Summary Points:

- Wait for a dip: No rush – buy when valuations cool off.

- Focus on quality: Pick 5-7 solid companies with strong fundamentals.

- Keep it lean: Limit to 15-18 stocks for balance and clarity.

- SIP it up: Use Systematic Investment Plans for discipline.

- Stay patient: Let winners run, cut losers fast, ignore the noise.

- Take a small risk: Bet 5-10% on a high-potential wild card.

- Enjoy the ride: Trust the process and stress less.

Introduction

Imagine this, it’s 2008, and the world feels like it’s crumbling. The sub-prime mortgage crisis has hit, markets are tanking, and I’m sitting in my Kolkata office thinking, “Well, this looks like a mess… but maybe it’s also a chance?” That’s when I dipped my toes into the stock market – nervous, clueless, but oddly excited. Today it’s 2025, and here I am, a bit wiser (and occasionally bruised). After 17 years of riding the rollercoaster of Indian stocks, I’ve learned a few lessons. I’ve seen the Sensex climb from 9,000 points to today’s 75,000 points. My portfolio has survived the pandemic, and learned some hard-earned lessons along the way.

So, if I had to start over today, knowing what I know now, how would I do it? Let’s chat about it in this blog post. I think, for starters, it will be a useful post to read.

Timing Isn’t Everything, But It’s Something

Back in 2008, I started buying when the market was in panic mode.

It felt like catching a falling knife, but looking back, it was one of my better calls. Why? Not because I timed it perfectly (I didn’t), but because I started when valuations were sane.

Today, in 2025, the Indian market’s a different beast. Till Sep’2024, it was a rage. Since then (last 6 months), the market has consolidated and Nifty 50 is almost 14% down. Nifty is much below its all times highs. So, would I jump in headfirst right now? I think, this is a good starting point.

[Note: I have already invested 90% of all my spare funds back into the market. Since last 6 months, I’m on wait and watch mode. If you’ll ask me today, I’m doing nothing since many weeks. I’m definitely not selling.]

Lesson #1: Don’t chase the hype.

If I were starting over, I’d wait for a dip, not a crash, mind you, just a little breather. Markets always give you an entry point if you’re patient. Think of it like waiting for the monsoon sales, you don’t buy a raincoat in the middle of a drought. I’d keep some cash handy, watch for overbought sectors (tech, green energy, Capex, etc), and pounce when the herd steps back.

The Core: Build Around Quality, Not Buzz

In my early days, I got suckered into every “multibagger” tip from friends, uncles, and random guys on TV channels. Penny stocks, IPOs with flashy ads, you name it, I was there, burning cash faster than a Diwali rocket.

Then I learned the hard way that cheap stocks are cheap for a reason, and hype fades. Today, I’d start with quality companies, businesses with strong fundamentals, decent cash flow, and a moat that keeps competitors at bay.

Take Titan, for example. Back in 2008, it was a solid player, but not the darling it is now.

If I’d stuck with it through the ups and downs, I’d have seen it grow into a jewelry-and-eyewear giant. Starting over, I’d pick 5-7 such names like HDFC Bank, Bajaj Finance, or maybe a few quality MNC’s like Seimens and ABB’s of the world. I would make them my portfolio’s backbone.

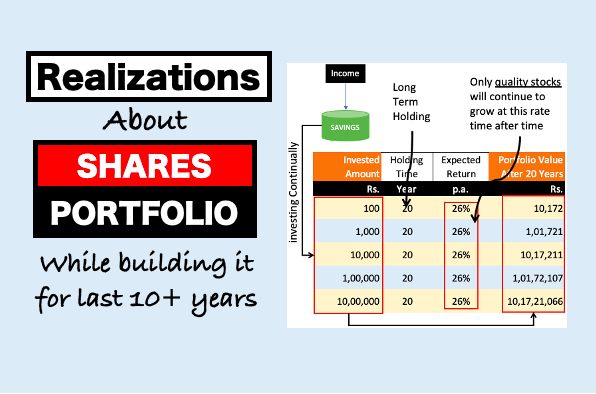

Not sexy, but steady. Why? Because over 17 years, I’ve realized compounding works wonders when you’re not constantly second-guessing your picks.

The Diversification: Don’t Overdo It

Here’s a confession, today, I own about 30 stocks. Thirty, I did it thinking I was diversifying. But really, I was just juggling too many balls and dropping most of them.

Lesson #2: Less is more. Starting over, I’d cap my portfolio at 15-18 stocks (maximum). I think, this is enough to spread the risk. If I’ll only these many stocks in my portfolio, I’ll actually know what’s going on with each company.

I’d split it something like this: 50% in large-caps for stability (hello, HDFC Bank, M&M), 30% in mid-caps for growth (maybe a Cable or a pharma), and 20% in small-caps for that adrenaline rush (small IT players and NBFCs).

Oh, and sectors? I’d lean into India’s long-term stories—renewables, infrastructure, digitalization—but avoid piling everything into one basket. Remember 2020? When IT soared and auto crashed? Yeah, balance matters.

SIPs, Patience, and Ignoring the Noise

If there’s one thing I wish I’d done more of in 2008, it’s SIPs, Systematic Investment Plans.

I was too busy trying to “time the market.” 50% of my choices back then sucked and 50% we reasonably good. But the time I put-in to construct my tailor made portfolio was not worth it.

My desire for return, in a 15-20 years, time horizon was close to 25% per annum. This I could have achieved by dividing my portfolio as 50% mutual funds and 50% stocks. The benefit of investing in mutual funds is that I can afford to invest in them in an auto mode. Though these days, we can also do SIPs in individual stocks, but I’ll avoid that.

Starting over, I’d set up SIPs in a good small cap and multi-cap mutual fund. 50% of my annual investment budget will go here. Benefit? This portfolio of my investment will be managed by experts (The Fund Managers) of these fund houses. I don’t have to worry about it. Why SIP? It forces you to buy low, buy high, and just keep buying, smoothing out the bumps. The result? In a long time horizon, this automatic investing can fetch me about 17-20% CAGR returns.

The balance 50% funds I’ll keep for my stock portfolio.

And patience? Man, that’s the golden ticket.

Moreover, I sold some winners too early (Titan & Asian Paints) and held onto losers too long (RIP, some random retail stocks). Now, I’d let my winners run and cut my losers fast. If a stock’s down 20% and the story’s broken, I’m out. No emotional baggage. And the noise?

Broker calls, TV experts, WhatsApp forwards, I’d tune it all out. For me, my stock portfolio building is like running a full 42K marathon. I’ll run it slowly and complete the race rather than burn-out in between. The thing is, I’m self-employed. I have no other choice but depend on my investment portfolio for my retirement. I cannot afford to play it recklessly.

The Risk Play: A Small Bet on the Wild Side

Okay, here’s where I’d have some fun.

Back in the day, I threw money at every crazy idea. Now, I’d still take a flyer, but smarter.

Maybe 5-10% of my portfolio goes into a future multibaggers, small-cap with big potential. These can be small biotech firm cracking a new drug or a startup in the defence space.

Risky? Sure. But 17 years have taught me that a little calculated chaos can pay off, just don’t too much on it. The thing is, even if have to sell at 50-60% loss, if will not effect my portfolio compounding a lot. But if they do well, I can add more funds to them and make it more countable for me.

Conclusion

Here’s the thing that I believe while building my investment portfolio, investment is not a task, it should be my way of life

If I’ve to start over, I start slowly and do it in apace that so that I enjoy it more this time. In 2008, I was stressed, glued to ticker tapes, panic-selling at every dip. Now, I’d zoom out.

India’s economy is still growing, the middle class is booming, and the market’s got legs for decades. I’d check my portfolio once a month, sip my chai, and trust the process.

What’s the point of building wealth if you’re a nervous wreck, right?

I’ll wait for a dip, pick quality over hype, keep it lean (15-18 stocks), SIP my way in, stay patient, take a small punt on the wild side, and chill out.

No rocket science, just lessons from a guy who’s been through the grinder and come out smiling (mostly).

What about you? How would you kick off your investing journey in 2025? Drop your views in the comment section below.