Liquidity vs Solvency | Financial Health Indicator | Stock Analysis

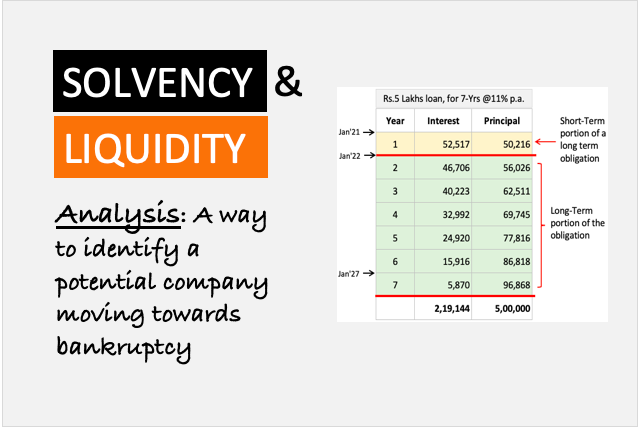

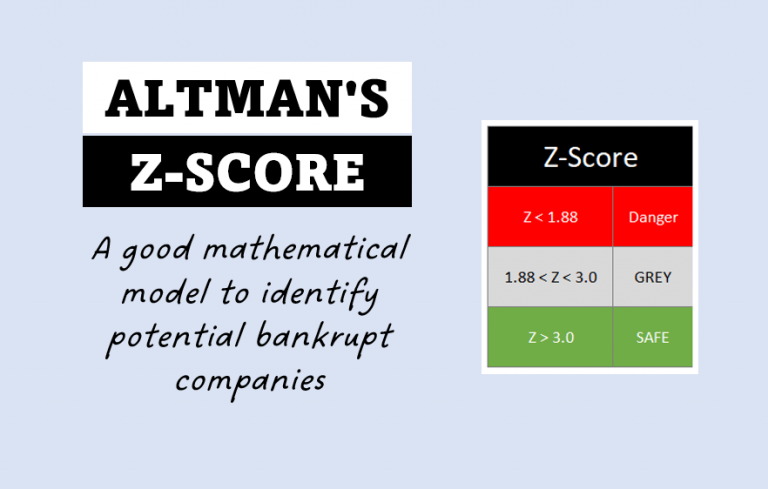

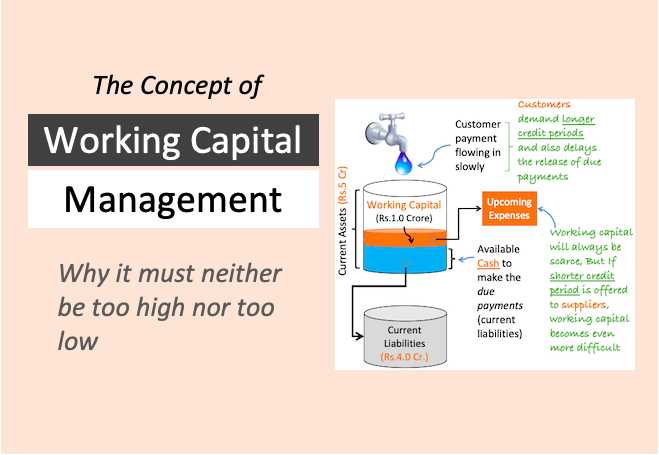

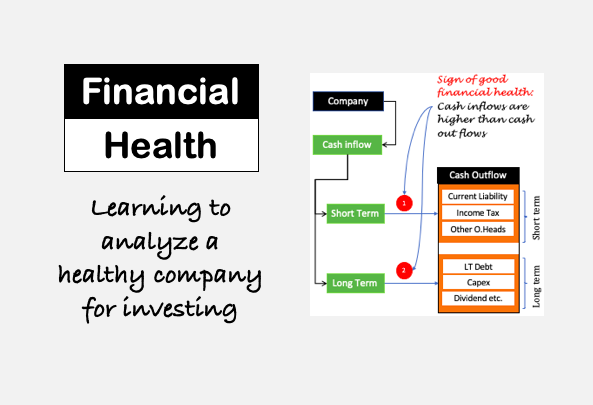

The objective of this article is to emphasize the need for maintaining basic liquidity and solvency levels for a financially healthy company. We’ll learn about liquidy vs solvency from the eyes of a stock investor. We’ll look at the concept and financial metrics that will help to quantify and comprehend a company’s liquidity and solvency…