Here in India, where we’ve seen our rupee sway with the global winds, what’s happening with the won is a story worth our attention. When you think of currency, you might imagine cold numbers and exchange rates. But behind every bill and coin, there are interesting stories. There are a few anecdotes concerning the Korean won that resonate with the human side of economics.

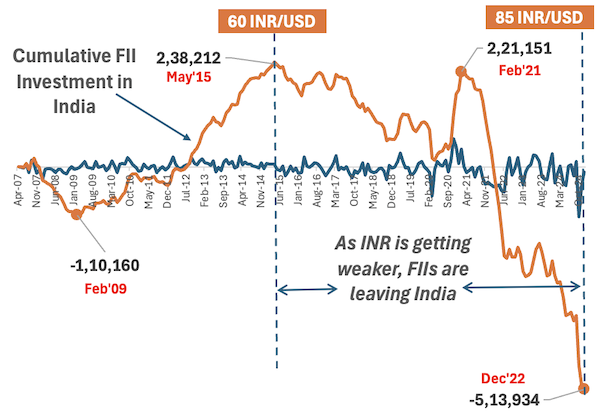

I’ll use the story to explain why FIIs have been the net sellers in India since 2015 (except for the brief period in 2020-21). You can jump to the conclusion to read it first.

But first, the story of Korean currency (won). This will give us a perspective to understand the health of our INR and its aftereffects.

From Ancient Coins to Modern Woes (Won)

Let’s start from the beginning.

The won, like the rupee, has a storied past. Born from the ashes of Japanese occupation in 1945, it has seen it all, from economic miracles to financial crises. Post-World War II, South Korea was a different world, much like India’s own journey from colonial rule to economic independence.

The ’60s to ’90s were South Korea’s golden era. It was akin to our own liberalization period. It was a time of rapid growth, where the won became a symbol of South Korea’s expanding economy.

But then came the 1997 Asian Financial Crisis. It was a stark reminder that no currency is an island.

The won plummeted, much like our rupee has in times of global financial unrest. Such periods teach about the interconnectedness of modern economies.

The 2024 Shake-Up

Fast forward to today, and the won is in the headlines again.

This time, it’s not just about economics. Political instability has gripped South Korea. There is an impeachment drama involving acting president Han Duck-soo and accusations against President Yoon Suk Yeol has shaken the nation’s political landscape.

The result? The won has fallen to its lowest level of 2008-09. It has crossed the 1,473 KRW/USD mark. It is that kind of a number that is sends shivers down the spine of the S.Korean investor.

This political turmoil isn’t just a headline for the local news; it’s a signal for investors worldwide, including us in India.

When a currency like the won depreciates, it impacts trade balances, import costs, and the value of investments in South Korean companies.

For Indian investors, especially those with stakes in technology or automotive sectors (like Hyundai India) where South Korea plays big, this is a moment to watch closely.

Bitcoin and the ‘Kimchi Premium’

There’s another layer to this story – the rise of the ‘Kimchi Premium’.

What is Kimchi Premium? Kimchi Premium is the price difference where cryptocurrencies trade higher on South Korean exchanges than global ones. For example, Kimchi Premium is when Bitcoin costs Rs.25 lakhs on South Korean exchanges but only Rs.22 lakhs elsewhere.

Why it is happening? Because the won is getting weaker. As the won is getting weaker, Bitcoin in South Korea is trading at a higher price than elsewhere. It is a phenomenon driven by capital flight and a search for stability.

It’s a reminder of how cryptocurrencies can become both a refuge and a speculative gamble when traditional currencies falter.

For us in India, this could be a lesson in market dynamics. Perhaps it is also an opportunity to understand the global crypto landscape better. Earlier, our hedge against weakening currency (inflation) was mostly gold or real estate, now in this space, cryptocurrencies (like Bitcoin) has also entered.

Why It Matters to Us

Why should we, sitting thousands of miles away, care?

Because in today’s globalized economy, a ripple in Seoul can create waves in Mumbai. The weakening won affects import/exports and also investments.

Import/Export

If the Korean Won weakens against the Indian Rupee, there are the two possible effects:

- Imports to India from South Korea become cheaper: Indian businesses can buy South Korean goods like electronics, cars, and machinery at a lower cost. Lower costs can potentially increase imports.

- Indian exports to South Korea become more expensive: South Korean buyers will need more Won to buy Indian goods. It will make Indian exports like spices, textiles, or pharmaceuticals less competitive.

This imbalance could widen India’s trade deficit with South Korea.

Investments

If the South Korean Won weakens, FIIs holding South Korean stocks may see reduced returns in their home currency when converting profits. It means, weaker Won will lower the value of their investments. So, it the currency will continue to weaken, FIIs generally sell their holdings.

Conclusion (INR Analogy)

From my vantage point here in India, the story of the Korean won in 2024 is a cautionary tale that tells the following:

- It highlights the fragility of currencies in the face of political instability. Today, 99% of our investments are completely dependent on the strength of a currency (in our case INR). If for some hypothetical reason, the value of INR becomes junk, all of our investments will become worthless.

- It also underscores the importance of diversification in an investor’s portfolio. Buying only stocks, mutual funds, ETFs, REITs, bank deposits, is not enough. It is essential to park money in gold (I mean physical gold) and in some digital currencies like Bitcoin.

- It also highlights the need for a keen eye on geopolitical developments, not just economic numbers.

INR Analogy

As we watch the won fighting these turbulent times, we’re reminded of our own currency’s journey.

No matter which government were were under (UPA or NDA), under both the governments, our currency has only weakened. Check the above chart which shown how INR has weakened since 2004 till today.

No doubt why FIIs have been net sellers in the Indian stock market since 2015 (except between 2020-2021 during COVID phases). Check the below chart to visually see the FII activity pattern between 2009 to 2015 and then between 2015 to 2024.

| Date | FII Net Purchase (Rs.Cr.) | Cumulative Investment (Rs.Cr.) |

|---|---|---|

| Apr-07 | 1,735 | 1,735 |

| May-07 | -120 | 1,615 |

| Jun-07 | -1,361 | 253 |

| Jul-07 | 7,869 | 8,122 |

| Aug-07 | -12,338 | -4,216 |

| Sep-07 | 16,358 | 12,142 |

| Oct-07 | 8,016 | 20,158 |

| Nov-07 | -13,689 | 6,469 |

| Dec-07 | -6,820 | -351 |

| Jan-08 | -29,448 | -29,799 |

| Feb-08 | -4,051 | -33,850 |

| Mar-08 | -3,764 | -37,614 |

| Apr-08 | -2,537 | -40,150 |

| May-08 | -6,696 | -46,846 |

| Jun-08 | -12,667 | -59,513 |

| Jul-08 | -4,604 | -64,117 |

| Aug-08 | -5,456 | -69,573 |

| Sep-08 | -12,503 | -82,076 |

| Oct-08 | -15,654 | -97,730 |

| Nov-08 | -5,459 | -1,03,189 |

| Dec-08 | 1,035 | -1,02,154 |

| Jan-09 | -5,173 | -1,07,327 |

| Feb-09 | -2,833 | -1,10,160 |

| Mar-09 | -684 | -1,10,844 |

| Apr-09 | 5,560 | -1,05,283 |

| May-09 | 13,886 | -91,397 |

| Jun-09 | -85 | -91,483 |

| Jul-09 | -1,365 | -92,847 |

| Aug-09 | -3,767 | -96,614 |

| Sep-09 | 13,331 | -83,283 |

| Oct-09 | 0 | -83,283 |

| Nov-09 | 1,708 | -81,575 |

| Dec-09 | 4,241 | -77,334 |

| Jan-10 | -7,217 | -84,550 |

| Feb-10 | -1,943 | -86,494 |

| Mar-10 | 14,792 | -71,701 |

| Apr-10 | 2,667 | -69,034 |

| May-10 | -12,071 | -81,105 |

| Jun-10 | 7,714 | -73,391 |

| Jul-10 | 8,541 | -64,850 |

| Aug-10 | 7,537 | -57,313 |

| Sep-10 | 22,476 | -34,837 |

| Oct-10 | 14,388 | -20,449 |

| Nov-10 | 5,351 | -15,098 |

| Dec-10 | -722 | -15,821 |

| Jan-11 | -8,904 | -24,724 |

| Feb-11 | -7,213 | -31,938 |

| Mar-11 | 7,977 | -23,961 |

| Apr-11 | 4 | -23,956 |

| May-11 | -3,705 | -27,662 |

| Jun-11 | 2,663 | -24,999 |

| Jul-11 | 4,282 | -20,717 |

| Aug-11 | -11,559 | -32,277 |

| Sep-11 | -3,089 | -35,365 |

| Oct-11 | 1,842 | -33,523 |

| Nov-11 | -6,509 | -40,032 |

| Dec-11 | -2,387 | -42,419 |

| Jan-12 | 9,469 | -32,950 |

| Feb-12 | 23,236 | -9,713 |

| Mar-12 | 6,527 | -3,187 |

| Apr-12 | -1,663 | -4,850 |

| May-12 | -2,756 | -7,606 |

| Jun-12 | 2,795 | -4,811 |

| Jul-12 | 5,903 | 1,091 |

| Aug-12 | 7,747 | 8,839 |

| Sep-12 | 20,808 | 29,646 |

| Oct-12 | 8,443 | 38,089 |

| Nov-12 | 6,292 | 44,381 |

| Dec-12 | 14,366 | 58,747 |

| Jan-13 | 19,198 | 77,945 |

| Feb-13 | 9,533 | 87,478 |

| Mar-13 | 9,423 | 96,901 |

| Apr-13 | 4,642 | 1,01,543 |

| May-13 | 14,466 | 1,16,009 |

| Jun-13 | -11,425 | 1,04,583 |

| Jul-13 | -414 | 1,04,169 |

| Aug-13 | -7,470 | 96,698 |

| Sep-13 | 11,176 | 1,07,874 |

| Oct-13 | 17,556 | 1,25,430 |

| Nov-13 | 6,956 | 1,32,386 |

| Dec-13 | 13,466 | 1,45,852 |

| Jan-14 | -1,266 | 1,44,587 |

| Feb-14 | 1,420 | 1,46,006 |

| Mar-14 | 25,376 | 1,71,383 |

| Apr-14 | 6,283 | 1,77,666 |

| May-14 | 11,803 | 1,89,469 |

| Jun-14 | 7,332 | 1,96,801 |

| Jul-14 | 6,965 | 2,03,765 |

| Aug-14 | 2,681 | 2,06,447 |

| Sep-14 | 1,503 | 2,07,950 |

| Oct-14 | -1,683 | 2,06,267 |

| Nov-14 | 10,946 | 2,17,213 |

| Dec-14 | -3,937 | 2,13,276 |

| Jan-15 | 8,541 | 2,21,817 |

| Feb-15 | 6,746 | 2,28,563 |

| Mar-15 | 6,581 | 2,35,143 |

| Apr-15 | 7,864 | 2,43,008 |

| May-15 | -4,796 | 2,38,212 |

| Jun-15 | -8,193 | 2,30,019 |

| Jul-15 | 2,298 | 2,32,317 |

| Aug-15 | -19,772 | 2,12,545 |

| Sep-15 | -11,279 | 2,01,265 |

| Oct-15 | 3,027 | 2,04,292 |

| Nov-15 | -9,030 | 1,95,262 |

| Dec-15 | -2,360 | 1,92,902 |

| Jan-16 | -14,356 | 1,78,546 |

| Feb-16 | -12,513 | 1,66,033 |

| Mar-16 | 24,202 | 1,90,234 |

| Apr-16 | 2,936 | 1,93,171 |

| May-16 | 38 | 1,93,209 |

| Jun-16 | 3,958 | 1,97,167 |

| Jul-16 | 10,123 | 2,07,290 |

| Aug-16 | 8,778 | 2,16,068 |

| Sep-16 | 3,330 | 2,19,398 |

| Oct-16 | -5,770 | 2,13,628 |

| Nov-16 | -19,982 | 1,93,645 |

| Dec-16 | -11,325 | 1,82,320 |

| Jan-17 | -1,901 | 1,80,419 |

| Feb-17 | 8,704 | 1,89,123 |

| Mar-17 | 26,473 | 2,15,596 |

| Apr-17 | -6,628 | 2,08,969 |

| May-17 | -453 | 2,08,516 |

| Jun-17 | -4,051 | 2,04,465 |

| Jul-17 | 1,465 | 2,05,929 |

| Aug-17 | -15,996 | 1,89,934 |

| Sep-17 | -23,970 | 1,65,964 |

| Oct-17 | -7,827 | 1,58,137 |

| Nov-17 | -13,515 | 1,44,623 |

| Dec-17 | -6,412 | 1,38,211 |

| Jan-18 | 9,568 | 1,47,779 |

| Feb-18 | -18,619 | 1,29,160 |

| Mar-18 | 7,905 | 1,37,065 |

| Apr-18 | -9,621 | 1,27,444 |

| May-18 | -12,360 | 1,15,084 |

| Jun-18 | -10,249 | 1,04,835 |

| Jul-18 | -2,769 | 1,02,067 |

| Aug-18 | -2,229 | 99,838 |

| Sep-18 | -9,469 | 90,369 |

| Oct-18 | -29,201 | 61,168 |

| Nov-18 | 4,934 | 66,102 |

| Dec-18 | -1,103 | 64,999 |

| Jan-19 | 128 | 65,127 |

| Feb-19 | 13,565 | 78,691 |

| Mar-19 | 32,371 | 1,11,063 |

| Apr-19 | 12,750 | 1,23,812 |

| May-19 | -2,136 | 1,21,676 |

| Jun-19 | -689 | 1,20,988 |

| Jul-19 | -16,870 | 1,04,118 |

| Aug-19 | -14,829 | 89,289 |

| Sep-19 | -6,624 | 82,665 |

| Oct-19 | 8,596 | 91,260 |

| Nov-19 | 12,925 | 1,04,185 |

| Dec-19 | 694 | 1,04,879 |

| Jan-20 | -5,360 | 99,520 |

| Feb-20 | -12,684 | 86,836 |

| Mar-20 | -65,817 | 21,019 |

| Apr-20 | -5,209 | 15,810 |

| May-20 | 13,914 | 29,725 |

| Jun-20 | 5,493 | 35,218 |

| Jul-20 | 2,490 | 37,708 |

| Aug-20 | 15,750 | 53,458 |

| Sep-20 | -11,411 | 42,047 |

| Oct-20 | 14,537 | 56,585 |

| Nov-20 | 65,317 | 1,21,902 |

| Dec-20 | 48,224 | 1,70,126 |

| Jan-21 | 8,981 | 1,79,107 |

| Feb-21 | 42,044 | 2,21,151 |

| Mar-21 | 1,245 | 2,22,396 |

| Apr-21 | -12,039 | 2,10,357 |

| May-21 | -6,015 | 2,04,341 |

| Jun-21 | -26 | 2,04,316 |

| Jul-21 | -23,193 | 1,81,122 |

| Aug-21 | -2,569 | 1,78,554 |

| Sep-21 | 914 | 1,79,467 |

| Oct-21 | -25,572 | 1,53,895 |

| Nov-21 | -39,902 | 1,13,993 |

| Dec-21 | -35,494 | 78,500 |

| Jan-22 | -41,346 | 37,153 |

| Feb-22 | -45,720 | -8,567 |

| Mar-22 | -43,281 | -51,848 |

| Apr-22 | -40,653 | -92,501 |

| May-22 | -54,292 | -1,46,793 |

| Jun-22 | -58,112 | -2,04,906 |

| Jul-22 | -6,568 | -2,11,473 |

| Aug-22 | 22,026 | -1,89,448 |

| Sep-22 | -18,308 | -2,07,756 |

| Oct-22 | -489 | -2,08,245 |

| Nov-22 | 22,546 | -1,85,699 |

| Dec-22 | -14,231 | -1,99,930 |

| Jan-23 | -41,465 | -2,41,394 |

| Feb-23 | -11,091 | -2,52,485 |

| Mar-23 | 1,998 | -2,50,487 |

| Apr-23 | 5,712 | -2,44,776 |

| May-23 | 27,856 | -2,16,919 |

| Jun-23 | 27,250 | -1,89,669 |

| Jul-23 | 13,922 | -1,75,747 |

| Aug-23 | -20,621 | -1,96,368 |

| Sep-23 | -26,692 | -2,23,060 |

| Oct-23 | -29,057 | -2,52,117 |

| Nov-23 | 3,902 | -2,48,215 |

| Dec-23 | 31,960 | -2,16,255 |

| Jan-24 | -35,978 | -2,52,233 |

| Feb-24 | -15,963 | -2,68,196 |

| Mar-24 | 3,314 | -2,64,881 |

| Apr-24 | -35,692 | -3,00,573 |

| May-24 | -42,214 | -3,42,788 |

| Jun-24 | 2,037 | -3,40,750 |

| Jul-24 | 5,408 | -3,35,342 |

| Aug-24 | -20,339 | -3,55,681 |

| Sep-24 | 12,612 | -3,43,070 |

| Oct-24 | -1,14,446 | -4,57,516 |

| Nov-24 | -45,974 | -5,03,490 |

| Dec-24 | -10,444 | -5,13,934 |

What we as investors can learn from it? Till USD is the main currency of the world, our investments must appreciate in value in INR and also in USD terms. If INR continues to devalue as it has been since 2004, out net worth is NOT growing as fast as we are currently assuming.

At present, there is no crisis alarm in India. But, if we ever face a situation like it is in South Korean now, our INR linked investment will be in danger.

- Action Point: Diversify your investments. Do not invest only locally. Keep accumulating physical gold.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.

![What's India’s Google Tax [Explained] - Thumbnail](https://ourwealthinsights.com/wp-content/uploads/2025/03/Whats-Indias-Google-Tax-Explained-Thumbnail-768x462.png)