Discover which Indian stocks FIIs (Foreign Institutional Investors) may buy again once they return to net buying. This article explores stocks which I feel are trading at discounted price due to recent FII selling. A few banks, IT, FMCG companies, etc are the victims of the FII selling. Learn why these stocks fell, what makes them attractive to FIIs, and how a comeback could spark future price gains. [For a broader perspective, check out our guide on Top Stocks to Buy in India.]

FIIs play a crucial role in stock markets by bringing in large amounts of foreign capital. Their investments signal confidence and often lead to rising stock prices. Conversely, when FIIs sell, their exit can lead to sharp declines. For example, in 2024, sectors like banking, IT, and FMCG are facing downward pressure as FIIs pulled out.

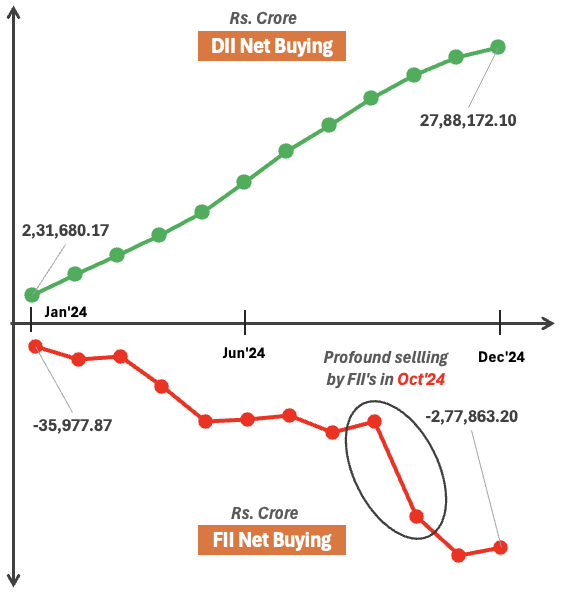

Check the below chart for FII vs DII activity since January 2024. You can see, where DII’s have been net buyers in 2024, FIIs has been the net sellers. Specifically in Oct’2024, the selling by FIIs was profound.

Why does this matter? These investors typically prefer companies with solid fundamentals and growth potential.

If they return, they are likely to reinvest in the same discounted stocks, creating upward momentum.

Imagine a popular cricket team where key players are benched. The team struggles, but once these players return, the team rebounds. Similarly, leading stocks like HDFC Bank, Infosys, or Britannia may bounce back once FIIs re-enter the Indian stock market.

In my view, tracking these discounted favourites can help identify great buying opportunities before FIIs return to the market.

Topics:

1. Why FIIs are Selling?

FIIs have been net sellers in 2024 for several reasons tied to global economic conditions.

- Rising interest rates in countries like the U.S. make bonds and safer assets more attractive. Why invest in Indian stocks when U.S. bonds offer similar returns with less risk?

- Geopolitical tensions, like conflicts or trade uncertainties, make investors cautious about emerging markets, including India.

- A Strong U.S. dollar also plays a role. When the dollar gains, FIIs prefer to pull out money from markets like India to minimize currency losses.

- China’s recent economic stimulus measures have also become more attractive as compared to India. FIIs seek better returns, hence they are reallocating funds from India to China, in a hope to capitalize on its recovery and growth potential.

In 2024, cumulative FII net outflows reached over Rs.2.77 lakh crore, putting pressure on Indian stocks.

Interestingly, while FIIs sold, Domestic Institutional Investors (DIIs) have stepped in to buy. DIIs, including mutual funds and insurance companies, invested over Rs.27 lakh crore in 2024. This shows confidence of domestic institutions in Indian companies despite global challenges.

Think of it like an IPL match. FIIs are the foreign players in the team who are supposed to be the big hitters, they have already left the field. But local players (DIIs) are still scoring.

Personally, I believe this DII support is a positive sign. Once global uncertainty fades, FIIs may return and invest in these currently undervalued stocks (comparatively), giving them a fresh boost.

Suggested Reading: When will FIIs return to the Indian stock market.

2. Characteristics of Stocks FIIs Prefer

FIIs typically favor stocks with specific characteristics, ensuring their investments are safe and profitable.

- First, they prefer high liquidity. This means stocks of large-cap companies that are easy to buy and sell without impacting their prices (high trading volumes). Examples include Reliance Industries, HDFC Bank, Infosys, Asian Paints, etc.

- Second, FIIs look for strong fundamentals. These are companies with stable profits, low debt, and solid management. A company like TCS, Maruti, Britannia which consistently reports strong earnings and has trustworthy leadership, fits this criterion.

- Third, FIIs tend to invest in sector leaders. They prefer stocks in key sectors such as banking, IT, FMCG, and infrastructure. These sectors typically drive the Indian economy, and top companies in these areas often weather economic uncertainties better. Think of HUL (FMCG) or Larsen & Toubro (Infrastructure).

- Lastly, FIIs like companies with global exposure. Businesses that sell products or services internationally can benefit from global economic growth. They also prefer foreign multinational companies listed in India. For instance, Infosys and Tata Motors are Indian companies who rely on export demand, making them attractive to FIIs. Another example can be foreign MNCs like Nestle India, Unilever (HUL), Hyundai India, Maruti Suzuki, etc.

In my view, understanding these preferences can help us align our investment with potential FII activity.

Investing in these types of companies, especially when they’re discounted, can lead to solid gains when FIIs return.

[Note: Disclaimer, none of the names mentioned in here should be considered as an investment advice. What I’m writing is just for building our perspective. I’m just sharing my know-how.]

3. Why These Stocks are Discounted Now

When FIIs sell large volumes of a stock, prices typically fall. This happens because more sellers in the market push the price lower due to excess supply.

Many high-quality large-cap stocks have seen sharp declines due to continuous FII selling. For example, HDFC Bank saw its stock price dip nearly 15% in Jan’2024, partly driven by FIIs reducing their holdings. Similarly, Infosys has been under pressure, with its price falling around 20% (between Feb to Jun’2024 period).

Another reason for this discounting is the global shift of investments to markets like China due to their recent economic stimulus. When FIIs move funds elsewhere, Indian stocks lose demand and prices fall.

These declines, however, do not necessarily mean the companies are weak; they often remain fundamentally strong.

From my perspective, these price drops create a rare opportunity for retail investors. When FIIs return, they’ll likely revisit these very stocks. Buying discounted stocks with strong fundamentals now can lead to gains later.

Think of it like buying your favorite branded winter jacket during summer sale. You know the value in winter will again peak. Understanding this dynamic can help us invest smartly, taking advantage of temporary market sentiment.

Conclusion

When FIIs start buying Indian stocks again, it could trigger a powerful rally.

Imagine a river that was dammed for a while – once the floodgates open, water rushes through with force. That’s what happens when FIIs re-enter the market: demand surges, and stock prices quickly recover.

FIIs hold immense influence because of the size of their investments. When they buy, confidence among retail and domestic investors grows, creating a ripple effect.

It is also important to note that FIIs (generally) do not invest in all type of stocks. They have their own specific preference and when they invest, most of their money go to a few stocks only. If they do not want to be so stock specific, they will pick the main index (Nifty 50 or Sensex).

As prices rise, those who bought discounted stocks during FII sell-offs could see significant gains.

Remember, Warren Buffett often says, “Be fearful when others are greedy, and greedy when others are fearful.” This is the perfect time to apply that logic.

India’s growth story remains intact – a young population, expanding infrastructure, and digital transformation continue to offer long-term potential.

The stocks that suffered from FII exits, like leading banks and IT giants, are still solid businesses. FIIs recognize this, and when global conditions stabilize, they’ll likely flow back to these reliable investments.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.