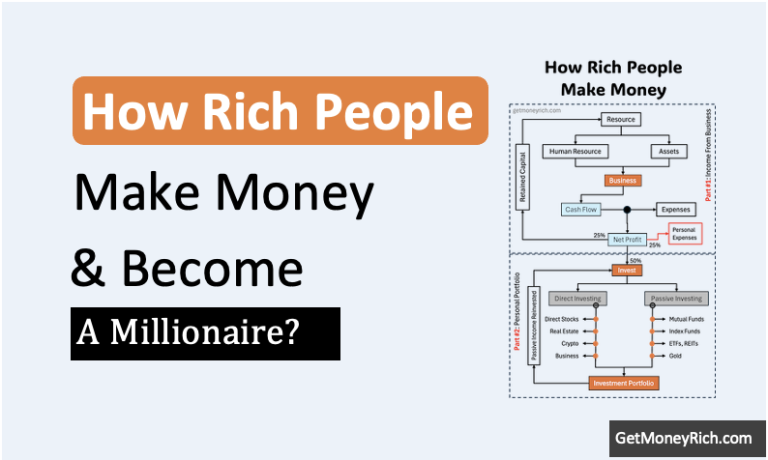

How Rich People Make Money [A Simple Guide]

Summary Points: I’ll explain how rich people focus on cash flow and net profit to grow their business, like my example of an ice-cream store. Check this mind-map You’ll see an example where how profits was split as 25% for business growth, 25% for family, and 50% for investing. I’ll share how they use direct…