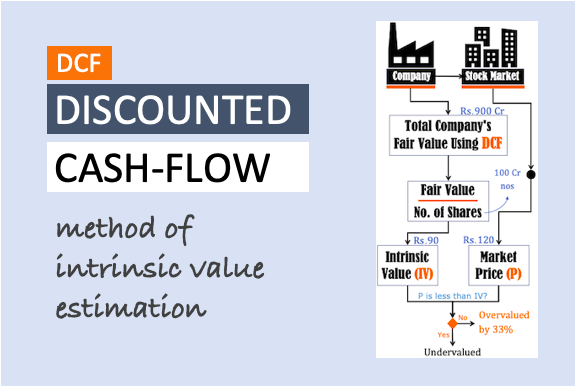

Discounted Cash Flow (DCF): How to use it for Stock Valuation?

[Updated] Discounted Cash Flow (DCF) method is a better way of intrinsic value calculation. The DCF model is derived from a concept called Net Present Value (NPV). Why Intrinsic Value is required? Because based on it, one can judge if the stock is fairly priced or not. DCF method is not an easy way of doing price…