As the world of investments and IPOs continues to evolve, the Swiggy IPO has been a topic of significant interest among investors. Given its status as a leading food and grocery delivery platform in India, it was expected that Swiggy IPO will make some buzz. Here’s what you need to know about the Swiggy IPO allotment status as of today.

Topics

1. Overview of the Swiggy IPO

Swiggy, headquartered in Bangalore, launched its Initial Public Offering (IPO) with the aim to raise approximately Rs.11,327.43 crore.

The IPO opened for subscription from November 6 to November 8, 2024. Its shares were priced in the band of Rs.371 to Rs.390 each.

This price range reflected a potential market cap of around Rs.95,000 crore at the upper end of the band.

Swiggy’s IPO was structured to include a fresh issue of shares worth Rs.4,499 crore and an offer for sale (OFS) valued at ₹6,828.43 crore.

2. Subscription and Demand

The Swiggy IPO saw a total subscription of 3.59 times. This is an indication of a healthy appetite from the market, albeit not overly exuberant.

The breakdown of subscription showed:

- Qualified Institutional Buyers (QIBs): Oversubscribed by 6.02 times, indicating strong institutional interest.

- Retail Individual Investors (RIIs): Subscribed 1.14 times, showing moderate but not overwhelming retail participation.

- Non-Institutional Investors (NIIs): Attracted 41% of their allocated portion. It is an undersubscription.

3. How To Check Allotment Process

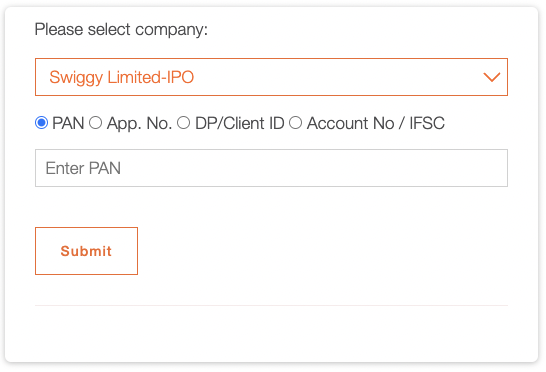

The allotment of Swiggy’s IPO shares was finalized on Monday, November 11, 2024.

If you have applied for the IPO, here’s how you can check your allotment status:

- Link Intime India Private Ltd: As the registrar for the IPO, investors could check their status on their official portal. By selecting ‘Swiggy IPO’ from the dropdown, investors can enter their application number, PAN, or DP/Client ID to see if they have been allotted shares.

- BSE and NSE Websites: Both exchanges provide a section to check IPO allotment. On BSE, one would navigate to the investor services, then to the application status check. Then select ‘Equity’ and ‘Swiggy Limited’ from the drop-down menu. On NSE, a similar process involves logging in with your credentials or via PAN to check the status.

- Bank Notifications: Investors might receive a debit message from their bank if their application was successful. It is an indication that the shares have been allotted with the amount debited from their account.

4. Grey Market Premium (GMP) and Listing Expectations

Interestingly, the grey market has shown a muted response to Swiggy’s IPO. With a GMP hovering around just Rs.1. It suggested a listing price close to the upper end of the IPO price band at around Rs.391.

This is a clear sign that the market seems cautiously optimistic. This could indicate a flat or slightly positive listing. There will not be a explosive debuts seen in some other tech IPOs.

5. Aswath Damodaran’s View on Swiggy’s IPO

According to Aswatch Damodaran, Swiggy’s IPO presents more than just an investment in food delivery. It’s a play on India’s economic evolution.

Damodaran explains that buying into Swiggy means betting on broader changes in India’s urban infrastructure and consumer behavior.

Damodaran argues that Food delivery in India is not just a service. It’s a response to the country’s congested urban layout, where time-saving conveniences carry substantial value.

A “Time Arbitrage” Opportunity

Damodaran compares Swiggy and Zomato, noting that both operate on a “time arbitrage” model.

In this approach, they capitalize on the inefficiencies of urban infrastructure to provide services that help customers save time.

Zomato, already a market leader, leverages this model effectively. Swiggy hopes to follow suit of Zomato in times to come.

However, Damodaran is cautious about Swiggy’s position in the market. He suggests that it trails Zomato in maturity and financial performance.

This can be a fair justification of Swiggy’s lower valuation as compares to Zomato’s.

Quick Commerce: A Trend, But With Skepticism

Addressing India’s “quick commerce” trend, where essentials are delivered within minutes, Damodaran shows skepticism.

While he acknowledges the growth potential for companies like Swiggy and Zomato, he questions whether the quick-commerce model has long-term value.

However, he points out that Swiggy’s established network of delivery drivers may give it an edge in adapting to evolving consumer demands, whether that means groceries or other services.

Valuation vs. Price: Swiggy’s Market Position

Damodaran highlights a distinction between Swiggy’s “price” and its “value.”

Swiggy’s current valuation might reflect its position as a secondary player in the food delivery space, especially when compared to Zomato, which has already made strides toward profitability.

Swiggy, still grappling with losses, requires patient investors willing to look past immediate financial results.

Damodaran advises investors to focus on Swiggy’s potential to capitalize on India’s infrastructure issues, rather than just recent numbers.

Long-Term Vision Required for Investors

For long-term investors, Damodaran stresses the importance of realistic expectations.

Swiggy’s current financial state, with its history of losses and cash flow challenges, might deter short-term-focused investors.

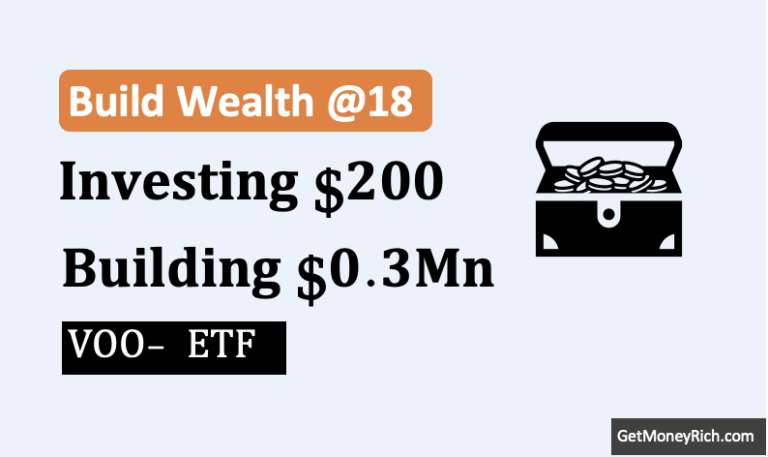

However, he believes Swiggy’s plan to use IPO funds for tech upgrades and brand expansion is essential for expanding in India profitably.

Damodaran’s view on Swiggy’s IPO is measured.

While he sees potential for Swiggy to grow by leveraging India’s infrastructure gaps, he advises caution.

For those betting on Swiggy, the expectation is that it will use its resources to become a more versatile platform and establish itself as a player that can adapt to India’s unique market challenges.

Conclusion

While Swiggy’s IPO did not see the frenzied demand of some high-profile tech listings, it still managed to attract a broad base of investors. I think, long-term investors have shown confidence in its business model and growth potential.

The subdued grey market activity might suggest a conservative investor outlook. It is perhaps due to the ongoing challenges in turning profitable.

Have a happy investing