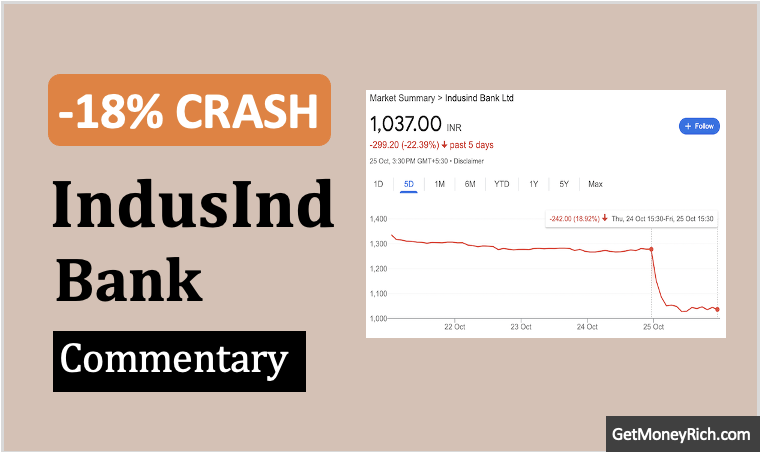

Yesterday I wrote about -27% crash in IndusInd Bank’s share price in a day. Wait, what happened? The bank blamed it on “discrepancies in its forex derivatives portfolio. It sounds like a mouthful of corporate jargon, right? I’m here to break it down in a way that doesn’t require an MBA or a finance dictionary. Let’s chat about what this means, why it matters, and what it might mean for an average person like us who just wants their money to stay safe.

The Big Crash: What Went Down

Picture this: It’s March 11, 2025, and IndusInd Bank’s stock goes from cruising along to falling off a cliff, down 27% in a single trading session. That’s not just a bad day; it’s a historic thud. The bank lost nearly Rs 19,000 crore in market value, and the reason they gave? An internal review found some “oops” moments in their forex derivatives portfolio.

They estimated it could hit their net worth, basically their total financial health, by about 2.35%, which works out to something like Rs 1,577 crore. That’s a lot of zeros, even for a big bank.

Now, if you’re like me, your first thought might be, “Forex what? Derivatives how?”

Don’t worry. I’ve got you. Let’s declutter this topic this step-by-step, like we’re figuring out a tricky puzzle together.

Forex and Derivatives: The Basics

First off, “forex” is just short for foreign exchange.

It’s all about swapping one currency for another, like when you trade rupees for dollars before a trip abroad.

Banks deal with forex all the time because they’re lending, borrowing, and moving money across borders. But here’s the thing, currency values aren’t static. One day, $1 might get you 87 rupees; the next, it’s 87.4. Those swings can make or lose you money, depending on which side of the trade you’re on.

Now, enter derivatives.

Think of them as financial tools, almost like bets or promises, tied to those currency swings.

A derivative is a contract where the bank says, “I’ll pay you a certain amount later based on what the dollar-to-rupee rate does.”

They’re used to either hedge (protect against losses if the currency moves the wrong way) or speculate (try to profit if it moves the right way). It’s a bit like insurance, or a gamble, depending on how you play it. IndusInd Bank had a whole portfolio of these contracts. It means, there was a big collection of these bets and hedges tied to forex.

So, What’s a “Discrepancy”?

Alright, here’s where it gets juicy.

A “discrepancy” is just a polite way of saying something’s off. Imagine you’re balancing your checkbook (or, let’s home budget). You think you’ve got 10,000 rupees left, but then you find an old receipt showing you spent 2,000 you forgot about. That’s a discrepancy, your records don’t match reality. For IndusInd, it’s the same idea, but on a way bigger scale.

When they said “discrepancies in the forex derivatives portfolio,” they meant something wasn’t right with how they tracked, valued, or recorded those currency contracts.

Maybe they thought a contract was worth 100 crore, but it’s actually worth 80 crore. Or they booked profits that didn’t really exist. Or, worst case, they didn’t properly account for losses piling up when the rupee or dollar moved against them.

We don’t know the exact details yet (they’ve hired PwC to dig into it, with answers due by late March 2025), but whatever it was, it was bad enough to shave off over 2% of their net worth. As of March’2024, the net worth of IndusInd Bank was about Rs.62,000 crores (2% of 62,0000 = Rs.1240 crores).

That’s not pocket change, it’s a signal something went seriously wrong with the accounting of the derivative contracts inside IndusInd bank.

How Did This Even Happen?

Think about a time you misjudged something, like overspending because you didn’t check your bank balance.

For IndusInd, this mess came to light because the Reserve Bank of India (RBI) rolled out new rules in September 2023, effective from April 2024. These rules told banks to double-check how they classify and value stuff like “Other Assets” and “Other Liabilities.” These are just fancy terms for miscellaneous financial buckets, including derivatives.

IndusInd did an internal review to follow these rules and, surprise, found the skeletons in their forex closet.

Was it sloppy accounting? Bad bets on currency markets? Weak oversight? Maybe all of the above.

The bank’s already been under a microscope, its CEO’s tenure got a one-year extension instead of three, hinting the RBI isn’t thrilled with how things are going. Add this discrepancy fiasco, and it’s like spilling coffee all over your shirt right before a big meeting.

Hence, the investors freaked out, and the stock tanked.

Why Should You Care?

Okay, so you’re not an IndusInd shareholder (or maybe you are). Why does this matter to regular folks? Well, banks aren’t just random companies, they hold our money. If they’re mismanaging stuff like this, it raises questions: Are my savings safe? Could this affect loans or interest rates?

The good news is, IndusInd isn’t collapsing. They’ve got enough capital to absorb this hit, and the RBI’s watching closely. But it’s a wake-up call about trust. When a bank admits to a billion-rupee whoopsie, it makes you wonder what else might be lurking.

For investors, it’s a harsher lesson. The stock’s now at Rs 655.95 (as of March 11), and analysts are slashing price targets left and right. Big names like Kotak and Nuvama are saying, “Nope, this bank’s got credibility issues.”

What’s Next?

IndusInd’s got PwC sniffing around, and by the end of March, we’ll know more. Was this a one-off mistake, or a deeper problem? The RBI might slap them with fines or stricter rules, too. For now, the bank’s scrambling to rebuild trust, but that 27% drop shows how fast confidence can vanish when you mess up this badly.

Whether it’s your own budget or a bank’s billion-rupee portfolio, clarity matters. IndusInd’s forex discrepancies are a fancy version of a simple truth, don’t lose track of what you’ve got, what you owe, or what you’re betting on.

For us, it’s a nudge to check our own finances. Start practicing a simple thing, create a monthly budget and start tracking all your daily expenses. Idea is to watch if your daily expenses are overshooting or staling within your planned budget.

What do you think—ever seen a financial mess-up this wild? Drop your thoughts below; I’d love to hear.

Have a happy invesging