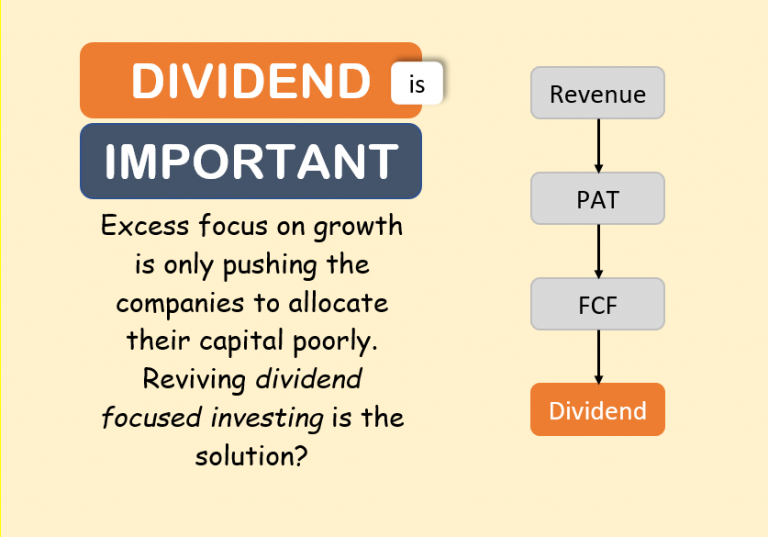

Why Dividend is Important?

Buying stocks of a company makes one a proportional owner of it. Suppose there is a company whose shares you own. This company made about Rs.2,140 crore net profit in a financial year (FY). Let’s assume that this profit was also collected as cash in the same FY. If you are a majority shareholder of…

![ROI Formulas: CAGR and XIRR, Meaning, Full Form, Use in Excel [Mutual Funds]](https://ourwealthinsights.com/wp-content/uploads/2018/04/How-to-measure-investment-returns-Image.jpg)