Which is the best strategy for stock picking? There are multiple stock investing strategies. Out of them, we cannot point to one as the “best”. The choice of strategy can change depending on the individual’s goals, risk tolerance, and investment horizon. In this article, we will discuss a few strategies that, we, retail investors can understand and implement easily. I’ve personally used them to make my stock investing process suit my personality.

Introduction

Whenever a good investor talks about stock investing, the intention is to buy good stocks at the right price. This is something that we all agree about, right? But in addition to it, there must also be a strategy in place. If one can follow a theme while investing in stocks, it will make the whole process of investment more understandable and relatable. There are multiple themes available for us to follow. In this article, we’ll talk about five such themes.

Why is a strategy necessary for stock investing?

- Provides A Framework: A strategy helps to build an investment framework. Framework-based investment decisions are more effective. It helps to define a specific approach to selecting stocks such as focusing on companies of specific industries etc.

- Risk Management: A well-designed strategy can help to manage risk. In stock investing, one of the bigger risks is the short-term price volatility of stocks and the presence of poor-quality companies in large numbers. My strategies are specially designed to handle these two potential risks.

- Goal-Based Investing: Practising stock investing with a strategy supports the concept of goal-based investing. It can enhance the chances of achieving investment goals. A strategy that aligns with an individual’s investment goals, can increase the chances of achieving those goals.

- Disciplined Investing: It helps to be disciplined. Having a strategy in place can help an investor to stick to a plan, even during market downturns or periods of uncertainty.

- Avoid Panic: A strategy-based investing is based more on a rational analysis of the business and less on emotional decisions. Analysis of business allows us to focus on facts and numbers.

Overall, a strategy can help investors make more informed and thoughtful decisions, which can lead to better outcomes over the long term.

Video [Hindi]

The Concept

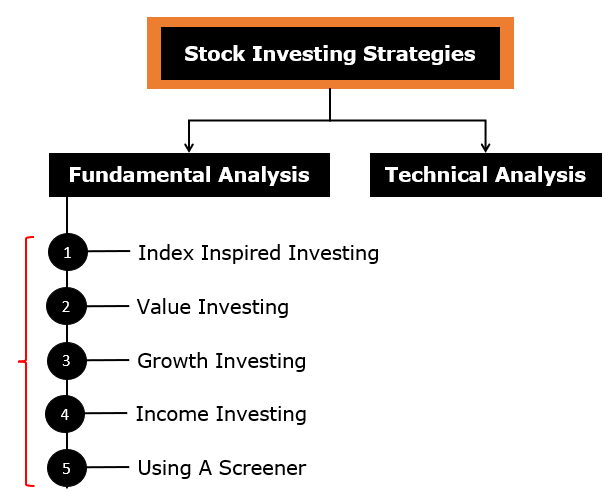

The use of stock investing strategies to practice investment is a concept that has roots in Stock Analysis. Depending on the type of analysis we prefer, will pave the path for a preferable strategy.

Primarily, there are two ways to analyze stocks:

- Fundamental Analysis: This method involves analyzing a company’s financial metrics, such as its revenue, earnings, and growth prospects, to determine its intrinsic value. Read more about fundamental analysis.

- Technical Analysis: This method involves analyzing a stock’s past price and volume data to identify trends and make predictions about future price movements. Read more about technical analysis for long-term investors.

In this article, we’ll not discuss these types of stock analyses. We’ll discuss five stock investing strategies that come under the umbrella of fundamental analysis. While discussing these strategies, I’ll try not to talk about theoretical knowledge, instead, I will share practical implementable ideas that I’ve practiced myself.

Let’s discuss the five stock investing strategies.

#1. Index Inspired Investing

Index-inspired investing is about buying stocks from the main indices of the stock market. Why index? Because these indices include the largest publically traded companies in the stock market. The constituent stocks of these indices can be assumed to be fundamentally strong. I follow stocks that are included in the following indices: (1) Sensex, (2) Nifty 50, (3) Nifty Next 50. Together, following these three indices, will give us about 100 number fundamentally strong stocks. If you want a bigger list, download the nifty-200 index list.

Then, we can follow the next steps:

- Create a watchlist: Prepare the watchlist in a Google Sheet. It’ll have about 100 number stocks as picked above. Google sheets can be used to track the live price & other stock data. To know more about how to prepare such a watchlist, read here.

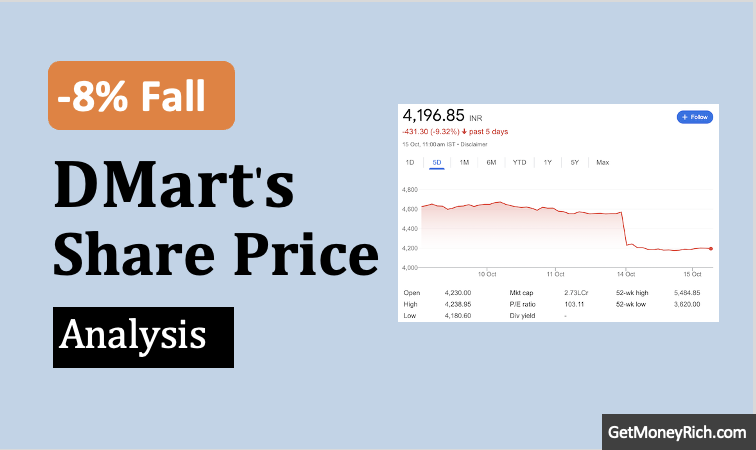

- Track Price Trend: Once the list is ready, start tracking its price trends for the last days and months. You can use our Stock Engine to track a stock’s price trends. If you want, you can also set a target buy price for your stocks.

- Target A Stock: Idea is to focus on those stocks whose price is falling. Once the current market price of stock comes closer to your target price, start buying them. The thumb rule is, a price correction of 8-10% will make a stock interesting.

It is one of the easiest ways to identify fundamentally strong stocks and buy them at a fair price. People who do not have time to learn about the stock analysis can use this trick.

#2. Value Investing

In this investment strategy, our focus will be on buying stocks that are undervalued. The idea behind value investing is that by buying stocks that are trading at a lower price than their intrinsic value. Such stocks are said to be trading at a discount. A trained value investor will only buy stocks at a discount, there is no other way.

To practice this investing style, once again we’ll need a list of a few high-quality stocks. We can again prepare such a list by taking inspiration from the Nifty 200 Index. I’ll suggest you add only 60-65 number stocks to the watchlist. Do not increase the list size beyond it as it will make it difficult to track and focus.

Again, one must prepare the watchlist in Google sheets as stated in point#1 above.

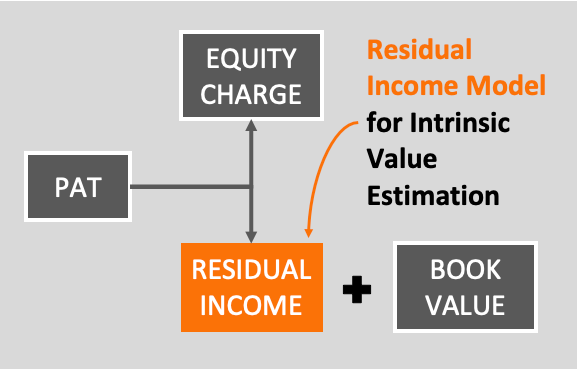

Once the list is ready, add a column called “Intrinsic Value”. Note the intrinsic value of the stocks included in your list. If you can calculate the intrinsic value on your own, do it. Else, you can use our Stock Engine.

The Stock Engine has its own algorithm that is used to estimate the intrinsic value of stocks. We regularly publish the intrinsic value of about 950 number Indian stocks for our subscribers.

What to do next? Generally, good stocks trade at a price much higher than their intrinsic value. This is why we prepare a watchlist to track a potential price correction. Once the current stock price comes close to a stock’s intrinsic value, it becomes an interesting consideration.

#3. Growth Investing

Growth investing is an investment strategy that focuses on buying stocks of companies that are expected to grow at a faster rate than the market. Following this strategy, one will invest in companies that are expected to have high earnings growth. In this investing strategy, the focus is less on the company’s current earnings or dividends, and more on its potential for future growth.

Here again, we will take inspiration from companies listed on a reliable index. I’ll use a wider index like S&P BSE 500 Index to prepare a primary list of stocks. Once the list is ready, the following filters must be applied:

- EPS Growth: Filter in all stocks whose past EPS growth rate is high. You can use a period of 3 years or 5 years for an evaluation. All stocks that had an EPS growth of 12% or more are acceptable.

- P/E Ratio: In this step, apply the filter and allow only those stocks whose price-to-earnings ratio is higher than 30. Please note that we are not talking about low PE stocks here. We want to include those stocks whose PE is high. The logic is that for those stocks which are growing fast, investors are ready to buy them even at higher PE levels.

After applying these two filters, we will have a list of such stocks whose past EPS growth is higher and whose current PE is also high. Now use these stocks to prepare a final watchlist as stated in point#1 above.

Once the price of any stock in this list corrects by 8-10%, it becomes interesting for investing.

#4. Income Investing

Income investing from dividends is an investment strategy that focuses on buying stocks of companies that pay regular dividends. The idea behind this strategy is to earn a steady stream of income from the dividends paid by the companies in which one has invested. Such companies have a track record of consistent dividend payments over time. Stable and growing dividends can supplement other income sources but it takes time to reach that stage

To create a watchlist stated in point#1 above, download a list of stocks from the Nifty 200 index. Many companies appearing in this list are blue-chip companies. Such companies believe in the theory of profit sharing with shareholders in the form of dividends.

Then do the following:

- Dividend History: Include only those companies from the list who distributed dividends in all of the last 10 years of operation.

- Net Profit: Only profitable companies shall be included. Companies whose net profit (PAT) was negative, and irrespective of it distributed the dividends, shall be removed from the watchlist.

- Price Tracking: Track the price of such companies. Whenever they see a price correction of 5-6% or more, they become attractive for investing.

Please note that these types of stocks generally trade at high price levels. Hence buying them only on corrections is essential. But it is also true that even after price corrections, their dividend yield will be low, in the 0.5% to 2% range. But we are not buying these stocks for this feeble dividend yield, right? The same stock’s yield will improve with time.

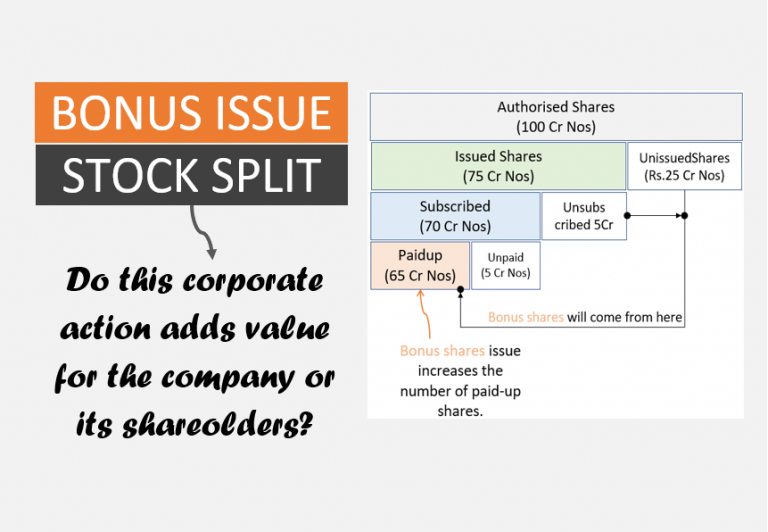

For example, suppose you bought TCS stocks in Jan’2013. Then, its price was Rs.676 per share. On Mar’13, it paid a dividend of Rs.22 per share. It’s a dividend yield of 3.25%. After 10 years, on Mar’22, TCS paid a dividend of Rs.47 per share. After considering the bonus share issue of 1:1 (on March 2018), today your dividend yield will be about 13.9%. The dividend yield could’ve improved further had the dividends payments of the past 10 years would have been used to buy more of TCS’s stocks.

#5. Using A Stock Screener

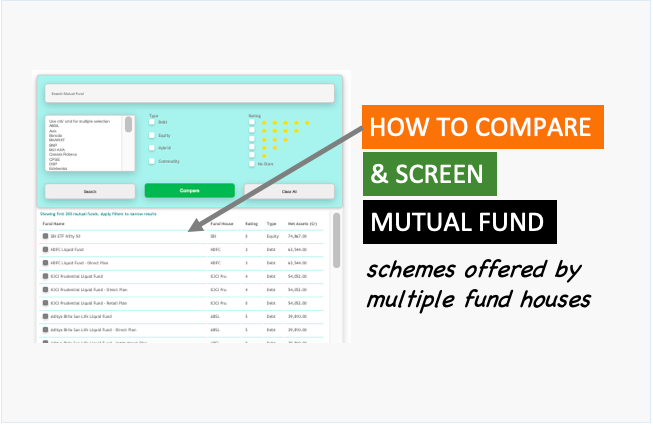

The use of a good screener as a part of a stock investing strategy is also good. One can use a screener to build a unique theme of their own. Suppose you want to invest only in such stocks whose revenue is growing very fast. A stock screener can be used to filter based on this revenue criteria.

I also use the BIG SCREENER of my Stock Engine to filter stocks of highly profitable companies. Parameters like ROE, ROCE, and ROIC are used to filter stocks showing high returns in these parameters. Once I have a filtered list of these selected stocks, I add them to my watchlist. I target them only when they are seeing a price correction of 8-10%.

Two Bonus Strategies

All five strategies discussed above come under the umbrella of fundamental analysis. Hence, two additional stock investing strategies automatically get attached to them.

- Buy and Hold: It is essential to buy stocks with the intention of holding them for an extended period of time, regardless of short-term market fluctuations. The idea behind this strategy is that over the long term, the stock market tends to rise, and by holding on to stocks for an extended period, investors can reap the benefits of these long-term gains. Here the focus is on the fundamentals and not on the price. Till the fundamentals are strong, stock can be held even for 15-20 years at a stretch. Suggested Reading: Timing the market vs time in the market.

- Compounding of Returns: When it comes to stock investing, there are two types of earnings that can be compounded, dividends and retained earnings. To make a dividend compound, the investor can use the payout to buy more stocks. Good companies compound the retained earnings at their end by making the asset, revenue, profits, profitability, and cash flows grow over time. But it takes time for the growth rates to show. So, a stock investor should not practice stock investing for short-term gains. The strategy should be to buy stocks worth Rs.1.0 lakhs and make it Rs.50 lakhs in the next 20 years.

A combination of the above two strategies has the power to build substantial wealth for its investor. First, buy stocks using the five stock investing strategies explained here. Then, let the two bonus strategies get applied to your holding stocks. The action is simple.

Conclusion

Investors can apply various stock investing strategies to achieve their financial goals. Each strategy is unique. One can pick their preference depending on their personal liking. Value investing strategy is my personal preference. I also like income investing. My Stock Engine has a separate algorithm for screening dividend stocks. It generates a list of consistent dividend-paying stocks.

No matter which investment strategy is used, the real power of equity investing can be seen only when the buy & hold and compounding strategy gets implemented.

Have a happy investing.

Suggested Reading: What is the right time to buy stocks for long term?

Thank you Mani for this beautiful article. I enjoy reading it,. I learn many things from here. Many informative tips are written in the article.

“Look for strong business” Great point described by you! Good article written in a very simple language.

Very informative write-up for beginners.

Dear Sir

Am your subscriber and bought the latest software from you. The analysis is thought provoking. However companies viz ASIAN PAINTS/PIDILITE AND NESTLE to name a few are always “overvalued” and can be undervalued in a situation viz 2008.

GUIDANCE.

Regards

NRAJENGANESH

A hint of the answer lies in their PE. Compare their PE with any other large-cap stocks, you will see the point.