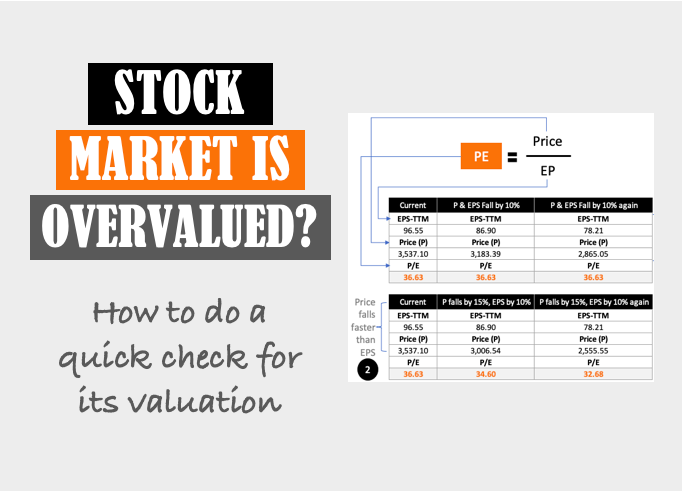

How One Can Verify Stock Market Valuation – Overvalued or Undervalued?

There is no doubt that Nifty and Sensex are trading at their all-time highs. For the last two days, from 19-Oct’21, the market is showing signs of correction. In days, the Nifty50 has fallen by about 2.5%. So, our stock market is overvalued or undervalued? People are waiting for a sizeable correction of the market….