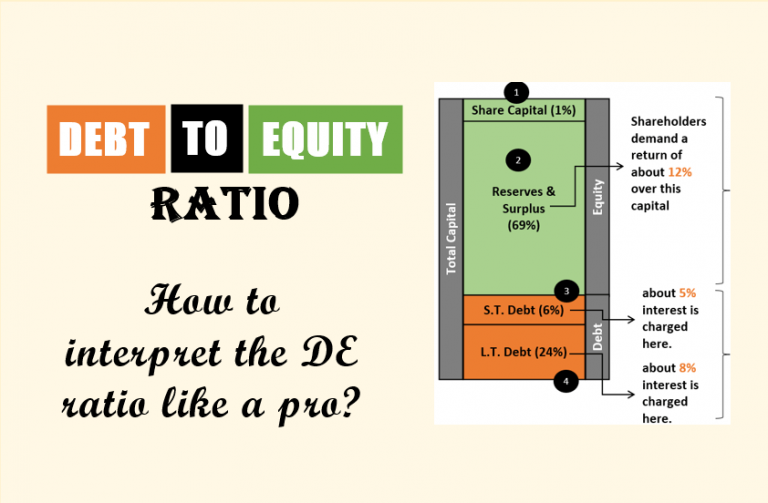

Understanding the Debt-to-Equity Ratio: What It Is and Why It Matters?

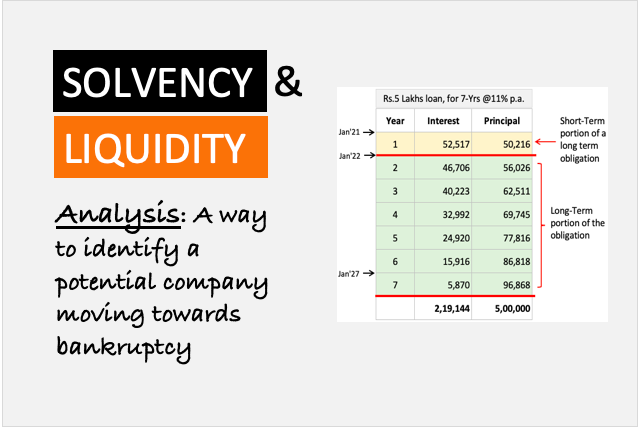

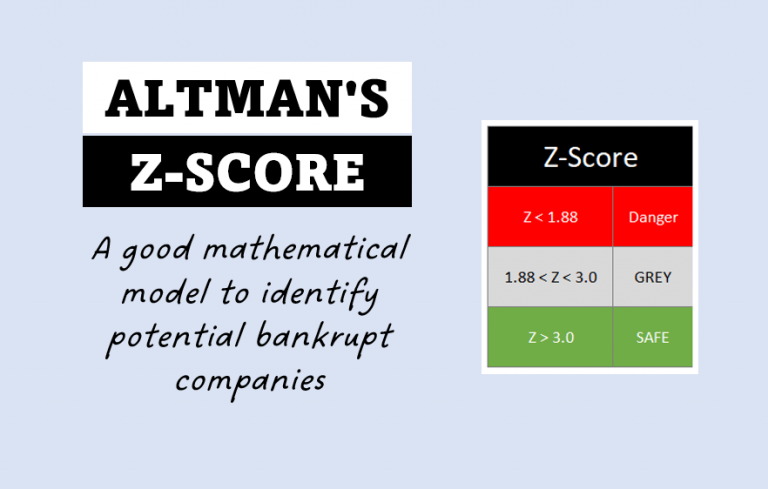

The debt-to-equity ratio (D/E ratio) is a critical financial metric that provides insight into a company’s financial leverage and overall risk profile. It compares a company’s total liabilities to its shareholder equity, offering a clear picture of its capital structure. We will explore what the D/E ratio is, why it is important, and how it…