Let’s learn to analyze a stock from the perspective of the total return it yields for shareholders. To get a feeling about the total return, we will have to look back and brush up on some basic concepts.

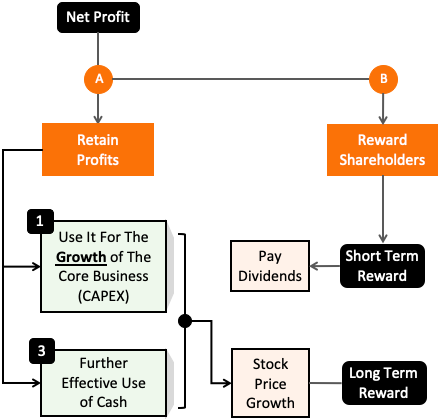

Suppose there is a company that makes a cash profit of Rs.10 Crore. How to utilize the profit? Considering all of it is realized as cash, a good manager would not leave it idle. How the net profit of the company gets used up?

Good companies use their profits to benefit their owners and shareholders. This benefit can be in the form of immediate or long-term rewards.

We will discuss more on how the company rewards its shareholders in the next section.

The Decision Making

For a listed company, its top management has to decide this at least once every year. They can either (A) retain all profits or (B) immediately reward their shareholders by distributing dividends.

Generally, companies retain majority profits and distribute the balance to the shareholders.

Now, the decision about the proportion of retention versus distribution is not an easy task. But when the job at hand is to maximize the total returns, decision-making takes a logical turn.

In this article, we will explore more about the concept of total returns.

Sharing all profits with the shareholders as dividend is perhaps an easy decision for the company. But the challenge for the top management is to use the capital more effectively. This way, they can maximize the shareholder’s value.

We will read more about “total return.” But before that, let’s first understand why dividend payment to shareholders is not an avoidable task for companies.

Dividends Distribution Is Not In Fashion

The dividend is taxed at a higher rate than capital gain. First, the company will deduct a TDS of @10% if the dividend amount is above Rs.5,000. Second, the dividend income will again be taxable at the hands of the shareholder as per their tax slabs. So, if one is already in the 30% tax bracket, dividend income will be taxed at this rate.

Compare it with the tax treatment of capital gains (LTCG). Till Rs.1.0 Lakhs, no tax is applicable on capital gains. Beyond Rs.1.0 Lakhs, A flat rate of 10% is applicable. Even the short-term capital gain (STCG) attracts a flat tax rate of 15% per annum.

So you can see, dividends are taxed more than capital gains. Hence, some might say reject dividends altogether.

Moreover, in the current times, people love growth stocks. There is a mindset where people are ready to compromise on dividends for long-term growth. This mindset is also reflected in how companies allocate their capital reserves. Predominantly, capital allocation by the companies favors earnings growth.

Generally speaking, S&P BSE 500 Index rose at 10.8% per annum in the last ten years. But I’m sure, dividend payment growth rate would not be even close to 6% p.a. in the same time horizon.

Which Type of Company Must Reinvest Profits?

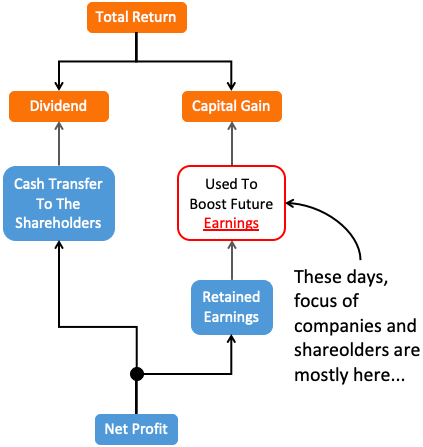

Total return has two components. The first is the dividend, and the second is capital gain. Both feed on the net profit generated by the company. Dividends are direct cash transfers done to the bank accounts of the shareholders. The capital gain happens as the company’s earnings grow.

These days, the focus of companies and shareholders and more on future earnings growth.

But a single-minded focus on growth may not be a correct business strategy. Why? Because growth is not such an easy thing to achieve. In fact, for most companies, it will only remain as a plan.

In the real world, most of the time, things don’t go as planned. As a result, the capital allocation to fund future growth will not yield the expected results. Why?

Because earnings reinvestment is better only for companies that have a moat. Only such companies must use reinvestment of profits to improve their core competencies.

So the crucial point here is, the company in consideration must have a moat. If it has it, then reinvestment will prove lucrative. But there will still be a caveat.

Limits of Reinvestment & Future Growth

A company may want to grow its sales at 100% per annum, but the growth rate has its limitations. Let me share an example.

In between Aug-2004 and May-2021, Google Inc had virtually no competition. How fast its share price grew in this period? Its stock price rose from $54.16 to $2,361. The stock also saw two splits in Yr-2014 and 2015. Considering it, the annual growth rate posted by Google, in a 16-17 years period, is 30.5% per annum.

Why do you think a company like Google could not grow faster? Because the market tends to put brakes on the growth rate. Even if the company has the widest Moat and is super rich in cash, it can still grow as much.

Hence, a company must analyze how fast it can actually grow and then proportionately allocate the capital. It will be needless to put everything for growth.

A better alternative will be to split the cash between dividends and retained earnings.

The Three Components of The Total Return

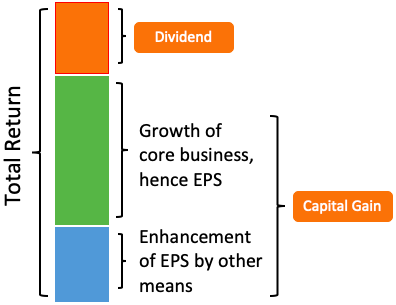

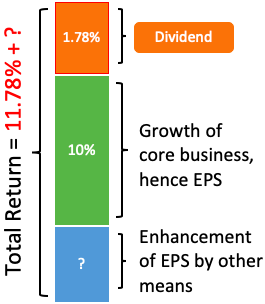

First of all, we must remember that the net profit generated by the company must contribute fully to increase the quantum of the total return. Now, the total return is composed of three components:

- Dividend.

- Growth of Core Business leading to EPS growth.

- Enhancement of EPS by other means.

Let’s build a deeper understanding of the above three components of total returns using a hypothetical example.

Example

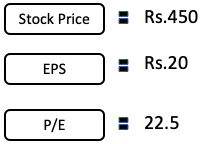

Suppose there is a company whose current share price is Rs.450. The company has posted a net profit of Rs.200 Crore. The number of shares outstanding for the company is 10 Crore. Hence its EPS is Rs.20 /share.

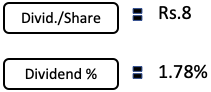

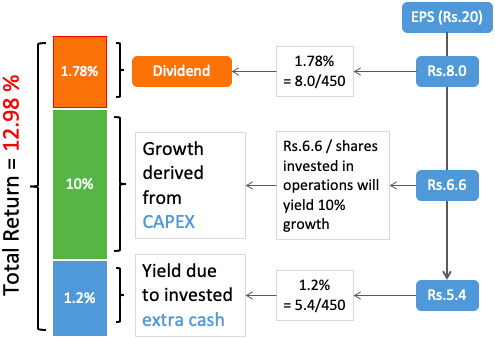

The company has also maintained a dividend policy of distributing 40% of its profits to shareholders as dividends. Keeping up with this payout ratio, out of the EPS of Rs.20, the company will distribute Rs.8 per share as dividends. At the current price levels, its dividend yield will be 1.78%.

Now suppose, the company set a goal to grow its core business at 4% above inflation. Considering average inflation of 6% p.a. in the next five years, the company’s target growth rate will be 10%.

So this way, we have two components of the total return formula (see below). Using this formula, the company has decided to ensure an 11.78% return for its shareholders.

But the big question is how to ensure that the core business grows at 10% per annum. Maintaining a dividend yield of 1.78% is also dependent on the growth of the core business. How to do it?

It will be possible only if the company expands its operating capability. It is why companies take CAPEX projects. The CAPEX plans increase the size of their assets, which in turn enhances their production capacity.

Retention Ratio

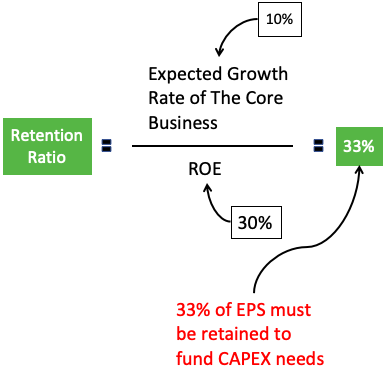

So here comes an important question? How much EPS shall be used for CAPEX needs? Experts have devised a formula to quantify this number (see below).

Replacing ROE with ROIC will give an even accurate number. But the use of ROE is good enough.

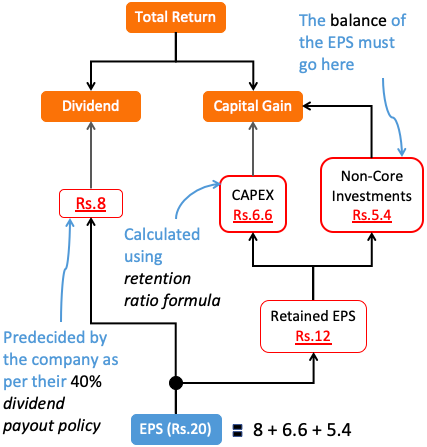

If the EPS of a company is Rs.20, then 33% of EPS will be Rs.6.6. What does this number mean to the company and its investors?

It means, to achieve 10% growth of its core business, reinvestment of Rs.6.6 per share into operations (CAPEX) is necessary.

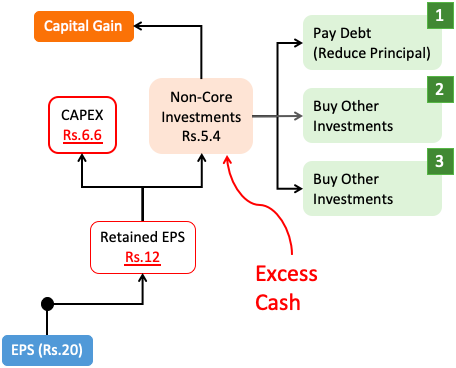

So, with the 40% dividend payout policy and 33% retention ratio formula, the EPS distribution of the company will look as shown below:

About Non-Core Investments

Priority for the company is CAPEX. Why? Because it focuses on growing the company’s core business. For companies that enjoy a wide economic moat (competitive advantage), CAPEX is their game-changer.

Why CAPEX has priority above dividend? Because in the long-term, CAPEX focus can render much higher returns for its shareholders. But overdoing CAPEX must also be avoided. That is where the use of the retention ratio formula is crucial.

Priority two for the company will be to reward the shareholders in the short term, at least once each year (dividends). It will not only give the shareholders an extra initiative to hold their stock longer, but it also acts as a check. Overdoing the CAPEX thing can do more damage to the company than good.

After allocating net profits to CAPEX and dividends, what remains can be called “excess cash.” EPS enhancement is also possible through the use of excess cash. Good companies mainly do the following three things with their “excess cash”:

- Pay Debt: The company must reduce the principal component of its loans. It gets paid using the excess cash. Debt reduction reduces interest expenses, increasing EPS.

- Buy Other Investments: Depending on the quantum of the excess cash, companies can use it for different types of investments. Diversification into non-core business is one option. For example, RIL investing in JIO. Mutual funds, stocks, and bonds can also be purchased using this cash. It will increase the “other income” of the company, thereby increasing EPS.

- Shares Buyback: If the company sees its stocks trading at undervalued price levels, it may decide to buy back its shares from the market. Shares buyback reduces the number of shares outstanding, increasing the EPS.

The yield of these investments, using excess cash, will be 1.2% (=5.4/450).

Analysis of The Total Return

All the permutations displayed above were for the single-minded purpose of enhancing shareholder’s value in the long term. How to quantify? By calculating the total returns. In our example, the quantum of the total return will be as below:

If the stock price goes down, the “dividend yield” and “excess cash yield” will improve and vice versa.

But the core-growth rate of 10% of the company is independent of the stock price.

We as an investor must also think further that if the total return of 12.98% is good enough or not.

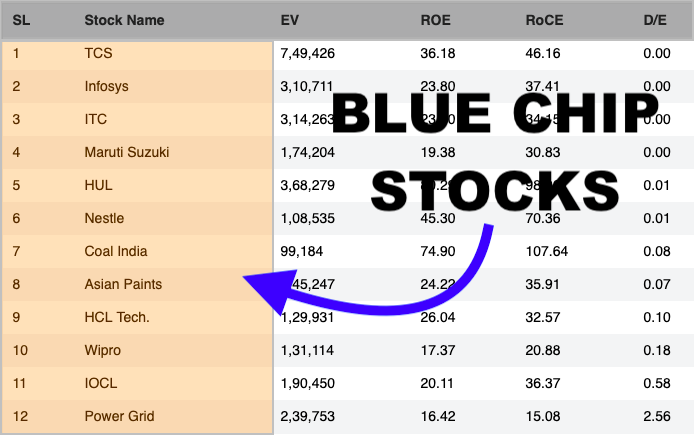

From my perspective, if the company in consideration is a blue-chip stock, then 12.98% is good. Moreover, out of 12.98%, I’m most likely to receive a yield of 1.78% each year as dividends. I can re-invest this money elsewhere and improve the return of my investment portfolio further.

Had it been a mid or small-cap stock, the total return in the range of 16-18% would have been acceptable.

Conclusion

Good companies always think in terms of ‘total returns’ to enhance the shareholder’s value.

From the perspective of shareholders, breaking down our expected returns into three components: (a) dividend yield, (b) core growth, and (c) excess cash yield will be a good idea.

If a company pays dividends regularly, it can be scrutinized based on the calculations shown in this article.

But if it is a non-dividend paying company, then the same analysis can be used to cross-check if the company is overdoing in CAPEX or keeping “excess cash” idle.

Thanks for reading. It will be my pleasure to have your feedback in the comment section below.

Have a happy investing.

sir you are really doing a good job. after reading you blog i feel some confidence in me about investing in

stock market i havent tried you excel sheet still a long way to go but definitely i will try it

Thanks a lot for quite an informative Article. I have simple query regarding CAPEX. Earnings and dividend details are part of the Annual report of the company. But how can i find the CAPEX expenses?