Summary Points:

- India: At a Rs.50L CTC, you face a 26% income tax hit (Rs. 13 lakhs), plus GST (avg. 12% of spending), pushing total tax to 32.2%, that’s a lot of money.

- USA: A PPP-equivalent of (Rs.50 Laks) $171,429 salary sees 25.4% in federal taxes ($43,619), with 7% sales tax bumping it to 29.1% – big salary, but payroll taxes are not pleasant.

- Dubai: Zero income tax on AED 240,000, just 5% VAT, so total tax is 3.5% – dreamy, but healthcare’s on you and education is very expensive.

- Takeaway: India and US slug it out around 30%, while Dubai’s a tax haven; each has trade-offs—familiar grind, structured chaos, or cash-rich freedom?

Introduction

Taxes always feel like that uninvited guest at every paycheck party. Yesterday, I ordered a take-away from an restaurant, and that CGST & SGST pinched. I thought, I’ve already paid my income tax, why I’ve to pay the tax again? I know everyone must bee feeling the same.

This usual chatter keeps going in my mind, how much of my income stays with me, and how much is charged to me as taxes to build roads, schools, or whatever else the government has on its mind? So, I decided to dig into it.

In this post, we’ll compare the tax systems of India, the United States, and Dubai.

We are no stranger to the tax slabs that greet us every year or the GST that pops up on everything from my chai to my car. But what about the US or Dubai? Do they tax the same way? Spoiler alert, they are not even close. You can also jump to the tax comparison table (between India, USA, & Dubai).

India

Let’s start with what we know best, India.

Suppose I have an imaginary friend earning a decent salary, say Rs. 50 lakhs a year (CTC), there are tax slabs that make you pay more tax as your income climbs. I’ll use the new tax regime as my reference.

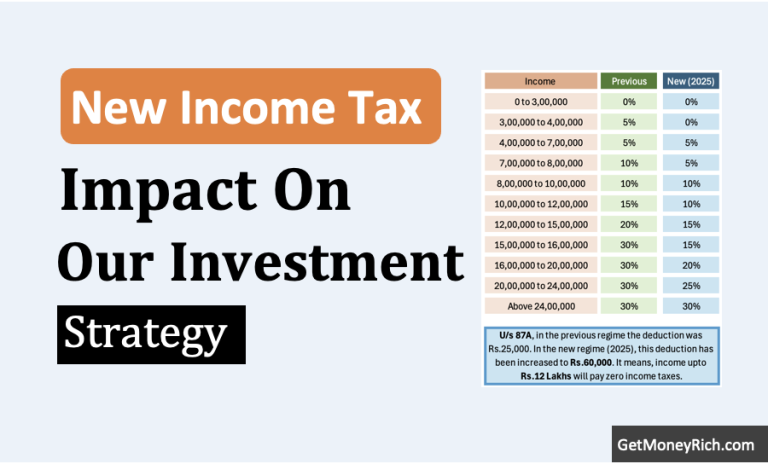

- You pay nothing up to Rs. 3 lakhs,

- Then it starts: 5% up to Rs. 7 lakhs,

- 10% up to Rs. 10 lakhs, and so on,

- hitting 30% for anything over Rs. 15 lakhs.

- If you cross Rs. 50 lakhs, a surcharge kicks in, 10% extra on your tax bill.

- There’s also a 4% cess for health and education.

For my imaginary friend earning Rs. 50 lakhs, after a small standard deduction of Rs. 75,000, the taxable income is Rs. 49.25 lakhs. Crunching the numbers, the tax comes to about Rs. 11.37 lakhs, plus a surcharge of Rs. 1.14 lakhs, and a cess of Rs. 50,000. Total? A hefty Rs. 13 lakhs becomes his income tax liability, which is about 26% of the CTC.

That’s a big chunk. And that’s just income tax.

Walk into a store, and there’s GST staring at you, 5% on your bread, 18% on your phone, 28% if you spend on something fancy like a smartwatch. What about Diesel and Petrol? If you are buying petrol at Rs.105 per litre, about 48% of that cost if taxes.

But it is also true that the money (tax collection) is used builds our highways, funds our schools, and keeps the country running.

Still, I can’t help but wonder, do other countries have it better or worse? Check here the tax comparison table (between India, USA, & Dubai).

The United States

Over there, they’ve got federal income tax with slabs that may sound familiar but there are different.

- For 2025, it starts at 10% for the first $11,600,

- then jumps to 12%, 22%, and

- All the way up to 37% if you’re raking in over $609,350.

Here we’ll take an equivalent Indian salary of Rs.50 Lakhs in the US. The PPP-equivalent salary to our Rs. 50 lakhs, around $171,429 a year, because living costs there are higher, the tax bill adds up fast.

After a standard deduction (say $14,600), the taxable income is about $156,829. The tax?

- Tax will be roughly $30,680.

- But hold on, there’s also Social Security tax (6.2%, around $10,453) and

- Medicare (1.45%, another $2,486).

- Total tax: $43,619, or about 25.4% of the salary.

Not too far from India’s 26%, right?

But here’s an added layer, states can pile on their own taxes.

- Live in California, and you might pay another 10-13%.

- Move to Texas, and it’s zero.

- I’ll keep it simple and skip state taxes for now, but you get the picture that location matters in the US.

Then there’s the indirect tax scene.

No GST or VAT here, but there is sales tax which is anywhere from 0% to 10% (6.5% average).

It’s lighter than India’s GST, but it’s there. Plus, fuel taxes, property taxes, it’s a mixed bag.

The US system feels like a balancing act: you pay for healthcare and retirement through payroll taxes. But you’ve got more control over what’s left.

Do I like US taxes batter than India? I think so. Check here the tax comparison table (between India, USA, & Dubai).

Dubai

There is no personal income tax in Dubai (Zero).

For that same Rs. 50 lakhs, which translates to about AED 240,000 in PPP terms, you keep every single dirham. No slabs, no surcharges, no cess, just pure, unfiltered take-home pay. I did a double-take when I first learned this.

How do they even run a city like that?

Well, they’ve got oil, tourism, and a knack for business. Instead of taxing your salary, Dubai leans on a 5% VAT on most goods and services, way lower than India’s GST or even US sales tax.

But Dubai has excise tax on things like soda (50%) or cigarettes (100%). But unless you’re chain-smoking or chugging cola, it’s barely a blip.

For our friend earning AED 240,000, the tax bill is a glorious zero. That’s 100% of your salary in your pocket. Imagine the possibilities, vacations, investments, or just a fancier apartment with a Burj Khalifa view. I mean, a lot is possible when you so much free available at your disposal. One may choose to splurge, but other may use that cash to make money from money.

But here’s a thought, no income tax means fewer public services funded directly by you. Healthcare, education, etc those often come out of your own wallet or through employer perks.

Is it freedom, or just a different kind of trade-off? For person like me, I’ll take take the cash and plan it the way I want. Check here the tax comparison table (between India, USA, & Dubai)

Comparing the Three

Let’s put this all side by side as a comparison table. Sometimes, numbers tell the story better than words.

Imagine our friend with Rs. 50 lakhs in India, and the equivalent in the US ($171,429) and Dubai (AED 240,000), adjusted for purchasing power.

| Parameter | India | USA | Dubai (UAE) |

|---|---|---|---|

| Salary (PPP Adjusted) | Rs. 50,00,000 (~$58,824) | $171,429 | AED 240,000 (~$65,306) |

| Income Tax System | Slabs (0% to 30%) | Slabs (10% to 37%) | None (0%) |

| Indirect Taxes | GST (0%-28%) | Sales Tax (~6-7%) | VAT (5%) |

| Avg. Indirect Tax % | ~12% of spending | ~7% of spending | ~5% of spending |

| Indirect Tax Paid (Local) | Rs. 3,10,691 | $6,263 | AED 8,400 |

| Tax Paid (Income) | Rs. 13,01,300 (~$15,309) | $43,619 | AED 0 ($0) |

| Total Tax Paid (Direct + Indirect) | Rs. 16,11,991 (~$18,964) | $49,882 | AED 8,400 (~$2,286) |

| Effective Tax Rate (Total) | ~32.2% (16,11,991 ÷ 50,00,000) | ~29.1% (49,882 ÷ 171,429) | ~3.5% (8,400 ÷ 240,000) |

| Take-Home Pay (Post-Income Tax) | Rs. 36,98,700 (74% of CTC) | $127,810 (75% of CTC) | AED 240,000 (75% of CTC) |

What these numbers say to us? India and the US are neck-and-neck with effective tax rates around 30%. But the US gives you a higher PPP salary because of its economy. Dubai, though, is the outlier, zero income tax makes it a winner for raw take-home cash.

Indirect taxes? India’s GST can sting, the US keeps it moderate, and Dubai’s VAT is a gentle tap.

Conclusion

So, where would I rather be?

India’s system feels familiar, but that 26% bite hurts when I think about my EMIs and rising prices. The US offers a bigger salary and a structured system, but those payroll taxes and state variations complicate things. Plus, healthcare isn’t free (likewise in India, its not free for majority middle class), but in the US, it is a lot costlier and complicated than India.

Dubai? It’s tempting. Keeping every rupee (or dirham) sounds like a dream, but the trade-off is a costlier lifestyle and less of a safety net.

I think back to my uncle who moved to Dubai years ago. He’d always brag about his tax-free salary, but then grumble about private school fees for his kids. Meanwhile, my cousin in the US loves the roads and opportunities but curses tax season.

Me? I’m here in India, wondering if our taxes could stretch a little further for better metro lines or cleaner air.

What about you? If you could pick, where would you park your paycheck, India, America’s, or Dubai’s?

I’ll say, the glass looks greener on the other side. I’m happy with my grind in India, and you? 🙂

Have a happy investing.

![Income Tax Slabs: Tax Liability Comparison Between 2020 and 2019 [Calculator]](https://ourwealthinsights.com/wp-content/uploads/2020/02/Income-tax-slabs-Image.png)

A good post. Few points to consider, the analysis is for 50 lakhs, a similar table for 15, 25 and 75 lakhs will make it useful for various is the income group. Also perhaps we can also try to put at what percentile this much earning put the in each country as people often want to relative earnings.