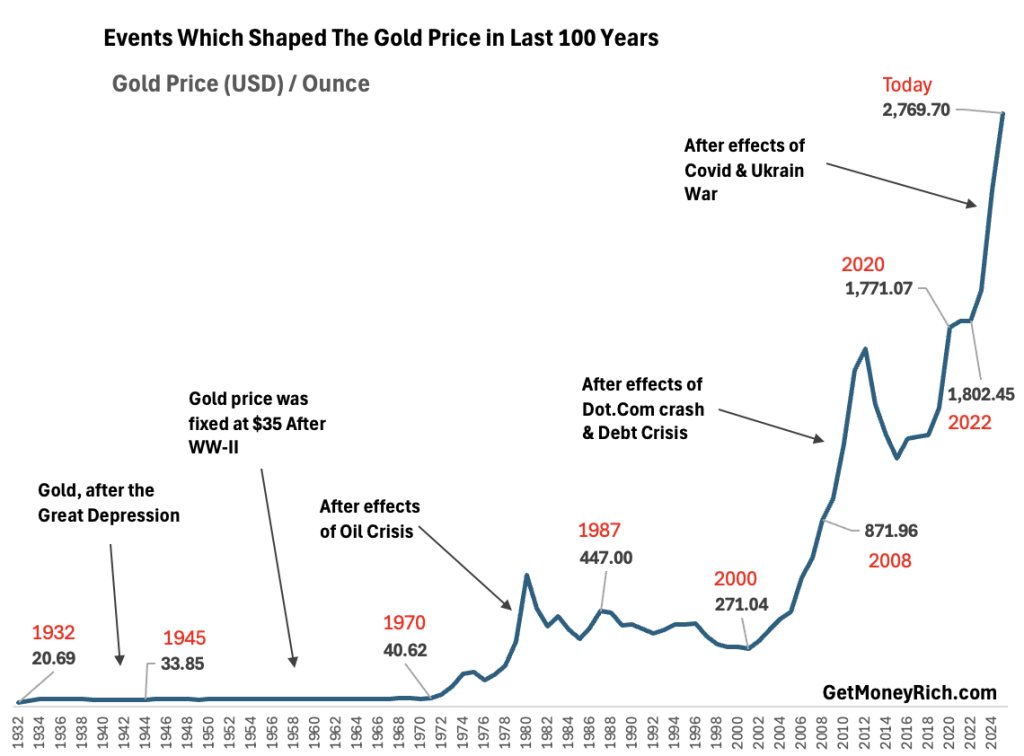

Gold has long been regarded as a safe-haven asset. It offers stability in times of economic turmoil and geopolitical uncertainty. Over the last century, several global crises have triggered a massive surge in gold demand. It lead to a sharp gold price increases. These events have ranged from financial collapses to wars and pandemics, each driving investors toward gold as a store of value.

In this article we’ll examines ten major events in the last 100 years that caused significant spikes in gold demand.

So, Let’s start the journey in a chronological order:

Table of Contents

- 1. The Great Depression (1929–1939)

- 2. World War II (1939–1945)

- 3. The Bretton Woods Agreement

- 4. 1970s Oil Crisis & Stagflation

- 5. Black Monday Stock Market Crash (1987)

- 6. Asian Financial Crisis (1997–1998)

- 7. Dot-Com Bubble Burst (2000–2002)

- 8. Global Financial Crisis (2008–2009)

- 9. COVID-19 Pandemic (2020–2021)

- 10. Russia-Ukraine War

- Conclusion

1. The Great Depression (1929–1939)

I’ve grown up hearing stories of how gold is more than just a shiny metal. It’s Lakshmi, it’s security, it’s tradition. Our mothers and grandmothers hoard it, not just for weddings, but as a shield against tough times. And history shows us they’re onto something.

Today, I want to take you back nearly a century, to a time of unprecedented global crisis: The Great Depression.

You might think, “What does a bunch of Wall Street bankers in the 1930s have to do with my SIPs and FDIs?” Trust me, the lessons are timeless, especially for us in India.

1.1 How the Great Depression Unfolded

Imagine the Sensex crashing not just a few points, but losing almost 90% of its value.

That’s essentially what happened in the US in 1929 when the stock market imploded. People went from being millionaires on paper to paupers overnight. And the dominoes kept falling…

- Banks went bust: Remember the PMC Bank crisis? Multiply that by thousands. Banks simply ran out of money, wiping out people’s life savings. Can you imagine the fear and panic?

- Companies shut down: No credit, no demand… factories closed, unemployment skyrocketed. It was like a never-ending Diwali without any bonus.

- Deflation nightmare: Prices of things kept falling, which sounds good, right? But businesses couldn’t make a profit, so they fired people, leading to even less demand. It was a downward spiral.

The impact was global. Even India, then under British rule, felt the pinch. Trade dried up, and farmers struggled to sell their crops. It was a harsh reminder that even seemingly distant events can have a ripple effect on our lives.

1.2 Why Everyone Ran for Gold?

In the midst of all this chaos, something interesting happened: people started hoarding gold. Why? Because when everything else is crumbling, gold stands tall.

- Faith in paper money vanished: When banks are collapsing, holding cash feels like sitting on a time bomb. Gold, on the other hand, has some tangible value, it’s real. It’s like preferring land over a fancy apartment in a shady builder’s project.

- The ultimate hedge: Gold became the go-to thing against economic collapse. While stocks became toilet paper and currencies fluctuated wildly, gold held its ground.

- Uncle Sam’s gold rush: Even the US government got in on the act. President Roosevelt basically told everyone to hand over their gold, and then he devalued the dollar against gold, making gold even more valuable. It was a bit like the government suddenly declaring that one tola of gold is now worth twice as much in rupees.

1.3 Gold’s Price Surge

| Year | Gold Price per Ounce |

| 1939 (Before the War) | $34.42 |

| 1945 (End of the War) | $35.00 |

Before the crash, gold was fixed at $20.67 per ounce. By 1934, it was $35. That’s a nearly 70% jump.

2. World War II (1939–1945)

Continuing our journey through history and its impact on gold, let’s turn our attention to World War II.

While the Great Depression was an economic earthquake, WWII was a full-blown global firestorm. And just like firemen rush to contain a blaze, people and governments rushed to gold for safety.

Consider this, entire countries were being invaded. The currencies were collapsing, and bombs were falling everywhere. In such a scenario, what do you trust? Not promises, not stocks, but something tangible, something that holds its value regardless of borders or regimes.

2.1 How the World Went to War (Again!)

The seeds of WWII were sown in the aftermath of World War I, with Germany burdened by heavy reparations. Add to that the global economic misery of the Great Depression, and you had a recipe for disaster.

A certain Mr. Hitler rose to power, promising to restore Germany’s glory (sound familiar to any political rhetoric we hear today?).

- Invasion after invasion: Germany started swallowing up neighboring countries like they were jalebis at a wedding feast – Austria, Czechoslovakia, Poland…

- Global conflict: Soon, it was a free-for-all, with almost every major country involved. From the icy plains of Russia to the islands of the Pacific, the world was at war.

The war meant economies were shattered, industries were destroyed, and people were displaced. It was a time of immense suffering and uncertainty.

2.2 Why Gold Became the King

During WWII, gold wasn’t just a safe haven; it was a lifeline.

- Paper currencies became suspect: Governments printed money like there was no tomorrow to fund their war efforts, leading to inflation. People lost faith in paper money and sought the stability of gold. It’s like preferring a government job over a startup during a recession.

- Capital flight: Wealthy individuals and governments smuggled their gold to neutral countries like Switzerland or the US, hoping to protect it from the Nazis.

- Central banks hoarding gold: Governments needed gold to back their currencies and pay for war supplies. The US, in particular, became the world’s gold vault.

2.3 Gold Price Reaction During World War II

| Year | Gold Price per Ounce |

|---|---|

| 1939 (Before the War) | $34.42 |

| 1945 (End of the War) | $35.00 |

Unlike other crises, gold’s price remained relatively stable during World War II because:

- The U.S. had fixed the gold price at $35 per ounce under the Gold Reserve Act of 1934.

- Gold demand surged, but price movement was restricted due to government controls.

However, black market gold prices soared in war-torn regions where people were desperate to convert paper money into a tangible asset.

3. The Bretton Woods Agreement (1971)

The collapse of the Bretton Woods system in 1971 was a defining moment in global financial history. It marked the end of the gold standard, leading to uncertainty in fiat currencies and a surge in gold demand.

This event reshaped the world economy and set the stage for gold to become a free-floating asset.

3.1 How The Things Unfolded

After World War II, the global economy needed stability. The Bretton Woods Conference (1944) established a new monetary system where:

- The U.S. dollar was pegged to gold at $35 per ounce.

- Other currencies were pegged to the U.S. dollar, making it the world’s primary reserve currency.

- The International Monetary Fund (IMF) and World Bank were created to support economic growth.

This system ensured stability in exchange rates and trade but relied on the U.S. maintaining enough gold reserves to back its currency.

By the 1960s, economic conditions had changed:

America was importing more than it exported, leading to a trade deficit and hence the balance-of-payments problem. The U.S. government also printed money like crazy to finance the war, increasing inflation. As inflation eroded confidence in the dollar, foreign governments started redeeming their U.S. dollars for gold.

During 1965–1970, France wsa led by President Charles de Gaulle. He aggressively exchanged U.S. dollars for gold, draining U.S. gold reserves.By 1968, the U.S. gold supply had fallen significantly. The US government was struggling to defend the $35 per ounce peg. By 1971, other countries also, including Britain, started demanding gold in exchange for their dollars.

Nixon Shock of 1971

On August 15, 1971, U.S. President Richard Nixon made a historic announcement. He declared that the U.S. would no longer convert dollars into gold. This effectively ended the gold standard, making the dollar a pure fiat currency. This event, known as the “Nixon Shock,” caused chaos in global financial markets and led to a surge in gold demand.

3.2 The Impact of Nixon Shock on Gold Demand

The collapse of Bretton Woods was like a signal for gold to shine again.

For decades, the dollar was “as good as gold.” Now, people realized it was just paper. Gold, on the other hand, was real. Without the gold standard, the US printed even more money. It caused the inflation to rise. Gold became the go-to remedy against rising prices. Under Bretton Woods, the gold price was fixed. Now, it could float freely, and investors rushed in, driving prices higher.

It was like a newly-listed stock suddenly becoming a multi-bagger.

3.3 Gold Price Reaction

| Year | Gold Price per Ounce |

| 1971 (Before Nixon Shock) | $35.00 |

| 1974 (Three Years Later) | $183.77 |

Gold’s price surged over 400% within three years after Bretton Woods collapsed. Investors sought gold as a safe-haven asset amid inflation and currency devaluation.

This event reinforced gold’s role as the ultimate hedge against fiat currency instability, a trend that continues today.

4. 1970s Oil Crisis & Stagflation

Picture the long queues at petrol pumps, rising prices of everything from atta to automobiles. This creates a general sense of economic gloom. That’s the 1970s for you, a decade marked by the Oil Crisis and Stagflation. It was like a double whammy that sent investors scrambling for safety. Guess where they ran? You got it, gold.

4.1 How the Crisis Unfolded

The 1970s were a turbulent time, with not one, but two major oil crises that shook the world.

- The First Oil Crisis (1973-74): Remember the Yom Kippur War? Well, when the US supported Israel, the Arab oil-producing nations (OPEC) decided to teach them a lesson by imposing an oil embargo. Suddenly, oil prices quadrupled. It was like (for example) the price of petrol jumping from ₹50 to ₹200 overnight.

- The Second Oil Crisis (1979-80): Just when things were starting to settle down, the Iranian Revolution happened. Iran, a major oil producer, saw its output plummet, causing another global supply shock. Oil prices doubled again.

These crises led to a turmoil like situation. Everything became more expensive because transportation and production costs soared. It was like your monthly budget going haywire because the price of daal doubled. Businesses struggled, unemployment rose, but prices kept climbing (stagflation).

4.2 How It Impacted The Gold Demand

In this mess, gold emerged as the hero.

As the cost of living skyrocketed, people realized their savings were losing value. Gold, being a tangible asset, held its value and became a shield against inflation. Stagflation was a new and scary phenomenon. Stock markets tanked, and gold became the go-to safe haven. Inflation and slow growth caused the US dollar to weaken. It made gold even more attractive.

4.3 Gold Price Reaction During the 1970s

The numbers speak volumes:

| Year | Gold Price per Ounce |

| 1973 (Before First Oil Crisis) | $65 |

| 1974 (After First Oil Crisis) | $183 |

| 1978 (Before Second Oil Crisis) | $185 |

| 1980 (After Second Oil Crisis) | $850 |

Gold prices surged by a whopping 1200% from 1973 to 1980. Imagine multiplying Rs.1 lakh by 13x in just seven years. That is a CAGR of 44% in 7 year period. At this rate of return, a Rs.7.7 Lakhs will become a crore in just 7 years.

5. Black Monday Stock Market Crash (1987)

Imagine waking up one morning and finding out that the Sensex has crashed by over 20% in a single day. That’s essentially what happened on Black Monday, October 19, 1987. It was a day of panic, fear, and a stark reminder that stock markets can be as unpredictable as Mumbai monsoons.

For us in India, Black Monday serves as a crucial lesson about the importance of risk management and the role of gold in a diversified portfolio.

5.1 How Black Monday Unfolded

In the lead-up to the crash, the stock market was on run of its lifetime. It felt like a non-stop Diwali celebration, with stock prices soaring higher and higher. But beneath the surface, things were getting a bit shaky.

The RBI (and in the US, it was the Federal Reserve) was increasing interest rates to control inflation. There were also deep concerns about the trade deficits. In this scenario, many stocks were trading at ridiculously high prices, with no real earnings to justify them.

Then came Black Monday. The Dow Jones (the US equivalent of the Sensex) plunged by over 22% in a single day. It was the biggest one-day percentage drop in history. Panic selling creeped in the market. Investors rushed to sell their stocks, but there were few buyers. The market froze up.

5.2 Why Gold Became the Safety Net

As the stock market crumbled, investors ran for the exits, seeking the safety of gold.

- Flight to safety: The sudden loss of wealth caused widespread panic. Gold, being a safe-haven asset, saw a surge in demand.

- Fear of recession: People feared that the crash would trigger a deep recession, like the Great Depression.

- Loss of confidence in the dollar: The US dollar weakened, making gold more attractive.

5.3 Gold Price Reaction During Black Monday

The numbers tell the story:

| Year | Gold Price per Ounce |

| January 1987 (Before the Crash) | $400 |

| October 1987 (Month of the Crash) | $486 |

| December 1987 (After the Crisis Settled) | $499 |

Gold prices jumped by nearly 25% in the months following the crash!

6. Asian Financial Crisis (1997–1998)

Let’s rewind to the late 90s, when countries like Thailand, South Korea, and Indonesia were being hailed as economic “Tigers,” roaring with growth. But just like a sudden illness can disable even the strongest animal, the Asian Financial Crisis struck these economies hard. It sent shockwaves across the globe.

6.1 How the Asian Financial Crisis Unfolded

In the years leading up to the crisis, the “Asian Tigers” were attracting massive foreign investment. But beneath the surface, vulnerabilities were building. What was the underlying issues? These countries had borrowed heavily in US dollars. It made them vulnerable to currency fluctuations. It was like taking a huge home loan in a foreign currency.

Many countries had their currencies pegged to the US dollar. But as USD was working like a global currency, it was continuously getting stronger. As US Dollar became strong, the values of these pegged currencies also went up with the dollar. This make their their exports expensive and un competitive.

While this was happening, the asset bubble was also getting created. Real estate and stock markets were booming, creating unsustainable bubbles.

Finally, the bubble burst:

- Thailand devalued its currency: In July 1997, Thailand was forced to devalue its currency, the Baht, triggering a domino effect across the region.

- Contagion: The crisis spread to Indonesia, South Korea, Malaysia, and other countries. Stock markets crashed, banks failed, and businesses went bankrupt.

6.2 Why Gold Demand Picked up

As the crisis unfolded, investors rushed to the perceived safety of gold.

As Asian currencies lost a huge chunk of their value, wiping out savings. People turned to gold to preserve their wealth. Bank failures and stock market crashes led people to withdraw their money and seek safer alternatives. Some Asian central banks started buying gold to stabilize their economies.

6.3 Gold Price Reaction

Here’s what happened to gold prices:

| Year | Gold Price per Ounce |

| January 1997 (Before the Crisis) | $369 |

| December 1997 (Peak of Crisis) | $383 |

| December 1998 (Crisis Subsides) | $290 |

Gold prices initially rose as the crisis hit, but then declined as the situation stabilized and international organizations stepped in to help.

7. Dot-Com Bubble Burst (2000–2002)

Remember the early 2000s? The internet was booming, and everyone was investing in tech companies. Eeven if they had no profits, people just bought their sakes as they were tech.

It was like a giant IPO mela, and everyone wanted a piece of the action. But as we all know, what goes up must come down, and the Dot-Com Bubble eventually burst, sending tech stocks crashing and investors running scared.

7.1 How the Dot-Com Bubble Burst Unfolded

In the late 1990s, the internet was the “next big thing,” and investors were throwing money at anything with a “.com” in its name. Companies with no profits were being valued at billions of dollars. Investors believed the internet would change everything overnight and ignored the fundamentals. Hundreds of internet startups went public, creating a feeding frenzy for investors.

Then came the crash. Investors realized that many of these companies had no real business model and would never make money. As fear grew, investors started selling their tech stocks, causing prices to plummet. Many dot-com companies went bust, wiping out billions of dollars in wealth.

7.2 Why Gold Became Dearer?

As tech stocks crashed, investors looked for a way to protect their wealth. Investors who lost money in the stock market sought safer alternatives. As so much money being pulled out of the market, the US economy slowed down, raising fears of a deeper recession. The US dollar depreciated, making gold more attractive.

7.3 Gold Price Reaction During the Dot-Com Bubble Burst

Here’s what happened to gold prices:

| Year | Gold Price per Ounce |

| January 2000 (Before the Crash) | $282 |

| October 2002 (End of the Crash) | $320 |

Gold prices rose by about 13% during the Dot-Com Bubble Burst, showing its ability to hold its value during times of crisis.

8. Global Financial Crisis (2008–2009)

Ah, 2008… the year the world almost ended (financially speaking). The Global Financial Crisis, triggered by the collapse of the US housing market, was a truly terrifying event. Banks failed, stock markets crashed, and the global economy teetered on the brink of disaster.

8.1 How the Global Financial Crisis Unfolded

In the years leading up to the crisis, the US housing market was booming. Banks were giving out mortgages like prasad at a temple, even to people who couldn’t afford them (“subprime” mortgages). As result, the demand in the housing market soared and house prices soared to unsustainable levels.

On the other side, these subprime mortgages were then bundled together and sold to investors around the world. These complex investments became toxic as homeowners started defaulting on their loans. As the housing market collapsed, banks that held these toxic assets began to fail.

Then, the dominoes started falling. The failure of this major investment bank in September 2008 triggered a global panic. Stock markets around the world plummeted and eventually crashed. The crisis was do deeply ingrained into the financial system that the global economy plunged into a deep recession.

8.2 Why Gold Became Dearer?

As the financial system imploded, investors scrambled for safety. Bank failures led people to lose confidence in the financial system. Governments around the world injected massive amounts of money into the economy to prevent a complete collapse. This was done by printing notes like never before. It was crisis moment and it created a climate of fear and uncertainty, driving investors to safe-haven assets.

8.3 Gold Price Reaction

Here’s what happened to gold prices:

| Year | Gold Price per Ounce |

| January 2008 (Before the Crisis) | $870 |

| December 2009 (After the Worst of the Crisis) | $1,096 |

Gold prices rose by over 25% during the crisis. It demonstrated its ability to act as a safe haven during times of financial turmoil.

9. COVID-19 Pandemic (2020–2021)

In early 2020, a new virus emerged, and within weeks, it had spread across the globe, causing a pandemic. It was a time unlike anything we had seen in a century. Lockdowns, travel bans, and economic shutdowns became the new normal. The world was gripped by fear and uncertainty.

Governments around the world imposed lockdowns to slow the spread of the virus. Businesses were forced to close, leading to massive job losses. Stock markets around the world plunged as investors panicked. Governments and central banks unleashed unprecedented amounts of stimulus to support the economy.

9.1 Why Gold Demand Picked Up

As the world grappled with the pandemic, investors sought refuge in gold. The pandemic created a perfect storm of fear and uncertainty, driving investors to safe-haven assets. Central banks slashed interest rates to near zero, making gold more attractive. In India, the Repo Rate in those days was as low as 4%. Massive government stimulus raised fears of future inflation.

9.2 Gold Price Reaction

Here’s what happened to gold prices:

| Year | Gold Price per Ounce |

| January 2020 (Before the Crash) | $1,520 |

| August 2020 (Peak Price) | $2,067 |

| December 2021 (End of Crisis Period) | $1,800 |

Gold prices surged to record highs during the pandemic, demonstrating its ability to act as a safe haven during times of crisis.

10. Russia-Ukraine War

Fast forward to 2022, and the world was facing another major crisis: the Russia-Ukraine War. The conflict sent shockwaves through the global economy, disrupting supply chains, causing energy prices to soar, and creating a climate of geopolitical uncertainty.

The Russia-Ukraine War highlighted our dependence on imported energy and the importance of diversifying our economy. It reinforced the role of gold as a hedge against geopolitical risk.

10.1 How the Russia-Ukraine War Unfolded

Russia invaded Ukraine in February 2022, triggering a major conflict. Western countries imposed sanctions on Russia, disrupting global trade. The war led to a surge in energy prices, causing inflation to rise. The conflict created a climate of geopolitical uncertainty, driving investors to safe-haven assets.

10.2 Why Gold Demand Rose

As the war raged, investors sought the safety of gold. Geopolitical uncertainty always boosts demand for gold. The war caused inflation to rise, making gold more attractive as a hedge. Some countries started diversifying away from the US dollar, increasing their gold holdings.

10.3 Gold Price Reaction

Here’s what happened to gold prices:

| Date | Gold Price per Ounce |

| January 2022 (Before the War) | $1,800 |

| March 2022 (Peak Price After Invasion) | $2,070 |

| December 2023 (Ongoing Conflict) | $2,050 |

Gold prices surged in the immediate aftermath of the invasion and have remained elevated due to the ongoing conflict.

Conclusion

From the ashes of the Great Depression to the uncertainties of the Russia-Ukraine war, the gold has behaved as a real money. Paper currencies have devalued, but Gold’s appreciated both in demand and value.

Our journey through a century of global crises reveals a recurring pattern: when fear and uncertainty grip the markets, investors flock to the perceived safety of gold.

Gold isn’t just for weddings and festivals; it’s a strategic asset that can help protect our wealth during turbulent times.

Understanding the gold’s role as a safe haven can empower us to mandatorily allocate a part of out funds to gold (physical gold). Stay away from E-gold, particularly of types like Sovereign Gold Bonds.

Diversify wisely, invest for the long term, and remember: gold has weathered storms for centuries, and it’s likely to continue doing so.

Have a happy investing.