Intrinsic Value Calculator (Modified Ben Graham’s Formula)

Modified Benjamin Graham Formula

Introduction

Have you ever wondered how some investors, like Warren Buffett, seem to pick winning stocks time and again? It’s not magic or guesswork. It’s about understanding what a company is truly worth.

That’s where the idea of intrinsic value comes in.

As an investor myself, I’ve always been curious about how the big names make their moves.

Today, I want to share with you a simple yet powerful tool to figure out a stock’s real value, Benjamin Graham’s intrinsic value formula.

Let’s dive in and see how it works, step by step.

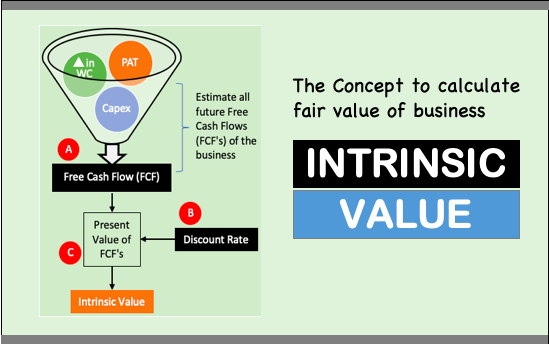

What is Intrinsic Value?

Imagine you’re at a local market, buying mangoes.

You know a good mango is worth Rs. 50, but the vendor is selling them for Rs. 40. You would like to grab a few more than your usual buy, right? Why? Because you are aware that you’re getting them at a bargain.

Stocks work in a similar way. Intrinsic value is the “real” worth of a stock, based on things like how much the company earns (EPS) and how fast it’s growing (g).

Some people might give this impression that stocks are just what people are willing to pay for it on the stock market. It is only partially true. In fact, in a long term, what dominates the rise or fall of a stock’s price is its fundamenatals (earnings and future growth).

When you buy a stock below its intrinsic value, it’s like getting those mangoes on sale. Over time, if the market realizes the stock’s true worth, its price goes up, and you make a profit.

For example, if a stock’s intrinsic value is Rs. 200 but it’s trading at Rs. 150, you could earn Rs. 50 per share when the price catches up with its true value.

Simple, isn’t it? But figuring out that intrinsic value takes some effort. That’s what we’ll explore in this blog post.

Why Intrinsic Value Matters

I remember when I first started investing. I’d look at stock prices jumping up and down and wonder, “What’s driving this?”

The truth is, in short term, market prices can be result of emotional calls. For example, sometimes they’re too high because everyone’s feeling excited and bullish about the Indian stock market. In other times they can be too low because people are in panic and wants to sell (like in 2008 crisis, 2020 COVID, etc).

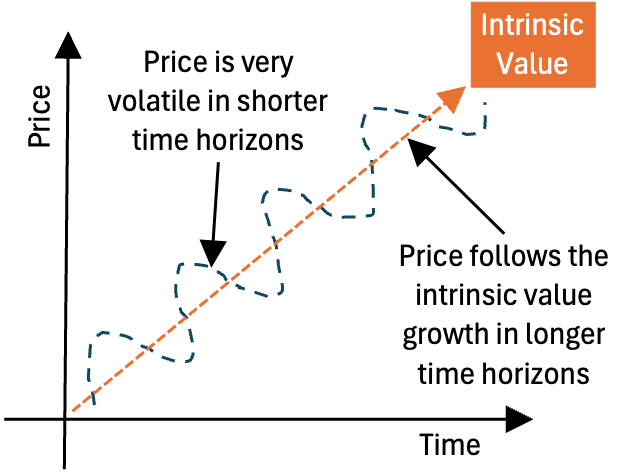

So, when a new investor, who does not know about the concept of intrinsic value, will beleive that stock price is always irrational. They only behave irrationally as they are driven by emotions. But in long-run, the effect of emotions tames down considerably. What matters more are the fundamentals of the company (earnings and growth).

In long term, the price of the stock generally follows the intrinsic value expansion or contraction.

The knowledge of the intrinsic value cuts through that noise. It gives you a solid number to decide if a stock is a good buy or not.

I will ask you to think about the intrinsic value like this.

If you’re buying a flat, you wouldn’t pay Rs. 2 crore just because someone else did, right? You’d check the value of similar properties nearby to gauze it actual value. Stocks are no different. Knowing the intrinsic value helps you avoid overpaying and spot opportunities others might miss.

Who’s Benjamin Graham

He is the many behind possible the first intrinsic value formula.

Now, let’s talk about Benjamin Graham. He’s not just any name, he’s called the father of value investing. Warren Buffett, one of the world’s richest investors, was his student.

Graham believed in buying stocks that are cheaper than their true worth.

The idea of the intrinsic value sounds smart, right? To help investors, he came up with a formula to calculate intrinsic value. It’s not perfect, but it’s a brilliant starting point.

Graham’s idea was simple, focus on a company’s earnings and growth.

We must get swayed by market hype. His formula has stood the test of time because it’s practical and logical.

Let’s see what the Ben Graham’s formula looks like.

Understanding Ben Graham’s Formula

Graham’s original formula is straightforward. Here it is:

V = EPS × (8.5 + 2g)

What does this mean? Let me break it down.

- V is the intrinsic value of the stock, what we’re trying to find.

- EPS is earnings per share, or how much profit the company makes per share.

- g is the expected growth rate of those earnings over the next 7-10 years.

- 8.5 is the P/E ratio Graham used for a company with no growth.

- 2g doubles the growth rate to factor in future growth potential which is “g.”

Don’t worry if it looks a bit mathematical at first. It’s easier than it seems. Later, Graham tweaked this formula to account for interest rates. The recised formula looks like below:

V = [EPS × (8.5 + 2g) × 4.4] / Y

Following the additional parameters added to the original formula:

- 4.4 was the average yield of top-quality US corporate bonds back in 1962, and

- Y is the current bond yield.

This version adjusts the value based on how much you could earn from safe investments like bonds. For now, let’s stick with the simpler one and adapt it for India.

Making It Work for Indian Stocks

Graham built his formula for the US market, so we need to tweak it a bit for India.

The big question is, how do we handle the interest rate part?

In the updated formula, Ben Graham used US bond yields. For us, the yield of 10-year Indian government bonds makes more sense. It’s like our version of a “safe” investment rate.

But to keep things simple, I often start with the basic formula:

V = EPS × (8.5 + 2g)

Then, I think about whether the result makes sense in today’s Indian market. For example, bond yields in India are usually higher than in the US, around 6-7% these days. That affects how we value stocks.

Let’s see it in action with an example.

A Real-World Example

Say we’re looking at a company, let’s call it “ABC Ltd.”

It’s got an EPS of Rs. 20, and we expect it to grow at 8% per year for the next 7-10 years.

How do we find its intrinsic value?

- First, calculate the growth part: 8.5 + 2 × 8 = 8.5 + 16 = 24.5.

- Then, multiply by EPS: 20 × 24.5 = Rs. 490.

So, the intrinsic value is Rs. 490.

If ABC Ltd. is trading at Rs. 400, it might be a bargain. But if it’s at Rs. 550, maybe it’s overpriced.

Now, let’s try the updated formula

V = [EPS × (8.5 + 2g) × 4.4] / Y

- Suppose the current 10-year government bond yield is 7%.

- Using V = [20 × (8.5 + 16) × 4.4] / 7, we get: [20 × 24.5 × 4.4] / 7 = [2,156] / 7 = Rs. 308.

So you can see, the use of the updated formula is yielding a lower intrinsic value than the original formula. This shows how bond yields can change the picture.

Which one should you use? I’d say, use both. First start with the basic formula. Then go on to use the updated formula. Both the formula’s will give you two numbers of the intrinsic value. Consider them as a range. The actual intrinsic value will lie somewhere in the middle (say).

Where to Get the Input Data

You might be wondering, “Where do I find EPS and growth rates?” Good question.

- EPS is easy, check financial websites like Moneycontrol or the company’s annual report or even my Stock Engine.

- For growth rate, it’s trickier. Look at the company’s past 5-year EPS growth or what analysts predict. Be cautious, though, don’t assume crazy high growth unless there’s solid proof.

- For bond yields, the Reserve Bank of India’s website or financial news like Economic Times can tell you the current 10-year government bond rate. It changes, so use the latest figure when you calculate.

Limitations of This Formula

I’ve been using this formula for more than 10 years now. As a beginner I found it eye-opening.

But today, I’ll say it’s not flawless.

- For one, it assumes 8.5 is the right P/E for a no-growth company. In India, P/E ratios can vary a lot, some sectors like tech, defence, renewable energy, etc might have 30 as the minimum PE. Other sectors like like steel might be at 10 or even lower (cyclical sector).

- Guessing the growth rate is another tough part. The things become even more difficult if the company in consideration is cyclical (like steel, cement, etc).

- Plus, the formula also ignores other important metrics like debt in the balance sheet, quality of competition, or management quality, etc.

A company might look cheap on paper but have huge loans dragging it down.

That’s why I will always dig deeper in the company’s balance sheets and do the checks. I’ll also read about the industry in which the company in operating. Idea of these study should be to get a clue if the company has a strong edge or not.

There are thousands of companies listed in our stock exchange. Why to settle for a weak or an average company. Our goal shall be to pick the best withing the sector or an industry.

Beyond The Formula

Graham’s formula is like a torch, it lights the way but doesn’t show the whole path.

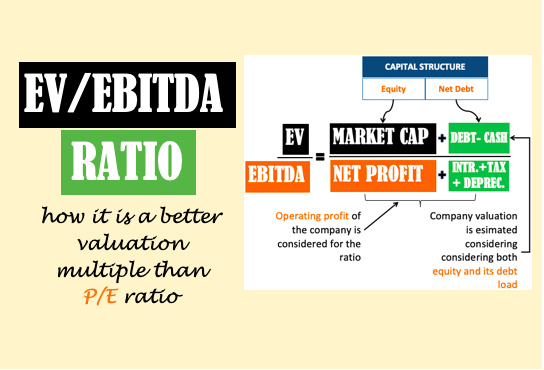

For a fuller picture, I’d pair it with other tools. What tools?

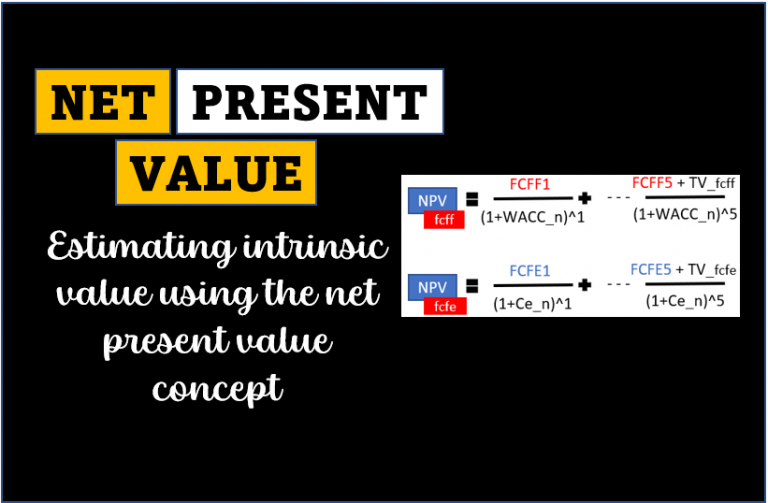

- Ever heard of discounted cash flow (DCF)? It’s more complex but estimates value based on future cash flows.

- We can also compare the stock’s P/E to its industry average.

These methods take more time, but they’re worth it for big decisions.

When I first learned about intrinsic value, it changed how I saw stocks. Suddenly, it wasn’t just about price, it was about value.

But I also learned no formula can do all the work. You’ve got to think hard and research well.

How Warren Buffett Uses It

Warren Buffett took Graham’s ideas and ran with them.

He doesn’t just calculate intrinsic value, he looks for a “margin of safety.” That means buying a stock way below its intrinsic value, so even if he’s wrong, he’s still safe.

Say the intrinsic value is Rs. 500, he might wait for it to drop to Rs. 350. Smart, right? It’s a reminder that discipline matters as much as the math.

Ben Graham’s Formula Updated for India

The Ben Graham’s formula has many limitations.

Experts of fundamental analysis of stocks prefer going into more detailed calculations to estimate intrinsic value. Read more about doing detailed stock analysis in MS Excel.

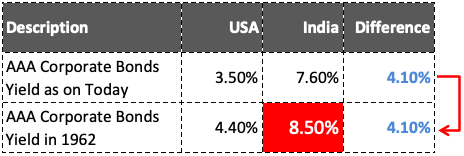

In the above formula of Benjamin Graham, there is a factor of “4.4”. This makes it suitable for stocks trading only in the US. There must be a different factor for Indian stocks, right? Why?

Because in the denominator there is a factor of “Y”. What is Y? Interest rate of AAA corporate bonds operating in a country (for us it is India). Hence, the numerator must also be tweaked for India.

Hence, I thought to use a slightly different form of this formula for my stock analysis. But the problem was, nowhere I could find the yield of AAA Corporate bonds of India in 1962. So I thought to use the below assumption to reconfigure the multiplying factor:

Hence the revised Benjamin Graham’s intrinsic value formula looks like this:

Conclusion

So, what have we learned?

Intrinsic value is your guide to finding stocks that are worth more than they cost.

Ben Graham’s formula, whether the basic V = EPS × (8.5 + 2g) or the updated version, gives you a solid starting point.

For Indian stocks, tweak it with our bond yields and market realities.

But don’t stop there. Use it as a first step, then dive into the company’s story, its profits, its risks, its future. I

nvesting isn’t just numbers; it’s about understanding what you’re buying.

Happy investing.

Handpicked Articles:

This is a great calculator! I’ve been trying to figure out what my intrinsic value is for a while now and this is a great tool to help.

Till date I tried my best to find out intrisic value formula. today I got it , thank you VERY MUCH “MONEY MANI”. I am renewing my money knowledge( share market) in your website daily in details.

Hi Mani,

I am beginner, knowing nothing much about trading of stock but try to get information from various sources, to buy the stock and keeping lot of enthusiasm. Well after reading your blog on intrinsic value, open eyes. It’s really great information.

Thanks.

Respected sir I have a doubt about corporate bond when we buying shares

Why we need to put the value of India AAA bond yield we are going to buy a company share if we take ROE percent its also come one result pls give me some idea

its really worth exploring this website with lot of useful financial information,kudos to the author

Thanks for posting your appreciation.

There are no confusion after reading this. Thanks a lot

Hi Mani

While surfing the net for “How to invest in stocks(NEVER invested in stocks before n no knowledge) ” i came across ur blog n worksheet, which i am about to buy.

Plz clarify few points:

1. Does ur worksheet works for penny stocks, for investing for 5-10yrs.If the company is relatively new, wut % should i fill in future prospects, as i cant evaluate the company`s financial data to give it a growth %

2. Will ur worksheet work, if the historical data is less than 10 yrs.

3. Does the values we enter needs to b changed frequently,lets says i monitor a stock for 1 month. Do i have to change any values after a certain period like 5,10,25 days to get the correct intrinsic value.

An early reply will b appreciated.

THANKS

Worksheet needs 10 years data. It will not work without it. If the user wanter, they can update the data every quarter (quarterly statement, and price datae), though it will change the intrinsic value a lot because it derived more from the historical 10 years data. Hence it is more stable and give it its relative reliability. Thanks for the query.

Hi, Can you give an example of a stock with the above formula? When I am comparing my answer with your online intrinsic calculator it is different all the time. Foe example take Hindustan Zinc with share price of Rs. 192.55, eps= 17.7, g =9, Y=6.08, so V= EPS x (8.5+2g)x8.5/Y = 17.7x(8.5+(2×9))x8.5/6.08 = 655.74rs but your online calculator shows rs214.79. Can you advise where am I going wrong?

“g” shall not be taken as 9, it is 9% (0.09). Thanks for your comment.

ur p/e is of 8.5 while sensex avg p/e is 22 over the years

pls update

It is a standard formula developed by Benjamin Graham who used the “factor of 8.5”. I think it cannot be changed. The multiplication factor added beside the main formula should take care of other variables.

i didnt get you

can you give some idea

I was looking for a different calculator for calculating the intrinsic value of stocks and came across this blog. I personally think that the best estimate is obtained if discounted cash flows are used. Each company is different and it is difficult for one formula and only one set of assumptions to be good for all companies.

Hello

please help me to calculate graham number of the company. i am a research scholar. i want to see it for pre and post period graham analysis. it is a growth stock

Sure, It ‘ll be a nice exercise.

Excellent article for finding out intrinsic value of a stock

Thanks for the applause

That’s a very useful information.Thank you and Keep sharing about Value Investing ideas.

hi,

you provided the great formula to identify and make the finance decision. very nice presentation.

Hi Mani,

Goof article. Challenge is how to find the future growth of the compnay. Do you have any advice on how to estimate this figure (g)?

Thanks.

Future growth rate can be estimated by seeing the past trends. Sometimes, company’s also share their future forecasts. But I agree, it is a challenge 🙂

Thanks.content was very good.I was wondering from last one year to learn how to calculate intrinsic value of the stock.

Hi Mani,

Thanks for such wonderful information. I tried using teh formula however it is difficult to find undervalued stocks. Most of the top performing stocks are overpriced.

Regards,

Deepak P

You are right. At a point in time where Sensex is close to 40,000 points, this is what is expected. You can see my watchlist, may be you can find some undervalued ones there.

HI, you wrote : 1962 in India, AAA Corporate bonds must have been yielding 7.9% per annum. Is this your assumption, or did you take it from a source?

I have made a guess. I have gives its rational in “Limitation of Graham’s Formula”. Thanks for asking.

First of all thank you for this wonderful post for helping to make understand the intricacies of intrinsic value. I am completely new to investment and my curiosity led me to this page when I googled for it. As you have said, this is deep knowledge and maybe I have grasped it superficially but then atleast there has been a start for me. I just wanted to ask, if we follow the concept the intrinsic value, should WE ALWAYS resist from overpriced stock even if they good stocks? Because depending on the times, most of the good stocks will be most likely overpriced at current time and should I be patient to wait for its prices to drop down (Should we really wait even if its very long) ?

Purchase of overpriced stocks are never advisable, no matter how big is the brand name. Thanks for asking.

Very good and informative site on stock markets. Thanks for sharing lot of tips and advices.

Ajanta Pharma Example- Last 5 year EPS has come down to 48.6 from 62.8 ie 23 % negative growth. Which growth rate is to be assumed ? and what will be intrinsic value as per your excel sheet ?

Future growth rate assumption cannot be made by only looking at EPS. One has to see the other growth metrics to arrive at an assumption. Thanks.

How did you calculate expected Growth Rate (%) in next 5 Years in http://ourwealthinsights.com/calculators/iv-ben-graham-formula.html?

Is there any formula or any website which directly gives this value?

This should be an estimation for each stock. How to estimate? See last five years sales growth, profit growth, EPS growth, Net worth growth etc. This gives a fair idea. Thanks for asking.

Very informative. Keep up the good work. God bless.

very powerful, useful, beautiful information

Is assuming 8.5 as the PE in the formula also suffering from the same problem as 4.4% interest rate factor for AAA rated corporate bonds in 1962 – pertaining to a period of time and not dynamic to suit the present times ? Maybe the reference may need to be made to Industry PE in the past 3/5 years or so ? In this case, multiple of 2X Growth Rate is also called to question, making the formula more subjective.

VALUE CREATION=ROCE-WACC÷ROCE is not reflected in your sheet.

how to calculate assumed growth rate(g) of stock?

Roughly it can be estimated by looking at pat 10 year growth rates of the following stock metrics:

– Sales.

– EPS.

– Free Cash flow

– Net Worth.

– Asset.

Where this cagr for calculating intrinsinh value is given in results?

Dear sir,

Probably a basic question from a beginner. when is it recommended to sell the stock?

Should we sell the stock when market price rise above calculated intrinsic value or value investors should hold forever? when to realize profit?

It is a tough question. The answer can get complicated.

But I follow this rule, which is simpler:

“Before purchase, fix a target price (with respect to the intrinsic value). Once the stock price breach the target price, sell. Make sure to reinvest all money back into a value stock”.

In your stock analysis worksheet you are calculating intrinsic value by different methods. That’s fine. But what is the basis for you arrivng an intrinsic value by averaging the values of all the methods. If you just take only 2 or 3 methods the average will be different and hence intrinsic value too. Please justify.

The estimated intrinsic value is not average.

It is better to consider weighted average when dealing with intrinsic value.