they earn profits from that.

- Finally, “I” stands for Investor. This is where money works for you. Investors put their money into things like stocks, real estate, or mutual funds, and they earn passive income. What is passive income? It’s the money that comes in even when they’re sleeping. For example, if you own a flat and rent it out, that rent is passive income.

Why Does This Matter to Us?

You might be wondering, “This sounds interesting, but why should I care about these quadrants?”

Good question.

When I first read about this in Rich Dad’s Guide to Investing, I was stuck in the E quadrant, working long hours in my corporate job. I thought I was doing well because I had a steady salary. But Kiyosaki made me realise something important, people in the E and S quadrants are limited by time. There are only 24 hours in a day, and no matter how hard you work, you can’t earn more than what your time allows.

In the book, Kiyosaki shares a story where his rich dad tells him, “In the E and S quadrants, you play the game as an individual, but in the B and I quadrants, you play as a team.” This sentence has stuck with me since.

I thought about how, in my job, I was always working alone (at least it seemed like that) to meet the deadlines.

Even when I started blogging, I started in the S quadrant. writing every post myself, managing everything on my own. It was exhausting. But in the B and I quadrants, you build systems or investments that work for you.

That’s when I understood why so many wealthy people focus on businesses and investments instead of just jobs.

The Reality of E and S Quadrants

Let’s talk a bit more about the E and S quadrants because that’s where most of us are.

If you’re an employee, you’re trading your time for a salary. It feels secure, after all, you get a fixed money in your bank every month. But Kiyosaki points out a problem: you don’t have much control over your income.

If the company shuts down or you lose your job, your income stops. I saw this during the 2020 COVID crash when many lost their jobs overnight. It made me realise how risky the E quadrant can be, even if it feels safe.

The S quadrant is a bit better because you’re your own boss.

I know many self-employed people in India, small shopkeepers, freelancers, even a close family member who runs his own boutique. They have more freedom than employees, but they’re still tied to their work. If they takes a week off, their business cannot earn anything. Kiyosaki says this is because S quadrant people are “also solo players like people in E.”

They rely on their own efforts, and that limits how much they can grow.

In Rich Dad’s Guide to Investing, Kiyosaki’s rich dad gives some tough advice. He tells Kiyosaki, “You don’t have the expertise that employers will pay big money for, so you’ll probably never make a lot as an employee (E).” He also says that Kiyosaki isn’t “smart” enough to be a star in the S quadrant, like a famous doctor, movie star, or a sports star like Virat Kohli.”

I found this a bit harsh, but it made sense. Not everyone can be a top professional or a celebrity. So, for many of us, the E and S quadrants might not be the path to big wealth.

The Power of B and I Quadrants

Now let’s look at the other side, the B and I quadrants.

This is where financial freedom lives. In the B quadrant, you’re a business owner who builds a system. Kiyosaki says, “Business is a team sport.” A business owner doesn’t do everything themselves, they hire people, create processes, and let the system run.

For example, think of a big brand like Britannia. The owner doesn’t milk the cows or deliver the Cheese, butter, and Biscuits. They have a team for that, and they earn profits from the whole operation.

When I left my corporate job in 2017 to focus on GetMoneyRich.com (now OurWealthInsights.com), I started thinking like a business owner. At first, I was doing everything myself, writing, editing, marketing. But over time, I understood that, I need a system to work for me.

I’m still not ready to hire a team, but I’ve a system that keeps working for me even when I’m asleep. Of course, I’m still not complete off the hooks. Every day, a fixed time slot, I’ve to render to my blog and to my Stock Engine. If I stop, the work will stop. But since 2017, I’ve built a system that can do about 40% of my work, the balance 60% is still dependent on me.

So, ‘am I fully in the “B” quadrant? Not yet. But for sure, I’ll be there someday. Also, it will not be that typical way of hiring people, find an office space, paying rents and salaries type of business. I’ll not do that. I’ve my own ways of building my resources that will work for me 24×7.

For example, We’ve built my Stock Engine tool (in collaboration with my brother). I wrote the financial algorithm part and he did the application part. This is one resource (Stock Engine) I have that needs minimal external manual intervention. I works virtually on its own.

Moving toward the B quadrant from S quadrant is not easy. But the more I’m progressing, it is giving me more time to focus on bigger ideas.

The I quadrant is the ultimate goal. This is where your money works for you. This is what I’ve been working toward through my investments. Over the years, I’ve built an investment portfolio with a mix of assets that keeps working for me without my intervention. I get passive income, it comes in whether I’m working or not.

Kiyosaki says, passive income is the key to financial freedom because you’re no longer trading your time for money.

Why We Fear Moving to B and I

I know what you’re thinking, “This sounds great, but starting a business is risky, and I don’t have money to invest!”

I used to think the same way. In the book, Kiyosaki addresses these fears.

He reminds us that just 100 years ago, most people were business owners. In the US, 85% of people were farmers or shopkeepers, not employees. Even in India, if you think about our grandparents, many of them ran small businesses or farms. My own grandfather was a professional teacher in a small school (S Quadrant).

But today, we’re taught to be employees. Our education system trains us to get good marks, find a secure job, and work for someone else. Kiyosaki says this is because of the industrial age, which promised job security and pensions.

But that promise is fading. During the 2008 financial crisis, I saw big companies lay off thousands of employees. Job security isn’t as secure as we think, right?

Starting a business or investing does feel risky, but staying in the E or S quadrant has its own risks. If you lose your job or can’t work, your income stops.

In the B and I quadrants, you’re building something that can keep earning even if you step away. It’s like planting a mango tree, it takes time and effort at first, but once it grows, you can enjoy the fruits for years.

How Can We Move Forward?

So, how do we move from the left side of the quadrant (E and S) to the right side (B and I)?

This is what I’ve been figuring out over the years, and I’ll share what is working for me and may also help other.

- First, start by learning. Read books like Rich Dad Poor Dad or The Intelligent Investor by Benjamin Graham, they’ll change how you think about money. I also recommend following good financial blogs to stay updated.

- Next, take small steps. You don’t have to quit your job tomorrow and start a business. When I was still in my corporate job, I started blogging on the side. It was my way of testing the S quadrant.

- Over time, I turned my blog into a small business. That’s from when I’ve started my transition toward the B quadrant. At the same time, I started investing small amounts in stocks and mutual funds, slowly building my presence in the I quadrant.

The key is to think like a team player, not a solo player.

Kiyosaki says, “In the real world of business, every day is test time, and business owners cooperate at test time.” In school, we’re taught that helping each other during exams is cheating, but in life, working together is how you succeed.

Find mentors, join communities, and learn from others who are already in the B and I quadrants.

Conclusion

Cash Flow Quadrant isn’t just a nice diagram, it’s a way to understand where you are and where you want to go. When I started my journey, I was an employee, trading my time for a salary. Today, I’m working toward being a business owner and investor, building systems and passive income that give me freedom. It’s not easy, and it takes time, but it’s worth it.

Think about your own life. Are you stuck in the E quadrant, always trading time for money? Or are you ready to take small steps toward the S, to ultimately be on the right side of the Cashflow quadrants? Why right side? Because that is where your money and systems can work for you.

I hope this idea inspires you as much as it inspired me. Let’s keep learning and growing together on this journey to financial freedom.