Stock Quality Checklist for Long-Term Investing

Picking stocks can feel like finding a needle in a haystack.

How do you know which company is worth your money?

As a stock investor, I’ve been there, scratching my head over balance sheets and market news. That’s why I created the above Stock Quality Checklist.

It’s a free tool that makes it easy to evaluate stocks for long-term investing.

It’s simple, practical, and built for regular investors like us. I’ve intentionally kept it simple so that more people can use it and get a perspective of how to discover quality stocks for long term investing.

Let’s dive into what it does and why you’ll love using it.

Why I Made This Tool

I wanted something straightforward. No fancy jargon, just a clear way to check if a stock is solid.

The Stock Quality Checklist is like a report card for companies.

It looks at ten key factors to see if a stock is a good long-term bet. You can consider it as a guide that holds your hand while you are ponding about if a stock is fundamentally good or not.

It’s perfect for beginner investors who use apps like Zerodha or Groww but want a bit more clarity.

Ever wondered if a companues like Nestle India or Asian Paints (in today’s context) is worth holding for years?

This tool gives you the clue about what to look for in stocks. Once you have that clarity, enter data into the tool to get a general perspective about the quality of the stock.

How the Tool Works

The tool is like a form that’s also like a multiple choice questions.

You type in the company’s name.

Then, you pick options for ten factors, like revenue growth or debt levels.

Each option has a score which are alloted based on the option picked by you. The tool calculates the weighted average score based on an algorithm.

After you hit “Evaluate Stock,” it shows you the score and a detailed breakdown.

The analysis will tell you what’s good, what’s not, and whether the stock is a strong pick.

If used wisely, this tool can be like your friend who can explain the company’s strengths and weaknesses to you.

What the Tool Checks

The checklist covers ten areas that matter for long-term investing. Let me share a few to give you a sense.

- Revenue growth shows if the company is growing its sales. A company like Bajaj Finance, with strong growth, will score high here.

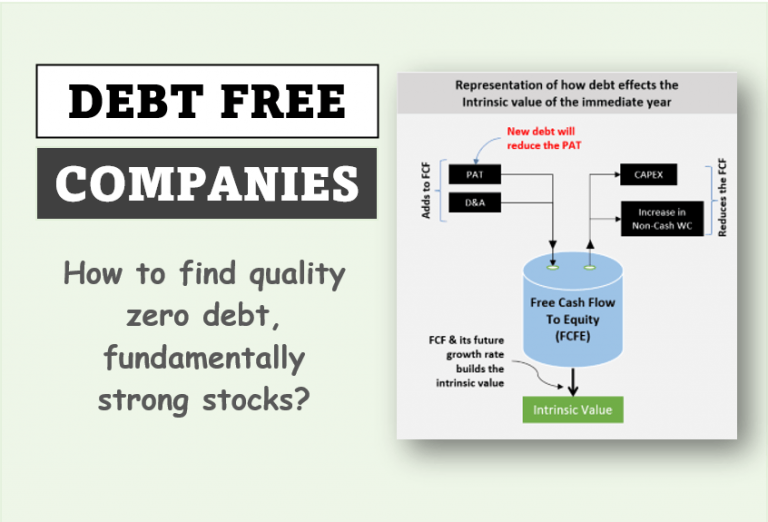

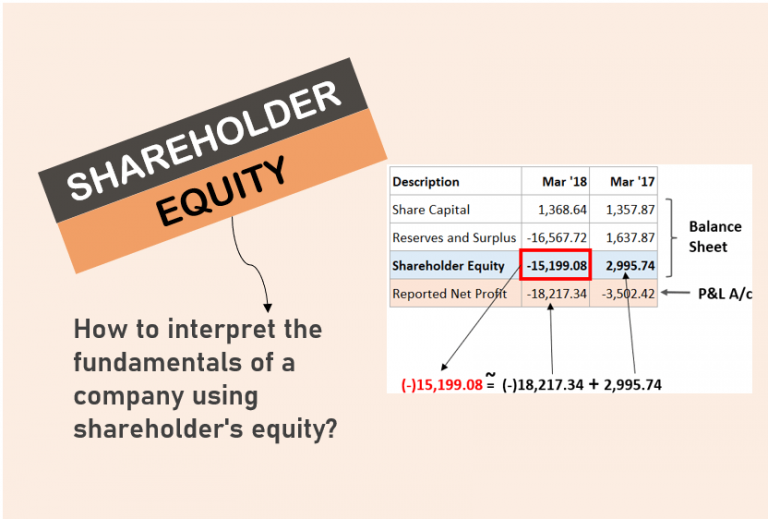

- Debt-to-equity ratio checks if the company borrows too much. Low debt companies, like Asian Paints, is a good example.

- Profit margins tell you how much money the company keeps from sales. One good example of a high profit margin company is Infosys.

- Management quality is another metric. A trusted team, like at TCS or HUL, boosts confidence.

- Competitive advantage is another big one. Does the company have a strong brand, like Maruti Suzuki?

- The tool also looks at dividends history of companies. The tool evaluates if the company is a consistent dividend payer or not.

- Stock volatility also plays a part. Generally strong stable companies has operate at low beta levels as compared to low quality stocks.

- ESG performance (environment, social, governance). Since last 5-7 years, quality companies and their ESG rating have done hand in hand. Now, it is less likely to find a company that is said to be of high quality but has a low ESG ratings. Check this link for ESG Rating of Indian Stocks.

- There is a general understanding that innovation is an integral part of quality companies. These companies generally dispaly costs as a part of R&D expenses.

- Customer loyalty is one strong qualitative indicator of quality companies. Generally good companies have a very high customer retention.

Each factor tells you something about the company’s future.

A Quick Example

Let’s say you’re curious about Titan.

You open the tool and enter “Titan.”

- You know its revenue has grown nicely, so you pick “Above 10% annually”.

- Its debt is low, around 0.4, so you select “Below 0.5”.

- Profit margins are around 12%, so you choose “10-15%”.

- You trust Titan’s management and give them “Excellent”.

- Their brand is a market leader, so that’s another full points.

- Consistent dividends for over 10 years.

- Moderate volatility in the stock price.

- Average or Moderate ESG ratings.

- The company also does decent or moderate R&D.

- Customer loyalty is also high.

Based on the above entries, The tool gives Titan a score of 93/100. It says Titan is a solid choice but suggests checking its ESG focus.

That’s the kind of clear perspective can be built about a stock in minutes by using the above tool.

What the Scores Tell You

The tool doesn’t just give a number. It explains what the score means.

- Above 80? The stock is a star, like Hindustan Unilever.

- Between 60 and 80? It’s decent but has some gaps.

- Below 60? Be cautious, it’s risky.

- Under 40? You might want to skip it.

The tool breaks down each factor, so you know why something like high debt is a concern.

It’s like a mini-report tailored to your inputs.

Why Investors Like Such Reports

Stock market is a rollercoaster. Moreover, all companies aren’t always transparent.

But anyways people invest in stocks without knowing the risks. New investors should especially take care.

This is where the tool like this comes in super handy. It’s simple enough for beginners but covers serious metrics.

You can use it to check stocks like ICICI Bank or Bharti Airtel.

It’s like a checklist you’d always like to before buying any stock. To get a correct answer out of this tool, it will force you to look at at least 10 parameters before buying one.

It’s for your investments. It is your assistant to help you build perspective about stocks so that you can invest with confidence. Who doesn’t want a little extra confidence?

How to Use The Tool Correctly?

The tool is a starting point. It needs you to input accurate data.

Not sure about a company’s revenue growth? Don’t know its debt ratio? You can subscribe to my Stock Engine to get an indepth data about stocks.

The tool works best when you feed it good info.

After you get the results, dig deeper. Maybe read what analysts are saying about the company.

A high score is great, but always double-check with the latest news.

I’ve codes and used similar tool myself. When I was a beginner, I can say that tools like this have been a game-changer for me. It helped me see why some stocks, like Nestlé India, are long-term keepers. Others? Not so much.

But here’s a question: are you ready to do a bit of homework? The tool makes it easy, but you still need to verify the data.

That’s how you build wealth, step by step, with patience.

Get Started Today.

Pick a company, maybe Dabur or Ador Welding, and fill out the form. It takes just a few minutes. You’ll get a score and a detailed analysis to guide you.

Don’t have all the details? No problem. Use my Stock Engine app, it can fill the gaps.

Try it out and see how it simplifies your decisions.

Conclusion

Investing for the long term doesn’t have to be scary.

With the Stock Quality Checklist, you’ve got a tool to make smarter choices. It’s like a trusted friend who declutters things down for you.

What stock will you check first? Drop a comment on my blog or tweet me at @ourwealthin.

Let’s make investing easier and build wealth together.

Happy investing.