So, we all love seeing those double-digit returns on our Nifty 50 investments, right? Apna Sensex and Nifty are like the darlings of the Indian stock market. But recently, I was digging into some numbers, and it made me rethink how we measure our investment success.

We usually pat ourselves on the back looking at how much our portfolio has grown in Rupees. “Wow, lakhs have turned into crores!” But here’s the thing: what if I told you that those impressive numbers might be hiding a not-so-pleasant truth?

The Dollar Story: Why Your Global Purchasing Power Matters

See, the world doesn’t run on Rupees alone. When we talk about buying power on a global scale, the US Dollar still reigns supreme. And over the last decade, the Indian Rupee has been steadily losing weight against the mighty Dollar. Rupaiya thoda kamzor ho raha hai, doston.

Let’s look at some hard numbers.

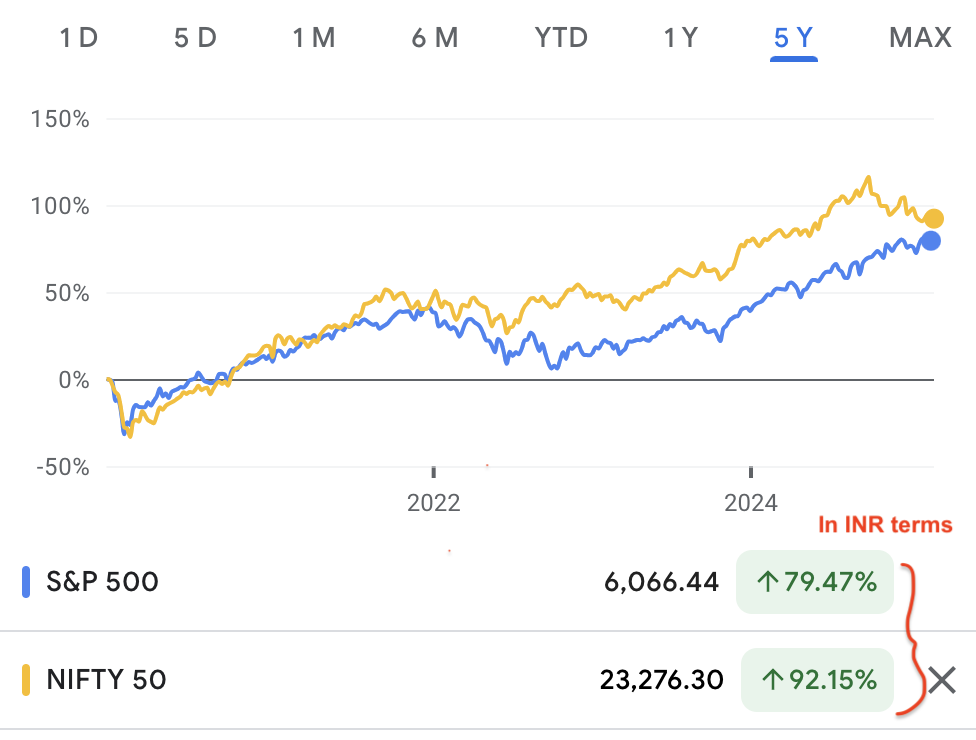

Over the past 10 years (2015-2025), the Nifty 50 gave some solid returns, right? Absolutely! But when you convert those returns into USD, the story changes. Suddenly, the S&P 500 (the big daddy index of the US stock market) looks way more impressive.

| Index | 10-Feb-15 | 10-Feb-25 | % Absolute Return | % Annualized Return |

|---|---|---|---|---|

| Nifty 50 | 8,805 | 23,381 | 165.60% (INR) | 10.25% (INR) |

| S&P 500 | 2,055 | 6,066 | 195.20% (USD) | 11.43% (INR) |

The Math, Made Simple

Let’s say you invested in Nifty 50 ten years ago. Back then, the Nifty was around 8,805. Now it is at 23,381. That’s a great jump of 165.6%.

But here’s the catch:

- 2015: US $1 was roughly Rs. 61.65

- 2025: US $1 is now roughly Rs.87.50

- Between 2015 and 2025: INR has become weaker by about 42%.

| Year | Exchange Rate (1 USD to INR) |

|---|---|

| 2015 | 61.649 |

| 2025 | 87.50 |

That means the Rupee has depreciated significantly in these last 10 years. Now, when you calculate your Nifty returns in USD, the actual gains are much lower.

Example Time: Our Story!

Imagine you invested Rs.1 lakh in the Nifty 50 in 2015. Awesome!

- In INR terms, it grew to Rs.2.66 lakhs (about 2.66 times). Not bad, hai na? (Absolute 165.6% and Annualized 10.25%).

- But in 2015, your Rs.1 lakh was worth about $1,622 ( = 100000 / 61.65).

- Today, that Rs.2.66 lakhs is worth only around $3,043 ( = 266000 / 87.5).

- In USD terms, the growth is only about 1.88 times in 10 years (Absolute 87.1% and Annualized 6.46%).

| Index | Nifty 50 (INR) | Nifty 50 (USD) |

|---|---|---|

| Absolute | 165.6% | 87.1% |

| Annualized | 10.25% | 6.46% |

So, while you think you’ve more than doubled your money (2.66x) , your actual gain in USD terms is significantly less (1.88x).

The S&P 500 Advantage

Now, let’s throw the S&P 500 into the mix. Over the same period, the S&P 500 has not only given fantastic returns in USD, but it has also benefited from the Dollar’s strength. Dollar strong, toh returns bhi strong!

| Index | 10-Feb-15 | 10-Feb-25 | % Absolute Return | % Annualized Return |

|---|---|---|---|---|

| S&P 500 | 2,055 | 6,066 | 195.20% (USD) | 11.43% (INR) |

Why Should You Care?

Okay, so why am I ranting about all this? Because as Indian investors, we need to think beyond just Rupee returns.

- Global Aspirations: Are you planning to send your kids abroad for studies? Dreaming of a European vacation? Thinking of investing in international real estate? All these things require Dollars (or Euros, or Pounds, but you get the point). Even if your aspirations are not of abroad, still a weak currency (INR) will hurt you as it creates inflationary pressures on our imports. Remember, Indian has a huge trade deficit as we are net importers.

- Real Wealth: If the Rupee keeps weakening, your wealth isn’t growing as much as you think, especially when it comes to global purchasing power.

Suggested Reading: (1) You can read here about what makes a currency strong. (2) You should also read this story about the Korean currency (Won) and what lessons we Indians can learn from it. (3)

So, What’s the Solution? Think Global

I’m not saying ditch the Nifty 50. It’s still a great index. But consider diversifying a portion of your portfolio into international assets, especially those denominated in USD.

- S&P 500 ETFs: These are an easy way to get exposure to the US stock market.

- US Stocks: Research and invest in individual US companies that you believe in.

- International Mutual Funds: Many Indian mutual funds offer exposure to global markets.

Conclusion

Don’t get me wrong, I’m a proud Indian investor. But I also believe in being smart and realistic. We need to understand the impact of currency fluctuations on our investments.

Think of it this way: If your investments aren’t outpacing the Rupee’s depreciation, your real wealth might not be growing as much as you think.

So, let’s start thinking globally, invest smartly, and secure our financial future, no matter what the Rupee does. What are your thoughts on this? Let me know in the comments below!

Disclaimer: I am not a financial advisor, and this is not financial advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

![Indian Rupee Hits Record Low: A Historic Dip [2024]](https://ourwealthinsights.com/wp-content/uploads/2024/11/Indian-Rupee-Hits-Record-Low-Thumbnail-768x436.png)