The Indian Hotels Company Limited (IH) is a major player in the hospitality industry. Founded in 1903, it operates under the famous brand “Taj Hotels.” The company is well-known for its luxurious hotels and exceptional service. It has a significant presence in India and overseas.

This article on The Indian Hotels (IH) is crucial for investors and anyone interested in the hospitality sector. It provides detailed insights into the company’s financial health and future prospects. By understanding these details, one can make informed decisions about the company.

In this blog post, I will cover several key aspects of The Indian Hotels.

- First, there will be a brief overview of the company and its main business segments. This will help us understand how IH operates and generates revenue.

- Next, we will dive into the company’s financial performance. We will look at important metrics like sales, profits, and growth rates. This section will help you see how well the company has been performing recently.

- We will also discuss the key business segment of TajSATS. This is IH’s in-flight catering business, which is a vital part of its operations. Understanding TajSATS will give you a better idea of the company’s diversified revenue streams.

- Then, we will explore the main growth drivers for IH. These include the expansion in the aviation sector and the increasing number of airports. We will also look at the rise in air passenger traffic and how this impacts IH.

- Finally, we will discuss the company’s strategic initiatives and future plans. This will include their expansion plans and investment in new business segments. We will also provide a valuation and outlook based on the report’s findings.

By the end of this post, we will have a clear understanding of The Indian Hotels and its potential as an investment.

Company Overview

Indian Hotels (IH) is a leading hospitality company in India. It was founded in 1903 by Jamsetji Tata. The company operates under the well-known brand “Taj Hotels.”

IH has a long history of providing luxury hospitality services. It is known for its iconic hotels and exceptional customer service. The company has a strong presence both in India and internationally.

The main business of IH is its hotel operations. This includes owning and managing hotels and resorts. The company’s portfolio consists of luxury, upscale, and economy hotels. These hotels cater to a wide range of customers, from high-end luxury travellers to budget-conscious guests.

One of the key segments of IH is TajSATS. TajSATS is a joint venture between IH and SATS Limited. It is a leading provider of in-flight catering services. TajSATS serves major airlines operating in India and abroad. It also provides catering services for corporate events, institutions, and other sectors.

TajSATS has a significant role in IH’s revenue generation.

- The business is divided into air catering and non-air catering.

- Air catering involves providing meals and services to airlines.

- Non-air catering includes catering for events, corporate clients, and other institutions.

- This diversification helps IH reduce its dependency on one single revenue source.

Apart from TajSATS, IH also has other business segments. These include luxury residences, spas, and wildlife lodges. Each segment adds value to the company’s overall portfolio.

IH has a robust growth strategy. It focuses on expanding its footprint through new hotels and strategic partnerships. The company also invests in upgrading its existing properties. This helps maintain its reputation for luxury and quality service.

Financial Performance

The Indian Hotels Company Limited (IH) has shown strong financial performance. This includes results for FY24 and estimates for FY25 and FY26. Here, we will look at key financial metrics and ratios.

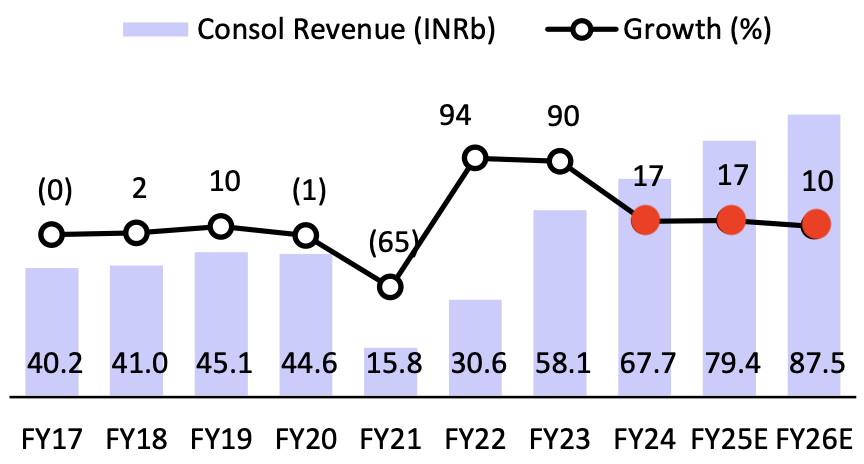

Sales

For FY24, IH’s sales were INR 6,700 crore. The sales are expected to rise to INR 7,900 crore in FY25 and INR 8,700 crore in FY26. This indicates a healthy growth trend. In the next 2 years, the company’s sales is expected to grow at about 15% CAGR.

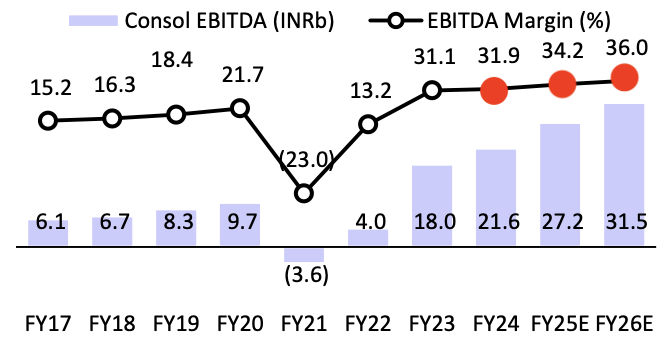

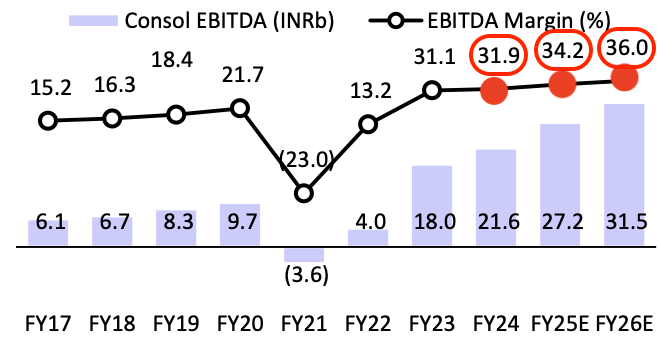

EBITDA

EBITDA for FY24 was INR 2,160 crore. The estimated EBITDA for FY25 is INR 2,720 crore, and for FY26, it is INR 3,150 crore. This shows steady improvement in operational efficiency. In the next 2 years, the company’s EBITDA is expected to grow at about 20% CAGR.

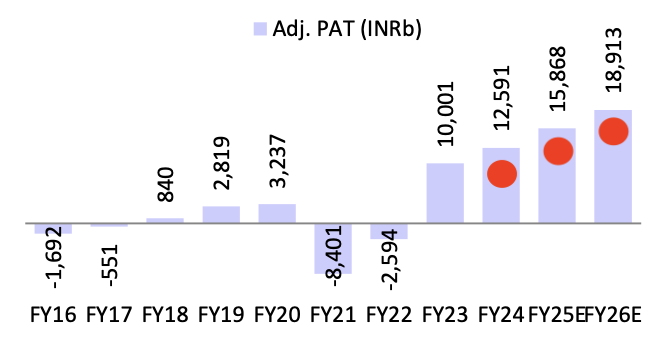

Net Profit (PAT)

Profit After Tax (PAT) in FY24 was INR 1,259 crore. It is projected to increase to INR 1,586 crore in FY25 and INR 1,891 crore in FY26. This reflects a positive outlook for profitability. In the next 2 years, the company’s PAT is expected to grow at about 22% CAGR.

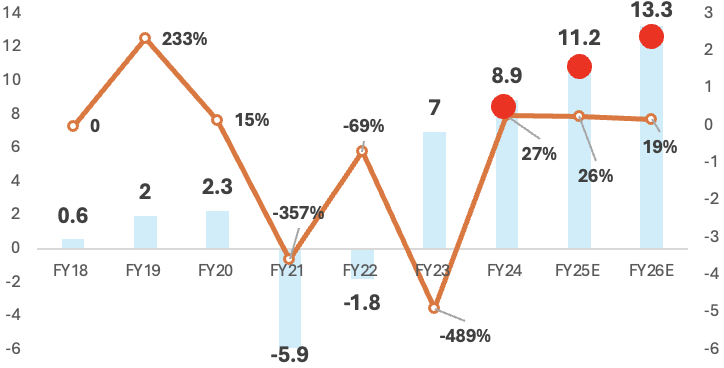

EPS

Earnings Per Share (EPS) grew from INR 7 in FY23 to INR 8.9 in FY24. It is estimated that the EPS will be about INR 11.2 in FY25 and INR 13.3 in FY26. This growth in EPS indicates better returns for shareholders. In the next 2 years, the company’s EPS is expected to grow at about 20% CAGR.

EBITDA Margin

The EBITDA margin for FY24 was 31.9%. It is expected to be 34.2% in FY25 and 36.0% in FY26. Improving margins highlight better cost management.

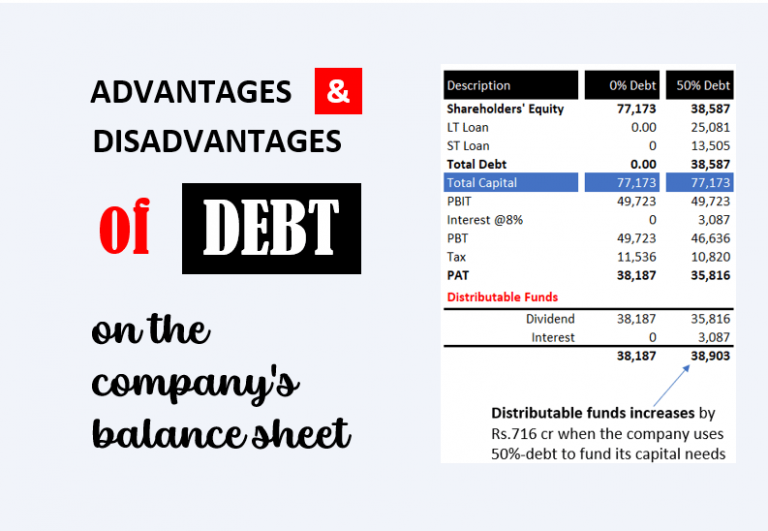

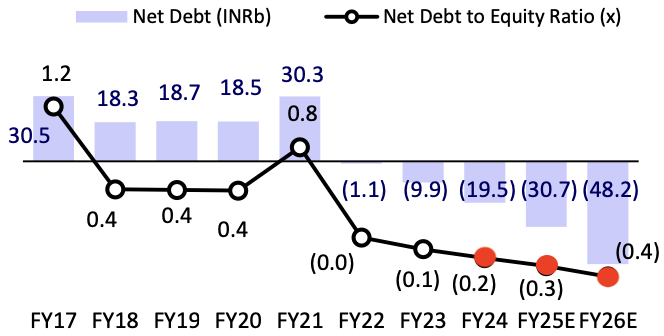

Debt-Equity Ratio

The Net Debt to Equity ratio was -0.2x in FY24, showing making it a debt free company. In the coming years, the company plans to remain debt free (till projected FY26).

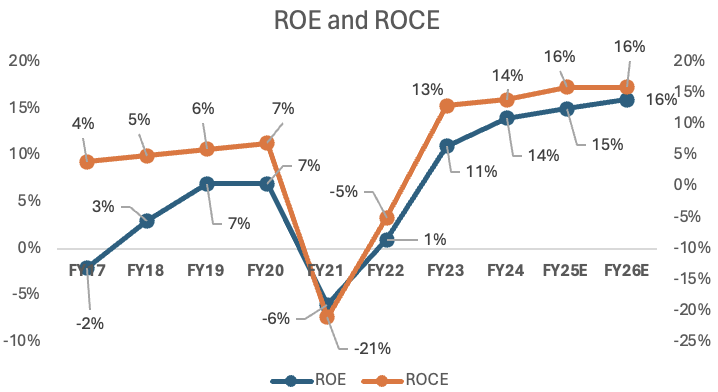

ROE and ROCE

Return on Equity (RoE) was 14% in FY24, expected to reach 15.9% by FY26. Return on Capital Employed (RoCE) was 11% in FY24, projected to rise to 16% in FY26.

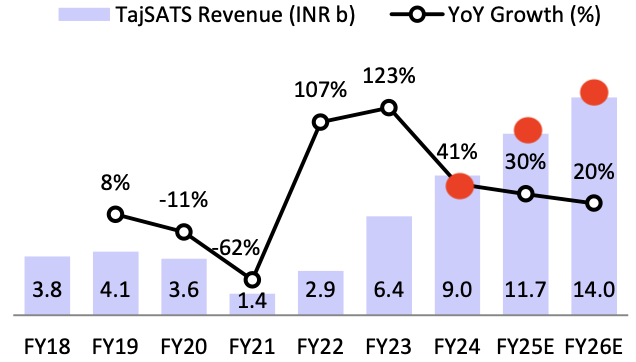

Key Business Segment: TajSATS

TajSATS is a key business segment of The Indian Hotels Company Limited (IH). It is a joint venture between IH and SATS Limited. TajSATS specializes in in-flight catering services.

This segment is significant to IH as it diversifies the company’s revenue. It helps reduce dependency on hotel operations alone. TajSATS serves major airlines operating in India and internationally.

The revenue sources for TajSATS are split into two main categories: air catering and non-air catering. In non-air business it caters to a diverse clientele including corporate offices (Citibank,Ikea) and retail chains (Tata Starbucks).

Air catering involves providing meals and services to airlines. Non-air catering includes catering for events, corporate clients, and other institutions. Approximately 85% of the TajSATS income comes from air catering business while rest 15% comes for non-air catering.

TajSATS has a strong client base. It serves leading airlines like Air India, Vistara, and Singapore Airlines. The company also provides catering services for corporate events and private functions. These services ensure a steady revenue stream from various sectors.

Financial performance for TajSATS has been robust. In FY24, TajSATS generated revenue of INR 900 crore, a significant increase from INR 640 crore in FY23. The air catering segment grew by 20%, while non-air catering saw a 25% increase.

It is expected that by FY26, 25% of the total income of Indian Hotels (IH) will come from TajSATS. This business will contribute almost 30% of IH’s net Profit.

Strategic Initiatives and Future Plans

The Indian Hotels (IH) has ambitious strategic initiatives and future plans. These plans focus on expanding and improving their services.

- For TajSATS, IH plans to open new kitchens and micro kitchens. These new facilities will help meet the growing demand for in-flight and non-air catering. The company aims to enhance its capacity and service quality.

- IH is also investing in reimagined and new business segments. This includes exploring new markets and innovative services. These investments are meant to diversify revenue streams and reduce dependency on traditional hotel operations.

- Another major focus is the room addition pipeline. IH plans to add new rooms across various hotels. This expansion will help cater to more guests and improve occupancy rates. The company is also upgrading existing hotels to maintain high standards of luxury and comfort.

IH’s asset management strategy is crucial for its growth. The company is optimizing its portfolio by selling non-core assets and investing in high-performing properties. This strategy helps improve the overall financial health of the company.

Corporate rate hikes are also part of IH’s future plans. By increasing corporate rates, the company aims to boost revenue from business travellers. This segment is a significant source of income for IH.

Valuation and Outlook

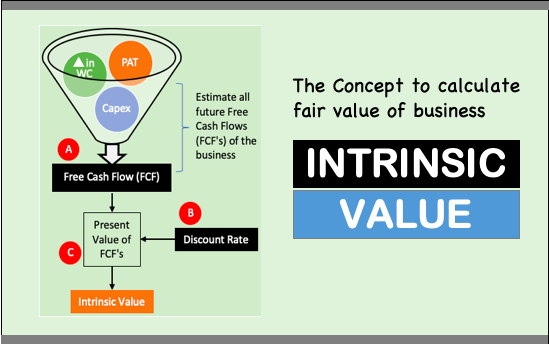

The Indian Hotels has a positive valuation and outlook. A target price of INR 625 for the stock. As per my Stock Engine, the estimated intrinsic value for The Indian Hotels (IH) is close to INR 255. But it does not consider the new cash flows being generated by the company by its new business streams. Hence, I’m assuming a stock price jump of at least 10% from the current price levels.

The valuation is calculated using the Price to Earnings (P/E) and Enterprise Value to EBITDA (EV/EBITDA) ratios. For FY26, IH’s P/E ratio is expected to be 34.3x, while the EV/EBITDA ratio is projected at 16.6x. These metrics help determine the stock’s revised fair value.

Indian Hotels (IH) is one of fundamentally super strong companies in India. For a price dip greater than 3-4% in its stocks, I’ll look to accumulate.