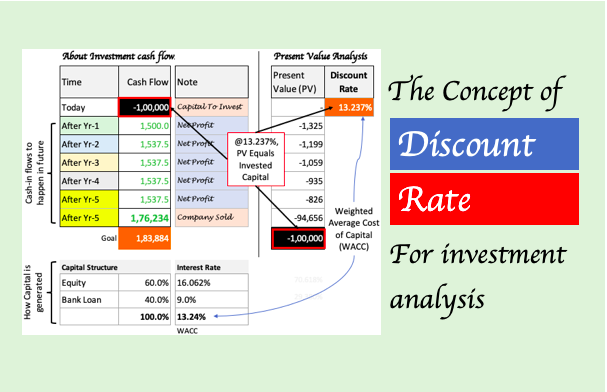

WACC Examples And Applications In Real-World Scenarios

WACC Calculator Enter values to calculate the Weighted Average Cost of Capital (WACC) and gain insights for your financial decisions. Market Value of Equity ($): Market Value of Debt ($): Cost of Equity (%): Cost of Debt (%): Tax Rate (%): Calculate WACC Explore WACC Applications Click on a scenario to learn how WACC is…