On December 20, Siemen India’s shares saw a sharp drop of over 9%. It triggered widespread concern among investors. The company cited several reasons, including slow private capital expenditure (capex) and strategic decisions related to specific technologies. I’ll try to declutter what happened and what I can understand about its implications.

1. What Happened?

1.1. Private Capex

Siemens’ management expressed concerns over the sluggish recovery in private capital expenditure (capex) in traditional industries such as automotive and metals.

Private capex is essential for Seimens India’s diversified business model.

Although sectors like semiconductors, batteries, and electric vehicles (EVs) have attracted significant investment due to their growing demand, traditional sectors have not seen the same level of momentum.

This gap reflects broader market trends where some companies are increasingly focused on futuristic and sustainable technologies. But industries like automotive and metals are facing challenges like overcapacity, global supply chain disruptions, and shifting consumer preferences.

As a result, Siemens’ performance in these traditional sectors has been slower, affecting its overall growth outlook.

For investors, this suggests that while there is substantial growth in emerging technologies. But the recovery in legacy industries is still uncertain and may require more time to gain traction.

1.2. Technology Choices

Siemens announced that it won’t participate in upcoming Line-Commutated Converter (LCC) projects for high-voltage direct current (HVDC) systems. Instead, the company plans to focus on more advanced Voltage Source Converter (VSC) projects.

LCC is a type of converter used in high-voltage direct current (HVDC) systems that relies on the natural commutation of AC to DC. VSC is a newer, more flexible converter technology that allows for bi-directional power flow and can connect both AC and DC grids more efficiently.

What is LCC and VSC? Think of LCC as an old blackboards of our schools and VSC as a modern digital whiteboard. While the chalkboard is reliable, the digital whiteboard is the future, offering more features and adaptability.

Siemens’ choice reflects its intent to align with future trends, even if it means losing out on some immediate opportunities.

1.3. Government Spending

Siemens India highlighted a slowdown in government infrastructure spending during the first half of FY25.

On one side it was private Capex and now Government spendings is also down. It has directly impacted its order book.

This slowdown in public sector investment, particularly in infrastructure projects, has led to fewer orders and weaker growth in certain segments.

Why there is a delay in public spendings?

Such delays can be attributed to various factors including:

- Political uncertainty,

- Slower execution of projects,

- Budgetary constraints, etc.

However, Siemens remains optimistic about a recovery in the second half of FY25. The company expects the demand for energy transmission and efficiency solutions to drive this rebound.

As the global push toward renewable energy continues, there is an increased need for efficient energy transmission systems to support sustainable growth.

Additionally, Siemens is seeing positive signs in sectors like electric vehicles and semiconductors. In these sectors the government spending has been more robust.

The second half of the fiscal year may therefore bring better growth prospects.

2. Market Reaction

The market didn’t take this news well. Siemens’ shares dropped from Rs.7,632 to Rs.6,885 in a single day, a decline of about -9.7%.

The broader concern was Siemens India’s cautious outlook and the impact of its strategic shift away from LCC projects.

Other companies in the same sector, like ABB India, also felt the heat. Even ABB India shares slipped about 5.7% in single day (yesterday).

3. Why Should You Care as an Investor?

- Short-Term Volatility: Stock prices often react sharply to news, but this doesn’t necessarily mean the company’s fundamentals have weakened. Siemens is still a leader in its sector, with strong profitability and a promising order book for the future. Short-term drops like this are a test of patience. If you’re investing for the long term, focus on the company’s strengths rather than daily price movements.

- Strategic Choices Matter: By prioritizing VSC projects, Siemens is betting on future technologies. While this might impact revenues in the short term, it positions the company better for the long run. Think of choosing a STEM course in school over an easier subject. It may be challenging initially, but it opens up better career opportunities later. Siemens is making a similar choice with VSC.

- Sectoral Trends: Private capex trends highlight where India’s economy is heading. Investments in semiconductors, batteries, and EVs indicate that these sectors hold potential for future growth. If you’re a stock market investor, tracking these trends can help identify promising opportunities.

4. My Take on Siemens

I’ve worked in the Steel industry for about 16 years. I know that Siemens is alike a Monopoly business when it comes to Electrical and Automations. It is from this business vertical that the company gets in moat. Overall the company’s top management is also one of the best.

From an investor’s perspective, I halve always been very vary of this company because of its expensive valuations.

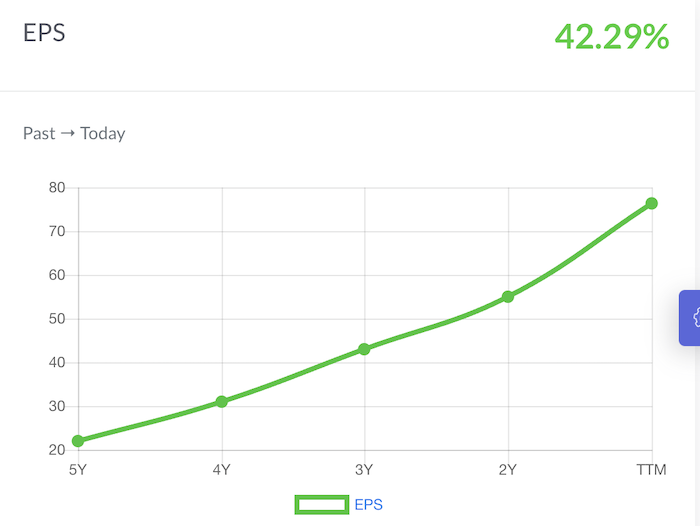

In the last five years, its PE has expanded from PE50 levels to PE90. In the same period, its EPS has growth at the massive rate of 42.3% per annum. But still, at a PE of 90, its PEG is still over 2, which is very expensive by all means.

Having said that, it is also true that Siemens’ recent developments reflect a company adapting to the times.

While the stock’s sharp drop may concern short-term investors, long-term investors can focus on the following aspects of Siemens India’s business:

- The Bigger Picture: Siemens expects new orders to grow by 20.9% in Q4 FY25. Additionally, its energy division’s planned listing in 2025 could unlock significant value.

- Sectoral Leadership: Despite challenges, Siemens remains a leader in industrial automation, infrastructure, and energy solutions. Its strategic decisions align with global trends, ensuring relevance in the future.

How I See Siemens India as a Stock?

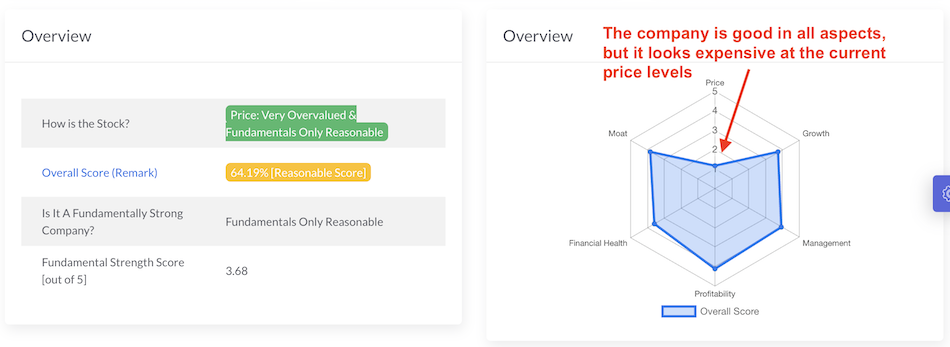

- I’ll not Panic: A sudden fall in share price doesn’t always mean the company is failing. I’ll instead use my Stock Engine app to analyze the company’s fundamentals.

- Understanding the Business: Before investing, understand what the company does and how it makes money. For Siemens, its focus on infrastructure, energy, and technology provides a solid foundation for future growth.

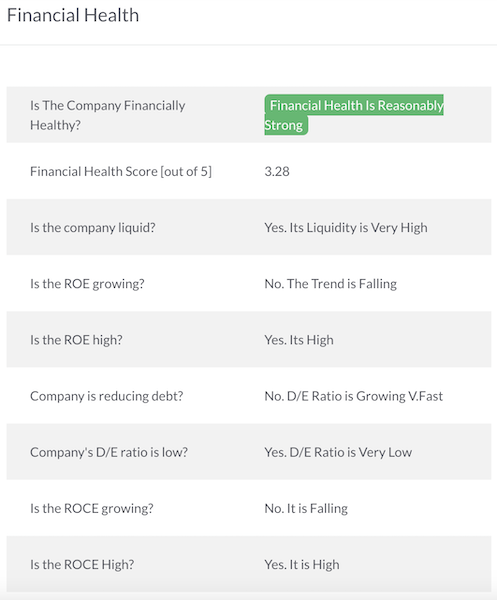

- Focus on Fundamentals: A stock’s performance in the long term depends on the company’s fundamentals, not its day-to-day price movements. Siemens’ strong profitability and promising order book suggest resilience despite current challenges. In terms of financial health, this is how the company looks to my Stock Engine app:

Conclusion

Siemens’ share price dip is just a reminder of the volatile can be stocks even for a fundamentally super-strong companies.

For long-term investors, the company’s strategic decisions and sectoral leadership provide reasons to stay optimistic. But price valuation is a major concern.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.