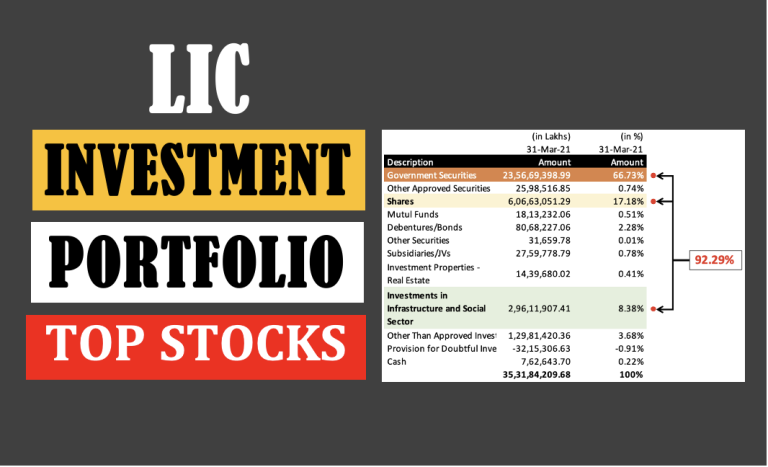

Uncovering the LIC Investment Portfolio: Where LIC Invests Its Money?

During this Adani-Hindenburg saga, there is a concern that the LIC Investment portfolio is over-exposed to Adani Group company’s stocks. I think this concern looks misplaced. Out of the total capital of LIC, only 17% (INR 60.6 lakh crore) is invested in stocks. My estimate is that, out of these 60.6 Lakh crores, LIC’s exposure…