Summary Points:

- I got an email from a reader wondering why the U.S. dollar stays dominant (Jump here for the reason).

- The USD’s reserve status and U.S. Treasuries keep its demand high.

- A strong dollar also lets the U.S. survive even with big deficits and high debts (for now).

- Low inflation and low rates help, making the dollar stable and debt affordable.

- Trump’s tariffs and WTO stance might shake things up and create future issues for the US.

- A tariff war could weaken the dollar if trust fades, but it’s still king for the moment.

Introduction

I recently received an interesting email from one of my reader. He shared some of his “random thoughts” about the U.S. dollar and its role in the world. The email caught my attention because it is trying to address a few big questions about global finance. He wrote his piece to me in his email but felt that his ideas are a bit scattered. But I think they’re onto something important. So I decided to turn my reply into a blog post for all of my readers to read and think about it. Before I share my reply, allow me to show you the extract of the email I’ve received:

The Email:

“Dollar is the World’s currency, hence it is always in demand. Moreover, as everyone considers US the safest investment destination, hence they park their money in US Treasuries which also keeps USD in high demand.

But I wonder, if the US’s high trade deficit, high debt to GDP ratio is something that US can maintain just because USD is the world’s currency?

Can you clarify this, “US strategically maintaining a low inflation, low interest rate environment has any relation with why the USD being the world’s currency.”

Also, as now the things are changing due to Donald Trump implementing reciprocal tariff’s and US not respecting the WTO agreement, will it have an effect on the US Dollar’s dominance? Is the US Dollar becoming weak over time due to this new tariff war is a possibility?”

These thoughts might seem all over the place, but they’re circling a central theme. What is the theme? The U.S. dollar’s dominance and whether it’s starting to crack under pressure.

Allow me to declutter the topic, organize the ideas, and explore what’s the point this deep email is trying to convey. So let’s start with the most basic question.

Why Does the US Dollar Rule the World?

The reader’s first point in the email is spot-on: the USD is the world’s reserve currency, and that keeps it in constant demand.

Most global trade, like crude oil and commodities, is priced in dollars. So it means, countries need USD to pay their bills. On top of that, U.S. Treasuries are the safe-haven asset. Investors worldwide see the U.S. as a stable place to keep their cash, especially during crises.

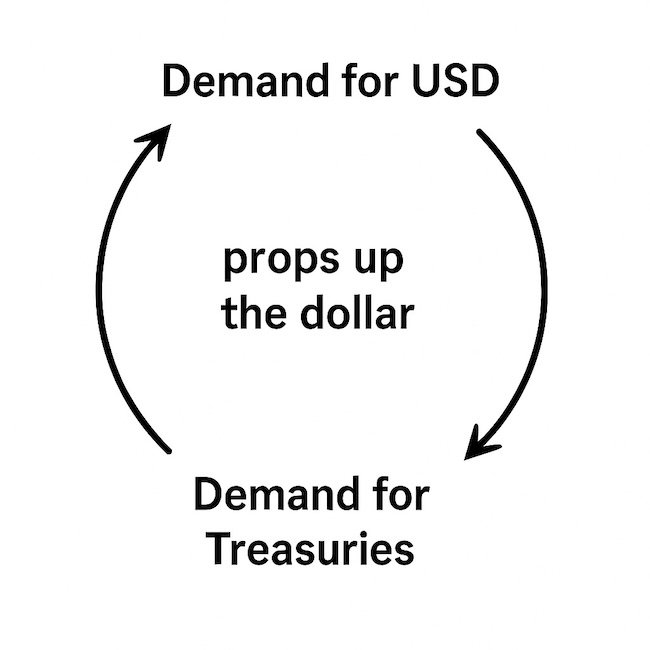

This trust creates a feedback loop. What is the loop? “The demand for USD drives demand for Treasuries, which in turn props up the dollar. It’s a powerful system – but is it invincible?

Can the U.S. Keep Breaking the Rules?

Here’s where the email gets deeper. “Can the U.S. sustain its massive trade deficits (importing way more than it exports) and a debt-to-GDP ratio over 120% just because the USD is king?”

I think it is a great question. For now, the answer seems to be a big “Yes.”

The USD’s status gives the U.S. what economists call an “exorbitant privilege.” Foreign governments and investors buy U.S. debt to hold dollar reserves. This way they are essentially funding America’s spending habits.

If any other country tried this, say, piling up debt while running persistent deficits, they’d face skyrocketing borrowing costs or a currency collapse. The USD’s dominance lets the U.S. defy gravity, at least for the time being.

But the reader is right to wonder, if this privilege depends on trust, and trust can fade. Donald Trump’s actions are actually making this trust fade. I want you to check this video of the PM of Singapore on the changing world order due to Trump’s policies.

Low Inflation, Low Rates – Is It Part of the Plan of the US?

This was an interesting question: “If the U.S. keeps inflation and interest rates low to protect the USD’s status.”

I’ll say it is not a conspiracy, but sure there’s a link.

Low inflation makes the dollar a reliable store of value. Why? Simple logic, nobody wants to hold a currency that’s losing purchasing power fast.

Moreover, low interest rates, meanwhile, keep U.S. debt affordable and attractive to foreign buyers. How? Low interest rates reduce the cost of borrowing for the U.S. government. It ensures that it can reliably pay interest without strain. As U.S. keeps paying the interest without fail, it is a signal of stability to foreign buyers. They see “US treasuries” as a low-risk investment. Even though the yield of US treasuries is low, foreign investors still consider US treasuries remain attractive because their safety and liquidity outweigh concerns about higher returns elsewhere. This makes the U.S. Treasuries (and hence USD) more attractive in uncertain times.

For years, the Federal Reserve has juggled these factors to support the domestic economy, and a nice side effect is reinforcing the USD’s global appeal.

Some might say, it’s a tightrope, too low for too long, and investors might look elsewhere for better returns. But I think interest in USD (U.S. Treasuries) is not dependent on its yield, it is dependent on the “liking and trust” that “United States” have for its investors. Till the trust remains, the appeal for the U.S. Treasuries will continue.

Trump, Tariffs, and the WTO Shake-Up

Finally, the email ties in the above concepts with the recent change of events happening in the US.

It talks about Donald Trump’s reciprocal tariffs and the U.S. not respecting the World Trade Organization (WTO) agreements it signed with other countries. The question is, could this dent the USD’s dominance? I think, it is a worry not very misplaced

What Donald Trump is trying to achieve? Tariffs aim to shrink the trade deficit by boosting U.S. production. If there will be fewer imports, more exports, trade deficit will begin to fall into place. If that works, it could actually strengthen the USD by keeping more dollars at home.

But there is a problem with this assumption. If trading partners retaliate with more restrictive tariffs on US imports, global trade could take a hit. It will in turn reduce the need for USD in transactions.

And what about ignoring the WTO?

That risks disturbing the trade system the U.S. built after World War II. It was a system carefully planned and executed that’s kept the USD on top. If other nations lose faith in U.S. leadership, they might start exploring alternatives, like pricing oil in euros or yuan.

I think that EURO replacing USD is a long shot for now. Even the Yuan doesn’t have that kind of trust. But if Donald Trump keeps acting way it has been doing till now, the cracks in the foundation will start becoming more visible. These are the kind of acts that will further strengthen the concept of an alternative for the USD.

So, Will the Dollar Weaken?

The big question in the email is, “whether these shifts, especially a tariff war, could weaken the USD over time.”

It’s possible. A full-blown trade war might rattle markets, erode confidence, and push countries toward de-dollarisation.

But the USD’s dominance is sticky. There’s no real rival yet, and its role is baked into the global economy.

Short-term, tariffs might even boost the dollar if they signal U.S. strength. Long-term, though, if trust in the U.S. falter, say, over debt or geopolitics, the reader’s hunch could prove real.

Conclusion

What I love about this email is how it digs into a tension we don’t talk about enough. The USD’s incredible power versus the risks piling up around it are real problems.

I think the problems highlighted in the email aren’t some random thoughts, they’re probing whether the U.S. can keep defying economic logic, and if new policies might tip the scales.

I’d say the dollar’s safe for now, but the cracks are worth watching.

I would like to hear you views on the USD’s dominance and trust money countries have on the US? Is it really going to fade away, gradually?

Have a happy investing.