Retirement Planning Calculator [India]

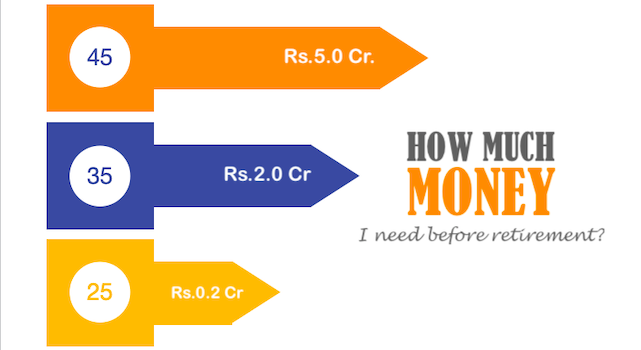

Unlock the secrets of retirement planning in India with this comprehensive calculator. Discover how age, income, and investments shape our financial future. I’ll suggest you, explore all the variables of the calculator. There are 14 number variables that shape the final result. Change a few tiny bits in each of the variables and observe how…

![Income Tax Slabs: Tax Liability Comparison Between 2020 and 2019 [Calculator]](https://ourwealthinsights.com/wp-content/uploads/2020/02/Income-tax-slabs-Image.png)