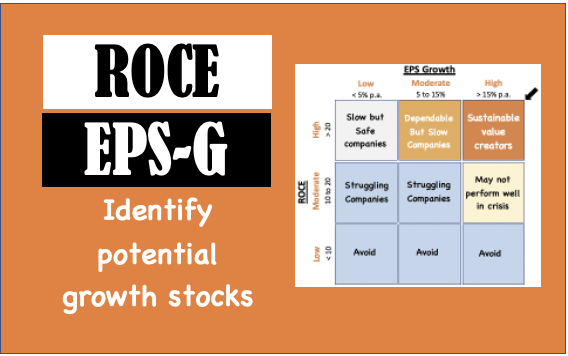

Effect of Profitability and Growth On Company Valuations [Intrinsic Value]

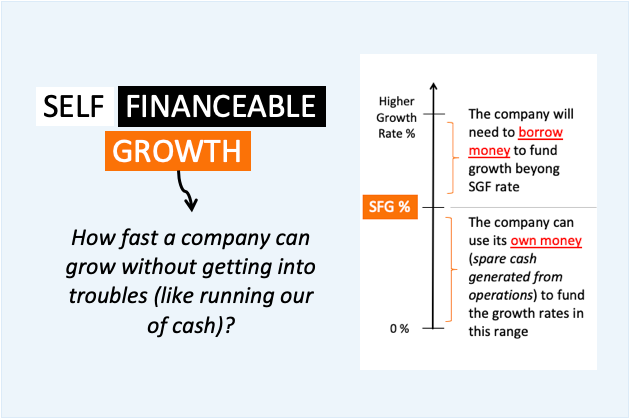

Deciphering the factors that influence company valuations is crucial for investors. Two key metrics that play a pivotal role in valuations are profitability and growth rate. We’ll understand how profitability and growth collectively affect the valuations of companies. We’ll use examples to get a hold of this correlation. Effect of Profitability (Example #1) Suppose there…