Systematic Transfer Plan (STP) is a useful tool like Systematic Investment Plan (SIP). SIP has become a synonym for mutual fund investing. People prefer buying mutual fund units through SIP route.

Hence these days, it is not necessary to explain the meaning and purpose of SIP to people. But the concept of Systematic Transfer Plan (STP) is still not as common. Why? Because Systematic Transfer Plan (STP) has more utility for those investors who want to invest a lump-sum amount in equity funds.

When it comes to lump-sum investing, risk is high. Investors who do not know how to mitigate this risk, they can take STP as a preferable route.

But this is also true that STP may not be useful in all types of lump-sum investing. What do I mean? We will discuss about it is this article. But first, lets start with more basic theories…

- Suggested Reading: What should be the thought process of investing 10 lakh Rupees?

Lump-Sum Vs Gradual Investing

How lump-sum investing differs from gradual investing (in our mind)? This is an important understanding which will further help us to get a deeper feeling about STP, it’s advantages, and it’s limitations.

- Gradual Investing: Retail investors mostly invest gradually. Why? Because our inflow of income is gradual. A portion of proceeds from monthly salary/income is first saved every month. Then out of these accumulated saving, money is invested gradually. An example of gradual investing is monthly SIP’s.

- Lump-Sum Investing: Retail investors will resort to lump-sum investing in two cases. First, when windfall cash inform of bonus, ex-gratia, arrears, allowances gifts etc is received. Second, in a market scenario where lump-sum investing becomes tempting (like today – in a bear market scenario). But not many knows how to invest a lump-sum amount. This is where STP can help.

SIP cannot handle lump-sum investing…

Why SIP is so popular? Because it enables people to automate their investments. Every month people need not think about how much to invest and where to invest. SIP does it for them automatically.

But SIP is not sufficient to deal with lump-sum amount available for investing? Why? Because of two reasons:

- First: In SIP, lump-sum amount stays in “savings account” for an extended time. Only small-small portion gets invested every month. The balance remains in the savings account. Hence, there is a chance that the savings may get spent on needless things (read: how to stop overspending). On the other hand, STP can lock all funds in one go.

- Second: Money which remains in the savings account earns a meager interest rate (4% p.a.). SIP can do nothing about this balance amount idling in our bank account. But if one follows the STP route, the residual amount also earns a better return than a savings a/c interest. Read: How to invest money.

Idle money is more prone to getting spent due to temptations. Essential is to lock ones money before the temptations starts to kick in. What is the solution? Systematic Transfer Plan (STP) can help.

Equity Vs Debt

Yes, STP is a tool using which one can invest lump-sum amount with minimum possible risk. How? To understand more about it, let’s first know a bit about equity and debt based mutual funds.

- Equity Based Funds: Investing in them is risky as in short term its price (NAV) remains volatile. Hence it is advisable to ‘invest gradually’ in equity. This helps us to take advantage of the rupee cost averaging. Read: How a beginner can start investing.

- Debt Based Funds: Investing in debt funds is considered safe. Their returns are predictable hence are referred as risk free. If one has no clue of where to invest money, opting for debt fund is better. As there is no risk of erosion of the principal amount in debt funds, investing here is safer.

Why STP investing is less risky? Because through STP one actually invests in a combination of debt based and equity based funds. But it is not like investing in balanced mutual funds (Hybrid funds). The process is different. We will know more about STP in next paragraphs…

Systematic Transfer Plan (STP)

Systematic Transfer Plan (STP) is a combination of three steps as shown above. In step #1 & step #3 people actually buy mutual fund units. Step #2 is where units bought in step 1 is redeemed gradually. Let’s see these steps in more detail:

- Invest Lump-Sum: In this step, the investors invests a lump-sum amount in a risk free mutual fund (debt fund). Here the purchase of mutual fund units are done in one go. This is what common people are really afraid of doing. But STP enables people to invest a lump-sum amount with a comparative ease. How? Because here the investment is made in a debt fund which is almost risk free.

- SWP: It is an acronym for Systematic Withdrawal Plan. In this step, a certain decided amount is gradually generated by selling units of debt funds bought in step 1. Not all units of debt funds are sold at a time. Example: small-small number of units are sold each month. The money so generated is then reinvested in step 3. Read: About income generation.

- SIP: It is an acronym of Systematic Investment Plan. This is a tool which can be used to buy units in equity funds gradually. When units of equity funds are bought like this (in a phased manner), the risk of making a loss is highly minimised. People who do not know how to time the market, for them SIP is a great risk hedging tool.

How STP helps in lump-sum investing? Once all the amount is invested in a debt based fund (in lump-sum), the investor gets a breathing time. From here onwards, transfer of money is gradual from a debt fund to an equity fund. But there is a limitation – the transfer can be within the same fund house.

A more visual representation of STP…

Investment steps of STP:

- First Step: As soon as the lump-sum amount gets credited into bank account, go to moneycontrol or valuereserachonline and pick a good debt based & equity based mutual fund. The units purchased of a debt based fund is the beginning of the process.

- Second Step: In the second step you will decide an amount which you would like to withdraw (SWP) each month from the debt fund for onward investing (SIP). This amount can be fixed or variable. We will know more about this in types of STP.

- Third Step: The amount decided in 2nd step gets automatically invested (like SIP) to buy units of a pre-decided equity based fund. In an STP, there is a limitation on number of transfers from a debt fund to equity fund. Example: Minimum of 6 transfers from a debt fund to equity. Read more about other limitations.

Tip: If you have subscribed to tools like fundsindia or scripbox, they make the whole implementation of STP very easy. FundIndia will carry on the process of systematic transfer of money from one mutual fund scheme (debt) to other scheme (debt) (of the same fund house) in a seamless manner.

Example of Systematic Transfer Plan (STP) – used alternatively

This is an example of a person who has self-accumulated the retirement corpus over time in an equity based fund. Say the person has accumulated 12,00,000 number units of a said equity fund. But when the person is nearing retirement, it was necessary to secure the accumulated corpus.

Hence, when the person was only 2 years away from retirement, he decided to move out his funds from equity into debt. He can gradually make the transfer in these 2 years. How? Say by selling 50,000 nos units each month for next 2 years (50000×24 = 12,00,000 nos).

This is an alternative example of systematic transfer of money from equity to debt based mutual fund. This was done by initiating a systematic withdrawal from equity fund. At the same time, instruction was also given to utilise the withdrawn amount to buy units of a debt based mutual fund.

By the time the person has retired, all his accumulated corpus was safely parked in a debt mutual fund. The units of debt fund can now be sold anytime without caring about the volatility.

Who should consider using STP for investing?

Anybody who is thinking to invest a lump-sum amount in equity, but is not sure of the market movements, can use the STP route. There are few clear benefits of Systematic Transfer Plan (STP):

- Lump-sum investing: STP makes lump-sum investing in equity (for a novice) less risky. How? Because the lump-sum amount is first parked in a debt fund. These debt funds have a definite returns over time.

- Investing Automation: For people whose savings are erratic can use STP. They can use their variable monthly savings to buy units of a debt fund over time (say 1 year). Once sufficient units are accumulated, the fund house can be instructed for STP from this debt fund into a suitable equity fund. Meantime, go on feeding the debt fund as well using monthly savings. See this example.

- Higher Returns than SIP: Suppose we have a lump-sum amount (Rs.200,000) available for investing. How SIP can be done out of it? First, by parking this money in savings a/c. Then each month a fixed amount of money will be debited from the savings account to buy units of a mutual fund. But here the interest earned on deposit in savings a/c is only 4%. But if the money is parked in a debt fund, it can easily earn 7% returns.

- Investing in a Falling Market: Consider a case where the stock market is correcting – like today (Mar’20). A person who is not comfortable with equity investing, can invest a lump-sum amount in a liquid fund. From this liquid fund, units of an equity fund is purchased each month. When units are purchased in a falling market, over time the capital appreciation will be great (see this example).

- Investing in a Volatile Market: What is a volatile market? When index keeps fluctuating up and down. It is almost impossible to time the market then. During such times, a lump-sum investor can use STP to buy units of equity fund.

When STP should not be used for investing?

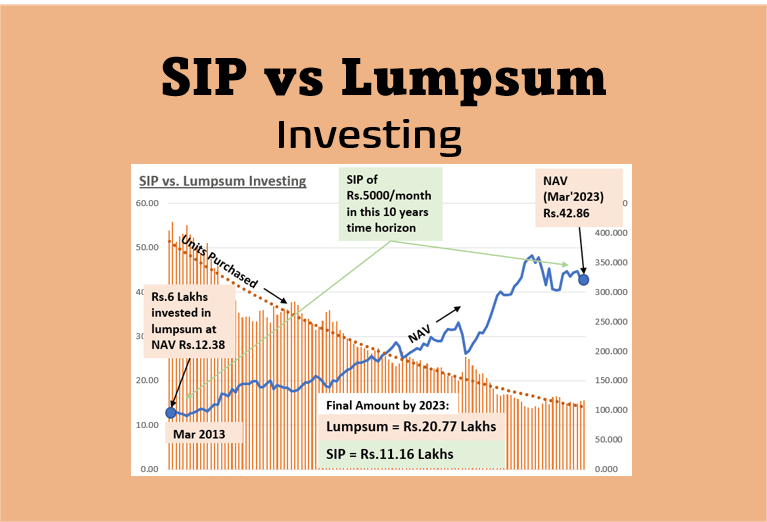

STP will not give good returns in a bullish market. There was a very strong bear phase in year 2008-09 due to sub-prime mortgage crisis. But post 2009, till next 3 years, the market was bullish (only going up).

During such times, use of STP to accumulate units of equity fund will not be profitable.

It must be kept in mind that, STP is for those investors who are not sure about the market. These are people who are ready to earn slightly lesser but assured returns. The same logic applies for SIP as well.

But for people who are more confident and knowledgable about equity investing, they can time the market well. For them lump-sum investing in equity will always fetch higher returns than SIP or STP.

Points To Remember About STP?

Like SIP, STP is also a way of automating our investments. But STP is more used to invest a lump-sum amount. Whereas SIP is a tool to invest small-small amounts each month. Here are few points to note about STP:

- Same Fund House: Systematic Transfer Plan works between two mutual fund schemes. The invested money is first redeemed by selling units of source fund (a debt fund). Then, the amount is reinvested in a destination fund (an equity fund). But this transfer can take place between mutual fund schemes of the same fund house.

- Exit Loads: Investors can maximise their returns from STP by choosing a source fund (say debt) which has no exit loads. Exit load is a charge levied by the fund house during sale of units. This can bring down the overall returns of STP. There are lot of debt funds which charge no exit loads. Better to opt for such funds.

- STP Frequency: Once a lump-sum amount is parked in the source fund (say debt), money can be transferred to destination fund systematically. The frequency of transfers can be daily, weekly, monthly or quarterly. This frequency must be decided by the investor.

- Minimum Withdrawal Amount: Though most mutual fund scheme allows systematic withdrawal (SWP) of as low as Rs.500 per transaction. But some fund house/scheme has a cap. This can can range between Rs.500 to Rs.4000 per withdrawal. An investor must clarify this point before starting a STP.

- Number of Transfers: An investor MUST clarify this query before starting a STP. Why? Suppose you have invested in a liquid fund. After first 3 withdrawals you want to stop the transfer from liquid fund to equity. This may not be allowed. Why? Because there is a limitation of minimum number of withdrawals in STP. Some schemes has minimum 6 withdrawals, some may have more. It is better to clarify this point before investing.

- Minimum Amount in Source Fund: Source fund is where you have parked your initial investment (say debt fund). It may not be possible to start a STP with only Rs.10,000 (say) parked in source fund. Mutual funds keep a cap on the minimum amount that a source fund must have to start STP. Get this point clarified before starting.

- Tax Implication: When units of a debt based mutual fund is sold (for profit) before 3 years of holding, STCG (Short Term Capital Gain Tax) is applicable.

Types of STP

There are mainly three types of Systematic Transfer Plan (STP) which can be utilized for lump-sum investing.

- Fixed STP: Suppose you have invested Rs.200,000 in a liquid fund. Henceforth, you would like to invest a sum of Rs.16,667 each month, for next 12 months, in an equity based mutual fund. The amount of Rs.16,667 becomes a fixed investment. Hence, this type of investing is referred as Fixed STP.

- Capital Appreciation STP: Suppose you have invested Rs.200,000 in a hybrid mutual fund. Say this fund yield a return of 10% p.a. Which is approximately Rs.5,000 per quarter. But this amount can vary depending upon the actual market performance. Hence, you have instructed your fund manager to redeem only the appreciated amount every quarter, and invest it in an equity fund. Here, every quarter the onward invested amount varies based on the actual capital appreciation. Hence, this type of investing is referred as Capital Appreciation STP.

- FlEX STP: It is a term commonly used for Flexible STP. What is Flexible STP? It is basically a Fixed STP with a small variation. In normal market times, a fixed STP amount get invested from debt to an equity scheme. But when market falls, a higher STP amount is invested. The calculation for the higher STP amount is based on a formula. A good example of FLEX STP can be read here.

How Will I use STP for myself?

I would use the process of Systematic Transfer Plan (STP) in a manual mode. What has been described till now is about STP in automatic mode.

First allow me to explain why I’m saying so? I’m a blogger. My income is not fixed. Even when I was in my job, every month my savings were not the same. They used to vary depending on my expense patters (Read more about expense tracking).

Hence, I would not prefer a pre-fixed amount (like SIP) being debited from my savings account for onward investing. Having said that, I would also not like to let my “variable savings” to idle in savings account. So what I’ll do?

I would let my variable monthly savings buy units of debt fund. This becomes like a “manual SIP”. If I save Rs.5,000, I’ll use it to buy units of debt fund. If I save less than Rs.5,000, I’ll buy less number of units. This way, my variable savings will continue to buy units of a “risk free” investment option. This option will yield better returns than money parked in savings a/c.

Now, whenever I see a market correction, I would sell a portion of units of my debt fund. The sale proceeds of this investment will be used to buy units of an equity based fund.

Though this whole process is manual, but it works for people like me who do not have an assured (fixed) income. This is an idea I’ve implemented after observing the process of STP.

Example of STP in a Falling Market

Suppose you got a bonus of Rs.100,000 on December 2007 (Sensex @ 20,800 levels). As the stock market is doing great, you decided to invest your bonus in an index linked mutual fund.

But considering that the Sensex is trading at all time high’s, you will have a doubt in your mind that whether it will be good to wait for the correction. So here you might do two things: one good and one bad:

- Option 1: Investing in Lump-Sum. You bought units of index fund. But within next 12 month (January 2009), the stock market fell (Sensex @ 8,900 levels). The invested Rs.100,000 will reduce in value to Rs.43,000. Opps! There is a very high chance that you will quit, and exit investment even at a loss.

- Option 2: Investing in Lump-Sum considering a possible correction. You bought units of a debt mutual fund. Then you allowed an STP of Rs.5000/month from debt to an equity fund. Why you will do like this? Because if Sensex is trading at all time highs, it a precondition that a bear market is around the corner. Investing like this, using STP on Jan’09, could have ensured windfall gains.

For me, Systematic Transfer Plan (STP) is one investment strategy that makes even a common man act like a wise investor (but in a falling market).

Limitations of Systematic Transfer Plan (STP)

STP is useful only for those people who have lump-sum money available for investing. Systematic Transfer Plan (STP) is effective for such people. They can invest a lump-sum amount in equity by taking minimum risk.

But there are two limitation of STP which is not as visible, but must be known to all investors. What is it?

1. Does not work in a rising market

From January 2012 to March 2015 (3 years), the Sensex only rose higher and higher. In such a condition (which happens rarely), Systematic Transfer Plan (STP) will not prove as beneficial.

In such condition, one time lump-sum investment will fetch better returns (Buy low and Sell High).

2. Short Term Capital Gain Tax

Another limitation of Systematic Transfer Plan (STP) is related to taxation. When a debt linked mutual fund is redeemed before 3 years, the profit portion will be taxable (capital gain tax).

Systematic Transfers (selling of units) from debt to equity mutual fund is treated as redemption. And as the redemption is from a debt linked fund, income tax cannot be avoided. If redemption is made after 3 years of purchase, long term capital gain tax will be applicable.

Conclusion

Income tax liability is one compromise which one should accept in STP. If the market is falling, and you have a decision to take between tax savings and investing, go for STP. Why?

Because we are paying small-tax today, to earn a potential high future returns from equity. The return from equity linked investing will be so high that the meager tax liability will not count much.

The only criteria in STP is to anticipate a possible stock market correction, and hold equity linked mutual fund units for at least 2-3 years.

I’ve learnt that STP is a tool which can always keep your savings invested. Check this example.

Very informative and easy to follow for exercising in actual.

Wow! After reading many many posts on several personal finance related blogging sites, this by far is the most comprehensive article i have come across. Simple to understand and all the information in one place.

Thanks for the feedback

This article is very helpful for a systematic transfer plan, so very nice…

Very informative …thanks for this ..

My pleasure. Thanks.