Value investors, inspired by the timeless wisdom of investing gurus like Benjamin Graham, excel at estimating the intrinsic value of stocks. However, navigating through the vast sea of over 5000 listed stocks in the market presents a daunting challenge. Even seasoned experts find it impractical to calculate the intrinsic value of every stock. So, what’s their secret? They turn to the application of meticulous stock selection criteria to strategically shortlist potential stocks. This is their secret stock selection formula.

[Note: I drew inspiration for this article from the invaluable insights shared by Benjamin Graham in his classic, ‘The Intelligent Investor’ – particularly in Chapters 11, 12, 14, and 15.]

In this comprehensive guide, we will delve into the art and science of stock selection. It’ll empower us to craft a personalized shortlist. But before we embark on this enlightening journey, a crucial word of advice for beginners:

As Warren Buffett wisely said, Risk comes from not knowing what you’re doing.

Hence, consider the following principles as your compass in the vast terrain of investment:

- Diversification is Key: A well-diversified portfolio is your shield against market volatility. Spread your investments wisely.

- Balance with Risk-Free Instruments: Allocate at least 50% of your portfolio to risk-free instruments such as bonds, deposits, and debt funds. This stable foundation provides resilience in turbulent market conditions. Why are debt funds better than FDs?

- Start with Index Funds: For novices, the initial steps into the investment world should be through index funds and Index ETFs. These instruments offer a stable and diversified entry point.

- Gradual Shift to Direct Stocks: As you progress, consider direct stock investments. However, prudence is paramount. Rather than hastily chasing individual stocks, build a portfolio akin to a curated basket of promising entities. Importantly, be vigilant to avoid overpaying for your stocks.

Success in investing is a journey, not a sprint. Embrace a long-term perspective (over 5 years) for equity holdings. Your equity basket may include index funds, ETFs, and self-curated stock baskets.

Now, let’s explore the essence of stock selection criteria — a formula that can help us navigate the complex stock market.

As the renowned investor Peter Lynch aptly puts it, ‘Know what you own, and know why you own it.’ Let’s unlock the secrets of effective stock selection together.”

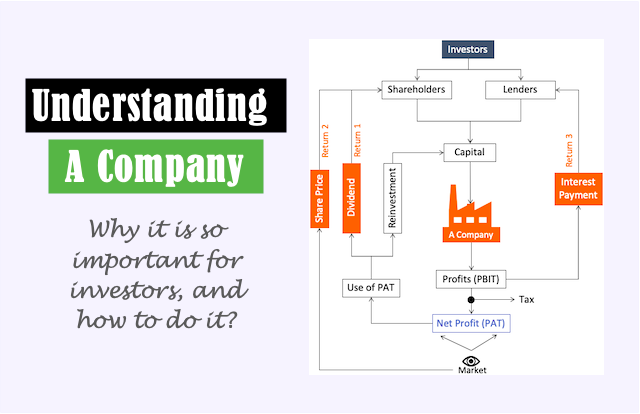

The Basic Concept

These stocks are shortlisted based on the stock selection criteria discussed in this article. There is a basic concept based on which these selection criteria have been developed. Each stock that one purchases must give the investors a minimum benefit in terms of quality and quantity.

- Quality: The past performance of a company must display minimum criteria. The present financial position must also be acceptable.

- Quantity: For every Rupee paid to buy the stock, it must display a minimum level of profit and assets.

Stock Selection Criteria – Approach Stocks Through Fundamental Analysis

In the long term, a retail investor can easily earn returns higher than bonds or bank deposits simply by buying an index fund or index ETF. But if the desire is to earn even higher returns, divesting into direct stocks will be required.

Direct stock investing is good but it also has its disadvantages. It will expect the investor to give it full attention. The investor must remain aware of the movements in the stock’s fundamentals and price. The investor must also be aware of how to analyze stocks.

If someone is okay with this limitation of direct stock investing, they can add them to their portfolio. The below stock selection criteria will be a part of learning the skills of stock analysis.

Minimum Ifs and Buts: As this article is for beginners, there will be minimum ifs and buts. Wherever possible, I’ll try to give a clear number as a selection criterion, without stating any exceptions. But in real-life investing, exceptions exist. For example, a stock that is yielding a 10% dividend might still not be a good buy. How? If it has reported a negative PAT or its EPS is falling year after year.

But for the moment, let’s not bother about the exceptions.

Let’s look at our selection criteria:

Criteria #1. Minimum Size: Total Revenue

It is easier to find value stocks in smaller-sized companies. But as this article is for beginners, large companies are more suitable for them. What is a large company? One that has a minimum revenue number.

- A private enterprise whose average total revenue, in the last 3 years, is greater than 850 crores.

- A government enterprise whose average total revenue, in the last 3 years, is greater than 500 crores.

The purpose here is to filter out the smaller companies. Why? Because they are more susceptible to the negative effects of competitive pressures.

Consider the case of Infosys. It is one of India’s leading IT companies. The company has consistently reported substantial total revenue over the years, making it a large-cap stock. The emphasis on a minimum revenue size serves to filter out smaller, potentially riskier companies. This stock selection criteria eventually aligns with the stability sought by most investors.

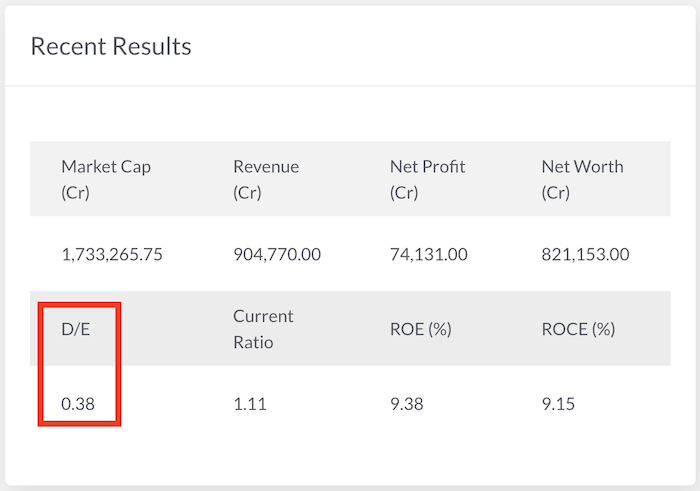

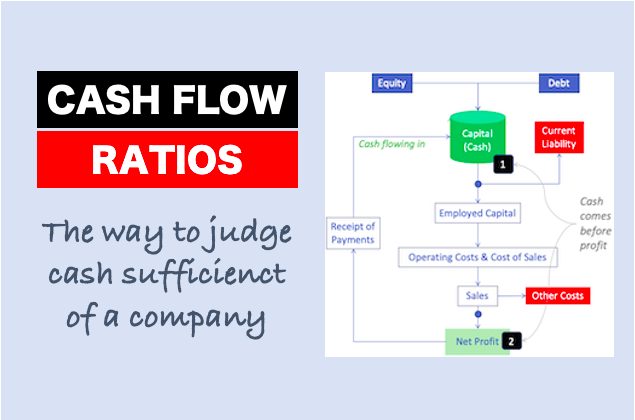

Criteria #2. Minimum Financial Position: Current Ratio & Debt

Investing in a financially healthy company is any investor’s priority. How to quantify a company’s financial position? A beginner can perform the litmus test using a liquidity and solvency ratio. Read more about financial ratio analysis.

- The current ratio of the company should be at least 1.5. It means the company’s current asset is at least 1.5 times as big as its current liabilities.

- The Long-term borrowing (debt) of the company should not be more than 110% of its net current assets (=Current Asset minus Current Liability, also called working capital).

- For a government enterprise, the debt limitation could be slightly higher. If its debt-to-equity ratio is less than two (2), it is within the acceptable limits.

Let’s take the case of Reliance Industries (RIL). we observe a current ratio comfortably above 1.5, showcasing its robust financial position. Additionally, managing a debt-to-equity ratio of around 0.38 reflects Reliance’s prudent financial management. These criteria aim to guide investors toward financially healthy companies, mitigating risks associated with excessive debt.

Criteria #3. Stable Profits

For beginners, it is more important to invest in a company with stable profits. How to judge if a company’s profits are stable or not?

- Note the operating profit and net profit of the company in the last 10 years. If for all the years, the number is positive, it is acceptable.

Look at Hindustan Unilever Limited (HUL) as a prime example of stable profits. Over the last decade, HUL has consistently maintained positive profit before tax (PBT) and net profits (PAT). This criterion encourages investors to prioritize companies with a history of stable earnings, fostering confidence in the company’s financial performance.

Criteria #4. Uninterrupted Dividend Payment

Investors love companies that pay dividends. The affinity further grows if the dividend payment is predictable. How to judge this predictability?

By looking at the dividend history of the last 10 years. What to look at?

- In all 10 years, the dividend has been paid or not.

- In all 10 years, the dividend payout ratio has been uniform or not.

Consider the case of ITC Limited which has a commendable track record of uninterrupted dividend payments over the past decade. It exemplifies reliability for income-seeking investors. This criterion aligns with the preference for companies with a consistent dividend history. Know more about high dividend-paying stocks in the Indian market.

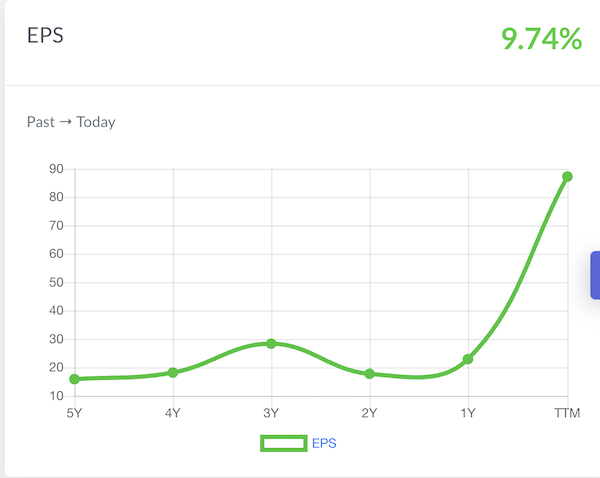

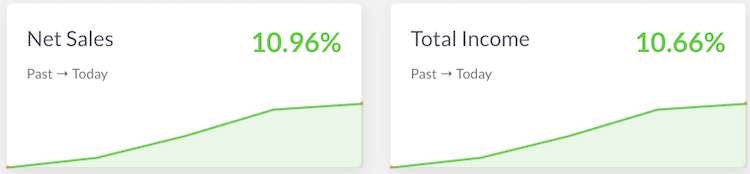

Criteria #5. A minimum Earning Per Share (EPS) Growth

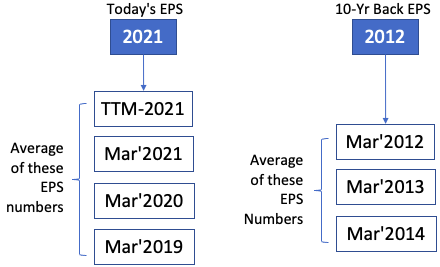

A listed company must exhibit a minimum growth rate of its EPS. Benjamin Graham has a particular way of calculating the EPS growth rate. What shall be considered as today’s EPS and 10-Yrs EPS is different.

An average EPS number must be considered, as starting and ending values (as shown below).

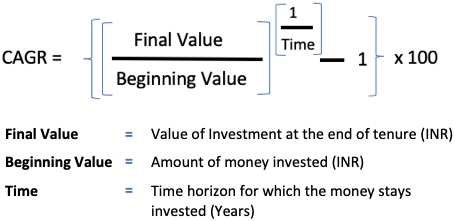

Once today’s EPS and 10-Yrs back EPS are known, the annualized growth rate (CAGR) to be calculated. Suggested Reading: How to measure return on investment.

A minimum annualized growth rate of 7.0% per annum is expected.

Why have I considered only a 7.0% per annum growth rate for EPS? Because a 10-year fixed deposit in India will yield these returns. I’m expecting that a business, in a 10-year time horizon, must yield at least this much earning growth for itself. Else why the owners of the business will care to run the business if a risk-free bank FD may fetch him/her better returns?

Analyzing Larsen & Toubro (L&T), we find a commendable average annual EPS growth rate over the years. L&T’s ability to achieve consistent EPS growth exemplifies the kind of companies investors may target using this criterion. It emphasizes the importance of sustainable earnings growth for long-term value creation.

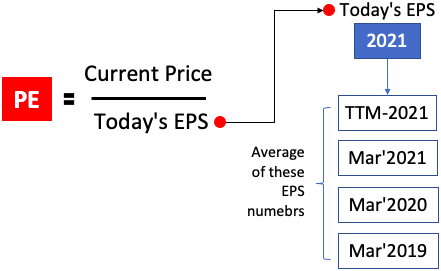

Criteria #6. A Maximum PE Ratio (Valuation Metric)

A PE ratio of 13.5 or lower is acceptable. What is the logic behind the 13.5 number?

The inverse of 13.5 is 7.5%, also called earning yield (EPS / Price). To understand the significance of PE-13.5 (or 7.5%), let’s take an analogy.

Suppose we bought an FD of Rs.5000. At the end of the year, it yields a return of Rs.335. What is the rate of return? 6.7% (335/5000). In terms of the prevailing interest rate, an ROI of 6.7% from a bank FD is acceptable, right?

So as a stock investor, our return expectation from our shares will surely be more than 6.7% (FD’s returns). Let’s say we expect it to be a moderate 7.5%, a risk premium of only 0.8%. The inverse of 7.5% earning yield is 13.5.

So you can see, an Indian stock trading at a PE multiple of 13.5 or lower is trading at attractive valuations.

Just a note of caution about the PE ratio. It is always better to calculate the PE ratio by oneself. Do not believe the numbers published by even the best of web portals.

How to calculate the PE ratio? Use this formula:

HDFC Bank is a stock often regarded for its stability. We find a PE ratio within the acceptable range. A PE ratio of 13.5 or lower, as seen in HDFC Bank, aligns with the principle of not overpaying for a stock. This criterion guides investors toward reasonably valued stocks. Read an in-depth content on the Price To Earning Ratio (P/E) here.

Criteria #7. Maximum “Blended Multiplier” (Valuation Metric)

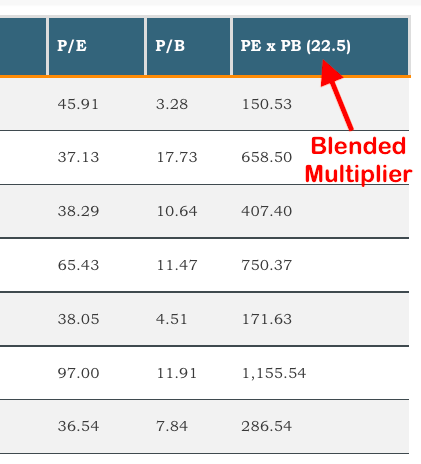

What is a blended multiplier? It is a product of the PE and PB ratio. According to Benjamin Graham, a maximum blended multiplier of 22.5 is acceptable (PE 15 x PB 1.5). In our article, we have considered an acceptable PE ratio of 13.5 (instead of Graham PE-15). Hence for us, our blended multiplier will be 20.5.

However, I feel that a blended multiplier of 22.5 is already a very stringent valuation ratio. Hence for our stock shortlisting, let’s keep the limiting number of 22.5.

How did Benjamin Graham arrive at a value of 22.5? PE of 15 multiplied by PB of 1.5.

In most cases, you will find that the blended multiplier of good stocks is much higher than 22.5. Only some government enterprises or fading companies will match these criteria.

Hence, Benjamin Graham suggests another selection criteria which is less stringent. The price of stocks not being higher than 1.2 times the net tangible assets.

What is the net tangible asset?

Net Tangible asset = Tangible Asset – Long Term Borrowing – Short Term Borrowing – Account Payables.

What are tangible assets? Look into the company’s balance sheet. The following line items will qualify as tangible assets:

- Property, Plant, and Equipment.

- Inventory (work in progress, & finished goods).

- Account Receivables.

- Cash.

- Raw materials.

Exploring the example of Asian Paints. The blended multiplier (PE ratio multiplied by PB ratio) falls within the acceptable limit. This criterion, inspired by Benjamin Graham, aids in identifying stocks that are not overvalued, contributing to a more balanced and prudent stock selection approach.

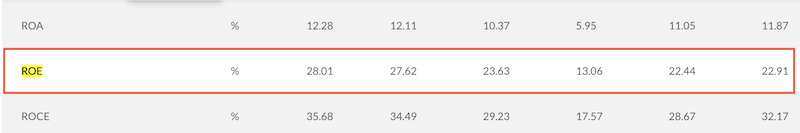

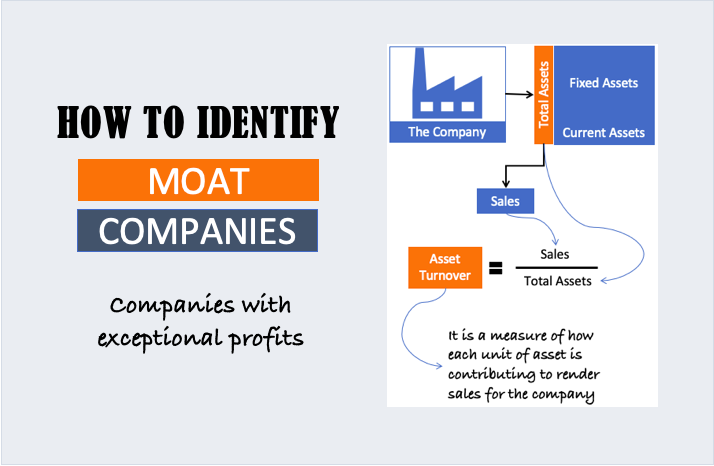

Criteria #8. Return on Equity (ROE)

ROE is a fundamental financial metric that holds significant importance in evaluating the performance and financial health of a company. It measures the efficiency with which a company utilizes its shareholders’ equity to generate profits. It provides investors with insights into the company’s ability to transform invested capital into profits.

A higher ROE generally indicates that a company is capable of generating high profits from its equity base. The ROE is calculated by dividing a company’s net income by its shareholders’ equity. This ratio is expressed as a percentage, representing the return generated on each Rupee of equity invested. Know more about ROE in this article.

Investors often seek companies with consistent and high ROE as it signifies effective management and a robust business model.

However, it’s crucial to consider the context of the industry in which a company operates when analyzing ROE. Industries with different capital structures may have varying average ROE levels. Comparing a company’s ROE with that of its industry peers provides a more meaningful assessment.

Titan Company has consistently demonstrated a healthy ROE. A robust ROE indicates that the company effectively employs its capital to generate earnings. This makes it an attractive criterion for investors seeking companies with a strong profitability track record. Investors use ROE as an additional tool to assess a company’s financial health and potential for long-term growth.

Conclusion

In stock market investing, having a systematic approach to stock selection is good. As Warren Buffett wisely notes, “It’s not about timing the market, but time in the market.” Our journey through these eight crucial stock selection criteria serves as a robust starting point for investors aiming to build a sound investment portfolio.

Remember, these metrics, though individual, weave a cohesive narrative when viewed collectively. They provide a foundational guide for selecting potential stocks. It combines the wisdom of renowned investors like Benjamin Graham and the practical insights needed for market success.

In the words of Peter Lynch, “Know what you own, and know why you own it.” This encapsulates the essence of our discussed criteria – a roadmap for investors to understand the stocks they choose and the rationale behind their selections. Know about GARP stocks – derived from Peter Lynch’s theory.

While these criteria serve as a fundamental framework, they are not exhaustive. Investors are encouraged to delve deeper, conduct thorough research, and stay informed. The above-listed stock selection criteria are like a starter’s guide to a more detailed fundamental analysis. For people who want to indulge in a detailed fundamental analysis, please check the link.

Have a happy investing.

I’d greatly appreciate a comment of this article in the comment section below.

Mani, Best gift of the new year to benefit many who follow & understand your amazingly simplistic yet effective ways of stock selection penetration. Your project management skills sychronises very well with Financial Process Managemnt & provides 3D clarity & confidence to getmoneyrich systamatically. Thanks & Happy New Year !!

Thank you for the awesome feedback.