The purpose of this article is to compare SIP vs Lumpsum investment as two distinct investing strategies. Investors often face the dilemma of whether to choose SIP or lumpsum investment. Both methods have their pros and cons. This article will help you understand which one is suitable for you. For quick answers, read the FAQs.

Introduction

Systematic Investment Plan (SIP) and Lumpsum investing are two ways to invest in mutual fund schemes:

SIP is a method of investing a fixed amount of money at regular intervals. Mostly, the people do a monthly SIP. The amount is debited automatically from the investor’s bank account on a specified date and time. This amount is used to buy the mutual fund units at the current NAV. This way over time, the investor accumulates a large number of units by investing regularly each month.

Lump Sum investing is a one-time investment in a mutual fund scheme. Here the investor is investing a bulk amount in a single transaction. The mutual fund units are purchased at the current NAV.

SIP is a disciplined way of investing, as it takes emotions out of the equation, and enables investors to take advantage of market volatility, while the lump sum is good for people who have a significant amount of money

– Nimesh Shah, MD & CEO, ICICI Prudential Asset Management Company.

Example

Suppose you have Rs. 1,20,000 to invest in a mutual fund that is expected to give an annual return of 12%. You have two options to invest this amount:

- SIP Investment: You can choose to invest Rs. 10,000 per month through SIP over a period of one year. At the end of the 12th month, you would have invested a total of Rs. 1,20,000. The value of your investments would have grown at a rate of 12% per annum. The final value will be about Rs.1,28,000.

- Lump Sum Investment: You can invest the entire Rs. 1,20,000 in the mutual fund in one go. Assuming that the mutual fund gives an annual return of 12%. The lump sum amount of Rs.1,20,000 will grow to Rs. 1,34,400 at the end of the first year.

Mutual Fund Calculator

Use this online mutual fund calculator to do your own calculations.

| Lumpsum Investment (Rs.) | |

| Monthly Contributions (Rs.) | |

| Rate of Return (% p.a.) | |

| Investment Horizon (Years) |

| Final Lumpsum Amount | |

| Final SIP Amount | |

| Total Amount (Rs.Lakhs) | |

| Present Value of Total Amount (Rs.Lakhs) |

Video

Pros and Cons

Pros of SIP Investing

- Discipline: SIP investing helps in maintaining financial discipline as investors commit to investing a fixed amount regularly. It helps in building saving & investment habits.

- Averaging of cost: Since investors buy units at different market levels, SIP helps in averaging the cost of investment. This form of investing helps investors to use the market volatility for their benefit without having to worry about market timing.

- Flexibility: As SIP investing repeats itself at regular intervals (like monthly) for a long time, one can use it flexibly. We can increase, decrease, or stop the SIP based on our choice.

Cons of SIP Investing:

- Lower Compounding: In the long-term, the SIP investors may not see the same kind of compounding of their invested money as a lump sum investor. For the same time horizons (like 10-15 years) SIP investors will get much lower compounding of capital. Check this example.

Pros of Lumpsum Investing:

- Higher liquidity: Lumpsum investing offers higher liquidity as investors can liquidate the investment whenever they require funds. But for sure, liquidity benefits will become visible only after the invested money has stayed parked for a few years at a stretch.

- Higher returns: In a rising market, over a long horizon (like 5 years plus), lumpsum investing generates higher returns than SIP.

Cons of Lumpsum Investing:

- Timing Risk: The biggest threat to practicing lumpsum investing is buying mutual fund units at the wrong time. Investing during market peaks can lead to losses. Hence, to practice lumpsum investing profitably, awareness about market peaks and bottoms is a must.

Lump sum investing is great for people who have a large sum of money and who are certain about their investment choice, while SIP is for those who don’t have the time or the knowledge to invest a large sum of money

– Naveen Kukreja, CEO & Co-founder, Paisabazaar

Real-Life Examples

Here are a few real-life examples of individuals who have invested through SIP or lumpsum mode. Check the outcomes of their investments to build your own perspective

- Rohit invested a lump sum of Rs.3.6 lakhs in a Nifty Bees ETF in March 2020. Due to the COVID-19 pandemic, the markets crashed, and his investment value fell to Rs.3.4 lakhs in April 2020. However, Rohit held on to his investment. By March 2023, the investment value had grown to Rs.5.85 lakhs. In comparison, his friend, Shalini, invested Rs.10,000 per month through SIP mode in the same mutual fund scheme from March 2020 to March 2023. Her total investment amount was Rs.3.6 lakhs, and the investment value grew to Rs.4.49 lakhs.

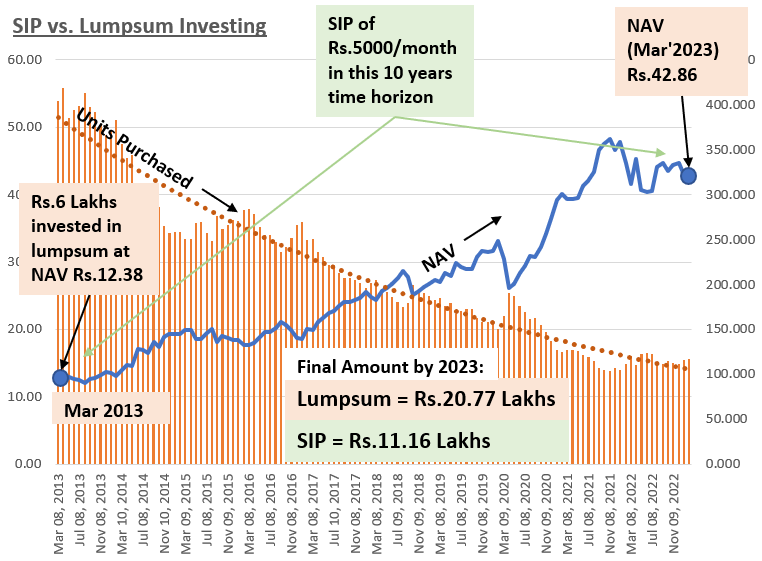

- Sanjay invested a lump sum of Rs.6 lakhs in Axis Blue Chip Fund in March 2013. By March 2023, the investment value had grown to Rs.20.77 lakhs. In comparison, his friend, Rajesh, invested Rs. 5,000 per month through SIP mode in the same mutual fund scheme from 2013 to 2023. His total investment amount was Rs.6 lakhs, and the investment value grew to Rs.11.16 lakhs.

These examples illustrate that both SIP and lumpsum investing can be profitable. Generally speaking, over a longer time horizon, in a growing stock market, lumpsum investing yields a bigger final corpus.

If you have a lump sum amount, invest in debt and equity in a ratio that suits your needs. If you don’t have a lump sum amount, don’t worry. You can still invest through SIPs, which can help you get higher returns over the long term.

– Swarup Mohanty, CEO, Mirae Asset Global Investments

Representation of Sanjay’s & Rajesh’s Investment

| Description | SIP | Lumpsum |

| Investment | Rs.5,000/mon | Rs.6 Lakhs (One Time) |

| Investment Dates | All months (Mar’13 to Feb’23) | On 08-Mar’13 |

| Holding Time | 10 Years | 10 Years |

| Final Value | 11.16 Lakhs | 20.7 7 Lakhs |

SIP allows investors to invest small amounts regularly and over a longer period, which can average out the cost of the investment. On the other hand, lump sum investing is best suited for those who have a lump sum of money and are willing to take higher risk to earn higher returns.

– Pankaj Mathpal, MD & CEO, Optima Money Managers

Comparison: SIP vs Lumpsum Investing

The amount of money available for investment is a crucial factor. Lumpsum investments require a large sum of money upfront. Whereas SIPs allow investors to start investing with smaller amounts.

The timing of the investment plays a role as Lumpsum investments require careful timing to maximize returns. Whereas SIPs allow investors to average out the cost of investment over time.

SIPs are generally considered less risky and more suitable for people who prefer risk-averse investing. Whereas Lumpsum investments are ideal for pro-risk investors. The potential for bigger compounding is more in lumpsum investing.

| Description | Systematic Investment Plan (SIP) | Lumpsum Investment |

|---|---|---|

| Investment Amount | Fixed amount at regular intervals | One-time Bulk investment |

| Market Timing | Not Necessary | Necessary |

| Rupee Cost Averaging | Applicable | Not Applicable |

| Impact of Volatility | Reduced Impact | Maximum Impact |

| Automatic Investing | Applicable | Not Applicable |

| Investor Type | Passive, Risk averse | Active, Pro-risk |

| Power of Compounding | Less Visible | More Visible |

| Risk of Loss | Low | High (if not timed correctly) |

| Flexibility | More Flexible | No flexibility |

| Compounding | Low | High (if timed correctly) |

Both SIP and lump sum have their pros and cons. SIP can help investors stay invested for the long term, while the lump sum can help them get the best returns in a short period. Investors should choose the option that suits their investment horizon, risk profile, and financial goals.

– Vidya Bala, Co-founder, PrimeInvestor

Case Study: SIP vs Lumpsum Investment

Here are the performance details of the HDFC Mid-Cap Opportunities Fund for SIP and lumpsum investments:

- SIP Investment: Suppose an investor had started a monthly SIP of Rs.10,000 in HDFC Mid-Cap Opportunities Fund on March 1, 2013, and continued until March 9, 2023. In that case, the total investment amount would have been Rs.12.1 lakhs. The current value (Mar’23) of the investment would be about Rs.29.19 Lakhs. It is a CAGR growth of around 19%.

- Lumpsum Investment: Suppose an investor had invested Rs.12.1 lakhs as a lump sum investment in HDFC Mid-Cap Opportunities Fund on March 1, 2013. In that case, the current value (Mar’23) of the investment would be about Rs.69.24 lakhs. It is a CAGR growth of around 19%.

So you can see that in both cases the NAV growth rate is the same. But in SIP mode, the money gets invested gradually. In lumpsum mode, all money gets invested in one go. Taking the weighted average, Rs.12.1 Lakhs stays invested for 120 months in lumpsum investing. While in SIP mode, Rs.12.1 stays invested for only about 60 months.

This is where the power of compounding takes its toll and the appreciated amount in lumpsum investing becomes Rs.69.25 lakhs vs only Rs.29.19 lakhs in SIP mode.

Harsh Jain, co-founder and COO of Groww, suggests that investors should consider their financial goals and risk appetite before deciding on an investment strategy. For long-term goals such as retirement, lump sum investments may be more suitable, while for short-term goals such as saving for a down payment on a house, SIPs may be more appropriate.

Risk & Limitations of Lumpsum Investing

From what we’ve read above, it looks like lumpsum investing is far more lucrative than SIP investing. But before building a bias toward lumpsum investing, let’s read about the associated risks and limitations of it.

- Availability of Capital: It can be a limitation in lumpsum investing as it requires a significant amount of capital to be invested at once. Investors who may not have a large amount of capital readily available may find it difficult to invest in a lump sum. Additionally, investing in bulk can also be emotionally challenging for some investors.

- Timing Risk: Investors may choose to invest at a time when the market is overvalued, leading to lower returns over the long term. The risk of entering the market at the wrong time is huge in lumpsum investing. That is why beginner and novice investors should avoid lumpsum investing.

- Risk of Panic Selling: The stock market can be highly unpredictable, and investors can experience significant fluctuations in the value of their investments. A sudden drop in the market can lead to a significant loss of capital. The loss becomes significantly higher in the case of lumpsum investing. This may lead to panic selling which further enhances the pain.

While lumpsum investing can offer higher returns than SIPs over the long term, it also comes with significant risks and limitations.

Conclusion

SIP and lumpsum investing are two different approaches to investing in mutual funds.

- SIPs offer investors the benefit of investing in a disciplined and systematic manner, without requiring a large amount of capital upfront.

- SIP also helps investors to take advantage of market volatility through rupee-cost averaging and reduces the risk of market timing.

- On the other hand, lumpsum investing offers investors the benefit of investing a large sum of money upfront. Potentially, it is used to time the market.

- Lumpsum investing may be more suitable for investors who have a significant amount of capital available and are confident in their investment strategy.

SIP may not yield significant returns if the market performs poorly over a prolonged period. Lumpsum investing, on the other hand, comes with the risk of market timing. A novice investor may invest at a high point in the market, potentially resulting in a negative or low return.

Individuals who can only see the market as too volatile should invest via the SIP route. Individuals who can see the opportunity in market corrections and crashes can practice lumpsum investing. I personally use a combination of SIP and lumpsum investing. I always keep some SIP going all the time. Whenever I see a major market correction or a crash, I used it as an opportunity to invest in lumpsum, in the same schemes where my SIP are currently active.

FAQs

The minimum investment amount for SIP and Lumpsum varies from one mutual fund scheme to another. Typically, the minimum amount for SIP investment is Rs.500, while the minimum amount for Lumpsum investment is Rs.5,000.

Both SIP and Lumpsum have their advantages and disadvantages. Individuals who can only see the market as too volatile should invest via the SIP route. Individuals who can see the opportunity in market corrections and crashes can practice lumpsum investing.

No. Suppose you had invested in a mutual fund scheme “A” in lumpsum in the year 2020. Today, if you want to start a SIP in that same Scheme “A” you can do it separately. But you will see two separate plans in your mutual fund portfolio, one for SIP and one for Lumpsum. Similarly, if one wants to switch from SIP to lumpsum investing, the current SIP plan can be stopped. Then, separately an additional lump sum investment can be made in the same mutual.

If we are talking about equity mutual funds, the ideal time horizon should be five years plus.

There are tax saver mutual funds (like ELSS). Investing in these mutual funds, both in SIP and Lumpsum mode, can offer tax breaks up to 1.5 lakhs under Section 80C.

Have a happy investing.