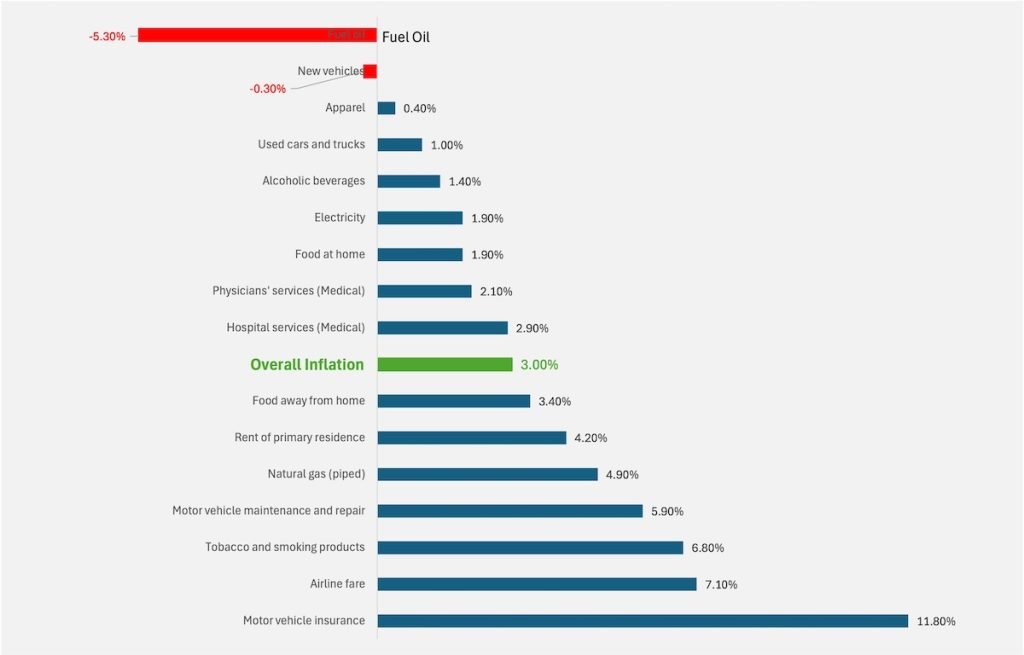

So, the latest inflation numbers are out, and honestly, it’s a bit like trying to unravel a puzzle, easy in some parts, complicated in others. Analyzing this data is actually whole lot more complicated than it looks at first glance. The headline number is 3% inflation overall. It sounds manageable, right? But dig a little deeper, and you’ll see that the story is far more interesting (and potentially worrisome) than just that single percentage.

Consider this: your overall household budget is your thali. Inflation is like the spice level – a little is okay, adds some zing. Too much, and suddenly your dal chawal isn’t quite as comforting as it used to be.

The Good, the Bad, and the Inflationary Data

Let’s start with the not-so-great news.

Some things are definitely pinching the pocket more than others. Motor vehicle insurance, for instance, has shot up a whopping 11.8%. I mean, seriously? It feels like just yesterday I was haggling with my agent for a better premium, and now this.

Airline fares are also soaring, up 7.1%. So, that dream trip to the Maldives might have to wait a little longer, folks. Or maybe, it is the right time to start looking for hotels and flights for off-season? What do you guys think? Let me know in the comment.

Then there’s the whole food situation. While overall food inflation is at 2.5%. The devil, as always, is in the details. Remember how just a few months ago, tomato prices were hitting the roof?

- The data shows that meat, poultry, fish, and eggs are up 6.1%.

- Eggs, in particular, have gone crazy, with a 53% increase over the year! Our nice egg fry for breakfast just became a slightly more luxurious affair.

- Even though the overall fruits and vegetables numbers are stable, we know how volatile those prices can be depending on the season and supply chain disruptions.

And then you have the silent creepy cost like rent and housing.

- Shelter have become about 4.4% costlier in last 12-months. For those of us in the metros, especially those just starting out in our careers, this is a significant chunk of our monthly expenses. It almost feels like you are paying you whole salary to the landlord only, doesn’t it?

A Few Silver Linings (Like Finding a $100 Note in Your Old Jeans)

It’s not all doom and gloom, though.

The report highlights that fuel oil prices have actually fallen by 5.3%. I’m not sure how many of us directly use fuel oil in our daily lives, but any drop in energy prices is welcome news. It can potentially ease some pressure on transportation costs. But what is more important to me is, why petrol prices are still so high?

So, What Does This Mean for You?

As someone who is always on the lookout for cost savings, inflation numbers are always not-welcomed. But as a stock investor, I do not see inflation as an evil number, but for sure it has to be controlled.

So, what we all can do when we see inflationary pressures?

- Budget Like a Pro: Now more than ever, it’s crucial to track your spending and identify areas where you can cut back. Maybe it’s time to dust off that old Excel sheet or try a budgeting app. Every rupee saved is a rupee earned!

- Prioritize Needs vs. Wants: That new gadget might be tempting, but is it really more important than having a comfortable buffer for rising food and housing costs? It’s all about making smart choices that align with your financial goals.

- Invest Wisely: Inflation erodes the value of your savings, so investing becomes even more critical. Explore options like stocks, mutual funds, or even real estate, depending on your risk appetite and financial situation. And please, please, please, do your research before putting your hard-earned money into anything.

- Don’t Panic: Inflation is a part of life, and the economy goes through its ups and downs. Don’t make rash decisions based on fear. Stay informed, stay rational, and focus on building a solid financial foundation.

Conclusion

The inflation story is complex, with some sectors experiencing significant price pressures while others remain relatively stable. It’s a reminder that we need to be smart about our money, prioritize our needs, and invest wisely to protect our financial future.

What are your thoughts on the latest inflation numbers? Are you feeling the pinch in certain areas more than others?

Share your experiences in the comments below! Let’s learn from each other and navigate these tricky times together.

Disclaimer: I am not a financial advisor, and this is not financial advice. Please consult with a qualified professional before making any investment decisions. This blog post is for informational and entertainment purposes only.