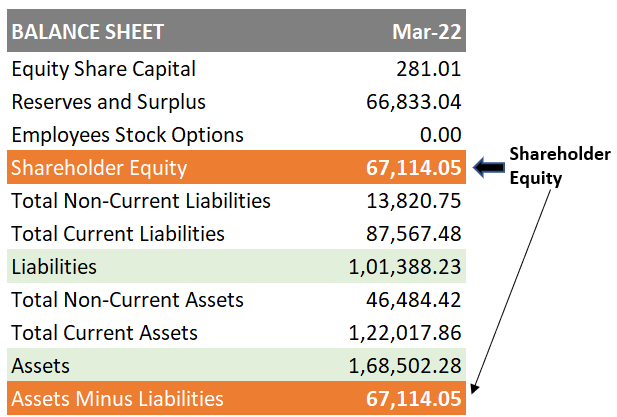

A more common term for shareholder equity is Net Worth. It is visible on the company’s Balance Sheet. This number highlights an approximate liquidation value, net of liabilities, of a company. It is the capital receivable at the hands of the shareholders after the company’s assets are sold and all debts are repaid. [For a broader perspective, check out our guide on Top Stocks to Buy in India.]

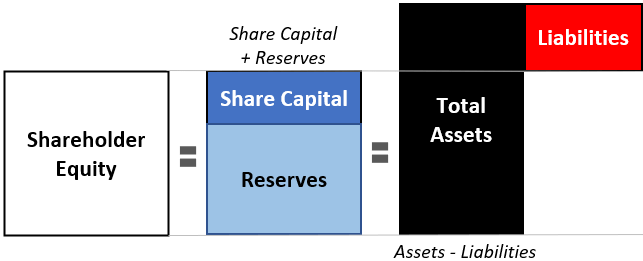

In terms of formula, shareholder equity can be quantified using two formulas:

Shareholder Capital = Share Capital + Reserves = Total Assets – Total Liabilities

Basics: Shareholder Equity

It will not be wrong to say that the quantum of capital indicated in the balance sheet against the line item “shareholder equity” are the investors/owners’ funds. We can look at the shareholder equity in two ways:

- First – In a worst-case scenario, when the company’s assets are liquidated, the shareholders are likely to receive at least the money equivalent to what’s indicated as shareholder equity.

- Second – It is one of the sources of capital for the company. It is the fund that the shareholders’ (owners) have invested in the company.

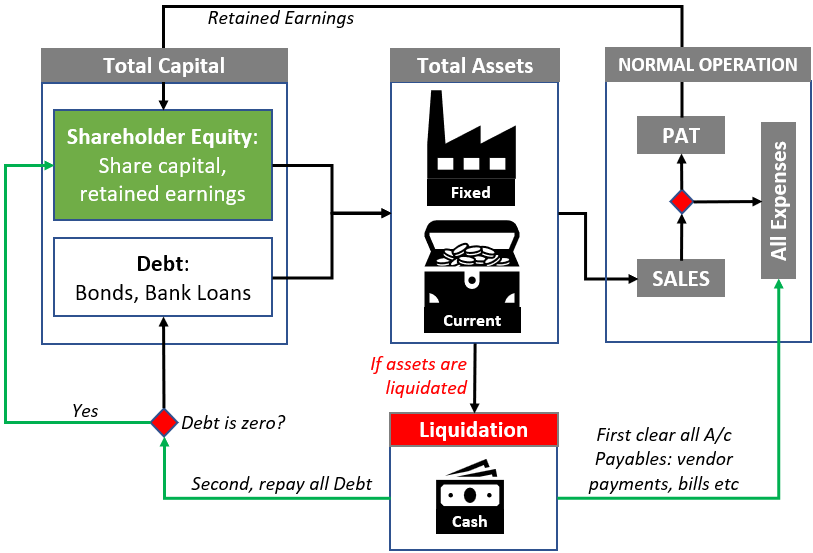

A company can have two sources of capital, equity, and debt. The capital so sourced is used to accumulate assets. The accumulated assets are then used to produce goods and services. The product is then sold in the market (Sales) to earn revenue and make profits. This happens when the business is operating normally.

In a worst-case scenario (like bankruptcy), the business is liquidated. The liquidated assets are used to first clear all the account payables, and the loan outstandings. Once it is done, what remains is distributed proportionally among the shareholders.

Here is an infographic showing the use of capital to do business (normal operation). But in the case of an emergency, the company’s assets can also be liquidated. This way, the shareholders (owners) hope to get back their invested money.

We can also see shareholder equity value as an indication of the company’s valuation. It displays what the shareholders’ are likely to receive if the company’s operation is stopped and its assets are liquidated. Please note that it is a company value looking from a very pessimistic angle. If the estimation of intrinsic value is a range, then the shareholder’s equity will be on the minimum side of it.

Interpretation of Negative Shareholders’ Equity

Before we go into the details of shareholders’ equity being negative, let’s recall the components of it. According to one formula, its two components are share capital and reserves. An alternative formula highlights two other components, assets and liabilities.

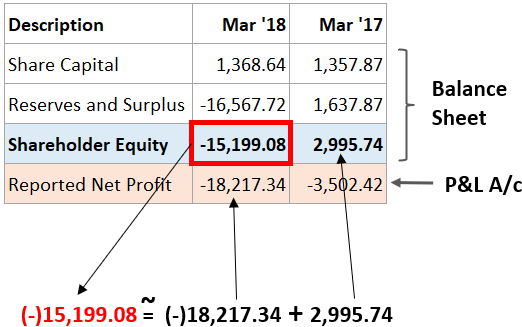

How shareholders’ equity becomes negative? I’ve seen some portals explaining the cause as liabilities becoming larger than assets. But it is not the root cause. The main reason that makes a company’s equity become negative is sustained negative net profit (PAT). How? Let’s understand it using a real-life example.

The example company reported a Shareholder Equity of Rs.2,995.74 crores in Mar’17. In the following FY, the company reported a Net Profit of (-)18,217.34 crores. This made the accumulated reserves of Mar’18 become negative. Hence, the Shareholder’s Equity number of Mar’18 becomes (-)15,199.08 crores.

This is just evidence, displaying how a negative PAT number of the P&L account can influence the shareholder equity number of the Balance Sheet.

How liability can become larger than assets?

A company that consistently reports losses, can run out of cash. They will not have sufficient working capital to clear the current liabilities. Hence, they will resort to short-term borrowings. Such borrowing will increase the size of the liabilities. If such loss-making continues, it eventually makes liabilities so big that it becomes greater than the company’s total assets.

A loss-making company might also sell its assets to manage immediate cash needs. This further depletes the total assets thereby leading to a negative equity situation.

How to interpret a positive shareholders equity? Positive shareholder equity shows that the liabilities of a company have enough assets to cover them in case the company goes into liquidation. Hence, a company with a positive equity number is viewed as financially healthy & safe for investment.

To know more about negative shareholder equity, I’ve written a separate article. Please visit the link to know more about it.

What a Retail Investor can know about a company by looking at its shareholder’s equity number?

We’ve already discussed how shareholders’ equity can become negative under the influence of losses. So the first conclusion we can record after looking at negative equity (Net Worth) is that in the past the company has reported huge losses. In the majority of cases, a loss-making company eventually runs out of cash. Hence, such companies are often debt-burdened. This makes the company, even more, riskier for its investors.

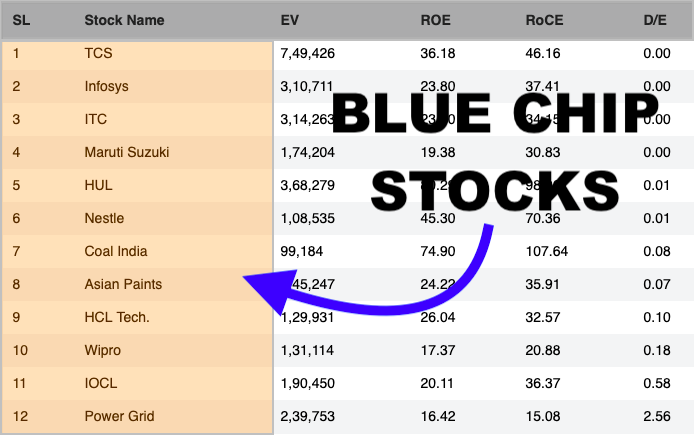

What we can conclude from a positive equity number? Frankly speaking, apart from its asset-liability balance, it does not conclude much. But the same number can speak volumes about the company when used in the form of a ratio. One such ratio is the Return on Equity (ROE) which is a ratio between the company’s net profit and shareholders’ equity.

ROE is a measure of how well the management is using the shareholder’s money to yield net profits. The higher the ROE number the better. But at times a high ROE ratio can mislead the investors. Hence, the use of ROIC and DuPont analysis is a must to better understand the quality of the displayed ROE.

Shareholder Equity As Detailed in Annual Reports

The shareholders’ equity as displayed in the online portals mainly has two components, share capital and accumulated reserves. But in the annual reports, more details are available. Let me give you an example. This is a company from the steel sector. The annual report gives a further break-up of share capital and the accumulated reserves. Please note that these days, the accumulated reserves are also reported as other equity.

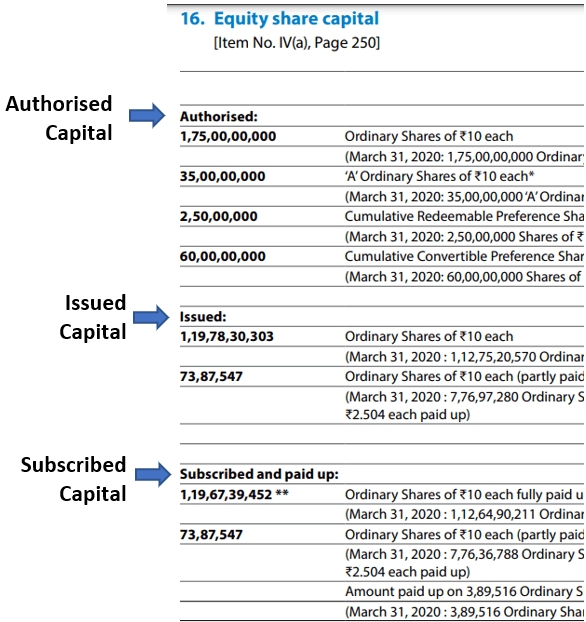

Share Capital

The details provided in the notes of the annual report clearly spell out how much is the authorized capital, and how much has been issued and subscribed. When the company takes approval of the authorized capital from the Registrar of Companies, they also specify how much of it will be from ordinary shares and preference shares. If you want to know more about authorized, issued, and paid-up capital, visit the link. I’ve written this article to explain the subject.

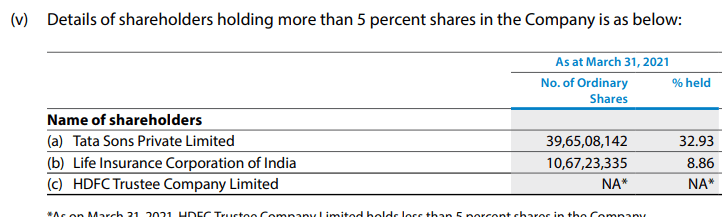

The annual report notes will also highlight the entities that hold more than a certain percentage stake in the company.

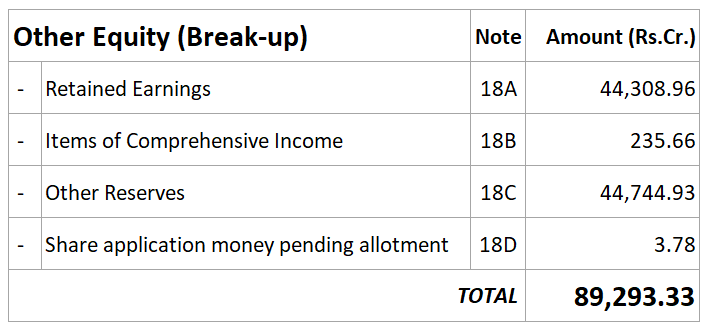

Reserves (Other Equity)

Typically, the other equity line item in the balance sheet can be further broken down into at least two key components, Retained earnings and Other Reserves. Retained earnings are basically the cumulative transfer of net profit from the P&L accounts. It is further distributed into Other Reserves as mandated by the government or as per the policies of the company.

Our example company has the following components of Other Reserves visible in the notes of its annual report.

- Securities Premium Reserve: Upon the sale of shares, the premium received by the company is recorded under this head as per the Companies Act, 2013.

- Debenture Redemption Reserve (DRR): As per the Companies Act 2013, any company that issues debentures must create this reserve. The value of this reserve must be at least 25% of the total value of debentures issued.

- General Reserve: A company keeps some funds allocated under this head as their backup fund. These funds are meant to be used in case of emergencies or unplanned cost occurrences. In the earlier days, keeping a general reserve was mandatory for the companies. But now it is not, but companies follow it as a good practice.

- Capital Redemption Reserve: When a company does a buyback of its shares, it is generally financed from its securities premium reserve or general reserve. As per the Companies Act, 2013 the company must maintain a reserve equal to the nominal value of the shares so purchased. This reserve is kept under this head.

- Other: Our example company has maintained a reserve under this head to manage any unforeseen contingencies.

How To Calculate Shareholders Equity

Shareholders’ equity is a key metric for evaluating a company’s financial health, and calculating it is straightforward. Here’s how:

The Basic Approach:

Shareholders’ equity represents the company’s net worth, essentially what would be left for shareholders if all assets were sold and debts settled. It reflects the total investment by shareholders and the company’s accumulated profits.

There are two main ways to calculate it:

- Total Assets Minus Total Liabilities: This leverages the fundamental accounting equation. You find the total value of all the company’s assets (cash, inventory, property, etc.) from the balance sheet, and then subtract the total liabilities (debt owed to creditors). This represents the shareholders’ claim on the company’s remaining resources.

- Share Capital Plus Retained Earnings Minus Treasury Stock: This approach breaks down the shareholders’ equity into its components. Share capital is the money invested by shareholders through common and preferred stock. Retained earnings are the company’s accumulated profits over time, minus any dividends paid out. Treasury stock represents company shares it has bought back and are no longer outstanding. Subtracting treasury stock from the sum of share capital and retained earnings gives a more precise picture of shareholders’ equity.

Remember:

- Both methods should result in the same value.

- You’ll find the necessary figures (total assets, liabilities, etc.) in the company’s balance sheet, a key financial statement.

By calculating shareholders’ equity, one can gauge a company’s financial stability. It also talks about the ability of the company to generate returns for shareholders. It’s a valuable tool for fundamental analysis alongside other financial metrics.

Conclusion

Shareholder equity displayed in the company’s balance sheet can be positive or negative. A positive number indicates healthy financials, and a negative value is evidence of a problem within the company. We’ve discussed in this article, how shareholders’ equity can become negative. The sustained negative equity value of the balance sheet is a sign that the company might file for bankruptcy in the coming time.

As an investor, we can estimate the profitability of a company using a Return on Equity (ROE) ratio. ROE is a ratio between net profit and shareholder equity. A company whose ROE is low or negative is another indicator of weak financials.

![Compare Indian Banks: A Quick Fundamental Analysis [2023]](https://ourwealthinsights.com/wp-content/uploads/2021/05/Compare-Indian-Banks-Image4.png)