Let’s unlock the wealth for ourselves. There exists a universal dream among people of building wealth and securing a brighter financial future. But we often hear the cry of those who say they lack the savings required to venture into the world of investments. Hence, they procrastinate, being convinced that the doors to financial prosperity are not open to them. These people do not realize the power of systematic investment plans (SIPs). Use the online calculator to dig deeper.

This article aims to give such people financial hope and empowerment. The write-up is for those who dream of building wealth even with their limited savings. There exists a financial pathway perfectly designed for this journey – Systematic Investment Plans (SIPs).

Let’s unravel the mystique surrounding SIPs. Systematic investment plans are an ally for people who can afford only small savings. Here we’ll not only grasp the essence of SIPs but also feel empowered to take our first steps.

Finance can be a daunting realm, especially for those who are new to it. Whether you’re a novice or an experienced hand, the concept of SIPs holds the promise of unlocking the doors to financial well-being for all.

So, let’s embark on this enlightening journey together, where limited savings are no longer a roadblock. We are going to make our small savings a stepping stone toward our financial freedom.

Use This Investment Planner [A Calculator]

Suppose, you are somebody, who can save only Rs.1,500 per month from your savings. But you wish that you had Rs.10 Lakhs as your wealth. Does this dream look farfetched? The way to build such wealth is to first save some money and then invest it wisely.

Use the below calculator to know how you can reach your goal. To build today’s equivalent of Rs.10 Lakhs in the next 20 years, it will need a lumpsum investment of Rs.1.17 Lakhs at a rate of return of 18% per annum.

But very few of us will have a lump-sum amount of Rs.1.17 lakhs available for investing, right? But this calculator will also tell you that a monthly SIP of just Rs.1,389 at 18% per annum for the next 20 years will build you Rs.32 Lakhs (which is today’s equivalent of Rs.10 Lakhs).

So you can see, how SIP has made it possible for a person who could only afford a savings of Rs.1,500 per month to become a Lakhpati (a millionaire).

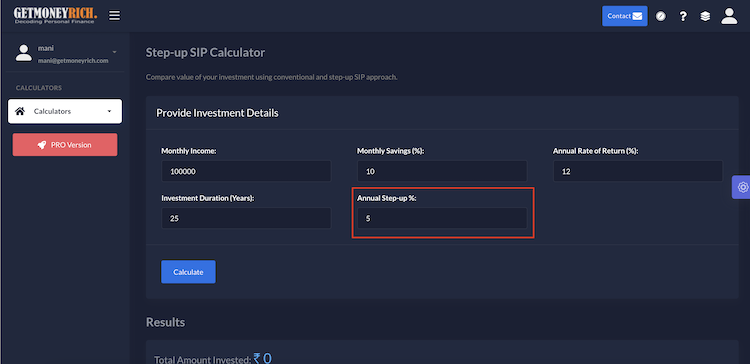

Suggested Reading: What happens if someone gradually increases their SIP contributions each month? It further creates a snowballing effect (higher power of compounding. Check this Step-Up SIP calculator.

Section 1: The SIP Advantage for Small Savers

Imagine a financial plan that doesn’t demand lump sum money. It is a plan where you can begin your wealth-building journey with as little as you’re comfortable with. Systematic Investment Plans, or SIPs, are precisely that. It is a strategy designed to make investing accessible to everyone, regardless of their savings potential.

At its core, SIP is about consistency and discipline. It’s like setting up a savings routine where you invest a fixed amount regularly, often monthly. The money is routed into selected mutual funds or stocks. The beauty of SIP lies in its ability to transform small, consistent contributions into a substantial corpus over time.

Distinct advantage of SIP

- Accessibility: Unlike traditional investments that require a lump sum upfront, SIPs can have a modest starting point. With an affordable minimum investment threshold, SIPs are the gateway to financial growth for individuals who thought they needed more money to start.

- Discipline: SIP instills financial discipline. When we commit to investing a fixed amount regularly, it becomes a financial habit. This disciplined approach ensures that our money is being put to work automatically month after month.

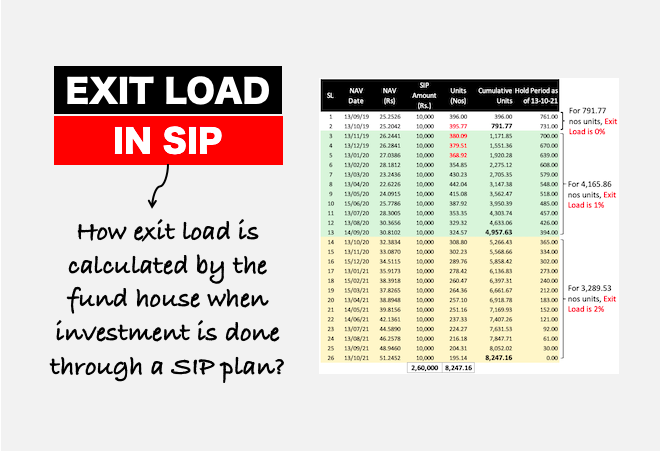

- Risk Mitigation: We worry about market volatility. SIPs address this concern through a concept known as “rupee cost averaging.” This means you buy more units when prices are low and fewer when prices are high. Over time, this strategy lowers our average cost per unit, helping you navigate market ups and downs. In fact, the greater will be fluctuations, the better it is for the SIP.

- Long-Term Growth: SIP is not a get-rich-quick scheme. It’s designed for those with a long-term investment horizon. The longer you stay invested, the more your wealth can grow. Compound interest, often referred to as the “eighth wonder of the world,” works its magic best over time, and SIP allows it to tap into its potential.

In essence, SIPs are a financial ally for small savers. Whether you’re saving for your child’s education, a dream vacation, or a comfortable retirement, SIPs provide the tools to turn your aspirations into financial reality.

Section 2: Overcoming the Lump Sum Myth

The belief that substantial savings are a prerequisite for entering the world of investments is a myth. It can discourage many aspiring investors. However, Systematic Investment Plans (SIPs) are tailor-made to beat this myth.

Imagine yourself as an athlete who does marathons. SIP investing is like running a marathon, steadily pacing yourself over time. While lump-sum investing is like sprinting. It requires a burst of funds upfront.

SIP overcoming the myth of lumpsum investing

- Compounding Magic: SIPs can be as effective money compounders as lump-sum money. Compounding is the process by which your investments earn returns, and those returns, in turn, generate more returns. Over time, this snowball effect can lead to significant wealth accumulation. The longer you stay invested, the more powerful compounding becomes. Compounding equally applies to all forms of investing.

- Smoothing Market Volatility: Market timing is a challenge for small investors. When one invests in a lump sum, bad timing can lead to losses or below-average gains. SIPs spread our investments over time, in highs and lows. Hence, in SIP investing the need to time the market becomes irrelevant. Why? Because one is investing at all times.

- Affordability: SIPs make investing affordable. You don’t need a vast amount of money upfront. Instead, you start with an amount that fits your budget, as small as you’re comfortable with (Rs.500 per month).

Practical Tip: Keeping an SIP in an equity scheme running at all times is the first step. In parallel, let a recurring deposit (RD) run and accumulate some cash in your bank account. Whenever there is a big correction or a crash in the market, use the funds in the RD to buy units of your SIP mutual fund in bulk. This way you are able to take the benefits of both, regular and lump-sum investing.

To illustrate the power of SIP and compounding, consider this simple example. Suppose you are a 25-year-old individual who just got into a job. Your target is to accumulate today’s equivalent of Rs.1 Crores as your retirement fund. To reach the goal, you will need to invest Rs.2,34,000 in lump-sum (at 18% per annum) for 35 years.

Now, how many 25-year-olds will have a spare Rs.2.34 lakhs for investing? A tiny minority, right? But a SIP of only Rs.2,250 at 18% per annum will build a today equivalent of Rs.1.Crore in 35 years (check the calculation in the above calculator).

Section 3: Key Benefits of SIP

Systematic Investment Plans (SIPs) are a tailored strategy designed to empower small savers. Let’s delve into the multitude of benefits of the SIP, in addition to what we’ve already seen.

- Accessibility: SIPs are remarkably inclusive. They break down the entry barriers to investing by allowing us to start with a minimal amount, as low as ₹500 or ₹1,000 per month. This accessibility means anybody can start investing regularly.

- Professional Management: Through SIPs, we invest in mutual funds. These funds are managed by experienced professional fund managers. Their expertise can be invaluable, especially for those who may not have the time or knowledge to manage their investments actively. A SIP investor just dumps his money to the fund manager who in turn applies his skill and knowledge to invest the collected money.

- Transparency: As SIPs are done in mutual funds, there is full transparency about where the money is invested. People can check the details of their mutual fund scheme online, anytime. The details of our contributions, the units purchased, and the current value of investments are all available online. This transparency ensures that we stay informed about our progress.

Section 4: Getting Started with SIP

Now that we’ve discovered the power of Systematic Investment Plans (SIPs) and their benefits, it’s time to take the next step. Don’t worry; it’s a straightforward process.

- Set Clear Financial Goals: Before diving into SIPs, it’s crucial to define the financial objectives. There are two things that must be defined, the corpus size and the time available to build that corpus.

- Assess Where To Invest: Experts also call it assessing one’s risk tolerance. This step is also straightforward and it is linked to our investment horizon. If the time is less than 3 years, one must invest in debt mutual funds. If the time is less than 5 years, hybrid funds are suitable. For a time horizon above 5 years, pure equity funds (or even direct stocks) are best.

- Choose the Right SIP: Choosing a mutual fund scheme that aligns with our goals is essential. One of the better ways to do it is to use a mutual fund screener. The Stock Engine has a mutual fund screener, it comes bundled up as free with it. Once you have picked a suitable scheme, you will know approximately what returns you can expect in the future.

- Determine the Investment Amount: Use the investment calculator provided in this article to determine how much you should invest each month (SIPs) to reach the goal.

Starting A SIP

All mutual funds have two plans, regular and direct. A direct plan always yields higher returns than a regular plan. Why? Because the total expense ratio of a direct plan is lower than a regular plan. Generally speaking, a direct plan will yield a 1% higher return than its regular sibling. Over a long SIP period, like 10 years, this 1% extra return can make a big difference.

For example, investing Rs.2,250 each month at 17% per annum for 35 years will build a corpus of Rs.5.91 Crore (equivalent to today’s Rs.76 Lakhs). Similarly, investing Rs.2,250 each month at 18% per annum for 35 years will build a corpus of Rs.7.89 Crore (equivalent to today’s Rs.1.0 Crore). So you can see, that a minor 1% differential in return substantially affects the final corpus.

Now the question is, how to invest in direct plans? The best way is to open the website of the mutual fund company (like ICICI Pru, HDFC Securities, Axis Mutual Funs, etc.) and apply there. You can also use apps like Kuvera to easily invest in direct plans.

Section 5: Real-Life Success Stories

Real-life stories have the power to inspire and demonstrate that wealth creation through Systematic Investment Plans (SIPs) is not only blah-blah but an achievable reality.

Let’s meet a few individuals who started with limited savings and witnessed their financial dreams come true through the magic of SIPs:

Rajesh’s Dream Vacation

Rajesh, a young professional, had always dreamt of taking his family on an exotic vacation. He decided to start a SIP for the next 3-year period in a debt mutual fund. Over the years, his SIP investments have grown consistently. As SIPs are executed on autopilot, at the end of the period Rajesh was astonished to see the accumulated corpus. Rajesh’s story is a testament to how SIPs can turn aspirations into reality, one step at a time.

Mita’s Education Fund

Mita was worried about her child’s future education expenses. With limited savings, she felt overwhelmed by the thought of covering the cost of higher education. Mita began a SIP specifically for her child’s education. As she diligently contributed for 12 years, a sum of Rs.5000 each month in a multi-cap mutual fund (16% p.a.). When the time came for her child to pursue higher studies, Mita was relieved that she had more than Rs.20 Lakhs in her SIP account.

Ankit’s Early Retirement

Ankit, in his early 30s, had always dreamt of retiring early to pursue his passions. However, he believed he needed a massive lump sum to achieve this dream. Ankit started a SIP with a portion of his monthly income (Rs.25,000) and stayed committed to his long-term goal (20 years). As his time horizon was long, he decided to risk investing in a quality small-cap mutual fund (17% p.a.). To his surprise, by the time he was in his early 50s, Ankit had amassed Rs.5.5 Crores (equivalent to today’s Rs1.7 crore). This was just enough for his early retirement.

Section 6: Overcoming Common Excuses

Excuses often stand as formidable roadblocks on the path to financial prosperity. However, understanding and addressing these common excuses can help us overcome them. For all of us who feel that investing is not easy, SIP is the answer to most of our excuses.

Excuse 1: “I’ll Start When I Earn More”

Delaying your investment journey until you earn more is a missed opportunity. By starting early, we can take advantage of the magic of compounding in the later years. Waiting until you earn more may cost you valuable years of potential wealth accumulation. So, even if one’s income is less, it is wiser to at least start a SIP of Rs.500 per month and let it compound for decades.

Excuse 2: “I Don’t Understand Investing”

Investing can seem complex, but SIPs in mutual funds can simplify the process. When we invest in SIPs, we are essentially delegating the investment decisions to the fund managers of the mutual funds. All you need to do is select a suitable mutual fund scheme that aligns with your goals and risk tolerance. It’s an excellent way for beginners to participate especially in the stock market.

Excuse 3: “I’m Afraid of Market Volatility”

Market volatility can be intimidating, but SIPs are designed to mitigate this risk. Suppose you are in your early 20s and have little idea of equity. Should you avoid equity and start your investments with insurance or bank deposits? I think a better start would be to start a SIP in index funds. To know more about index investing; read this article.

Excuse 4: “I’ll Build Emergency Savings, Then Invest”

Building emergency savings is essential. While saving is essential, delaying the start of a SIP in a suitable equity-linked plan is also a necessity. Even a 2-3 years delay can substantially hinder the possibility of us reaching our financial goals. I think, when the convenience of SIP is there, we shall not delay our equity exposure even by one month. Start today.

Conclusion

In the journey towards financial empowerment, small savers often find themselves wrestling with doubts, hesitations, and perceived limitations. However, we stand at the cusp of transformation, where small savers are no longer bound by the confines of their initial savings. Systematic Investment Plans (SIPs) emerge as the torchbearers of financial hope and empowerment.

SIPs shatter the misconception that substantial savings are a prerequisite for investing. They offer a disciplined, strategic, and long-term approach that not only mitigates risk but also leverages the power of time and compounding.

Remember that it’s not the size of your initial savings that matters but the commitment to your financial goals. SIPs are the vehicle that transforms determination into prosperity.

The power to unlock wealth and secure a brighter financial future is within your grasp.

Have a happy investing.

Suggested Reading: