These days we often hear the phrase called “taking a haircut”. What does it mean, and how it effects a common man?

In simple language, taking a haircut means “agreeing to settle a deal for a loss”.

Why banks would agree to accept a loss making deal?

To understand this, one must first understand what is the main ingredient of the deal.

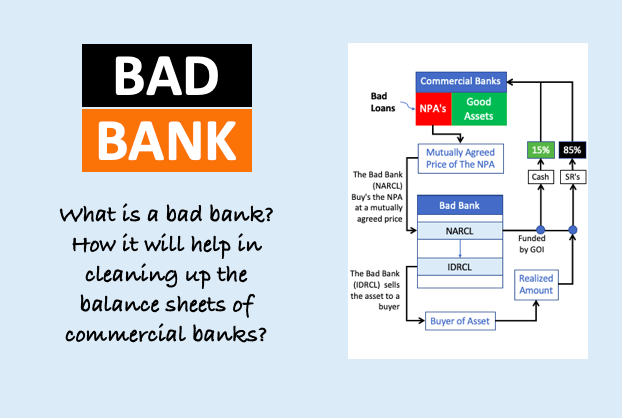

The deal is about the long overdue NPA (Non Performing Assets).

Who are on the table for this deal?

- Lender of loan- Bank.

- Borrower of Loan – Company, Individual etc.

What are NPAs? Those loans issued by banks whose repayment (both principal and interest) has not been made since long time.

But why banks allowed such non-repayment of loans in first place?

Because the borrower (company or individual) declared self as “bankrupt“.

Means, it can no longer pay its bills or pay any dues arising out of any financial obligations.

Easy, right? First take the loan. Make a mess of this money. Then declare self as bankrupt.

Finally make a deal with banks and ask them to take a haircut.

It looks all unfair, right?

So this questions props-up again, why banks should get into a loss making deal in first place?

Lets consider an example…

Kingfisher Airlines loan outstanding Rs.6,963 Crore.

Vijay Mallaya offered to pay only Rs.4,000 Crore to banks.

Indian Banks consortium led by SBI refused this proposal saying that they will not take this haircut.

How much is the haircut here? Loss of Rs.2,963 Crores (6,963 minus 4,000).

Today in hindsight, it looks only fair that the consortium of banks should have agreed to take those Rs.4,000 crore and settled the loan once and for all.

Why I say so? Because almost 4 years have passed, and Indian Banks has received virtually nothing.

Vijay Mallya fled the country. Bank’s consortium has to fight case in UK court.

Kingfisher Airlines is dead. Hundreds of employee lost their job. Airlines service in India saw a huge beating.

Who lost here? Everyone, country, airline industry, business, employees, consumers, overall business sentiment and what not.

These are typical examples where it seems, accepting a haircut could have reduced the pain for everyone.

Another example of haircut…

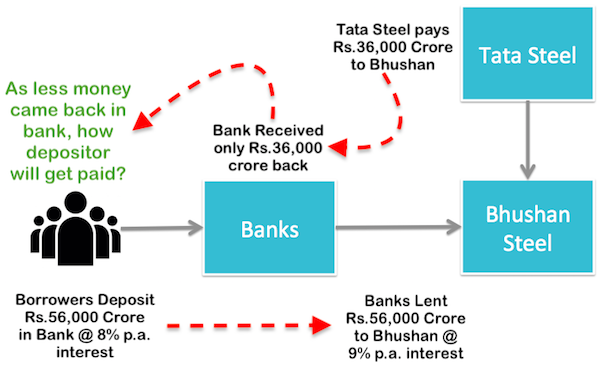

Bhushan Steel had a total loan outstanding of Rs.56,097 Crore.

Tata Steel offered to pay Rs.36,000 (approx) crores in exchange of 72.65% stake in Bhushan Steel.

Here the banks agreed to take a haircut (loss) of almost 20,100 Crore.

How Banks went forward for this deal?

The company (Bhushan Steel) facing bankruptcy, has to face the actions as per Insolvency Act.

One of the possible action was, asking for bids for takeover of the bankrupt business.

What are the benefits in proceeding like this?

- Banks will get back at least 65% of the loan amount.

- Bhushan Steel will not go for lockdown.

- Employees will not loose jobs.

- Tata Steel will get a majority stake in their competitors business.

Negative side of haircut.

Why banks agree for haircut?

Because it is better to get something than nothing.

The line of thought is not wrong. Because a bankrupt business anyways cannot pay anything.

Alternatively, what banks can do is to seal the assets of the bankrupt business and sell them.

But often such distressed selling are even less lucrative than haircut.

Moreover, individual selling of all assets of a business calls for a lot of effort and cost.

Hence a better alternative is to crack a deal like Bhushan-and-Tata.

But there is a negative side of such a haircut deal.

On one side banks can claim that, taking a haircut is better than encountering further losses.

But the question is who bears the loss of the haircut?

Government, RBI or Banks? I suppose none. Even depositors will not be said that their money is lost.

So who actually bears the burn of a business going bankrupt leading to non-repayment of dues?

My assumption is, it is the economy that will have to pay the price is long term.

In most likely case, government will issue bonds to RBI. RBI in turn will infuse more currency in the system.

More currency will eventually lead to higher inflation.

Inflation caused by actions like currency printing, to makeup for the lost money, cannot be good for the economy.

Read more about why printing more currency is detrimental for the economy.

Suggested Reading:

While a bank bear losses then in that condition the equity side of that bank will be written off equivalent to the amount of loss faced by bank.