Is the DCF Model Flawless? The Limitations of Discounted Cash Flow (DCF) Model

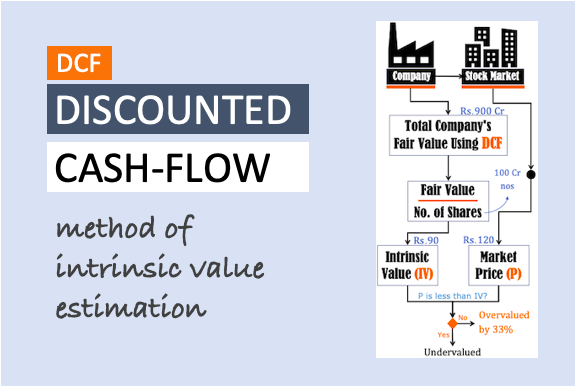

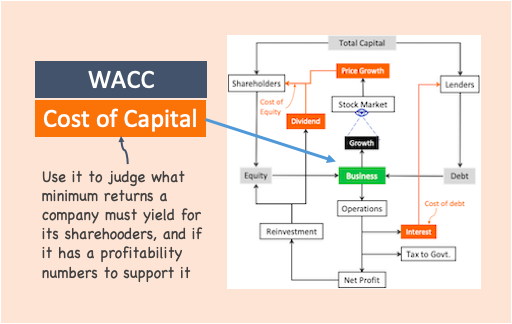

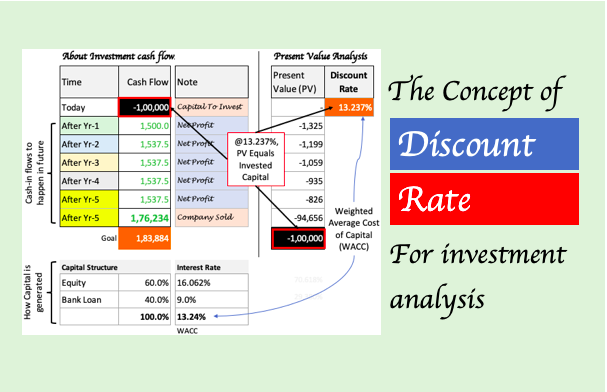

While the discounted cash flow (DCF) model is a widely used method for valuing stocks. But it is not without limitations. Let’s examine the limitations of discounted cash flow (DCF) model. The limitations are with respect to present value calculation based on the future growth rate, cash flow estimation, and discount rate. The article will…