Starting early and staying invested in stocks is crucial for wealth building. By beginning our investment journey at a young age and maintaining a long-term perspective, we can benefit from compounding. It significantly grows our wealth over time. This approach to stock investing minimizes risk and maximizes returns. It is especially essential for novice stock investors whose stock analysis skills are not as mature. Starting early and staying invested is a strategy that can give our holding stocks the power to take us to financial independence. Read more about a few best compounding assets.

Investing in stocks has long been recognized as one of the most effective ways to build wealth over time. Unlike savings accounts or fixed deposits, which offer modest returns, stocks have the potential to deliver significant gains.

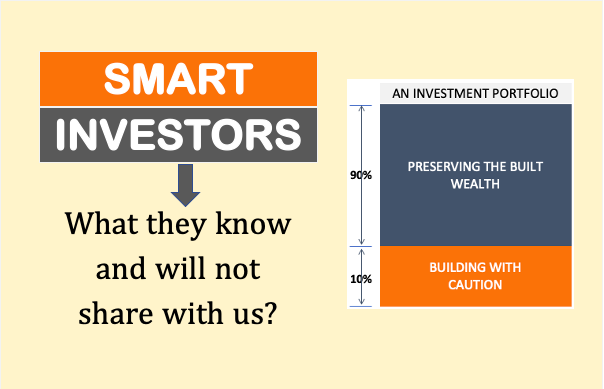

There are two ways to fetch significant gains from stocks, The first is by practicing stock investing like Warren Buffett, Peter Lynch, etc. Second is by simply keeping stocks in our portfolio for a very-very long term. The second approach is for us, retail investors. We neither have the time nor the resources to analyze stocks deeply like professional investors, so our way of investing should be of buy-and-hold type. Read about stock market basics.

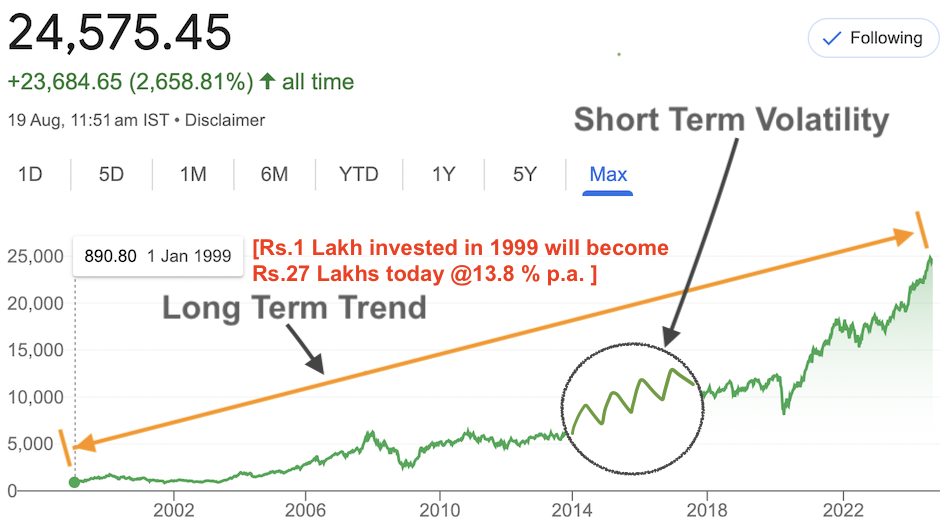

Staying invested is important. The stock market is known for its volatility, with prices fluctuating daily. However, history has shown that despite short-term market swings, stocks generally rise over the long term. By staying invested through market ups and downs, we can avoid the risks associated with short-term volatility. Staying invested ensures that we can benefit from the market’s long-term growth potential.

Topics

1. Starting Early and Staying Invested [Effect of Compounding]

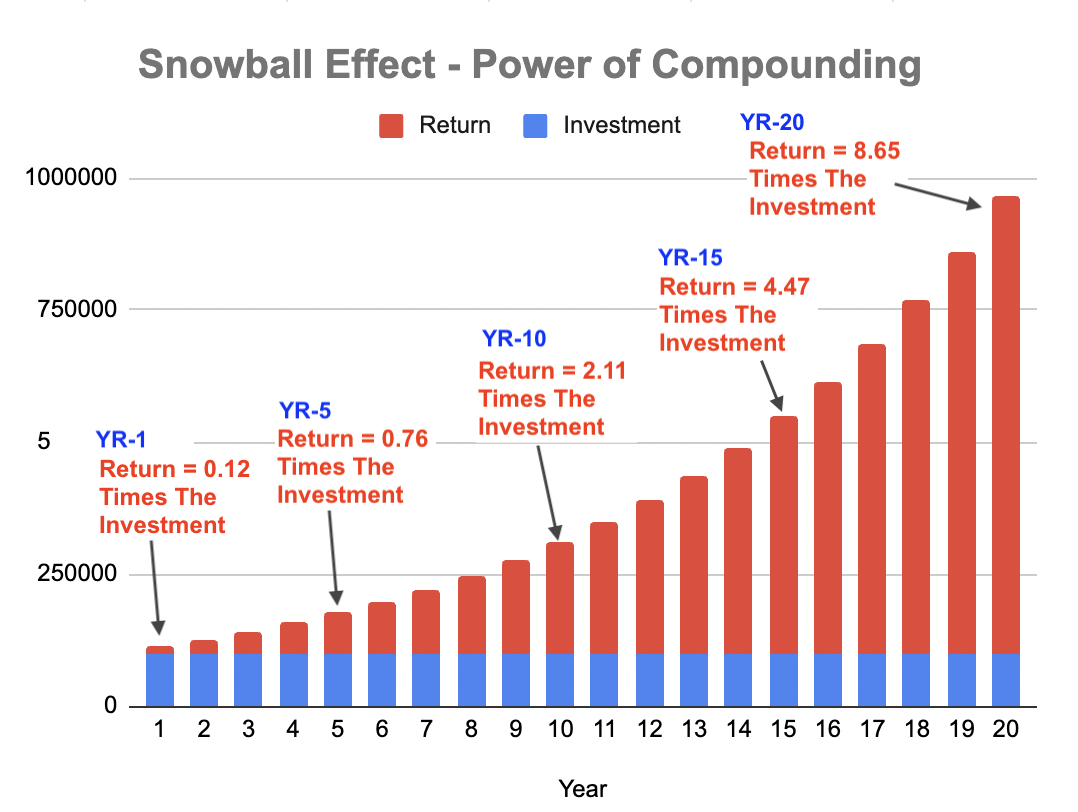

Compounding is often referred to as the eighth wonder of the world. Why? Because it is a powerful financial concept that can significantly amplify our wealth over time.

Compounding is the process where the returns on your investments generate their own returns. This process creates a snowball effect. As time goes on, the growth accelerates, leading to exponential wealth accumulation. The key here to unlock the full potential of compounding lies in staying invested for the long term.

Snowball Effect of Compounding: Example

Here is an example, that explains the snowball effect.

Let’s consider an example where an investor starts with a lump-sum investment of Rs.1 lakh in an index fund with an average annual return of 12%. The blue-bar represents the investment amount and the red-bar indicates the compounding returns.

You can see, in the first year, the return is Rs.12,000, which is just 0.12 times the investment. Compare it with the return of the 20th year, which is 8.65 times the investment. If the money is left for one more year (till the 21st Year) the return on this year will be 9.8 times the investment amount.

So you can see, how the returns (red-bar) are growing faster and faster with every passing year? This is called compounding. The effect of compounding becomes more visible in the later years of the long term holdings.

1.1 How Compounding Works in Stock Investing

Generally, in 90% of articles across the web, you will read a standard version of “How Compounding Works.” But those explanations may not be true for stock investing. Here, the compounding of money happens differently.

The traditional explanation of compounding is often associated with fixed-return investments like bank deposits or bonds, where returns are reinvested periodically. However, for long-term stock investing, the compounding effect happens differently.

In the case of stocks, the compounding is internal to the company.

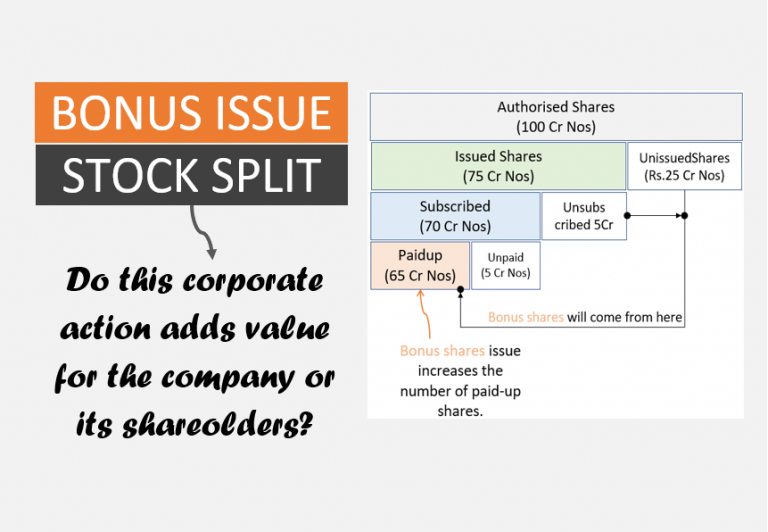

When a company generates profits, it can choose to pay out a portion as dividends or reinvest the profits back into the business (retained earnings). The reinvested profits are used to fund expansion, and innovation, reduce debt, or enhance operational efficiency. Over time, these reinvested earnings can lead to higher future profits.

Investors who recognize the company’s ability to generate high returns on equity (ROE) and effectively reinvest its earnings tend to hold onto their stocks. As the company’s profits grow, the intrinsic value of the business increases. This is reflected in the rising share price over the long term. This is the true compounding effect in stock investing—where the value of the investment grows as the company compounds its retained earnings. It eventually leads to share price appreciation.

1.2 Examples of Compounding: SIP vs. Lump-Sum Investing

Let’s consider two common investment strategies: Systematic Investment Plans (SIP) and lump-sum investing.

- SIP Route: Imagine you start a SIP at the age of 25, investing ₹5,000 every month in an equity mutual fund. The fund generates an average annual return of 12%. By the time you reach 45, you have already invested ₹12 lakhs. But thanks to compounding, your portfolio could grow to approximately ₹50 lakhs. To give your SIP more compounding power, read about step-up SIP.

- Lump-Sum Investing: Now, suppose you invest a lump sum of ₹12 lakhs at the same age, with the same annual return of 12%. By the age of 45, your investment could grow to around ₹1.15 Crores.

Suggested Reading: Read more about SIP vs Lump-sum investing.

Both approaches benefit from compounding, but the lump-sum investment grows faster initially because the entire amount is exposed to returns from the beginning. However, SIP offers the advantage of disciplined investing over time, reducing the risk of market volatility.

1.3 Comparison Table: Compounding in SIP vs. Lump-Sum Investing

| Investment Strategy | Total Investment Amount (₹) | Investment Period | Average Annual Return (%) | Estimated Value at Age 45 (₹) |

|---|---|---|---|---|

| SIP (₹5,000/month) | ₹12 lakhs | 20 years | 12% | ₹50 lakhs |

| Lump-Sum | ₹12 lakhs | 20 years | 12% | ₹115 lakhs |

1.4 Starting Early vs. Starting Late

The timing of when you start investing has a profound impact on the benefits of compounding. Consider two scenarios:

- Starting Early: If you start investing Rs.5,000 per month at age 25 and continue for 20 years at an annual return of 12%, your investment could grow to approximately Rs.50 lakhs by age 45. Please note that to build Rs.50 Lakhs you have invested only Rs.12 lakhs.

- Starting Late: If you delay investing until age 35 but invest ₹10,000 per month to catch up, your total investment would still be ₹24 lakhs. But by age 45, your portfolio could grow to only ₹38.6 lakhs.

This comparison illustrates that even doubling your investment amount later in life cannot fully compensate for the lost time. The earlier you start, the more time your investments have to compound, resulting in significantly greater wealth.

2. Why Starting Early Matters in Stock Investing

Starting early in equity investing offers several critical advantages. It gives us time to identify and capitalize on the growth potential of good companies. While the power of compounding is one key benefit, another significant advantage of starting early is the extended time horizon that is available for investors. It allows us investors to identify, invest in, and hold onto promising small-cap or micro-cap companies as they evolve into industry giants.

This process can lead to substantial wealth creation, often described as “windfall gains.”

2.1 The Journey from Micro-Cap to Large-Cap

Small micro-cap stocks are often in the early stages of their business lifecycle. They may be new entrants in a market, or they may operate in niche segments with innovative products or services.

These companies are typically under-researched and undervalued. They present a unique opportunity for early investors. If these companies manage to grow their revenues, they can expand. With the rise in their market share, and by scaling their operations effectively, they can transition into large-cap companies over time.

Investors who start early have the luxury of time. It allows them to hold onto these companies as they grow. As a small company scales, its earnings grow, and so does its valuation.

For instance, a micro-cap company with a market capitalization of ₹100 crore might grow to become a large-cap company with a market capitalization of ₹100,000 crore over a couple of decades.

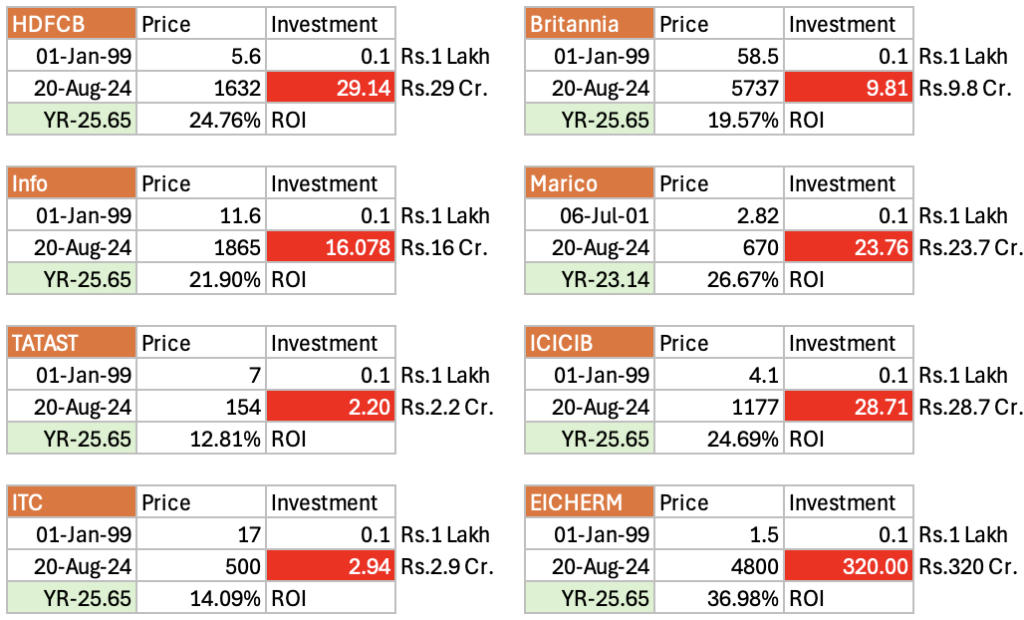

Here is an example of a few Indian companies, which were small caps in the late 1990s and became big large caps today (25 Years). See how holding on to these stocks for all these 25 years would have compounded the value of shareholder’s investment:

For example, Rs.1 Lakhs investment in HDFC Bank’s shares in 1999 would have become Rs.29 crores as of today. Similarly, Rs.1 Lakhs investment in Eicher Motor’s shares in 1999 would have become Rs.320 crores as of today.

As an investor, our focus should be to identify the potential of a few such companies early on. We can buy their shares, and then hold on to them throughout their growth phase. This way we would see the value of our investments multiply many times.

2.2 The Impact of Market Inefficiencies on Early Investments

One of the reasons of starting early in stocks, that is so advantageous for us is, the nature of market inefficiencies. Smaller companies, especially micro-caps, are often overlooked by large institutional investors and analysts. This lack of coverage can result in these companies being undervalued compared to their true growth potential. Savvy individual investors who start early and conduct thorough research can identify these undervalued gems before they catch the broader market’s attention.

As these companies grow and their financial performance improves, they attract more attention from institutional investors and analysts. This increased interest can lead to a re-rating of the stock, where the market starts valuing the company more appropriately, leading to significant price appreciation. The early investor, who got in before this re-rating, stands to gain considerably as the company’s market capitalization and stock price rise.

2.3 The Role of Patience and Long-Term Vision

Starting early in stocks also gives us time to build a long-term perspective. It is crucial when investing in smaller companies (potential multi-baggers). In the near term, these companies often face volatility and fundamental challenges as they grow. Hence, their stock prices also remain excessively volatile.

However, early investors who believe in the company’s long-term potential, and are willing to weather the short-term volatility, can reap substantial rewards. But this will be possible only if they hold these stocks for very long periods (like 10-20 years).

Patience and domain knowledge is key in this process.

Unlike larger, more established companies, small caps can take years to realize their full potential. Early investors who understand this and are willing to stay invested for the long haul can benefit from the entire growth cycle of the company. Below are a few examples of potential future multi-baggers:

| SL | Industry | Related Company | Remarks |

| 1 | Pharmaceutical Industry | Laurus Labs | A pharmaceutical company that specializes in active pharmaceutical ingredients (APIs), formulations, and biotechnology |

| 2 | Specialty Chemicals | Aarti Industries | A prominent player in the Indian specialty chemicals sector |

| 3 | EV Battery Mfg. | Exide Ind. | Exide Industries has begun shifting its focus towards lithium-ion batteries and advanced energy storage technologies |

| 4 | Green Hydrogen | Reliance Ind. | Green Hydrogen industry is still in its early stages globally. RIL has announced ambitious plans to develop large-scale green hydrogen production facilities |

| 5 | Drone Tech | IdeaForge Tech | Specializing in the design and manufacturing of Unmanned Aerial Vehicles (UAVs) for various applications |

| 6 | Semiconductor | MosChip Tech | The company focuses on semiconductor IP, chip design services, and IoT solutions. |

| 7 | Semiconductor | Syrma SGS | Involved in the production of printed circuit boards (PCBs), radio-frequency identification (RFID) products, and semiconductor-related components |

2.4 Early Entry Provides Margin of Safety

Another crucial benefit of starting early in stock investing is the margin of safety it provides. When we invest in a small company at an early stage, we get to buy it at a low price relative to its future potential. Why so? Because at that stage, the stock is not as well known and covered by analysts. Hence, they are mostly hidden from the public eye.

This lower entry price reduces the risk and provides a buffer against potential downturns. If the company encounters challenges or the broader market experiences a correction, the early investors are less affected. As these investors bought in at a low price may still be in a profitable position or face less severe losses compared to those who enter the market later at higher prices.

3. How to Get Started Early

Starting early in stock investing is one of the best decisions you can make for your financial future. Here’s a step-by-step guide to help beginners get started:

Step 1: Educate Yourself

Before investing, it’s crucial to understand the basics of the stock market. Begin by learning about how stocks work, the different types of equity, and the factors that influence stock prices. You can read books, attend webinars, or follow reputable financial blogs to build your knowledge. Read more about the stock market basics.

Step 2: Set Financial Goals

Determine what you want to achieve with your investments. Are you saving for retirement, a house, or your child’s education? Clear financial goals will guide your investment strategy and help you stay focused during market fluctuations. Read about how to manage your finances.

Step 3: Assess Your Risk Tolerance

Understanding your risk tolerance is key to choosing the right investments. If you’re comfortable with high risk, you might invest in growth stocks that offer higher returns but with greater volatility. If you prefer stability, consider blue-chip stocks that are more stable but grow slower. Align your stock picks with your comfort level to avoid panic selling during downturns. Read about how to do risk assessment of oneself.

Step 4: Start Small with a Diversified Portfolio

As a beginner, it’s wise to start with a small, diversified portfolio. Consider investing in a mix of large-cap, mid-cap, and small-cap stocks to spread risk. You can also include mutual funds or ETFs, which offer instant diversification. Read more about building a winning stock portfolio.

Step 5: Invest Regularly

Consistency is crucial in stock investing. Consider starting a Systematic Investment Plan (SIP) where you invest a fixed amount regularly. This approach helps you take advantage of rupee cost averaging and builds wealth steadily over time. Read more about the power of SIPs.

If you want to go the direct stock investing way, Read about this 4-step process.

Conclusion

Starting early and staying invested in stocks is more than just a strategy. It is also a commitment to building long-term wealth. By embracing the power of compounding, we allow our investments to grow exponentially over time.

This approach is particularly beneficial for us, retail investors, who may not have the time or resources to engage in deep stock analysis regularly. Instead, by adopting a buy-and-hold strategy, we give our investments the best chance to weather market volatility and capitalize on long-term growth.

The key to successful stock investing lies in patience and discipline. It’s about resisting the urge to react to short-term market fluctuations. Instead, the idea here is to focus on the bigger picture. What is the bigger picture? A simple understanding about companies is that they go through cycles of growth. Early investors who can identify and stick with promising stocks through these cycles often reap the most significant rewards.

The journey of wealth creation through stocks is not about Usain Bolt’s (a sprinter) but about Eliud Kipchoge’s (a marathoner). Hece, we need not take the fastest route to wealth creation. A stable and consistent speed will take us a long way over time. Starting early gives us the advantage of time. It allows us to ride out the market’s ups and downs with manageable stress.

Whether we’re investing in well-established industries or emerging sectors, the principles remain the same. We must stay informed, stay committed, and most importantly, stay invested.

As we continue on our investment journey, we must not forget our financial goals. Assessing our risk tolerance regularly, and maintaining a diversified portfolio is a key.

These practices, combined with the benefits of starting early, will set us on the path to financial independence. Read more about two decades of SIP and Financial Independence.

Suggested Reading: