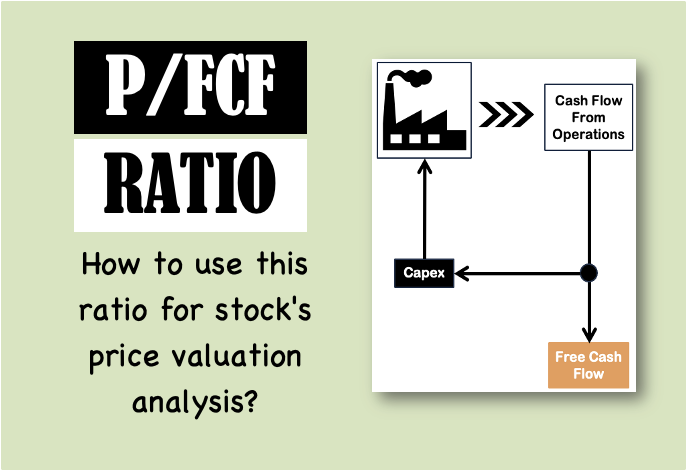

Price to Free Cash Flow (P/FCF) Ratio

The Price to Free Cash Flow (P/FCF) ratio is a valuation metric that compares a company’s stock price to its free cash flow. By dividing the stock price by the free cash flow per share, the P/FCF ratio provides insight into how much investors are willing to pay for each unit of cash generated by…