Hey everyone, today I have come with a topic that’s been buzzing in my chai breaks since the latest budget: taxes! Specifically, how the ever-changing tax rules are impacting our decisions related to investments. Now, I know taxes aren’t exactly the most exciting thing to talk about, but trust me, understanding this stuff can boost our wealth-building journey by a fraction percentage points for sure.

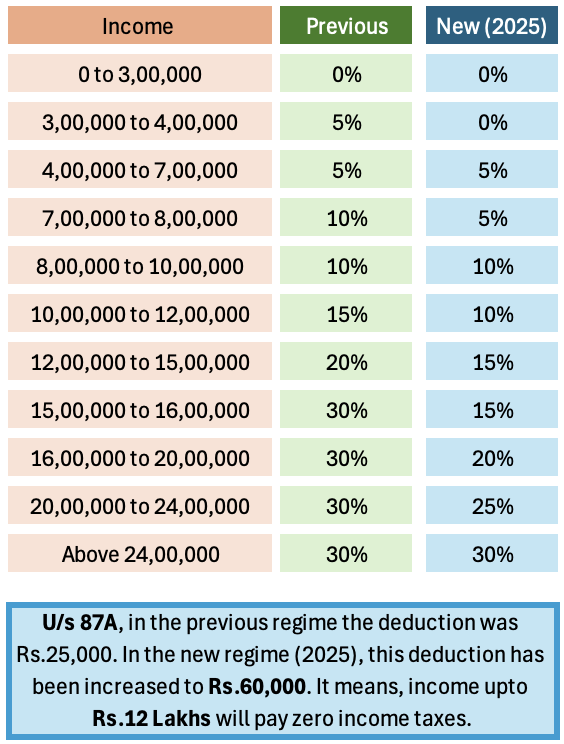

Remember when the government introduced that “simplified” tax regime a few years ago? The one that promised lower tax rates if you ditched all those deductions we’ve grown so fond of?

Well, it’s having a bigger impact than many of us initially thought.

The Old vs. The New: A Quick Recap

Basically, the new regime says, “We’ll tax you less, but you can’t claim deductions like 80C (PPF, ELSS, the usual suspects), HRA, or home loan interest.”

Sounds tempting, right? Especially when you see that ₹12 lakh tax-free income slab! But before you jump ship, let’s think this through.

So, What’s Changing in Our Investment Habits?

- Goodbye Tax-Saving, Hello Stocks? Listen, I love saving tax as much as anyone else, but with fewer tax breaks, instruments like ELSS funds have lost some of their sheen. Now, more and more people, including some of my own friends, are getting into direct equity. The thinking is simple: stocks might not give you upfront tax savings, but their potential for higher returns makes them attractive, especially since the LTCG tax on equities is still relatively benign.

- Mutual Funds: A Reality Check: Remember those debt funds your dad always told you to invest in? Well, the tax treatment on them isn’t as sweet as it used to be. Indexation benefits are largely gone, making them less appealing compared to, say, fixed deposits. This means we might see a slight tilt towards equity-oriented or hybrid funds, where you can still benefit from those LTCG rules. Read about impact of removal of indexation for realty investors.

- Real Estate: Buying a Home for Tax Benefit? Think Again! Earlier, the thinking was simple. Take a home loan and save tax. Now the equation has changed. Buying a home just to save tax? Not so much anymore. Now, we’re seeing more people investing in property for actual appreciation or rental income. REITs (Real Estate Investment Trusts) are also gaining popularity – a way to get into real estate without actually buying a physical property. Read about why I prefer REIT over a physical real estate property.

- Insurance: Protection First, Investment Second! I’ve always been a big believer in separating insurance and investment. But many people used to buy insurance solely for the tax benefits. The new rules, which limit tax-free maturity proceeds to policies with premiums under Rs.5 lakh, are forcing us to rethink that strategy. Now, it’s all about buying insurance for what it’s meant for: protection against unforeseen circumstances.

How I think When Tax Laws Change For Good & Bad

Look, there’s no one-size-fits-all answer here. What works for your neighbor might not work for you. The key is to keep the portfolio sufficiently diversified. I’ll never keep my money concentrated on only one theme. That theme can be as broad as equity, debt, real estate, or precious metals. It can also be as focused as industry allocation in stock investing. I know, I’m not Warren Buffett and hence, I’ll keep my money spread enough to suit my risk appetite.

For me, what works are the following:

- Keeping gold,

- Having a house (zero rental expense),

- Parking a part of my corpus in Fixed Deposits,

- Keeping myself sufficiently insured (at least a large health insurance cover), and

- Then building a large stocks portfolio.

If there is any economic or policy changes that I observe is happening, the first thing I consider is portfolio rebalancing. For example, under the present (post-trump) uncertainties increasing some allocation in gold will be a good idea. If I can afford, I will also consider buying a small rental property.

In a bear market, I will certainly increase my allocation to my stock portfolio. Because it is where the real future wealth building is happening.

Frankly speaking, with my size of investment portfolio, I do not think any income tax changes really effect me much. Add to it my investment horizon (15-20 years), the risk becomes even negligible.

Conclusion

The new tax regime has thrown a wrench into our traditional investment strategies. But that’s not necessarily a bad thing. It’s forcing us to become more informed, more strategic investors.

So, take the time to understand the implications of these changes and adjust your portfolio accordingly. And if you’re feeling overwhelmed, I’ll suggest you to read more. These days, even AI can answer your queries. 😉

Have a Happy Investing.

Disclaimer: I am not a financial advisor, and this is not financial advice. Please consult with a qualified financial advisor before making any investment decisions. Aur haan, market mein risk toh hota hi hai! If you want you can use my Stock Engine to get a perspective on Indian stocks.